January 17, 2026 | Trading Desk Notes for January 17, 2026

The Art Of The Deal

I started this year with a “gut feeling” that events in 2026 would “rock our world.” When Trump snatched Madero, I wrote, “Here we go.”

This morning, Trump cranked up the “We have to have Greenland” pressure by declaring that Germany, France, the UK, the Netherlands, Denmark, Sweden and Finland would be subject to additional tariffs of 10% (starting in February and accelerating to 25% in June) until they agree that the USA can have a “Complete and Total purchase of Greenland.” (Those countries had pledged to send troops to Greenland in “solidarity” with Greenland, telling Trump they were not for sale.)

So, “Here we go, again.” Perhaps this is how a “world-class” dealmaker starts a negotiation with an eye to ultimately settling for a significantly beefed-up US/NATO presence in Greenland. Or perhaps this is one more step in changing the “world order” as we know it, and we will see more clashes between Trump and former allies that reshape the geopolitical landscape.

Trump is scheduled to be in Davos this coming week; expect more tape bombs.

Question: What is Trump going to do ahead of the midterm elections? (Trump: When you think about it, we shouldn’t even have an election.)

Answer: Economically: Run it hot. Geopolitically: Run it hotter.

Silver

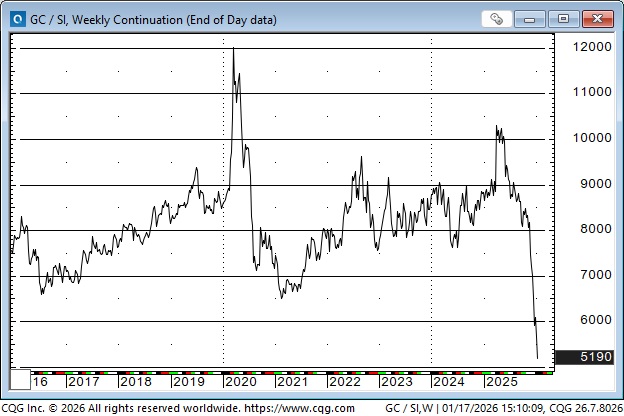

This week’s high in Comex March silver (~$94) was double the price in early November. Nine months ago, silver was ~$30.

The Comex used to be “the” benchmark price (along with the LME) for silver, but now that people want access to physical silver, not just an opportunity to bet on changing silver prices, and with China controlling ~70% of the world’s silver refining capacity (and restricting exports), Shanghai has become the more important market. Spot prices in Shanghai have been higher than NY prices recently, perhaps reflecting the demand for physical silver. See this terrific post from Tracy Shuchart on Substack.

While Comex silver prices have soared by ~$24 YTD (~35%), open interest on the 5,000 ounce contract has declined. (The value of a single contract at $90 is $450,000). Some of this decline may be due to longs taking profits (rebalancing) and/or backing away from rising margin requirements. (Trading volumes have increased from what they were over the past few months.)

The Comex mini contract (1,000 ounces, with a contract value of $90,000 at $90) has seen a dramatic increase in both open interest and volume, with “retail” likely aggressively chasing the market higher. (YOLO/FOMO).

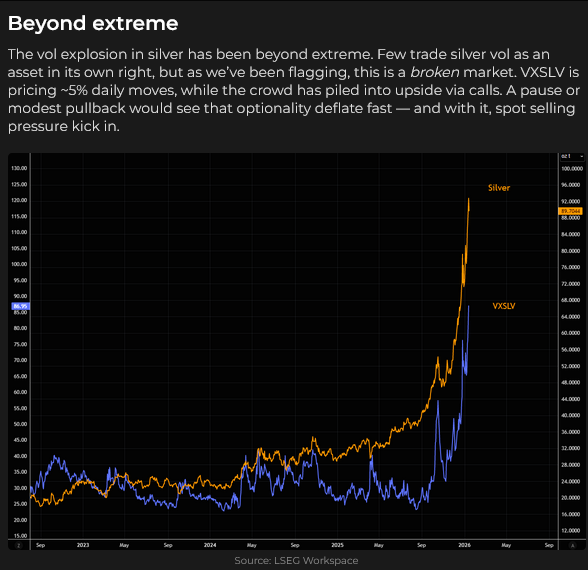

The VOL on Comex silver options has spiked by ~4X from a month ago.

