October 27, 2025 | Hold the Applause

Happy Monday Morning!

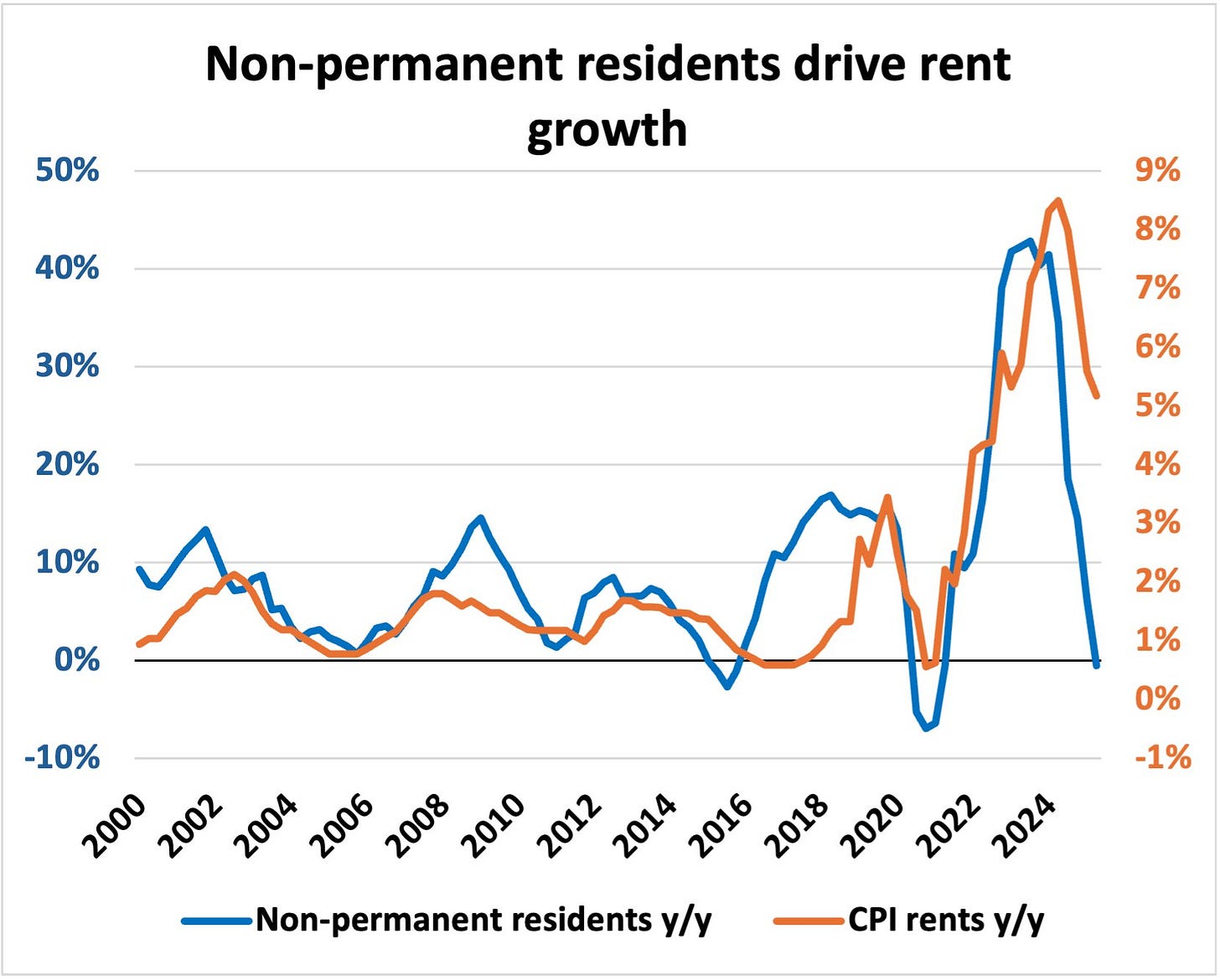

Canada’s annual inflation rate rose to 2.4% in September, more than expected. Perhaps more intriguing is that rental prices are accelerating higher. They’re now up 4.8% year-over-year and 6.1% annualized over the past three months. A head scratcher for any regular reader here.

