January 11, 2026 | Why the Bull Market Doesn’t Need MAGA

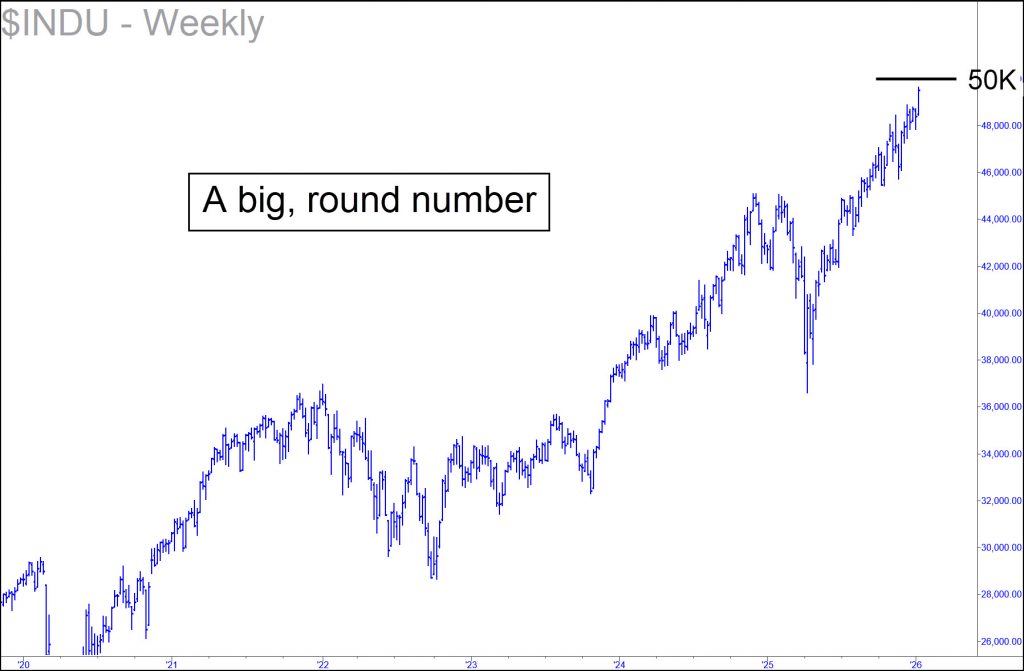

The Dow is poised to hit 50,000 this week, a milestone that would have seemed surreal when the blue chip average, plagued by covid, was bottoming near 18,000 six years ago. Although there can be little doubt that Trump helped kick stocks into high gear, one could argue that a powerfully bullish economic cycle made the man rather than the other way around. Stated another way, the stock market’s spectacular rally reflects a cyclical mood-change across America that made Trump’s election not merely possible, but inevitable.

Would shares be at these heights with Kamala Harris in the White House? It seems implausible, since she could never have matched Trump’s ambitious agenda. This is not to suggest that all or even most of his initiatives will succeed. In fact, some of the most important ones could lay an egg. Tariffs, for instance. They amount to little more than a new tax on global trade, with consequences that have yet to produce a clear result, let alone a positive one. His promise to make life more affordable for most Americans could also be a non-starter for reasons explained here a couple of weeks ago. And his plan to revitalize Venezuela’s oil production has already been labeled ‘uninvestible’ by the CEO of ExxonMobil. As for the reshoring of manufacturing. no one is talking about how revived and new factories would have to be practically worker-less to compete with heavily robotized plants in South Korea, China, Japan and elsewhere.

What Jobs?

And what about Trump’s plan to radically reorganize the mortgage market so that young people can buy houses? Although this sounds appealing, what will be the source of their income? The job market is changing so rapidly, especially with AI increasingly replacing more white-collar workers, that even seasoned recruiters can no longer predict where the jobs will be in ten years.

Stocks have soared nonetheless, not because Trump will necessarily succeed at making American great again, but because, for better or worse, he is perceived by investors and the entire world as being solidly in command of the nation’s affairs. Realize that stocks rose sharply during Biden’s first two year in office. If shares could do that while a head of cabbage occupied the White House, their turbocharged performance under Trump should have surprised no one. Even a do-nothing Harris might have enjoyed the economic Grand Supercycle’s runaway finale by simply holding onto the reins.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman January 11th, 2026

Posted In: Rick's Picks

Next: What is the Yen Carry Trade? »