September 7, 2025 | Trading Desk Notes for September 7, 2025

The summer doldrums are over – tensions and volatility surge, creating great trading opportunities!

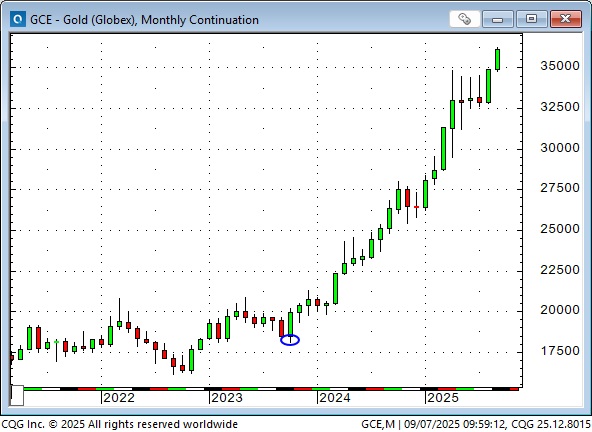

Gold is at record highs, in nominal and inflation-adjusted terms.

Comex gold futures are up ~38% YTD, up~100% from the October 2023 lows (blue ellipse) made just before the Hamas attack on Israel.

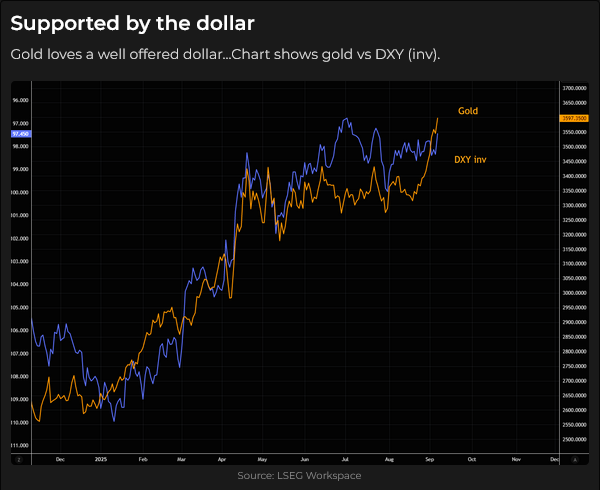

A weaker USD (down ~12% YTD to 3-year lows) has been the mirror image of a higher gold price.

GDX, the gold miners’ ETF, has rallied to record highs, up over 90% YTD, significantly outperforming gold, after lagging bullion for the last several years. The GDX is now up ~160% from the October 2023 lows (blue ellipse on the chart below).

In previous notes, when the prices of gold mining stocks lagged behind bullion prices, I wrote that central banks were the major buyers of gold and they wanted bullion (in their own vaults), not shares of gold mining companies.

During the 2008-2011 commodity boom (when gold soared from ~$750 to ~$1900), the GDX more than tripled, outperforming gold, as investors saw gold shares as a levered play on the gold rally, as miners’ revenue soared relative to operating costs. I suspect that view is in play again, helping to drive the GDX higher. Additionally, some money managers who are bullish on gold may be prohibited or restricted from buying bullion, so they opt to buy gold shares instead.

Comex gold open interest has surged ~15% since mid-August, as gold prices have rallied by ~$300. However, open interest is still well below the highs of the past few years, leading me to believe that the Comex is following, rather than leading the rally. Asian buyers, both central banks and speculators, are driving the rally.

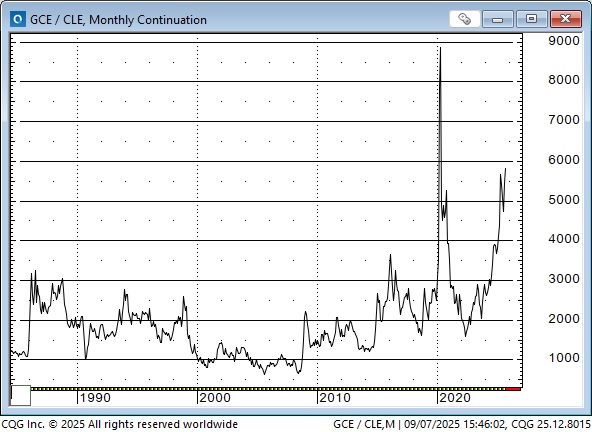

WTI crude oil has never been cheaper in terms of gold, except for two months during covid. It takes ~58 barrels of WTI to buy one ounce of gold. (I remember talking with the Finance Minister of Oman in 2005 and telling him that his country should invest some of their oil revenue in gold. At that time, you could get an ounce of gold for five barrels of WTI.)

