The aging bull market smells like it’s in a topping process, although it could take a vicious head-fake or two to new highs to set the hook. Last week, I raised the possibility that shares had entered a vortex similar to the one that led to the 1929 Crash. A key similarity is that investors have begun to freak out over tariff news they’d grown accustomed to shrugging off. Is it possible the reason for the stock market’s hysterical behavior lies elsewhere? The mainstream media and its vaunted experts used China’s ‘rare-earths’ threat ten days ago to explain why shares plummeted that Friday. However, when the market began to recover Sunday evening, they changed their tune with sheepish second-day stories about how rare-earth minerals turn out to be not so rare after all.

It is the breathtaking stupidity and incompetence of journalists who invent the news that has caused me to tune out their blather and focus solely on charts when I forecast market trends. As far as I’ve observed over 50 years, price movement is caused mainly by arcane cyclical forces that color our perceptions of news. Is it not, therefore, reasonable to infer that the stock market’s ups and downs create the headlines, not, as is almost universally believed, the other way around?

A Bitcoin ‘Tell’

Far more interesting to me these days than the stock market’s headless-chicken act is the spectacular bull market in gold. Prices have risen by 31% in the last two months, impaling Hidden Pivot targets as though they were as mushy as journalists’ brains. Until recently, I’d assumed quotes were rising so steeply because gold, traditionally a haven in times of uncertainty, had glimpsed some horrible economic catastrophe ahead. However, there is a second possibility — that gold is caught up in the Everything Bubble, albeit with high relative strength that factors its superiority over other investable assets on which the ever-gluttonous 20% have gorged themselves since the covid hoax. (Note: Bitcoin wackos who see it as a store of value should have noticed how the cryptos died during this latest phase of bullion’s moonshot.)

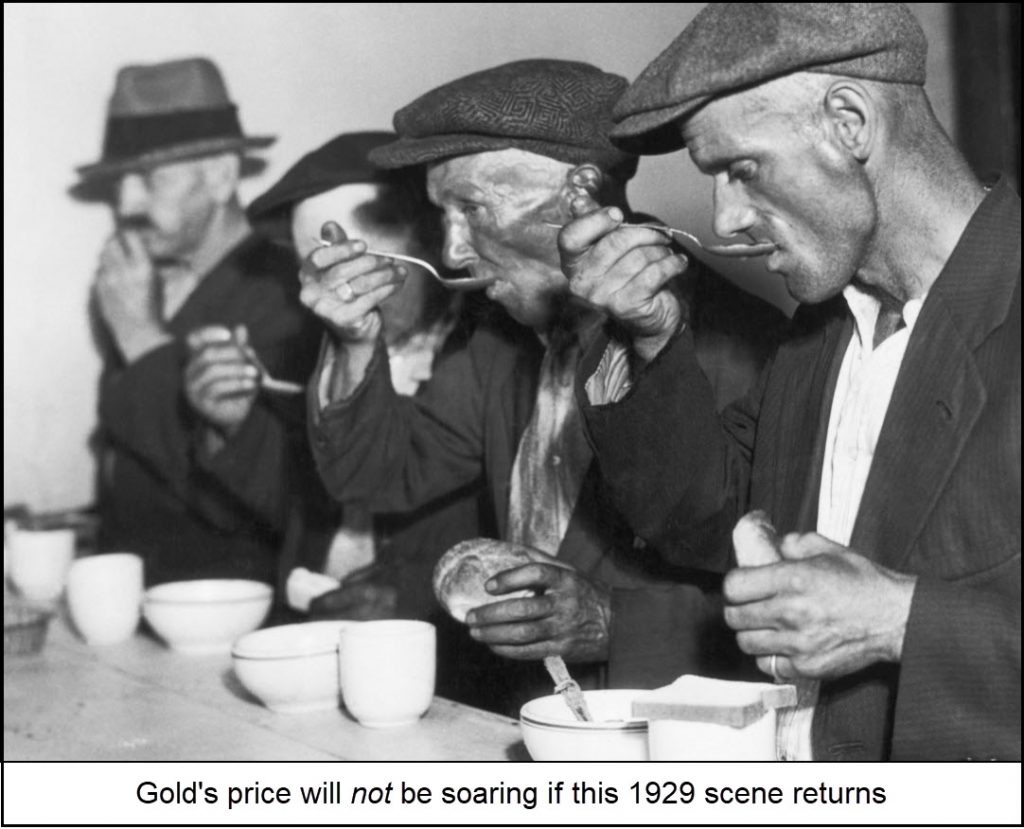

My technically derived targets for gold go no higher than 5020 (basis the December futures), but I am open to the possibility of a further doubling in price to $10,000 or so. That would be logical if the Everything Bubble is the reason for gold’s rally so far to a record 4392. But speaking as a hard-core collapsitarian who sees no possible endgame other than a deflationary bust, the $5020 target could prove to be as high as it gets. That doesn’t mean gold’s real value would stop increasing, only that its nominal value might be capped at levels far lower than estimates promoted by publicity hounds in my line of work.

A Lucrative Plateau

I have always maintained that gold would outperform all other investments in an economic collapse; however, it could do so by simply plateauing while most other investable assets plunge as they did in the 1930s. In the meantime, the bulletin I sent out to subscribers on Thursday night about gold futures and GDXJ may have caught an intermediate top. I have made both ‘touts’ publicly viewable on the Rick’s Picks home page for those who are interested in the details.