October 6, 2025 | Unsold Inventory Steve Saretsky

Happy Monday Morning!

Last week we penned an article titled ‘Intervention Required’ in which we highlighted the growing chorus of developers demanding immediate government intervention to arrest the collapse in the new housing industry.

With home sales in Canada’s largest major metro running 90% below the long term average, things are starting to get out of hand. Hard to believe there’s been just 1300 new condo sales in the entire GTA this year. A metro of nearly 7 million people.

We refer to commentary from BILD Canada which represents more than a thousand home builders and developers across the GTA.

“With pre-construction inventory dropping dramatically, the signs are clear that the new residential sector in the GTA is basically stopping. Greater Vancouver is seeing a third of its normal activity and will be soon in a similar place, many other Ontario markets like Ottawa and the Kitchener-Waterloo area are struggling, and we are now seeing even some troubling signs in Calgary. Why is the government ignoring these obvious warning signs?”

It’s no question the GTA is the eye of the storm, but as BILD warns, places like Vancouver and Calgary aren’t far behind.

Executives in Vancouver’s real estate industry are warning of a glut of newly built condos sitting unsold and empty throughout the region.

About 2,500 new condos are sitting unsold and empty in Metro Vancouver, according to the Canada Mortgage and Housing Corporation (CMHC).

That number is double what it was last year, according to CMHC.

Greg Zayadi, the president of Vancouver-based development company Rennie, said the market slowdown has been happening since March 2022.

“But, yes, over the last year it’s gotten very real,” Zayadi said.

“The last time we saw this level of developer-owned unsold inventory was 24 years ago.”

Zayadi is right, although he is flagging CMHC completed and unsold inventory numbers which, surprisingly, don’t show the worst of it.

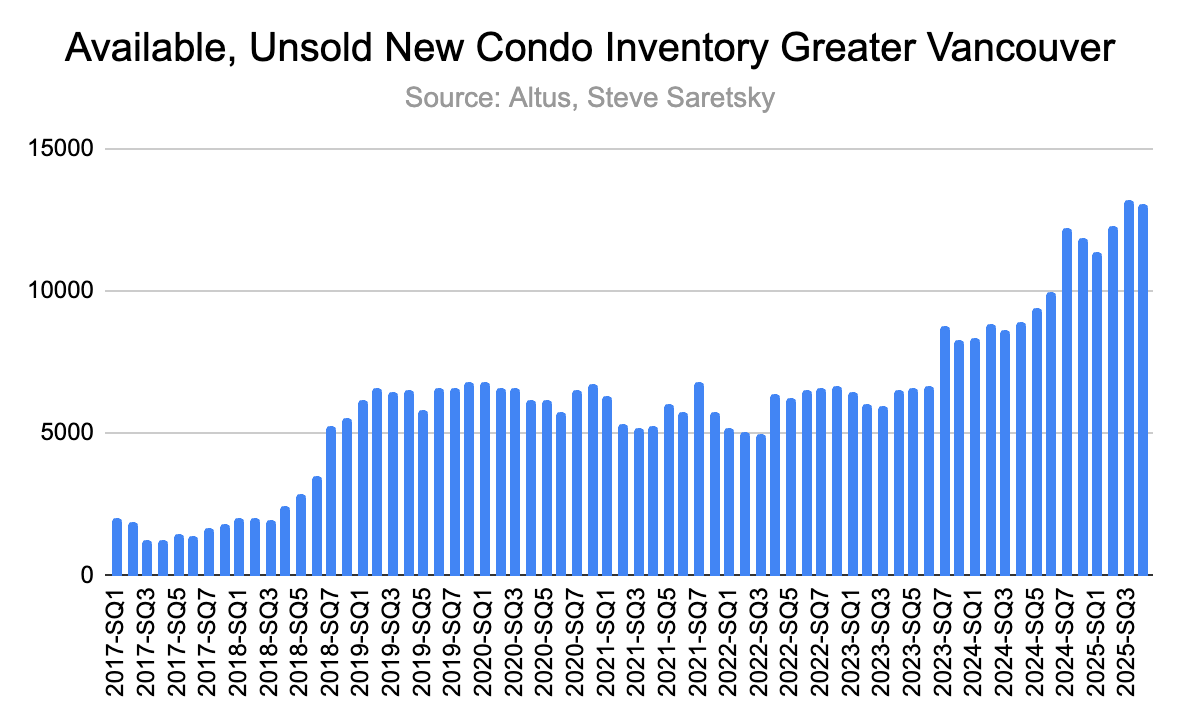

Altus Group data, which tracks projects that have launched or completed, shows developers are currently sitting on nearly 13,000 unsold condo units.

This is what you call shadow inventory, and does not typically show up on the MLS system that predominately warehouses resale inventory. By the way, resale inventory in the condo market is at its highest levels since September 2012…

For a developer, if you can’t sell what you already have, why on earth would you launch a new project?