Interest rates – the Fed is focused on employment, not inflation

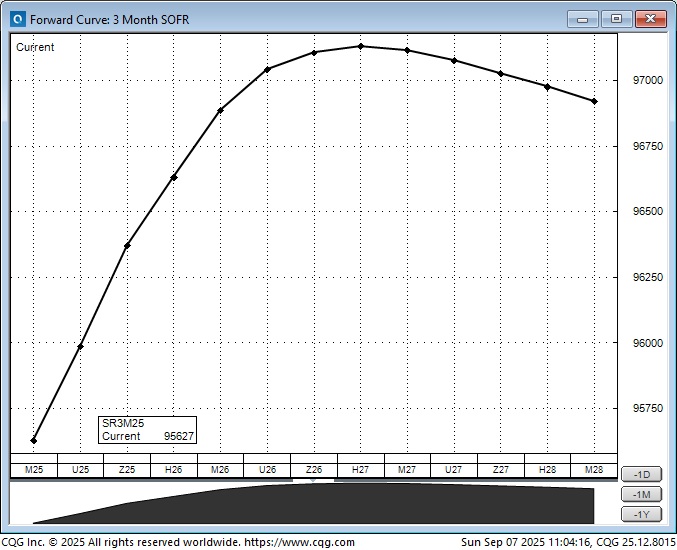

US employment is softening, and the Fed is behind the curve. The forward short-term interest rate markets are currently pricing in a minimum of two and perhaps three 25bps cuts by December, with another four cuts in 2026.

On Tuesday, September 9, at 10:00 a.m. ET, the BLS will release its annual revisions for employment data covering the period from April 2024 to March 2025. These revisions may have a greater market impact than last Friday’s employment report, given the market’s growing “sensitivity” to BLS revisions. (No kidding!)

The monthly ADP employment report will likely be more closely followed now, given that it’s private (not subject to political pressure) and also because the BLS revisions have shown that the ADP data was more accurate, month to month, than the (soon-to-be-revised) BLS reports.

If Tuesday’s BLS annual revisions indicate a substantial decline in employment (last year’s annual revisions saw a decline of ~800,00 jobs), the market will immediately start to price in more aggressive cuts from the Fed.

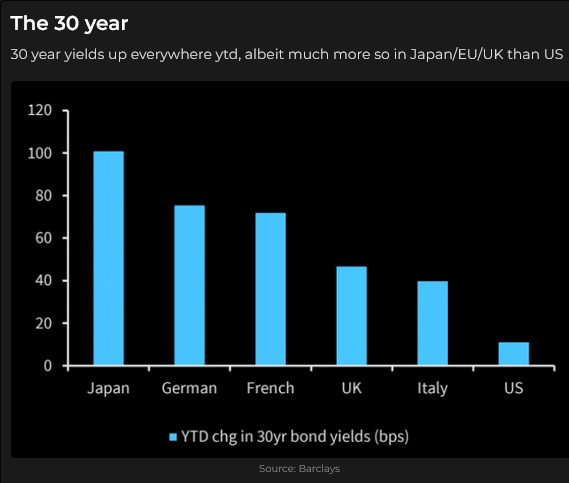

Global long bond market yields hit multi-year highs last Tuesday. The US 30-year yield reached 5%, the UK yield hit 5.75%, a 28-year high, and the Japanese yield was 3.25%, a record high. However, long bond yields tumbled (prices soared) from Wednesday to Friday as various reports indicated a significant softening of employment (the demand for labour is weakening).

Are high yields the best cure for high yields?

