June 10, 2025 | The End of the Fiat Currency Experiment, in Seven Charts

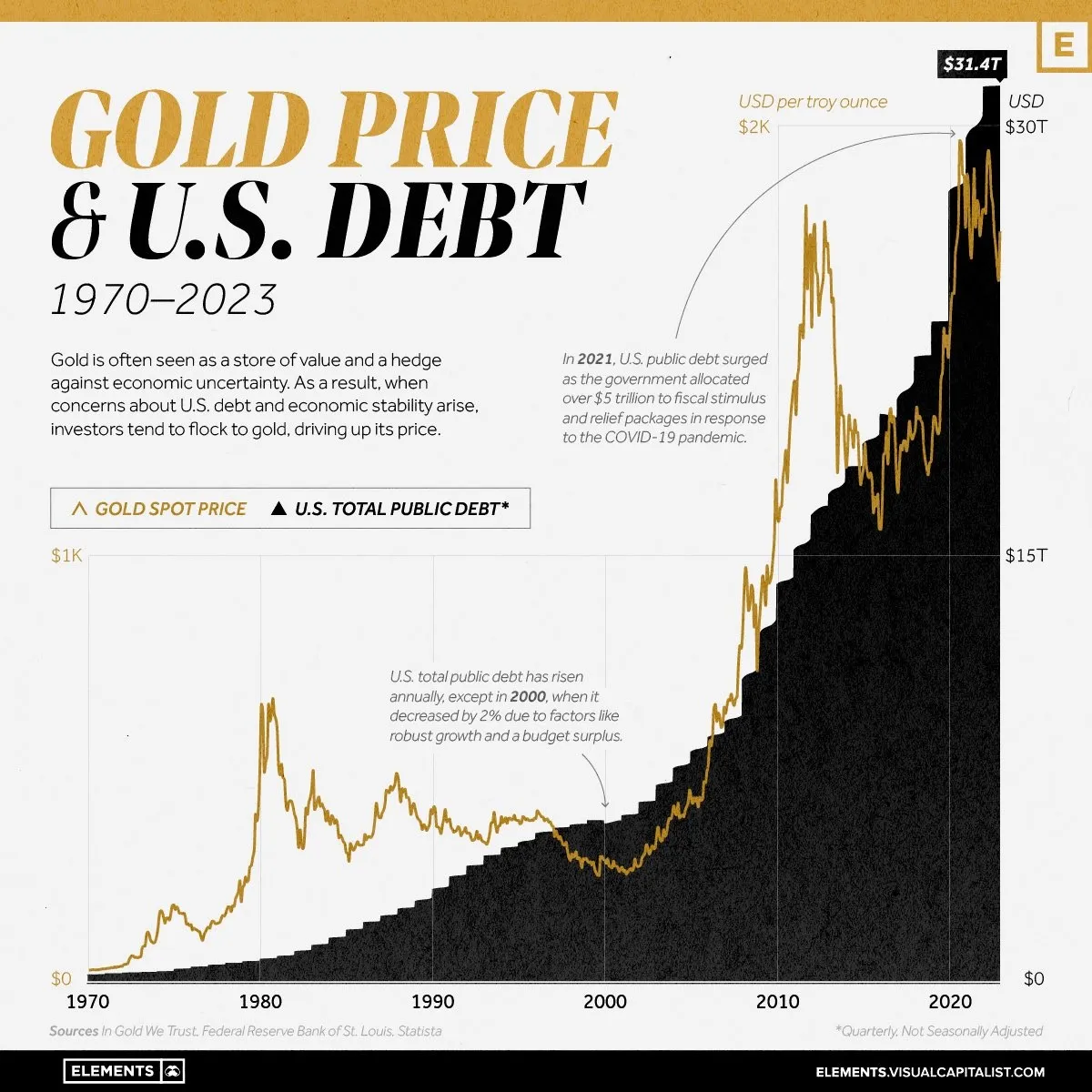

Anyone with a grasp of human nature in 1971 would have understood that giving governments monetary printing presses untethered to anything real would produce a world awash in debt. And that’s exactly what we got:

For a sense of the scale we’re now working with, consider the concept of “trillion”:

A million seconds ago was May 23rd

A billion seconds ago was 1993

A trillion seconds ago was 30,000 B.C.

The US national debt is now rising by $1 trillion every six months.

As for gold, humanity’s base money for the three millennia preceding 1971, note how its dollar price has tracked US government debt over the past half-century. And this chart only runs through 2023. Adding the most recent 18 months would make it even more dramatic.

