October 13, 2025 | Is the AI Stock Bubble Partially Fake?

There’s a business practice sometimes called “vendor financing” in which a company lends money to a customer, who then uses that money to buy the company’s products. The company reports the proceeds as sales and income, usually without a full accounting to its shareholders.

This financing scheme can work — as long as the customer pays back its debts. But if the customer defaults, the company is stuck with a non-performing asset, leading to write-downs that can wipe out prior sales and earnings.

Why do we care about this arcane, borderline-sleazy business practice? Because it’s taking over the world of AI, which is currently supporting the entire US financial system. Two examples:

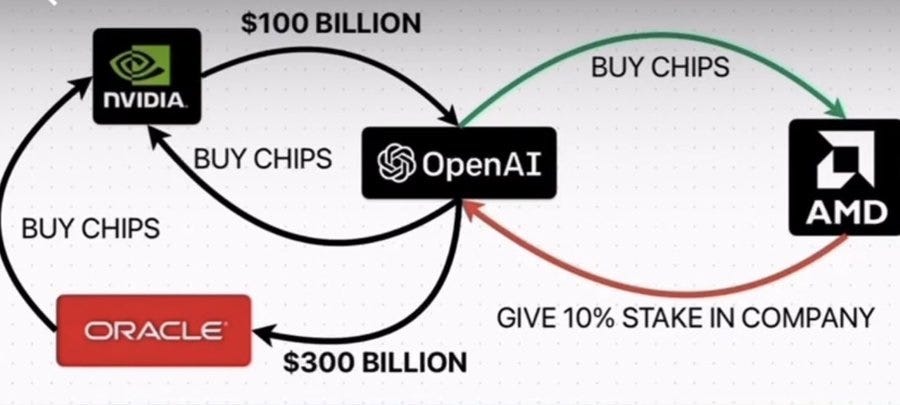

- Chip maker Nvidia invests $100 billion in AI leader (and supposed non-profit) OpenAI. OpenAI uses that money to build more AI data centers, which run on Nvidia chips.

- Chip maker Advanced Micro Devices (AMD) gives OpenAI 10% of its stock in return for a promise to use AMD chips in future AI data centers. Investors pour into AMD stock on the news, raising its market cap by more than the cost of the stock it sold.

This story continues through numerous other deals worth hundreds of billions of potentially illusory sales and market cap. Here’s a graphic depicting some recent action…

…and two simpler views of the concept:

For a deeper dive, see the following:

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino October 13th, 2025

Posted In: John Rubino Substack