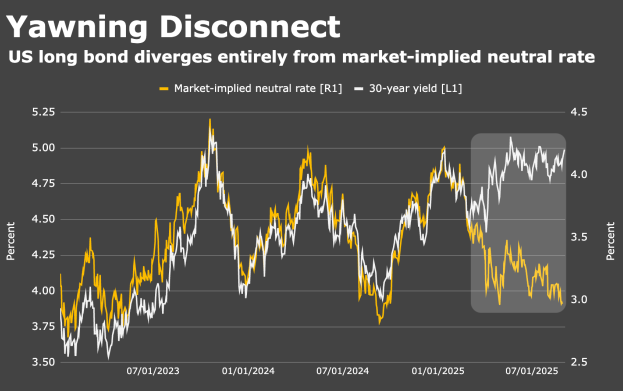

The sharp rally in global long bonds from Wednesday to Friday may have been triggered by reports of softening employment and the prospect of more of that to come. Still, I think there was also an element of short-covering by bond bears who have been positioning for yields to keep rising as governments appear to be unable (unwilling?) to “balance the books” and have instead decided to opt for “creeping inflation” to keep a lid on debt service costs rather than to raise taxes/cut services.

I can envision a “teeter-totter” of bond sentiment from now on, with the bullish side believing that bonds will rally as employment softens and the economy weakens (and bonds rise relative to stocks), while the bearish view holds that governments will be unable to match expenditures with revenue and will continue issuing more and more bonds (rather than balancing the books and getting voted out of office!)

I’m generally going to side with the bond bears, as I believe governments will choose to continue debasing (reducing the purchasing power) of their currencies rather than balance the books. Still, there will be times, and perhaps this coming week, with BLS revisions, CPI, and PPI, when the bond bulls will be winning.

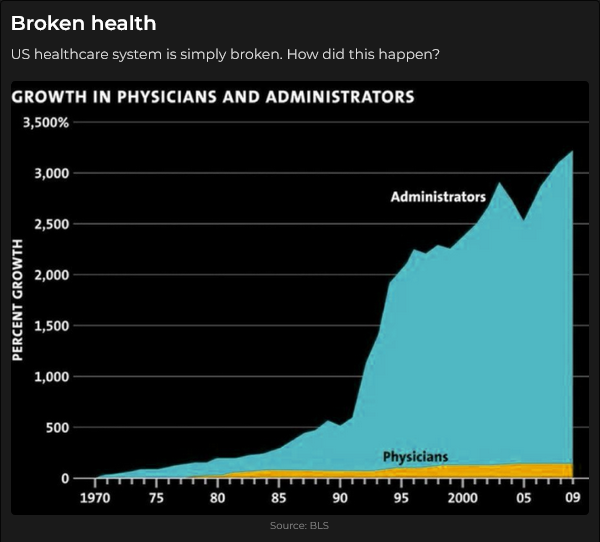

My understanding of inflation is that people are aware that their cost of living—the cost of buying things or services they want or need—is increasing much faster than the CPI. Current inflation leads to expectations of higher inflation in the future, as people realize that the purchasing power of their currency is shrinking. (For instance, Health care costs, electricity, and home insurance costs are rising much faster than the CPI.)

Stagflation is worse. That’s when prices are rising, but the economy is softening, and wages are not keeping pace with prices. Actually, that seems to be happening right now, at least for many people who are in the bottom 50% of wage earners.

Stocks

Stocks have been in a bull market; pick your time frame, but since 1982, stocks have generally been rising. The S&P has tripled since the covid lows five years ago. The 2008 bear market doesn’t appear significant on this chart.

High corporate earnings (and corporate buybacks, and momentum, and TINA and FOMO, and systematics and passive investing, etc) support high stock prices. If the prices of high-flying stocks with strong earnings start to fall, does that mean that the broad market declines, or does capital “rotate” to “defensive” equities, keeping the indices up?

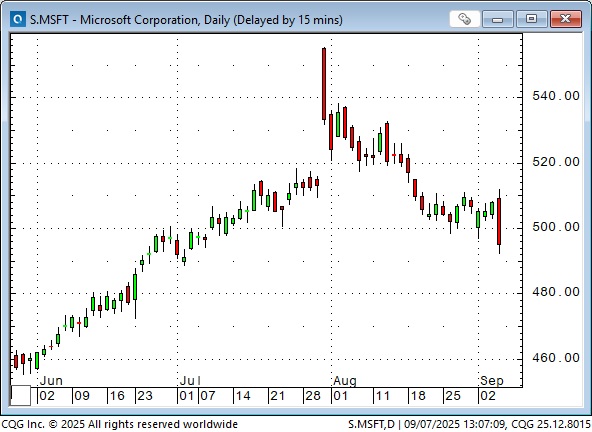

MSFT and NVDA account for approximately 15% of the S&P market cap.

