November 3, 2025 | Worse Than The 90’s?

Happy Monday Morning!

As expected the Bank of Canada slashed rates once again, bringing the overnight rate to 2.25%, and bringing the prime rate to 4.45%, it’s lowest level since June 2022.

“There’s nothing to cheer about here. We’re lowering interest rates because the economy is under immense strain,” noted Warren Lovely, managing director with National Bank.

The Bank of Canada has downgraded its forecast for economic growth in 2025 to 1.2%, and to 1.1%. in 2026. Both were previously expected to be 1.8%.

The key takeaway here is as follows. Canada’s GDP is running at -0.2 on a six month annualized rate. The official statisticians haven’t declared a recession but for all intents and purposes we’re already in one.

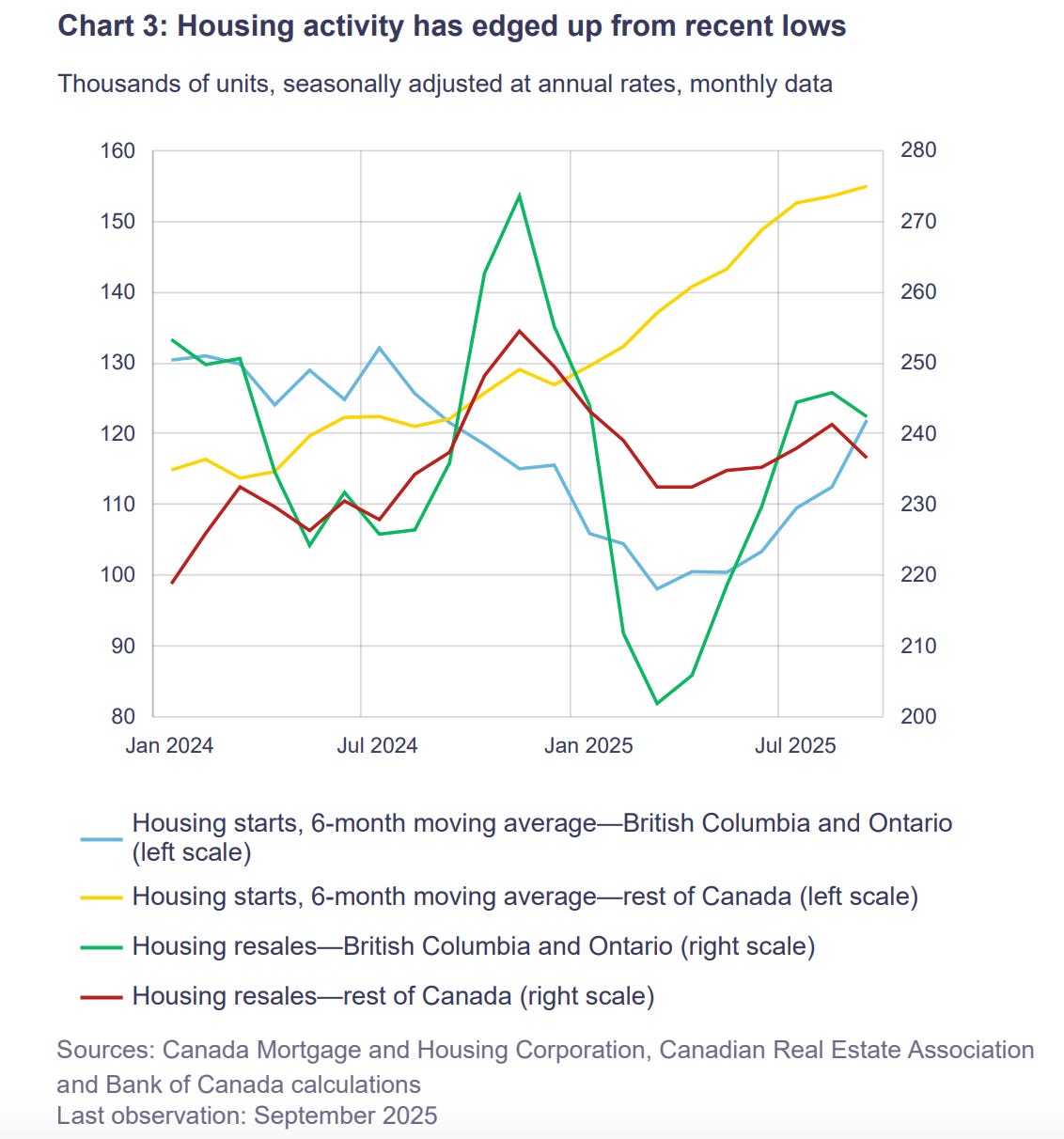

The Bank of Canada believes rates are “at about the right level” in part because they see a rebound in residential investment.

However, we see nothing to suggest an imminent bounce in the housing market. As we highlighted last week, the recent bounce in seasonally adjusted housing starts are reflective of investment decisions performed several years ago. A housing start, as defined by CMHC, is counted once the foundation is built back to grade. In other words, after the land was sourced, permits approved, pre-sales sold, land excavated and foundation poured. In other words, a seriously lagging indicator that gets muddied further with seasonal adjustments.

Here’s the headline this past week.

There were just 28 new condo units sold in the old city of Toronto in September, and 155 across the entire Greater Toronto Area. The bleak sales figures are running 90% below the ten year average.

“It’s worse than the 1990s,” said BILD spokesperson Justin Sherwood. “We have a serious issue on our hands relative to being able to produce housing at a rate that people can afford to buy.”

Despite the Bank of Canada’s best efforts, we see no bounce in the housing market right now.

