October 24, 2025 | Recession Watch: Shadow Banking Crisis … and So Much More

The spread of private equity and non-bank lending has created a “shadow banking system” that’s largely invisible — until something breaks. Then the resulting losses show up in the real banking system, and everyone freaks.

In the past couple of months, some of this shadow paper went bad without warning. Here are a few bullet-point snippets from reporting on the debacle:

- Regional lender Zions Bancorp announced a $50 million writeoff on “what it believes to be apparent misrepresentations and contractual defaults” by two borrowers.

- Regional lender Fifth Third Bancorp (FTB), in a regulatory filing in early September, said it would take a $170 million charge related to the collapse of subprime auto lender Tricolor. JPMorganChase (JPM) also wrote off $170 million in Tricolor-related loans in the third quarter. And Raistone, which facilitates short-term business loans, has said $2.3 billion has “simply vanished” as a result of First Brands’ failure.

- “I probably shouldn’t say this, but when you see one cockroach, there are probably more,” said JPMorgan CEO Jamie Dimon. “I expect it to be a little bit worse than other people expect it to be.”

- The First Brands collapse WIPED OUT $4 billion in leveraged loans held across ~80 CLOs from PGIM, Franklin Templeton, Blackstone, and others. The sudden failure is a major warning for the broader credit market and leveraged loan sector.

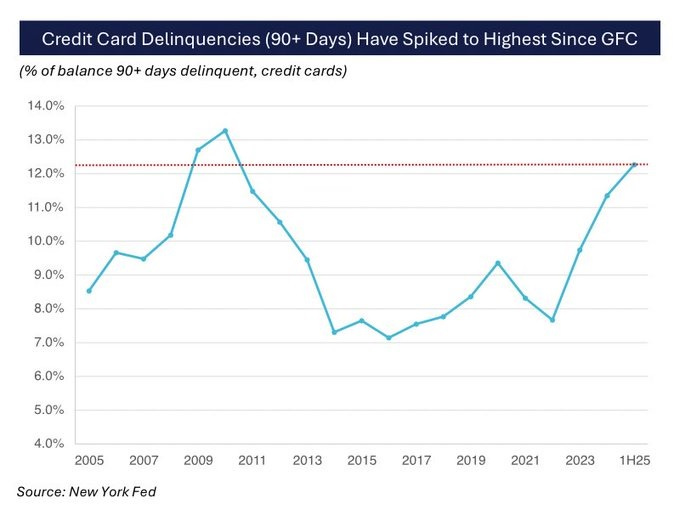

But of course, shadow banking is just one of our problems. Others include soaring credit card delinquencies…

