November 10, 2025 | No Bailout

Happy Monday Morning!

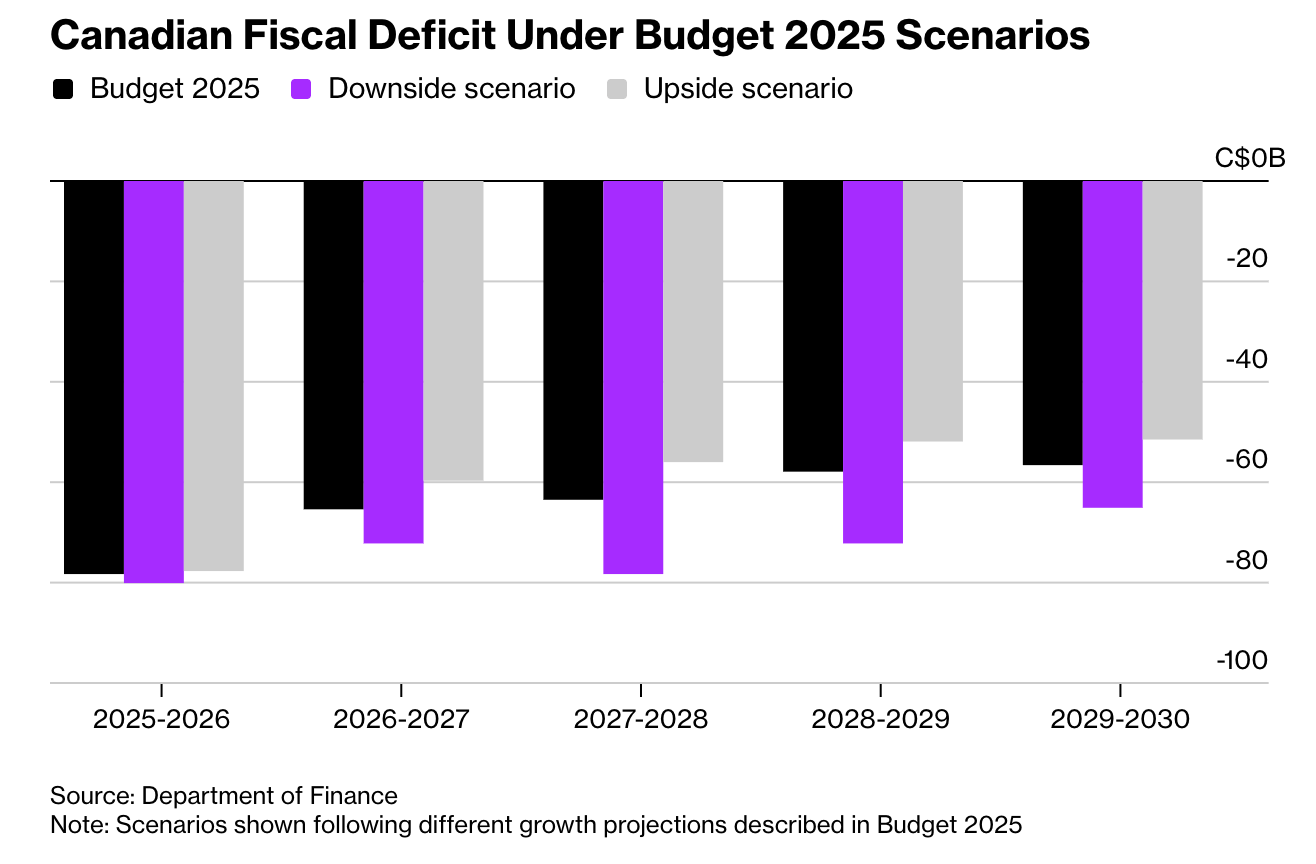

The Carney government unveiled its highly anticipated fiscal bazooka. The deficit is pegged at $78.3 billion for this fiscal year, representing 2.5% of Canada’s GDP. That’s roughly in line with the median estimate in a Bloomberg survey of economists.

The budget foresees an extra $167 billion in total budget deficits over the next five years, compared with the last fiscal projection under Trudeau.

In other words, Big beautiful deficits as far as the eye can see.

While policy wonks will debate the size and the effectiveness of this budget, what caught our attention was the lack of any significant housing policies. Here’s what we got:

- No MURB (Multi-unit Residential Building) tax incentive for rental construction, as promised during the election.

- The UHT (Underutilized housing tax) has been eliminated as of the 2025 calendar year. It was nearly costing more to administer than it was collecting in revenues.

- Increasing the Canada Mortgage Bond annual issuance limit from $60 billion to $80 billion. Used to finance rental construction through CMHC.

- An extra $12.2 billion federal dollars over 10 years directed to Provinces/ Municipalities for housing infrastructure in exchange for cities limiting or reducing development charges.