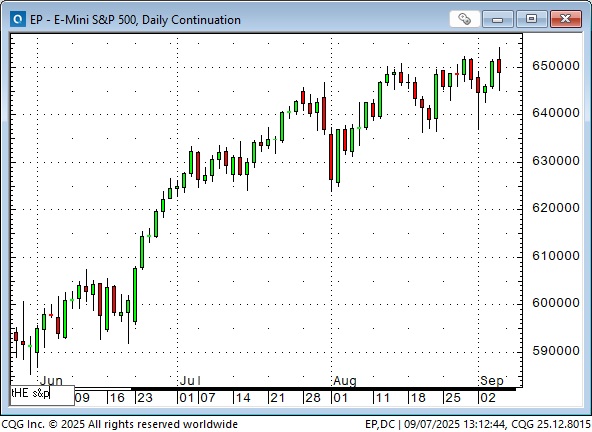

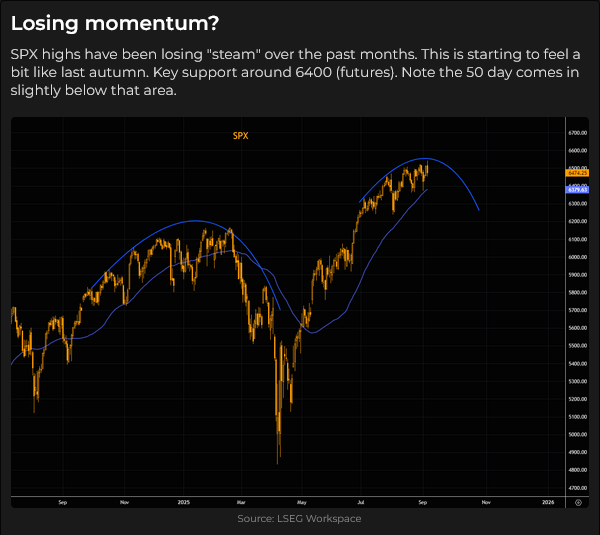

The S&P rallied to new all-time highs following Friday’s weaker-than-expected employment report (stocks love the idea of lower interest rates), but then slipped about 70 points before recovering to close the week about unchanged. At some point, it seems possible that the prospect of a slowing economy may mean lower earnings, and (gasp!) lower share prices, even though a slowing economy likely means lower interest rates.

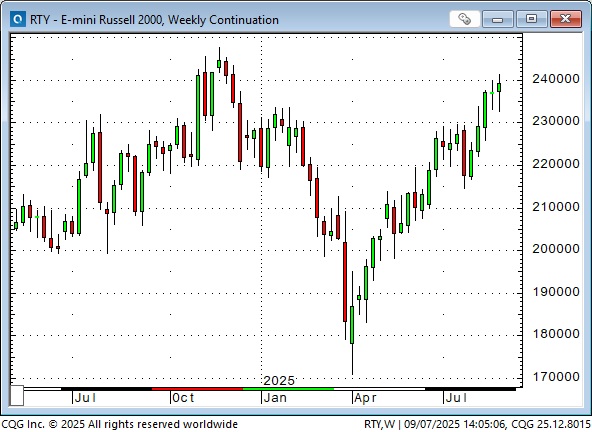

The Russell 2000 index rallied to new highs for the year following the UE report and has now closed higher for five consecutive weeks. The RTY has been the “weak sister” of the leading stock US indices this year, very much in the shadow of the glamorous big-cap tech stocks. Is it now “catching up” as a result of “rotation?”

I think the “speculative fever” in US stocks topped out around August 13 (blue ellipse), but if the NAZ trades through that level, it could “melt up” higher.

The long-term bullish story for stocks is that, in an inflationary environment, investors can’t stay in cash; they must own assets.

Currencies

The DXY US Dollar index has been under pressure since the beginning of 2025, falling ~13% from January’s highs to July’s 3-year lows.

The USD bounced back ~4% from the beginning of July to the start of August, when it got slammed by the weaker-than-expected employment report (blue ellipse), which included the significant downward revisions to May and June that got the head of the BLS fired for “rigging” the data to make Trump and the Republicans “look bad”. The USD was slammed again on Friday due to another round of weaker-than-expected employment data (pink ellipse), falling to a 6-week low.

