January 19, 2026 | Gold Miner Q4 Earnings: Worth Waiting For A generational bull market

We still have a while to wait for the gold/silver miners’ Q4 and full-year 2025 earnings. Newmont, one of the early reporters, is scheduled to release its results on February 19.

But after that, the deluge.

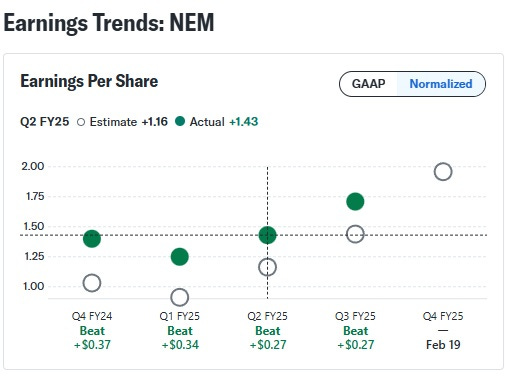

And a fun deluge it’s going to be. Sticking with Newmont, here’s a chart of its past year’s earnings versus analyst estimates. Note that, thanks to a combination of rising gold prices and management’s attention to cost control, the miner has consistently beaten expectations.

Now look at the Q4 2025 estimate. It’s up big, as analysts try to keep up with gold’s steady price increase. But if Newmont just matches this estimate, that would be 33% year-over-year and sequential growth, with correspondingly high free cash flow.

This, in turn, makes many things possible for Newmont and its peers, including debt reduction, dividend increases, and opportunistic acquisitions. In other words, a big Q4 earnings gain is just the first in a series of interesting developments/announcements.

So don’t think in terms of “topping” action. Continue to add to positions drawn from our Portfolio, via low-ball bids, dollar cost averaging, and put writing. We’re in the early stages of a generational bull market, and the real fun is still to come.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino January 19th, 2026

Posted In: John Rubino Substack

After listening to a video of Eric Sprott talk about Hycroft near end of October. I loaded up at about 7 dollars a share. Hycroft is now trading in the low 40s. Been long AGQ the 2x silver etf for about last year and a half up almost 6 fold last year. Don’t listen to the so called experts leveraged etfs are to be held only short term or the so called experts repeating stocks are going to crash day after day. I look for whatever reason I can to be bullish as gold silver and stocks have a lot higher to go.