- $13B For a new ‘Build Canada Homes’, an agency that will build social housing.

None of this is big and bold, in fact, it is mostly status quo and unlikely to have any material impact on the housing market. And perhaps, that’s exactly what they want.

Here’s what we know for sure.

The MURB program was the most highly anticipated program, one that was promised during the election, and was ultimately left out of this budget. It would have been a highly favourable tax incentive for high-income earners to invest and build new rental housing.

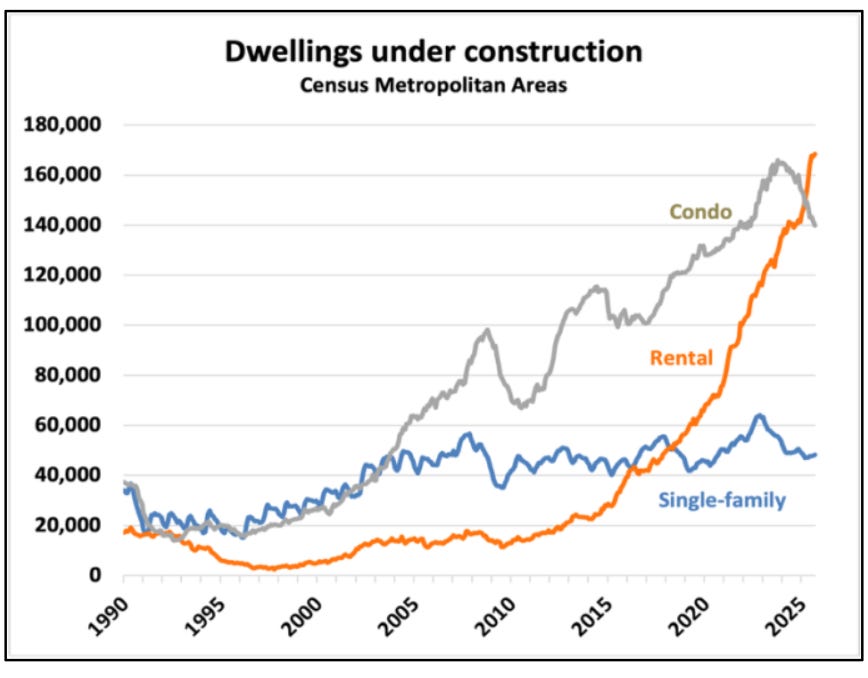

Our belief is the Carney government is probably already worried about how much rental housing is currently under construction, with nearly 90% of new rental construction currently financed through CMHC (the taxpayer).

It’s been effective, but perhaps too effective. Rents are falling, vacancies are rising, and we still have a pipeline full of new rental completing soon.

This becomes even more concerning when you consider the Carney Governments intention to throttle immigration.

Acknowledging Trudeau’s egregious policy blunder.

“We are taking back control over the immigration system and putting Canada on a trajectory to bring immigration back to sustainable levels—allowing us to fulfill the promise of Canada to those who call it home.”

“The 2025-2027 Immigration Levels Plan is already delivering results: new temporary foreign worker arrivals have fallen by about 50 per cent this year, and new international student arrivals are roughly 60 per cent lower than in 2024.”

“Housing affordability has improved for both renters and home buyers, supported by government actions such as investments in purpose-built rental construction, lower immigration targets, and new supports for first-time home buyers.”

New targets will stabilise permanent resident admission targets at 380,000 per year for three years, down from 395,000 in 2025 (500K under Trudeau) and will reduce temporary residents from 674K so far this year to 385K next year, and just 370K in 2027 and 2028.

Huge.

In fact, it was actually the biggest “Housing policy” in the budget.

The biggest takeaway from budget day is the signal the Carney government sent to the housing world.

There is no bailout coming.

The Feds could have offered to stimulate housing demand through a variety of measures but decided to do, effectively, nothing.

For several decades policy makers have continuously intervened every time the market wobbles.

This time, despite a budget that promised “generational investments” there were no handouts for the development community.

This is particularly surprising considering the development industry is on life support right now, particularly in the GTA. If there was ever an excuse to stimulate housing, it would be now. So far there’s been just 1200 new home sales for the entire GTA this year, down from an average of 20,000.

Right or wrong, the Carney government has seemingly little interest in stimulating demand on the purchasing side, hence their continued focus on rental housing through Build Canada Homes and through the increased issuance of Canada Mortgage Bonds to fund new rental construction.

We continue to believe we are going through a monumental shift for how housing gets built in this country, moving away from pre-sales and towards state-financed rental.

Business models will need to change, and the housing market will need to face economic gravity on its own. For now.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky November 10th, 2025

Posted In: Steve Saretsky Blog

Next: The Tariff “Dividend” »