So what does Stats Canada see that we don’t?

Real time data from Rentals.ca, which measurings asking rents, shows asking rents in Canada decreased 3.2% in September, marking the twelfth consecutive month of year-over-year declines.

Conversations with our industry contacts suggests rents are down at least 10% since peaking a year or two ago in most major metros, including Vancouver, Toronto, and even Calgary.

Not only are rents not accelerating higher, but we believe the likelihood for further downwards pressure on rents remains the most likely outcome given the record number of new rental housing currently under construction, combined with near zero population growth. Analysis from Ben Rabidoux, friend of the newsletter, suggests the same.

Considering both prices and rents continue to fall across most of Canda, and considering shelter accounts for nearly a third of the CPI basket, we believe markets are correct in looking past the most recent CPI reading. Market odds for a rate cut from the Bank of Canda this Wednesday sit firmly at about 80%. More cuts.

Speaking of head scratchers. The Carney government took a victory lap on September housing starts data which suggested a 14% jump in September.

The seasonally adjusted annualized rate of housing starts was 279,234 units, up from a revised 244,543 units in August. Remember, housing starts are reflective of investment decisions performed several years ago. A housing start, as defined by CMHC, is counted once the foundation is built back to grade. In other words, after the land was sourced, permits approved, pre-sales sold, land excavated and foundation poured. In other words, a seriously lagging indicator that gets muddied further with seasonal adjustments.

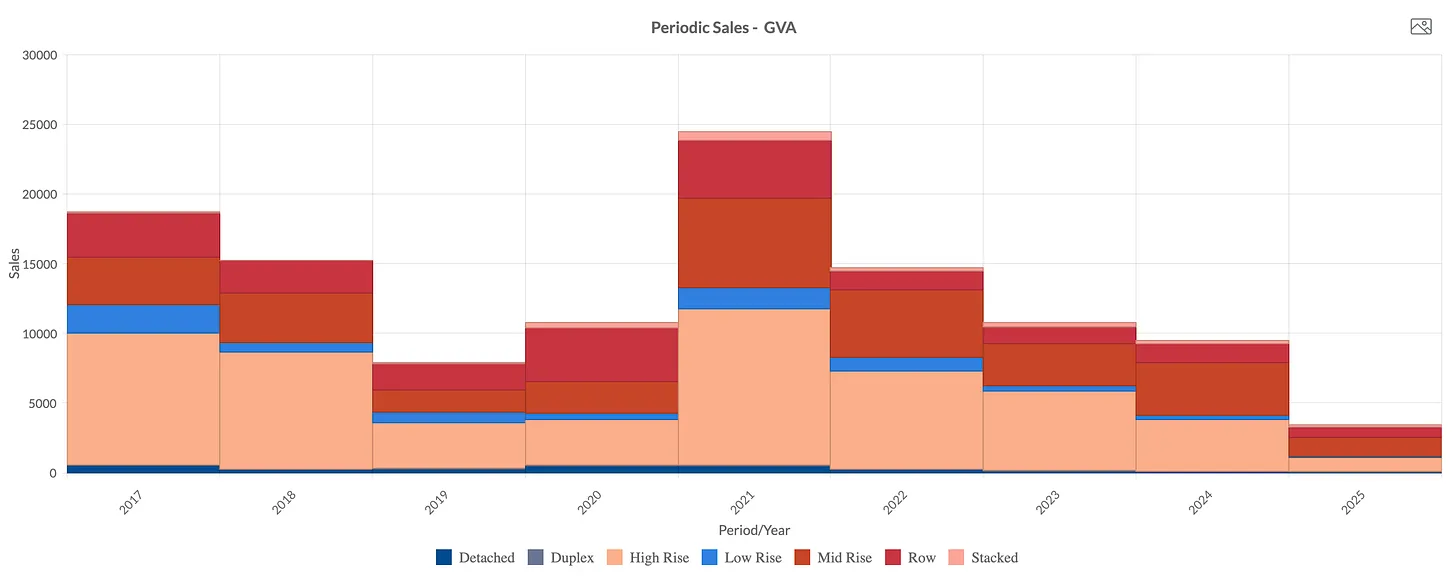

New home sales in Greater Vancouver are sitting at 3400 year to date, and should finish the year down about 60% from 2024, and nearly 85% below levels seen at the height of the bull market.