The leading European currencies (the Euro, British Pound and Swiss Franc) rallied ~15 to 17% against the USD from January lows to July highs.

The Yen rallied ~12% from January lows to April highs, but has given back about half of those gains as of Friday. The Yen has weakened against the USD over the past few months, despite Japanese interest rates rising relative to US rates.

The FX market reaction to the US employment data highlights that in the world of currencies with depreciating purchasing power, the current “important thing” is the relative spread (or interest rate differential) between the USD and other currencies. If the premium of US interest rates over Eurozone rates is shrinking, the USD falls against the Euro. Other things, such as relative energy policies, proximity to a hot war, or the sustainability of an entrepreneurial environment, seem to have less importance.

The Canadian Dollar fell to 22-year lows early this year in a “hostile” political environment between Canada and the USA, but the CAD has been weak for years. Falling commodity prices have hurt the CAD, but government policies haven’t helped. We need a “shake-up” (or as my long-retired university prof told me the other day, “We needed a Trump, just not the one we got.”)

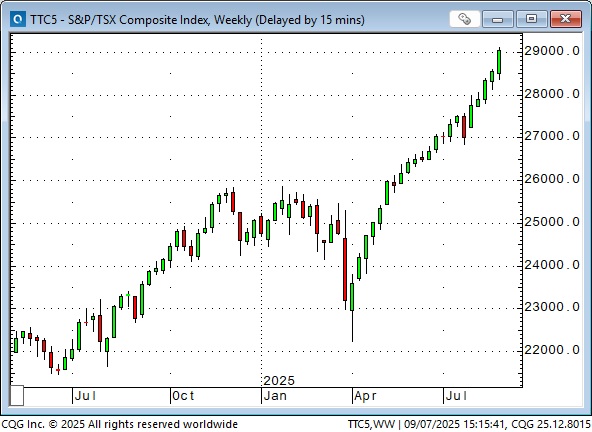

The TSE Composite has rallied ~30% from the “Liberation Day” lows in April, making new record highs nearly every week since the middle of May. Liberals might think of this as the “Carney rally”, but virtually every stock index in the world has rallied since April.

The Canadian unemployment rate is 7.1%, a nine-year high. Youth unemployment is at a 15-year high of 14.5%. Approximately 100,000 (mostly part-time) jobs were lost in the last two months, and Q2 GDP was minus 1.6%. The Canadian dollar is at a 16-year low against the Euro.

Key events this week

Sunday: Japanese PM steps down.

Monday: French election,

Tuesday: BLS revisions to US employment data from April 2025 to March 2025

Thursday: ECB meets, US CPI and PPI

Possible sometime this week: The Supreme Court to rule on a lower court decision that Trump didn’t have the authority to make trade deals. The market expects the SC to rule in Trump’s favour, but markets would be stunned if they ruled against Trump. The administration is counting on (“hundreds of billions of dollars”) of tariff income to offset revenue lost from tax cuts.

Next week: The Bank of Canada and the Fed are expected to cut rates on September 17.

Quote of the week

“Positioning shifts with the rumour mill, not the academic models.” Stephen Innes, a Veteran Canadian financial markets trader, currently living in Thailand. I highly recommend his excellent Substack reports; they are currently free.

My short-term trading

I took a couple of slight losses shorting the S&P this week and went into the weekend long the Yen with a tight stop that was hit for a tiny loss when the markets opened Sunday afternoon. The Yen dipped on the Prime Minister’s resignation.

The Barney report

Barney and I have been home alone the past few days while my wife has been in Vancouver visiting family and friends. We’ve had lots of great walks in the forest and on the golf course (after hours, and Barney loves finding golf balls), and Barney has been very patient with me when I spend long hours at my desk. He’s a beauty!

Listen to Mike Campbell and me discuss markets

On Saturday morning’s Moneytalks podcast, Mike and I discussed the market reactions to recent soft employment data. We also discussed how the Fed and the Bank of Canada are both expected to cut interest rates next week, and we also talked about the strength of the gold market. You can listen to the entire show here. My spot with Mike starts around the 1-hour, 6-minute mark.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair September 7th, 2025

Posted In: Victor Adair Blog