December 21, 2025 | The Next Fed Chair Inherits the Death Spiral

President Trump is auditioning candidates for Fed chair (to take office in May 2026), with the main criteria apparently being who will cut rates fastest and deepest. So consider a near-zero Fed Funds rate a given for the coming year.

But that’s just the beginning of a very complex process.

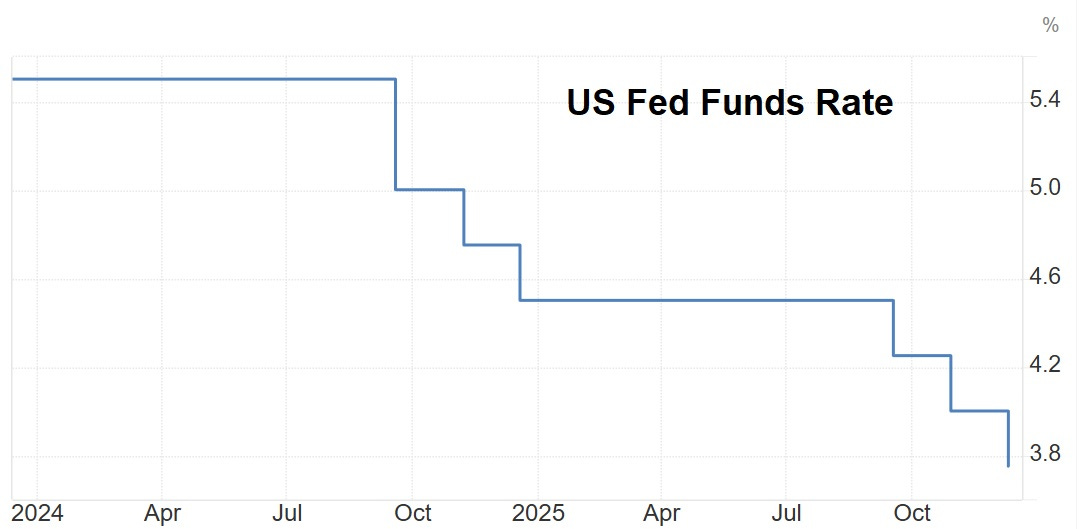

Let’s start with the fact that the Fed has already been lowering rates since September 2024:

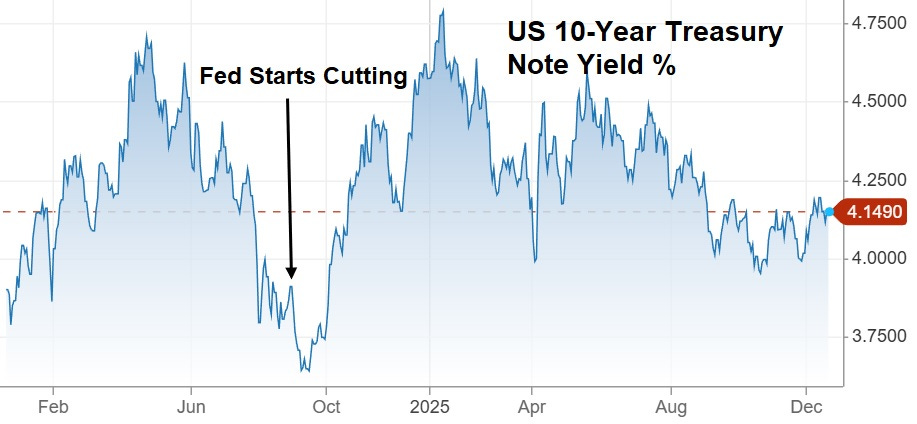

But longer-term rates have gone the other way, with the US 10-year Treasury yield (the reference rate for mortgages and car loans) rising slightly since the start of this easing cycle.

Bonds Don’t Respect the Fed

The bond market, which fears inflation, doesn’t seem to believe the Fed can maintain price stability. Which presents the government with a dilemma: If lowering short-term rates causes long-term rates go up, then cutting rates actually tightens monetary conditions. And the government’s policy of staffing the Fed to achieve dramatically lower short-term rates will have the opposite of the desired effect.

Death Spiral Scenario

Here’s how this might play out:

- The Fed cuts overnight interest rates back down to zero.

- Bond yields return to their recent highs of around 5%. Bond portfolios in pension funds and IRAs crater, and equities (which don’t like high interest rates) teeter. The AI bubble looks ready to pop.

- The Fed restarts quantitative easing (QE), aggressively buying bonds to depress long-term interest rates.

- This fails. Bond owners happily sell the Fed their now-questionable paper, but refuse to re-invest the proceeds in other bonds. Long-term rates stay high.

- The government tries to pre-empt an equities bear market by buying stocks. This temporarily stabilizes Big Tech shares, but further spooks the bond market, sending interest rates higher despite QE.

- 30-year mortgage rates hit 8%, causing home sales to crater.

- Stocks resume their slide despite the government throwing trillions of borrowed dollars at the problem.

- The Fed goes full Modern Monetary Theory, running the government and supporting the financial markets with newly created currency. Everyone loses faith in the system, and the leveraged speculating community (i.e., pretty much everyone) heads for the exits.

- “Monetary reset” becomes headline news, with the main question being how high the gold price will have to go to make it feasible. And, at long last, the fiat currency experiment ends.

Keep stacking. Inevitable is becoming imminent.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino December 21st, 2025

Posted In: John Rubino Substack