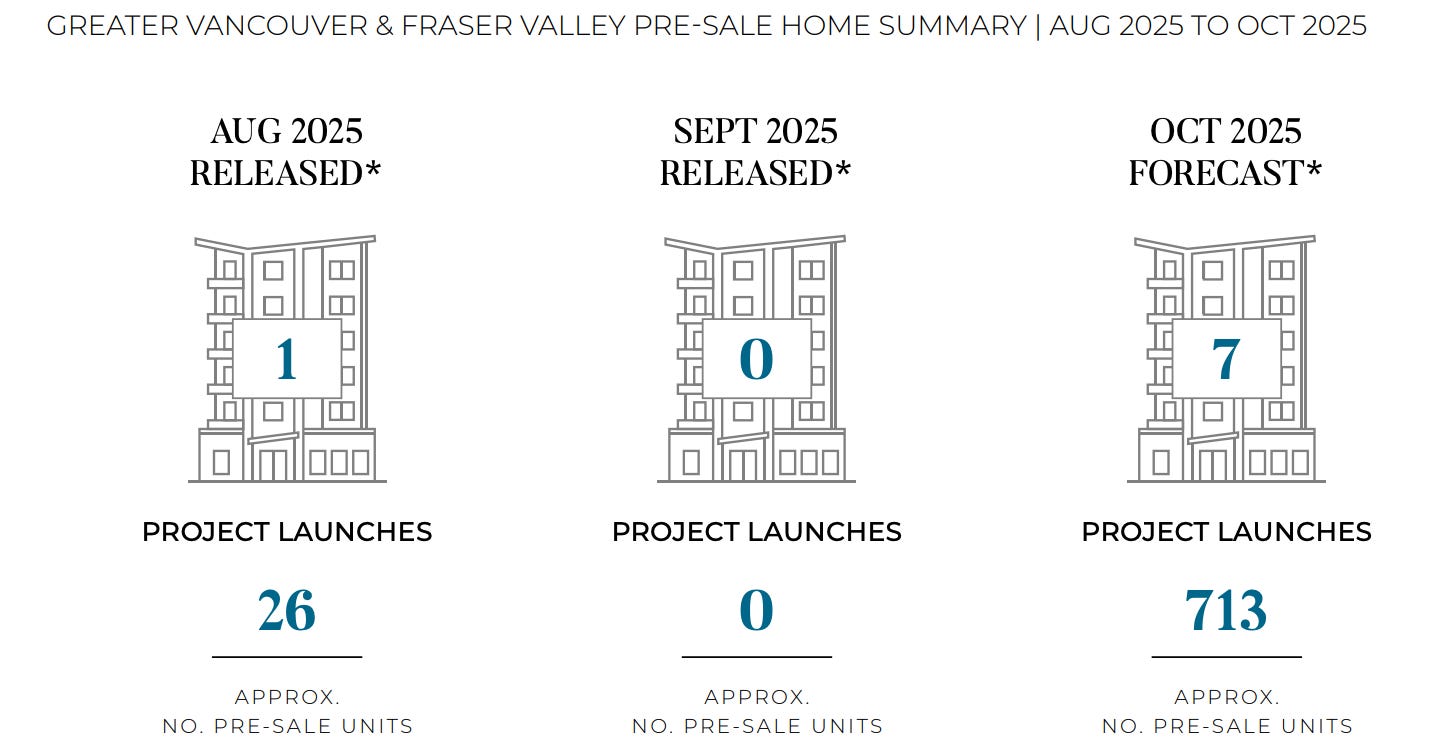

And so, new project launches continue to circle the drain. There’s only been one project launch in the entire lower mainland over the past few months. Per MLA, this marked a departure from historic norms, as over the past five years September has averaged about eight project launches and roughly 350 sales.

So where do we go from here? The government is promising us a record number of new and affordable housing. Yet the math suggests otherwise.

None of this is new. Governments lie all the time. We’ve also known for several years that economic gravity would pull housing starts lower and lower for years to come.

What is most interesting this past week is not Zayadi’s comments noting a 24 year high in completed and unsold inventory, but his suggestion that “We need to get to a point where we can deliver inventory as an industry, as a province, at $700 to $900 a square foot. That’s $200 to $300 above where the market is today.”

If Zayadi is right, and I believe he probably is, the downturn is new housing sales is likely to persist for several more years before the cost of delivering new housing falls $200-300/sqft accordingly through a combination of lower interest rates, lower development fees, and lower construction prices, or demand surges enough to clear the backlog of unsold inventory in both the resale and the pre-sale market.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky October 6th, 2025

Posted In: Steve Saretsky Blog

Next: Consumer Collapse in Motion »