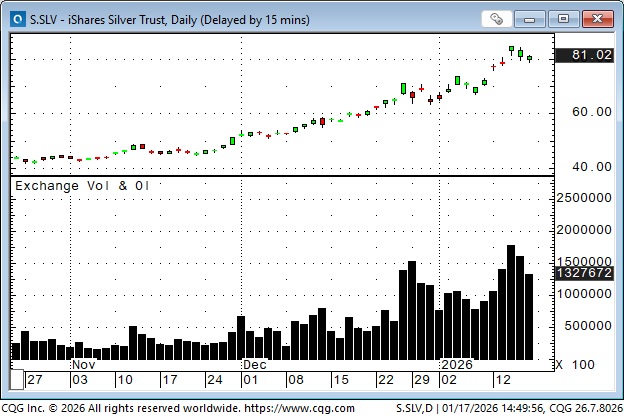

Volumes in the SLV silver ETF have exploded higher on retail buying.

The 2X ProShares Ultra Silver ETF has also seen increased volumes.

The silver miners ETF has more than tripled in the last 12 months.

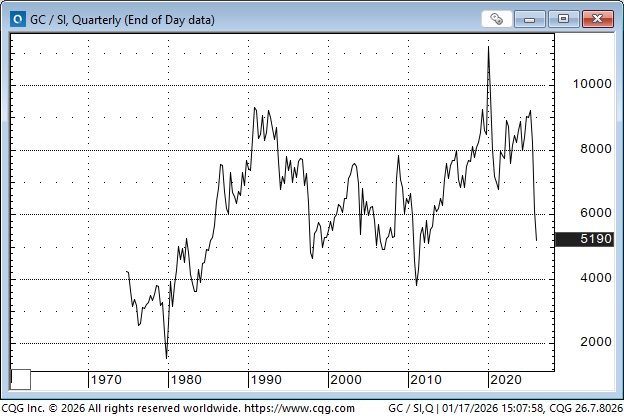

The gold/silver ratio: In 1980, when gold traded at $850, silver traded at $50. It took only 17 ounces of silver to buy one ounce of gold. (It now takes ~52, and as recently as seven months ago, it took over 100 ounces of silver to buy one ounce of gold.)

During the covid panic, it took 120 ounces of silver to buy one ounce of gold.

High prices are the best cure for high prices

In the history of commodity markets, there have been many instances when prices for a particular commodity spiked, usually due to a near-term imbalance between supply and demand, whether perceived or real. When that happens, speculators often jump on the rally in the hopes of making a “sure profit”. (My long-time friend, and veteran market observer, Bob Hoye says that, “people will believe the most preposterous stories, as long as the price keeps going up!”)

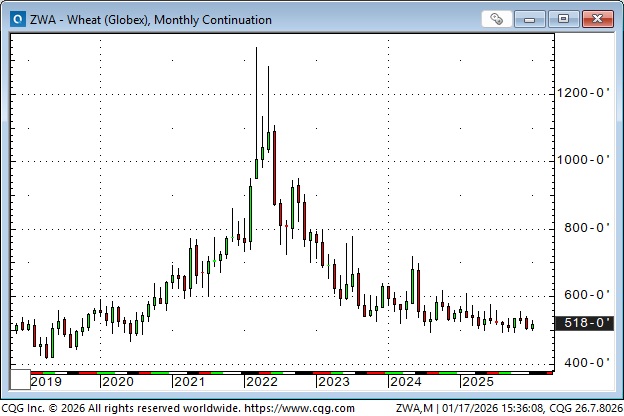

For instance, wheat prices were trending higher on the Chicago Board of Trade in 2020 and 2021, and spiked to record highs following the invasion of Ukraine. However, within 18 months, prices were back to 2020 levels, and have remained around there ever since.