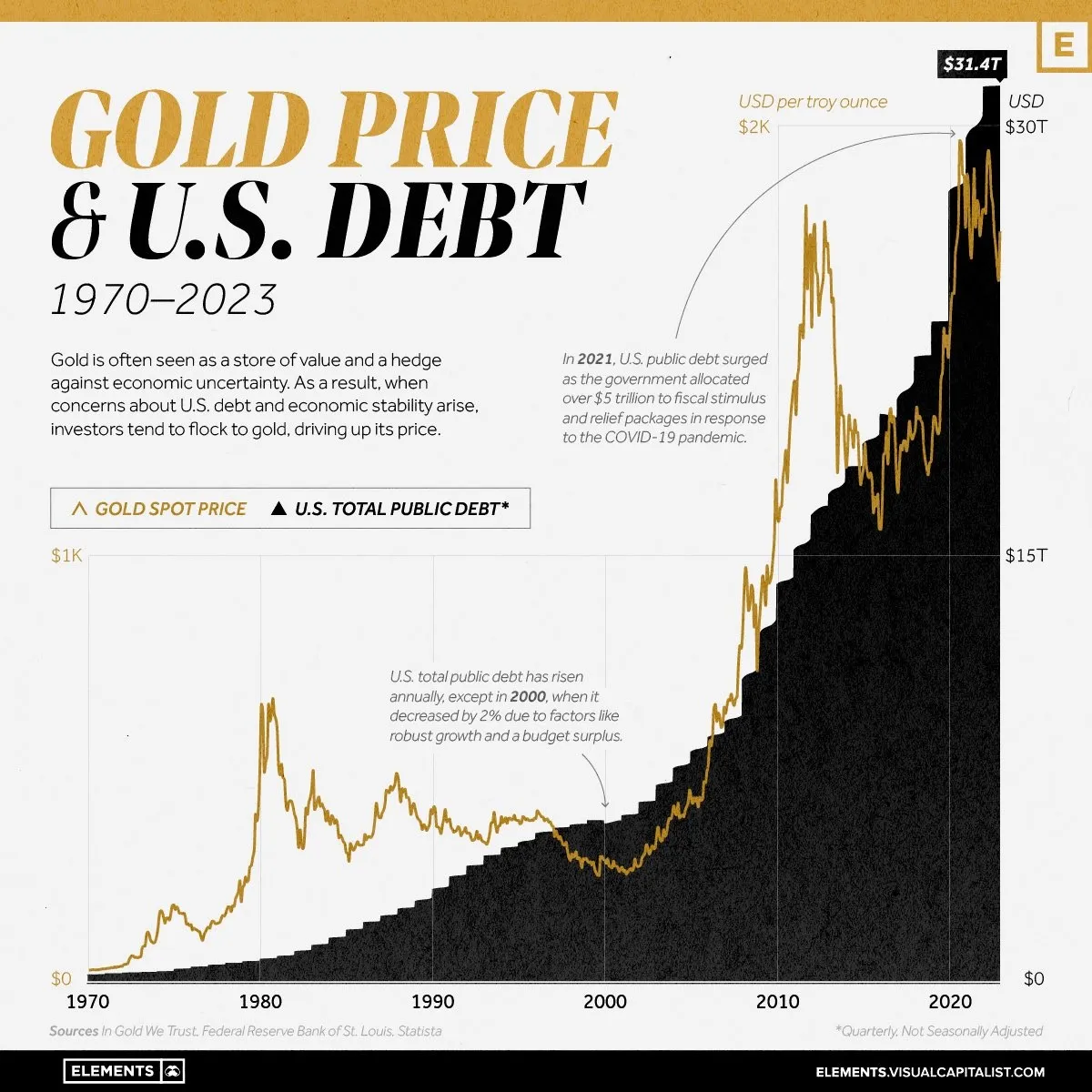

The gold/debt relationship isn’t just a US phenomenon. Incrementum calculates that gold is rising even faster against other currencies:

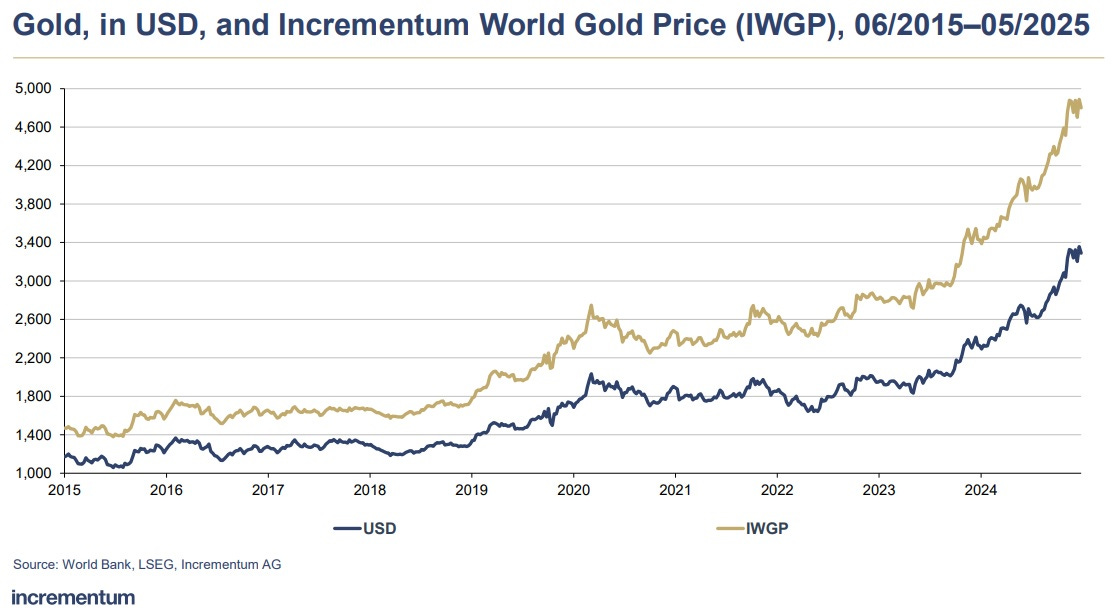

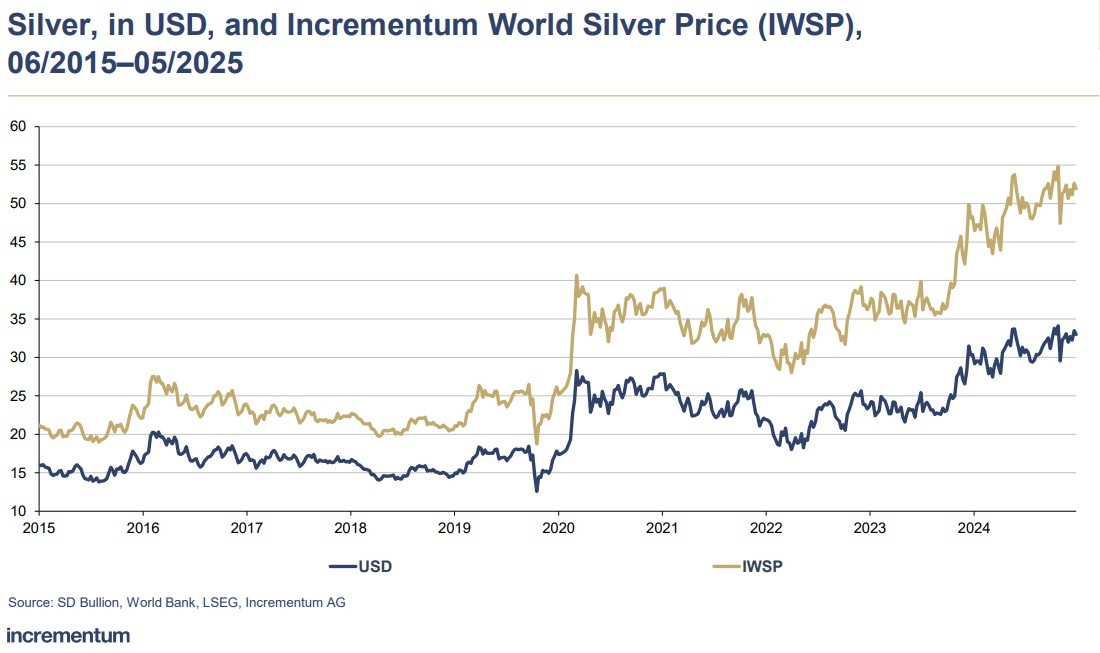

Same thing for silver:

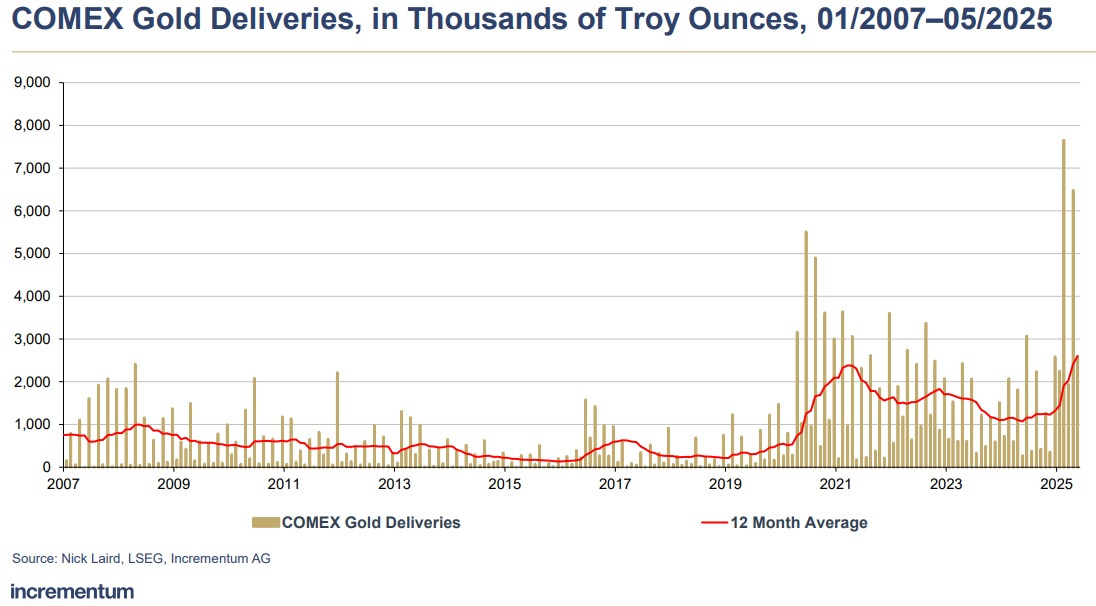

Stampede Into Physical

Another thing our hypothetical 1971 observer would have expected is a rush into physical precious metals when unbacked fiat currencies started declining uncontrollably. That, too, is happening, as bullion deliveries from the Comex (a futures exchange not designed to be a source of physical metal) soar:

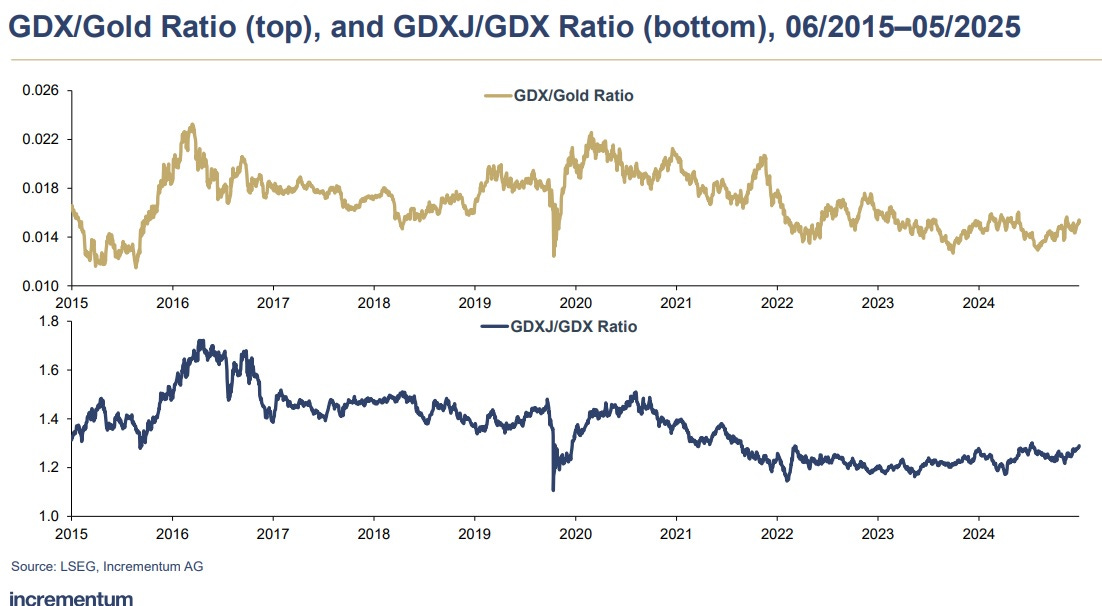

Now It’s the Miners’ Turn

The move into physical metals initially left the mining stocks behind. Note how the GDX and GDXJ, which contain the major gold miners, have lagged the metal in this cycle:

That’s changing, as FOMO (fear of missing out) erupts in precious metals. 2025 has been nice so far, with GDX up by 52%. But it’s just a taste of what’s coming.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino June 10th, 2025

Posted In: John Rubino Substack

Next: Wise To Be Wary »