February 2, 2026 | Liquidity or Price

Happy Monday Morning!

As expected the Bank of Canada remained on the sidelines this past week, opting to keep interest rates on hold, and will continue to do so, barring a significant shift in the economy.

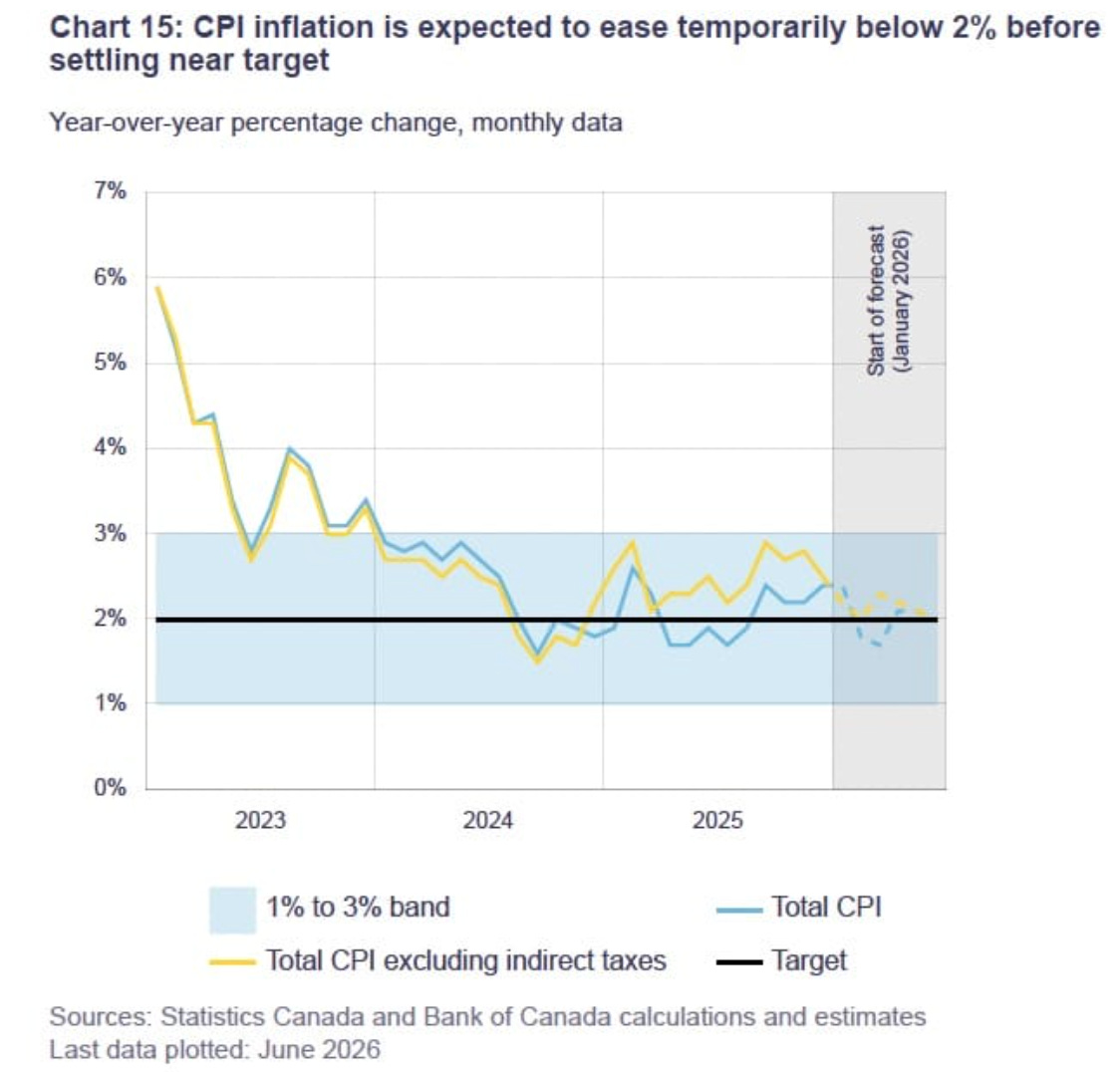

Inflation pressures don’t appear to be a concern for the BoC, despite overall price levels suffocating the life out of many Canadian households.

“Turning to inflation, it averaged 2.1% last year, and has now been within the 1% to 3% band for two years. The Bank expects CPI inflation to stay close to the 2% target over the projection as tariff-related cost pressures are offset by excess supply.”