Greater Vancouver resale numbers for the month of October will get released to the public later this week. Here’s what you’ll see. Home sales were 20% below the ten year average and inventory was 40% above the ten year average. The sales to actives ratio sits firmly in buyers market territory at 14%, resulting in further downwards pressure on home prices.

We find it rather intriguing that markets are currently pricing in no more rate cuts from the Bank of Canada this year, and no cuts in 2026 either.

Housing makes up such a large part of the economy, but more importantly drives household wealth and consumer sentiment, and so we believe markets are likely underpricing the odds for additional cuts from the BoC.

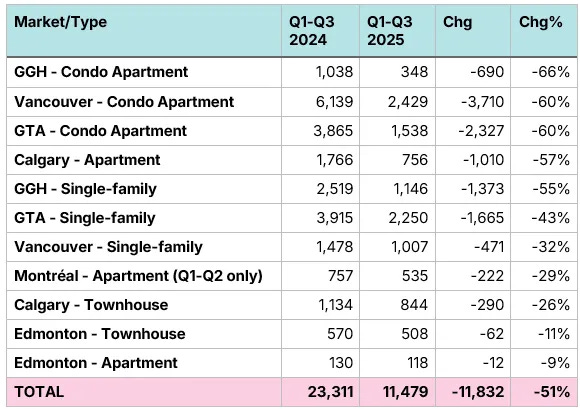

The acute weakness in housing, particularly in the construction sector, is not isolated to just Toronto. New home sales are down 51% in Canada’s six largest housing markets.

This will flow through into future housing starts and price reductions, as inventory swells on developer balance sheets. Remember, most new home inventory doesn’t hit the MLS, it sits at presentation centres in the shadow market.

It will take more than a few rate cuts from the BoC to get buyers off the sidelines. As it stands right now, variable rate mortgages at most lenders sits at about 3.8%, this is only marginally lower than where fixed rates sit as bond yields have barely budged all year, down about 30bps since the calendar turned over.

In other words, borrowing power hasn’t improved very much when you consider that the majority of borrowers are still taking fixed rate mortgages. Those fixed rates could come under pressure with the whopper of a budget deficit expected this week from the Carney Government.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky November 3rd, 2025

Posted In: Steve Saretsky Blog

Next: Perched in the Danger Zone »