February 6, 2026 | Tech’s Momentum Breaks — And the Market Scrambles for Alternatives

Technology investors are discovering that nuance cuts both ways. Markets are no longer reacting simply to whether a company is “in AI” or “not in AI”, they’re reacting to how AI reshapes business models. And this week, that shift in mindset produced some of the sharpest rotations we’ve seen in years.

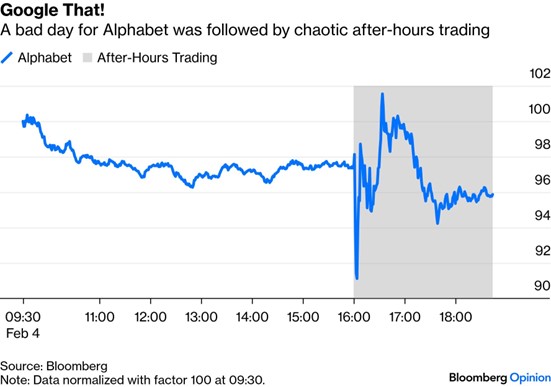

Earnings season made the divide painfully clear. Companies delivering strong results are being rewarded even if they’re spending aggressively on AI infrastructure. But when earnings disappoint, that same spending is suddenly viewed as wasteful. Alphabet’s latest report captured this tension perfectly: revenue ahead of expectations, but higher capital spending plans sent the stock sliding. Investors want AI ambition, but they want it paired with near‑term profitability.

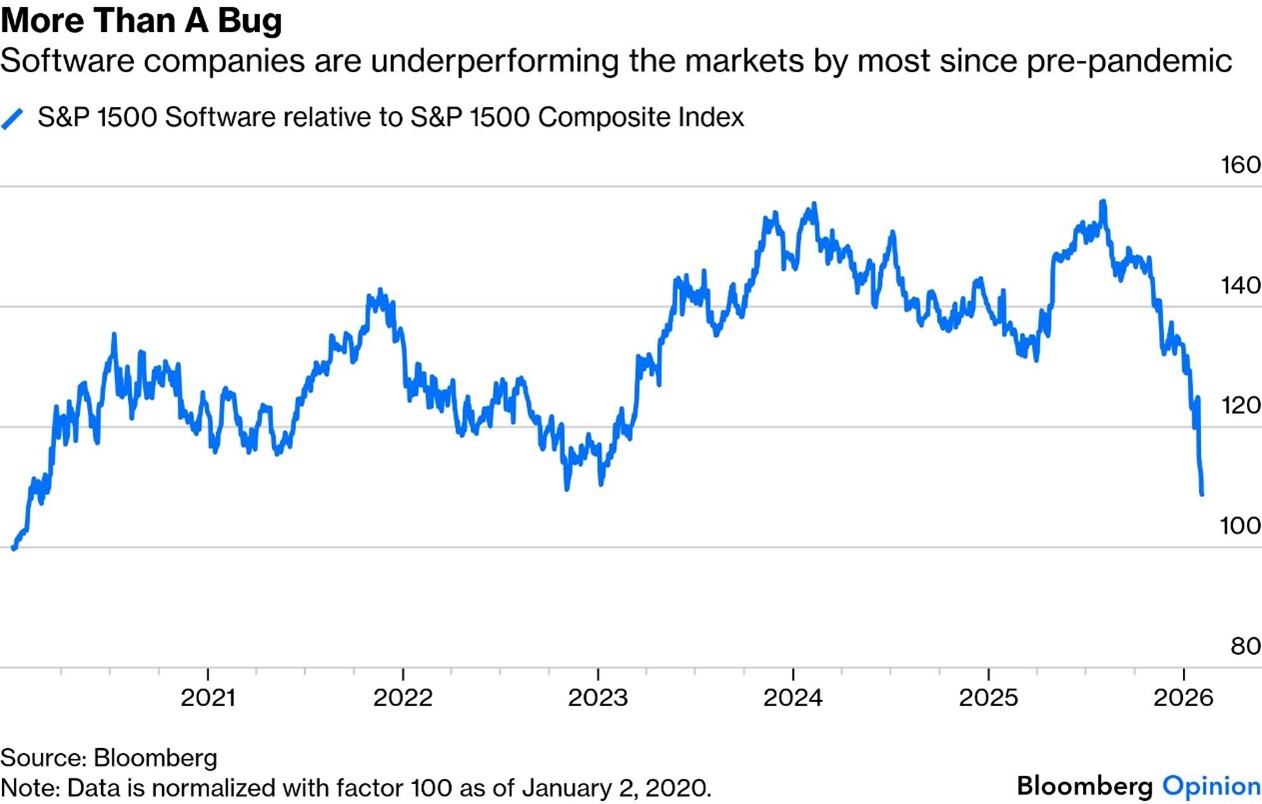

Software stocks felt the brunt of this new scrutiny. The sector is down sharply year‑to‑date, and the selloff accelerated after a new AI tool from Anthropic raised concerns about disruption in legal‑workflow software. Thomson Reuters’ double‑digit decline underscored a broader truth: any company whose core business can be automated, or partially automated, now trades with a permanent question mark over its valuation. The market is no longer pricing “AI opportunity” alone; it’s pricing “AI risk.”

This shift has also created unusual distortions in quantitative factors. Momentum, which had been dominated by mega‑cap tech winners, abruptly reversed, while value surged. A move of this magnitude, without a clear macro catalyst, is extremely rare. It suggests that systematic investors were caught off guard by the speed of the rotation, forced to unwind positions in a hurry. When factor moves become this outsized, it’s often a sign that the market is struggling to price a new regime.

Even long‑time technology optimists acknowledge that the current environment is challenging. Some point out that while AI‑driven demand for data‑center infrastructure has boosted certain semiconductor names, it has also created a valuation hangover for earlier winners that aren’t participating as fully in this cycle. The sharp post‑earnings declines in several high‑profile chip and software companies reflect a market that is no longer willing to give the entire sector the benefit of the doubt.

Yet this is not a broad‑based selloff. It’s a rotation. Roughly two‑thirds of the S&P 500 rose on days when tech was under pressure, and equal‑weighted indices hit new highs. Investors aren’t abandoning equities, they’re looking for businesses with clearer earnings visibility and less AI‑related uncertainty. Consumer staples, energy producers, and industrials have all enjoyed renewed interest as capital flows toward companies tied more directly to economic resilience.

This search for value is not confined to the US. While the Magnificent Seven have dominated headlines, markets outside America are quietly outperforming. Many international companies—particularly in Europe and parts of Asia—offer strong balance sheets, attractive valuations, and far less exposure to the AI disruption narrative currently rattling US tech. For investors willing to broaden their horizons, the most compelling opportunities may lie beyond Silicon Valley’s shadow.

Fraser Betkowski

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Richardson Wealth Limited is a subsidiary of iA Financial Corporation Inc. and is not affiliated with James Richardson & Sons, Limited. Richardson Wealth is a trade-mark of James Richardson & Sons, Limited and Richardson Wealth Limited is a licensed user of the mark. Richardson Wealth Limited, Member Canadian Investor Protection Fund.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth February 6th, 2026

Posted In: Hilliard's Weekend Notebook

Next: The Economy into 2028 »