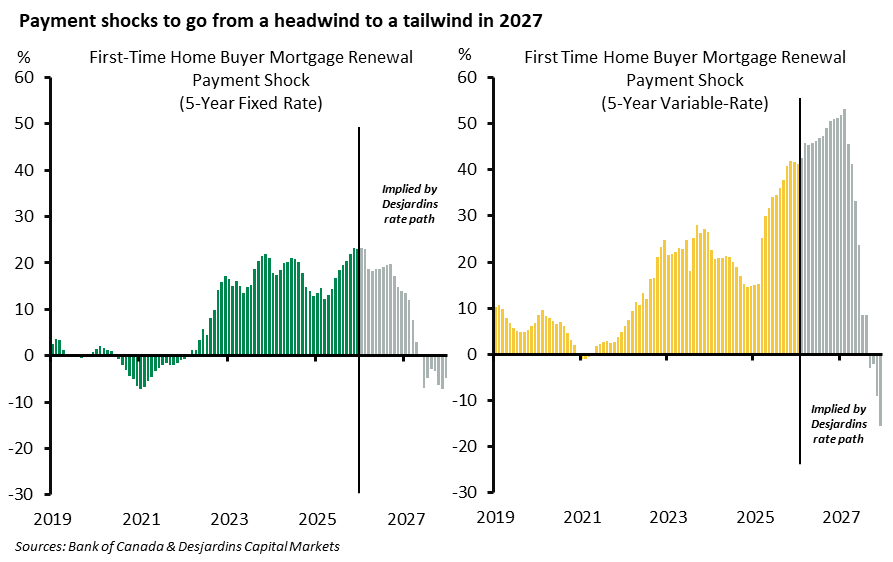

The Bank of Canada also flagged mortgage renewals, which are set to have a banner year. A record number of mortgage holders will renew their mortgage this year. According to the BoC, the median payment shock for 2026 sits near ZERO.

There’s just one problem with median and averages.

You can drown in a river that’s three feet deep on average.

Per research from Desjardins, the dispersion of outcomes is wide. In fact, mortgage renewals will hit hard for borrowers coming off their ultra low 5 year fixed rates from the depths of the pandemic. Simulations suggest five‑year fixed‑rate borrowers are bracing for ~20% payment shocks, while five-year variable‑rate, fixed‑payment borrowers could see even larger payment increases.

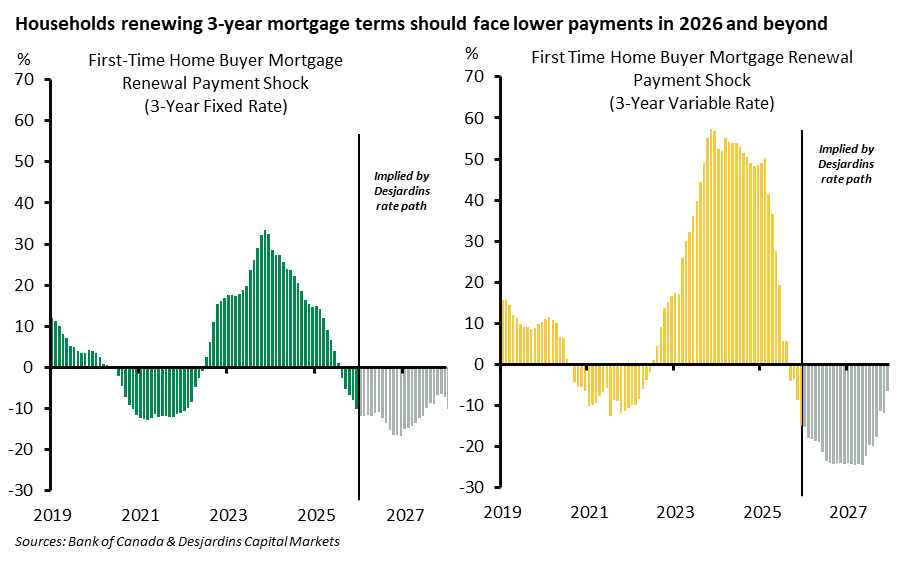

However, borrowers who renewed during the Bank of Canada’s hiking cycle and deliberately chose shorter terms are set to see a notable decline in monthly payments. Desjardins simulations suggest that payments for borrowers originally on three year terms could fall as much as 20%.

Ultimately, we dodged the worst of it. The mortgage renewal wave went from a tsunami to a modest ripple.

But it could have been a lot worse. Mortgage rates went as high as 6.5% and have now settled in at 4%. Banks have been proactively massaging amortizations. Effectively anyone who claimed financial hardship was allowed to re-extend amortizations without having to requalify. While others enjoyed a significant reduction in mortgage principal from the historically low rates.