There’s more than enough silver in the world to satisfy current demand (Google: how much silver is there in the world), but it may take some time to get it into “deliverable condition,” and in the meantime, silver prices may stay high. But high prices will encourage substitution and innovation, and the supply of deliverable silver will eventually overwhelm demand, especially speculative demand, leading to a decline in prices.

Stock markets

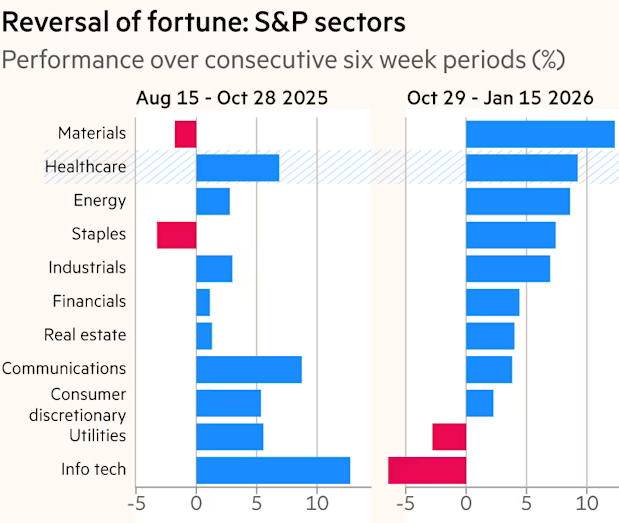

Stock market volatility is low, with indices around the world trading in narrow ranges at or near record highs. Rotation out of Big Cap Tech to other sectors continues.

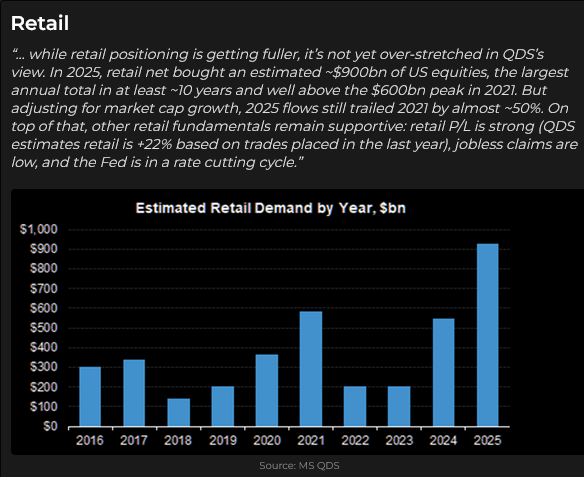

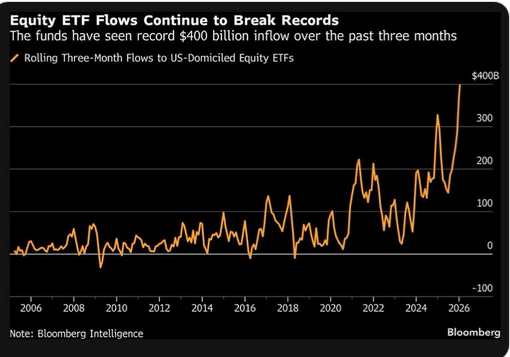

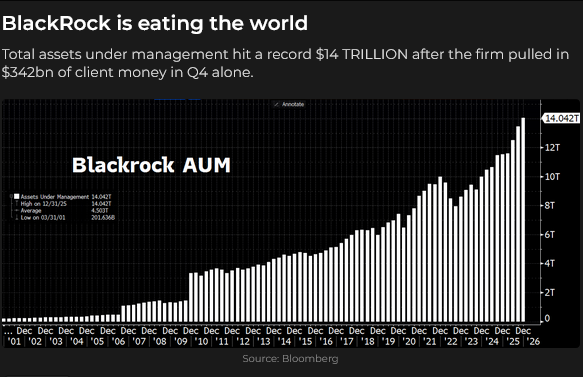

Capital is flowing into equity markets, with ALL leading Wall Street analysts forecasting that rising corporate earnings will drive stock indices higher in 2026.

