January 12, 2026 | State-Directed Credit Allocation

Happy Monday Morning!

As we highlighted in last week’s piece ‘The Perils of Price Discovery’ Vancouver home sales recorded a 25 year low last year, leaving many sellers stuck in their homes, unwilling to accept todays pricing. Many sellers learned the perils of price discovery. Too slow to reduce prices in a falling market, eventually capitulating for less many months later.

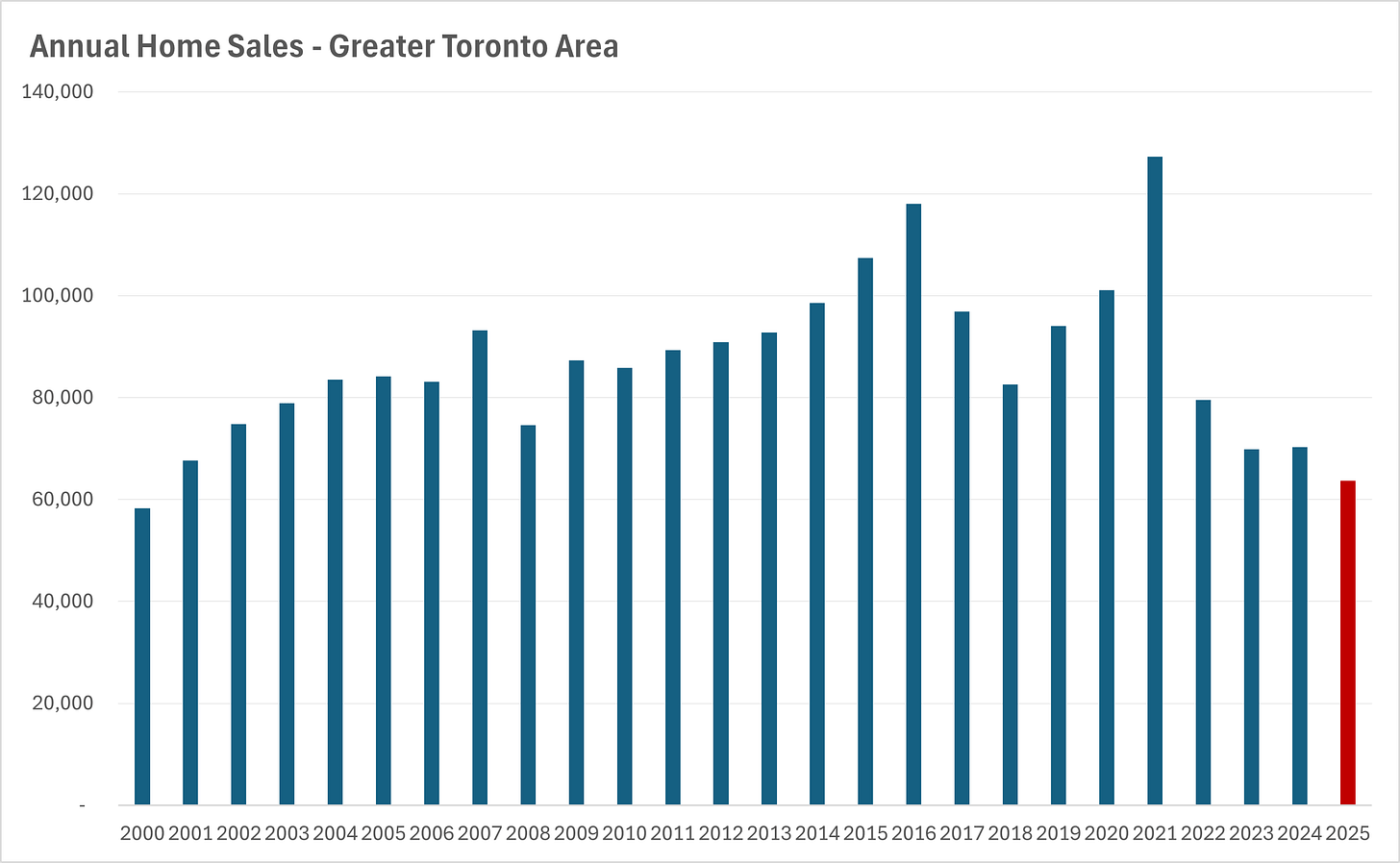

It appears things were no different in the GTA.

Toronto home sales fell to their lowest levels since the year 2000, despite adding over two million people to the region since then.

With supply outweighing demand, lower prices is the obvious conclusion. The question we have to ask ourselves now is what reverses this trend? Either demand needs to pick up significantly, or sellers need to start pulling listings off the market indefinitely.

We continue to believe that the majority of sellers in 2025 that were not able to sell (25 year lows) will be back again in 2026. Sellers are coming, I can assure you our phones have been busy to start the year.

So how do you meaningfully shift the demand curve higher to counter the bloated inventory levels?