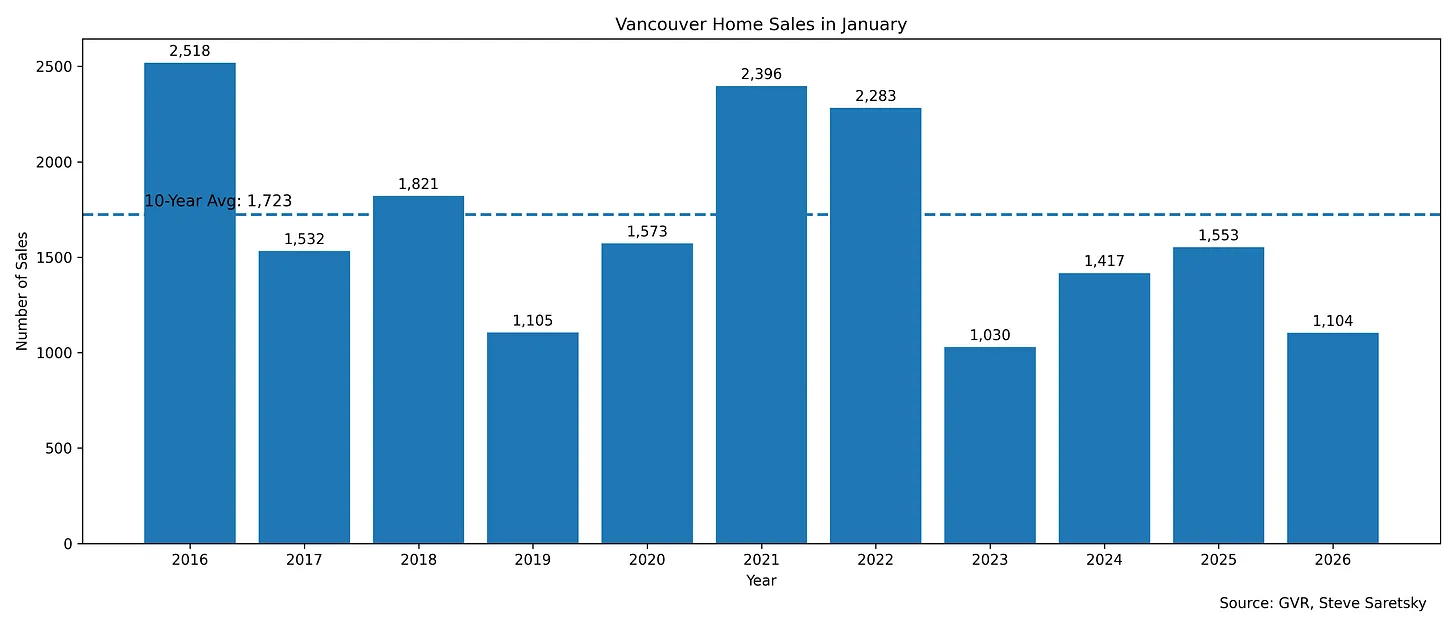

Borrowers are getting used to life with 4% mortgages, but the housing market hasn’t.

Greater Vancouver home sales continued their slump into 2026. January home sales fell 29% year-over-year in January, and were a whopping 35% below the 10 year average.

The sales to actives ratio was just 9%, the lowest reading since September 2012. In other words, only 9% of homes available for sale during the month are actually selling, which ultimately means more price reductions are coming.

If you’re a home seller today you get to decide between liquidity or price, because you can’t have both. You can stick your heels in and wait for your price, or you can skate to where the puck is going and accept tomorrow’s price.

Those waiting for BoC cuts to stimulate demand have been left disappointed. There appears to be no further relief coming from the BoC, nor OSFI for that matter.

Despite industry chatter that OSFI (the banking regulator) would replace the stress test with its loan to income test, OSFI decided this past week to keep both the LTI test, and the stress test in place.

“Following its pilot, OSFI has determined that loan-to-income (LTI) limits lessen the build‑up of highly leveraged residential mortgage borrowers, which in turn reduces systemic risk. Therefore, LTI limits will remain in place.”

“At this time,” OSFI will leave the stress test in place as a “complement” to LTI limits, says OSFI Executive Director of Policy and Risk, Theresa Hinz.

So there you have it.

The housing market remains on life support, desperate for a demand boost. The reality is buying a house is a major purchase and you’re less likely to make a move when the media is spinning up headlines suggesting an imminent invasion from the United States.

Nothing freezes a housing market like uncertainty.

If anything is going to turn the tide on the demand side it will have to come from an extension of CUSMA sometime this summer. Until then, nervous buyers will take their time, anxiously awaiting positive headlines so they can dip their toes back into the pool. That can only be derived by mending relations with our largest trading partner.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky February 2nd, 2026

Posted In: Steve Saretsky Blog