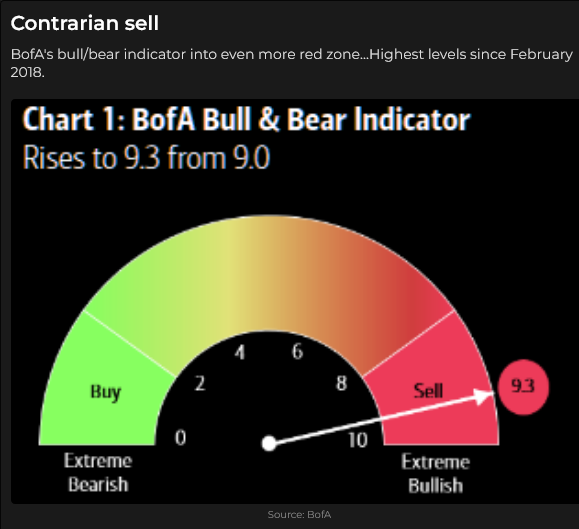

Market sentiment is very bullish. The BoA bull/bear indicator is at an eight-year high.

Currencies

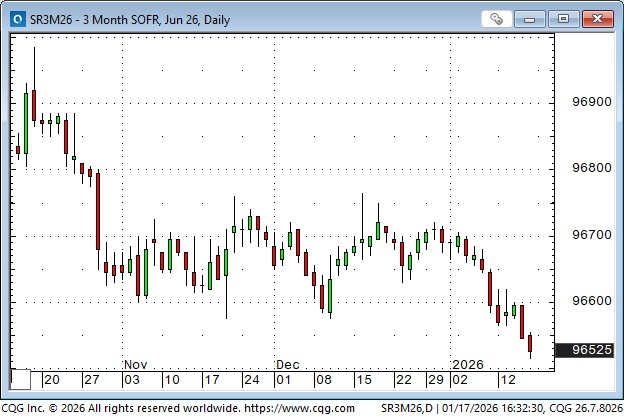

The DXY US Dollar Index has rallied ~2% since Christmas, in quiet markets, as traders modestly reduce expectations for US interest rate cuts in 2026.

The Yen slipped to an 18-month low this week (and is ~1% away from 36-year lows) as the USD gained against virtually all currencies.

The Japanese 10-year bond yield rose to a 26-year high.

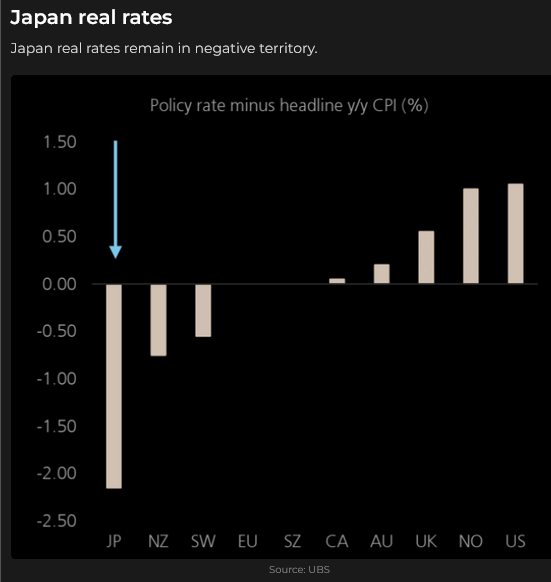

Japanese real rates are the lowest in the G10 as the BoJ is reluctant to raise rates aggressively (the Takaichi government wants to go to the polls to get a mandate to go deeper into debt to stimulate the economy), so a weaker Yen is the “escape valve.”