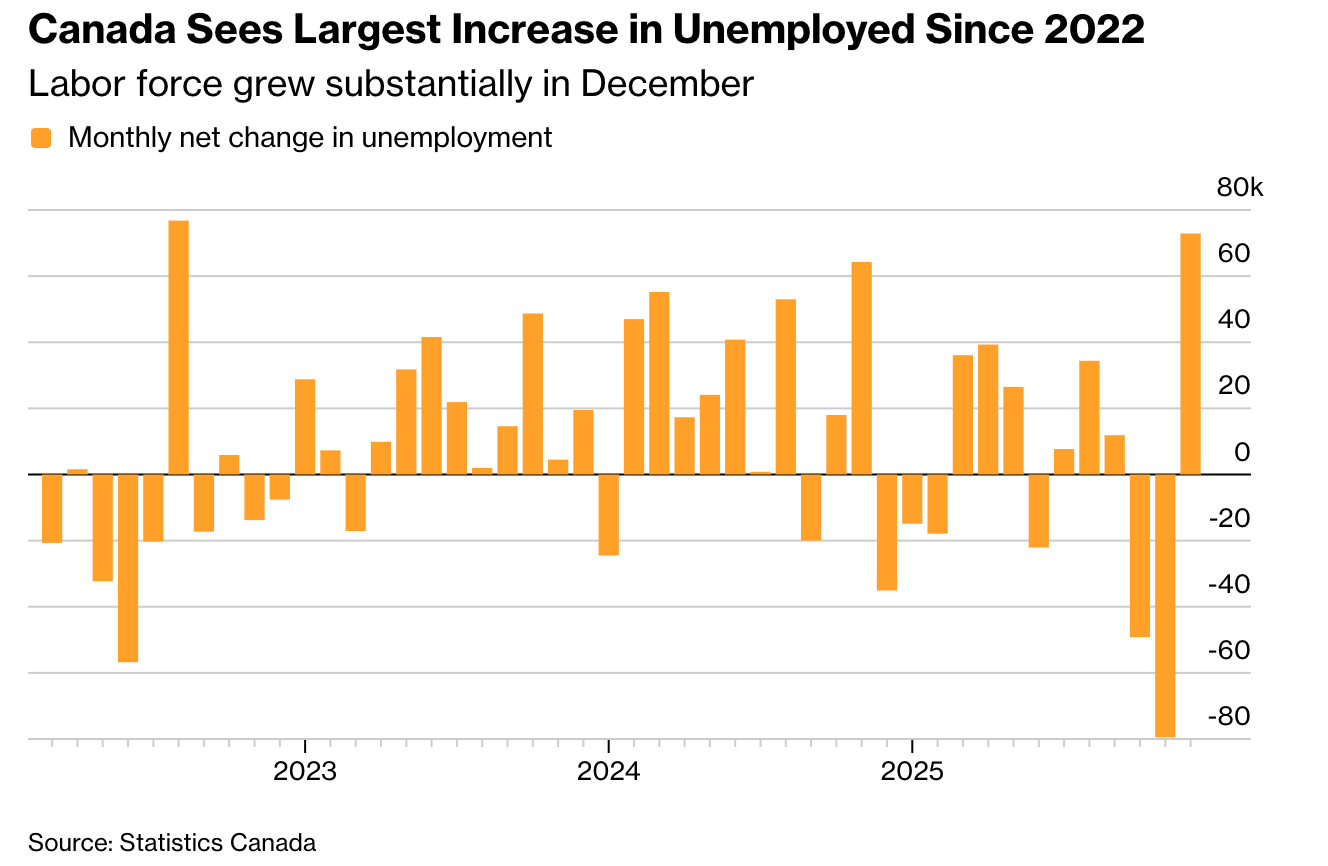

Interest rates are expected to remain relatively flat this year, population growth is non-existent, and the labour market certainly isn’t booming. We learned this past week that the unemployment rate rose 0.3 percentage points to 6.8% in December, mostly due to more job seekers re-entering the labour pool trying to find work.

Most of the people who joined the labor force last month didn’t find jobs, pushing unemployment up by 72,900.

In other words, the demand picture looks questionable at best. Absent policy intervention, there is no mechanism to clear this market.

Although, we need to keep an eye on the fiscal taps.

We already know Canada is set to run a whopping $80B deficit this year. However, more importantly, our neighbours to the south are set to fire the fiscal bazooka.

With US midterms around the corner, the Trump administration is rolling out the red carpet for voters. In the last few weeks, Trump has floated $2000 tariff dividend cheques, a plan to cap credit card interest rates at 10% for one year. Although even more shocking is his plan to ban institutional buyers of residential real estate, and directing Fannie and Freddie (Government-sponsored enterprises (GSEs) that buy and guarantee mortgages) to buy $200 billion in mortgage bonds to bring down mortgage rates.

If enacted, these anti-capitalist, anti free market polices would even make Mr. Eby blush.

The point here is not about whether you agree with these policies, but rather the omission that the Trump administration is going to run the economy hot, hot hot this year, even if it means steam rolling free markets.

It’s becoming increasingly clear that more western democracies have entered a state-directed credit allocation model, where the government gets to pick the winners and losers.

We have always believed our housing crisis is largely self-inflicted, and can be altered with the stroke of a pen, whether it’s through foreign buyer controls, zoning, lending standards, or immigration.

Let’s see what they have in store for us in 2026.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky January 12th, 2026

Posted In: Steve Saretsky Blog