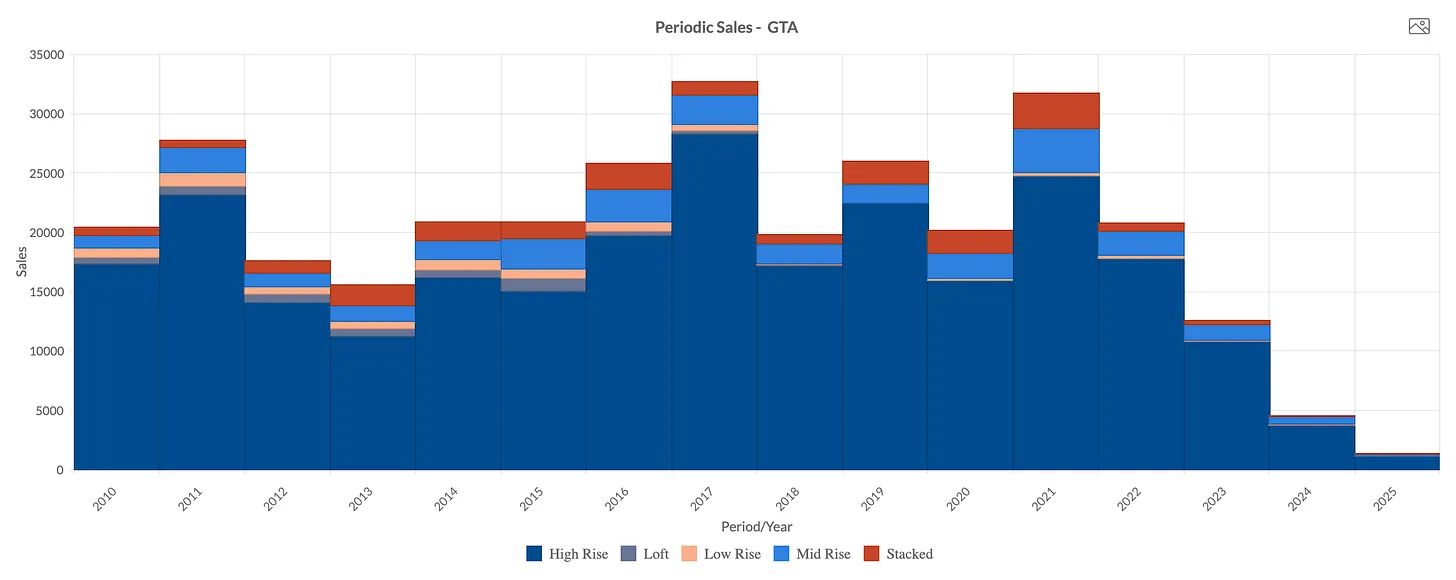

Things are even worse in the GTA where there’s been less than 1200 new home sales for the entire region. The average over the past decade is around 20,000 new home sales for the year. In other words, new home sales are effectively non existent in the GTA.

One can’t emphasize just how bad the pre-sale market is. The industry is on life support. Things are so bad we are hearing growing calls for the removal of foreign buyer bans and even developer bailouts.

We continue to believe housing starts are going to fall off a cliff in the year ahead, and believe any monthly uptick in housing starts is simply noise.

Yes there will be some rental housing built through CMHC financing and a few social housing projects but nothing that can fill the void of the collapse of the pre-sale space.

The recent jump in housing starts and rising rents should be faded by any astute housing observer.

We try not to give poltical advice here but The Carney government would be wise to hold any applause.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky October 27th, 2025

Posted In: Steve Saretsky Blog

Next: Private Credit Winter »