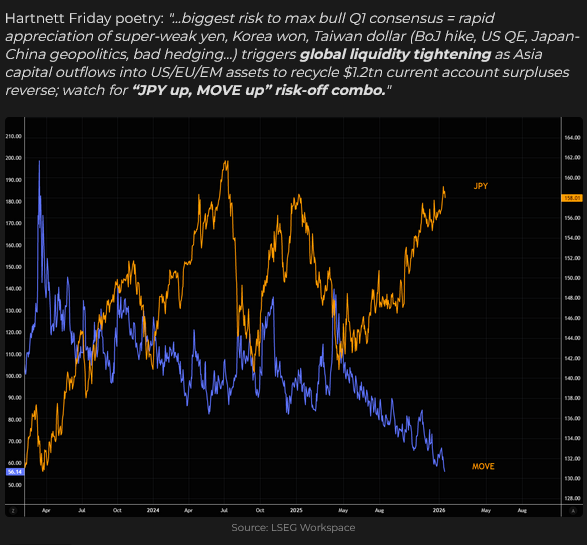

With the Yen (and the Korean Won and the Taiwan Dollar) so weak, there is talk of possible intervention (Kevin Muir, the Macrotourist, notes that the Korean authorities are offering tax incentives to encourage citizens to repatriate capital). If (and it’s a big if) intervention takes place (especially if the US also participates) and the market decides that the North Asian currencies have made a solid multi-year bottom, there could be a significant impact on other global markets (for instance, a possible flow of funds away from US equity and bond markets). Here’s a comment from Michael Harnett, Chief Investment Strategist at Bank of America (who also produced the Bull/Bear contarian chart above):

The rally in the RMB may help to create “room” for other Asian currencies to rise. (Falling prices in this chart mean that it takes fewer RMB to buy one USD.)

Energy

WTI prices rose from ~$56 to $62 on escalating violence in Iran, but quickly fell back to ~$59 when Trump and Iran “went quiet.”

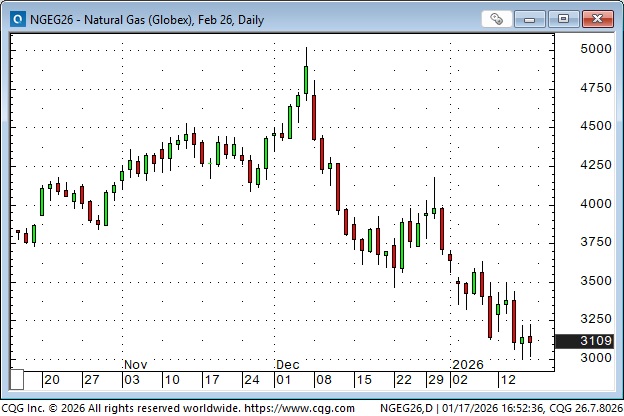

Natural gas has been relentlessly weak, despite expectations of very cold weather in the Eastern US.

Uranium issues remain aggressively bid.

My short-term trading

I shorted the S&P as it fell back from record highs on Tuesday, covered the position, and went long near the lows on Wednesday. I covered that trade on Thursday and reshorted the market on Friday. It was a good week, and I remained short into the weekend. I feel the market is vulnerable and could break on a change in sentiment. Trump’s Greenland initiative could spark some selling.

The Barney report

My wife was in Vancouver for three days this week, so Barney and I were home alone, and he stayed pretty close to me. I like to play hide and seek with him (he thinks I’m not very good at hiding), and here he is with his paws up on the kitchen island, looking for Papa, who has ducked down on the other side. What a handsome boy!

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the wild silver market, the low-VOL stock market’s rotation, what Trump is going to do next, and what happened in Iran. You can listen to the entire show here. My spot with Mike starts around the 57-minute mark.

The annual World Outlook Financial Conference will be at the Bayshore Hotel on February 6 & 7, 2026. I will be the lead-off speaker on Friday afternoon. You can view the agenda, see the list of speakers, and purchase a ticket here.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair January 17th, 2026

Posted In: Victor Adair Blog