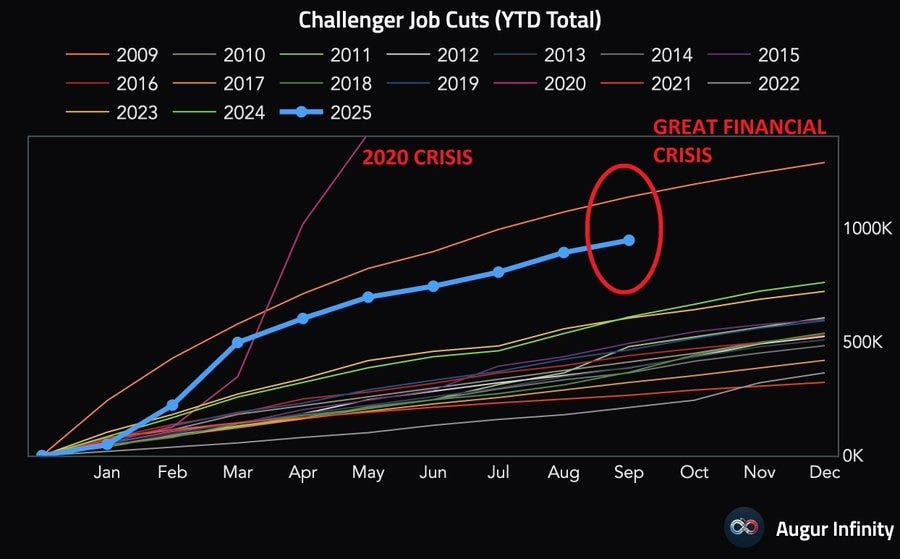

…layoffs approaching Great Financial Crisis levels…

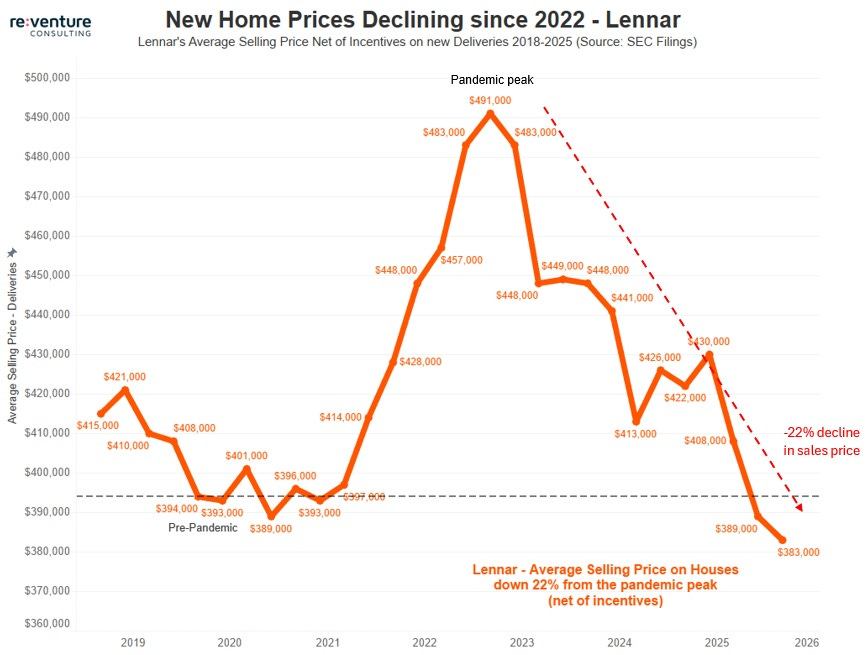

…new home prices down by over $100,000 since 2022…

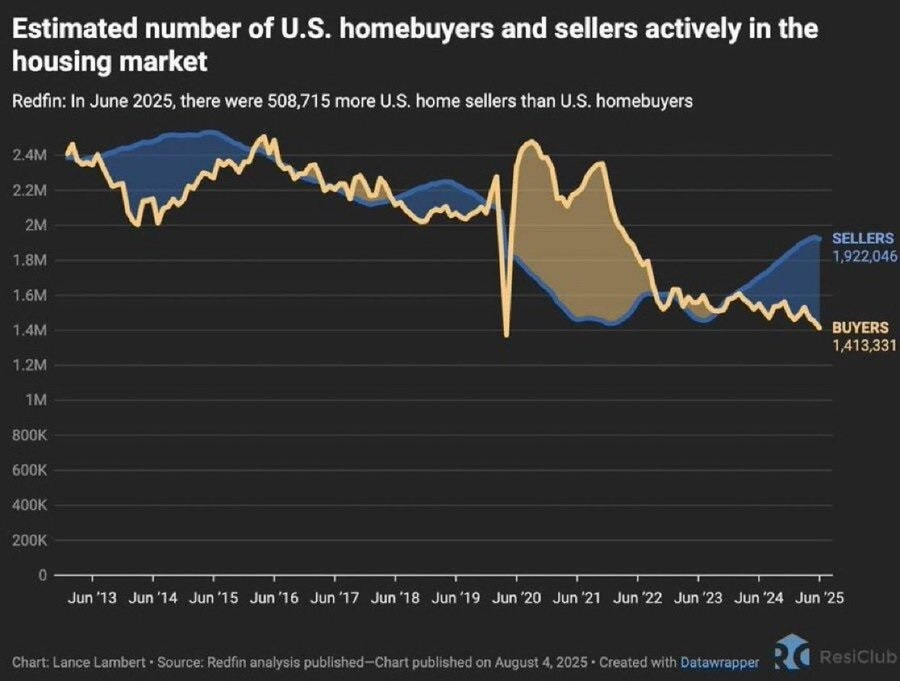

…home sellers now outnumbering home buyers…

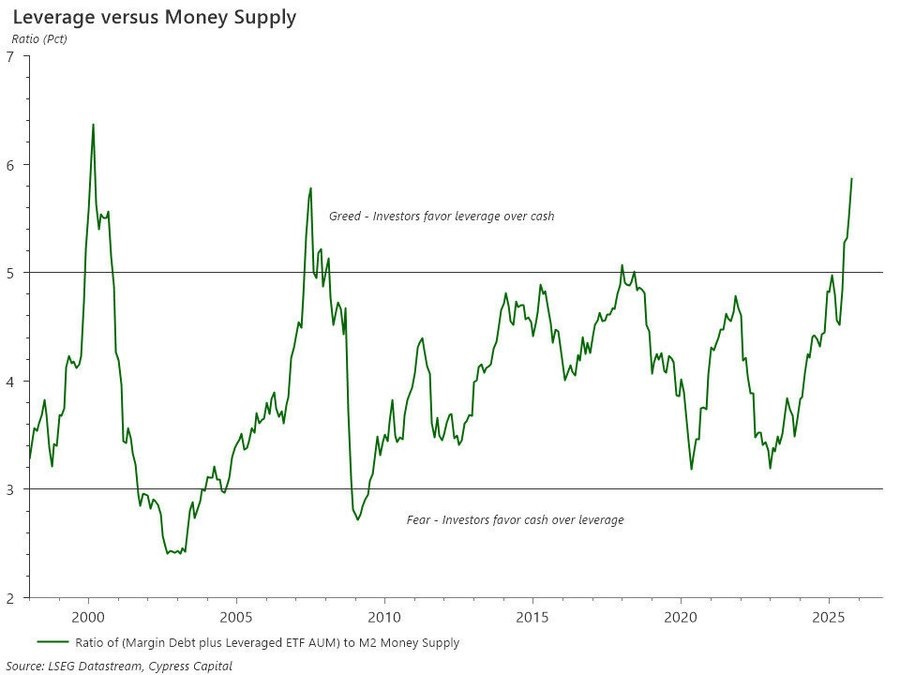

…and financial leverage that’s growing much faster than the money supply — which coincided with the previous two stock market crashes:

Meanwhile, all of this financial fragility is perched upon the precarious pillar of AI spending, which accounts for just 4% of U.S. GDP but supplied 92% of this year’s GDP growth. In other words, minus the current tech bubble, the economy is dead in the water.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino October 24th, 2025

Posted In: John Rubino Substack

Next: China Rare Earth Grip Tightens »