September 22, 2025 | Imminent Bounce

Happy Monday Morning!

As expected, Tiff Macklem and the Bank of Canada slashed rates by 25bps this past week. The Bank pushed aside inflation concerns, suggesting “There was a clear sense that the balance of risk had shifted… Tariffs are weakening the Canadian economy.”

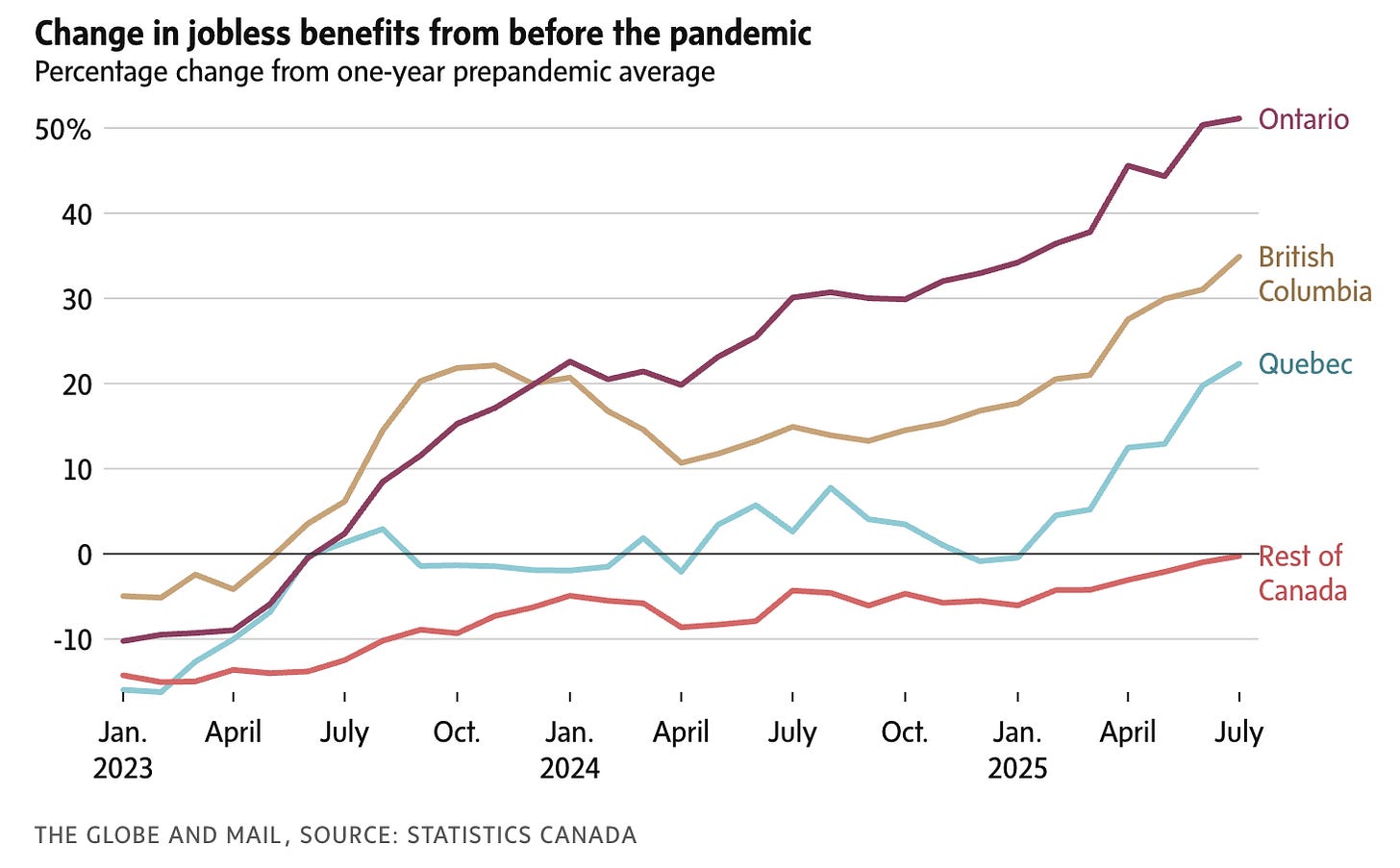

Job losses are picking up momentum. The unemployment rate has ticked up to 7.1%, the highest in nine years outside of the pandemic. The share of the labour force without work for more than six months is now at levels last seen in 2011, and the number of EI recipients has been climbing steadily for two years.

And so, the Bank of Canada is likely heading back to the chopping board once again. Market odds now place about a 40% chance of another rate cut in October, but a 100% chance of at least one more cut before year end.

Naturally, this has many housing enthusiasts already frothing at the possibility of another bull market.

Even RBC is suggesting that house prices could be poised to bounce higher, and soon.

From RBC, after the rate cut announcement.

We think additional easing from the BoC is likely – the central bank today clearly laid out concerns about the economy, and in the past has rarely cut (or hiked) interest rates just once after initiating or restarting a policy shift. But it’s not guaranteed, should the labour market show clearer signs of recovery and/or inflationary pressures rebuild.

Finally, housing activity has been in a recovery mode since taking a plunge in the spring – resale activity in August reached the highest level this year. That, however, has not yet spurred a turnaround in house prices, which have continued to fall alongside shelter inflation, and is giving the BoC cover to opt for additional rate cut(s) if necessary. Still, house prices are one area that deserves close attention, for what could impede future rate cuts.

In other words, RBC argues a potential rise in house prices could ultimately impede future rate cuts.

What does RBC see that we don’t?

Yes it’s true that home sales have bounced higher, now rising for five consecutive months after a disastrous spring market that was impeded by tariff news. But context is warranted. There were just over 40,000 home sales nationwide in August, which was up nearly 2% from last year, although still historically weak. Prior to 2020, one would have to go all the way back to 2012 to find an August this weak.

Home sales are improving as buyers dip their toes back into the pool, however demand remains historically weak.

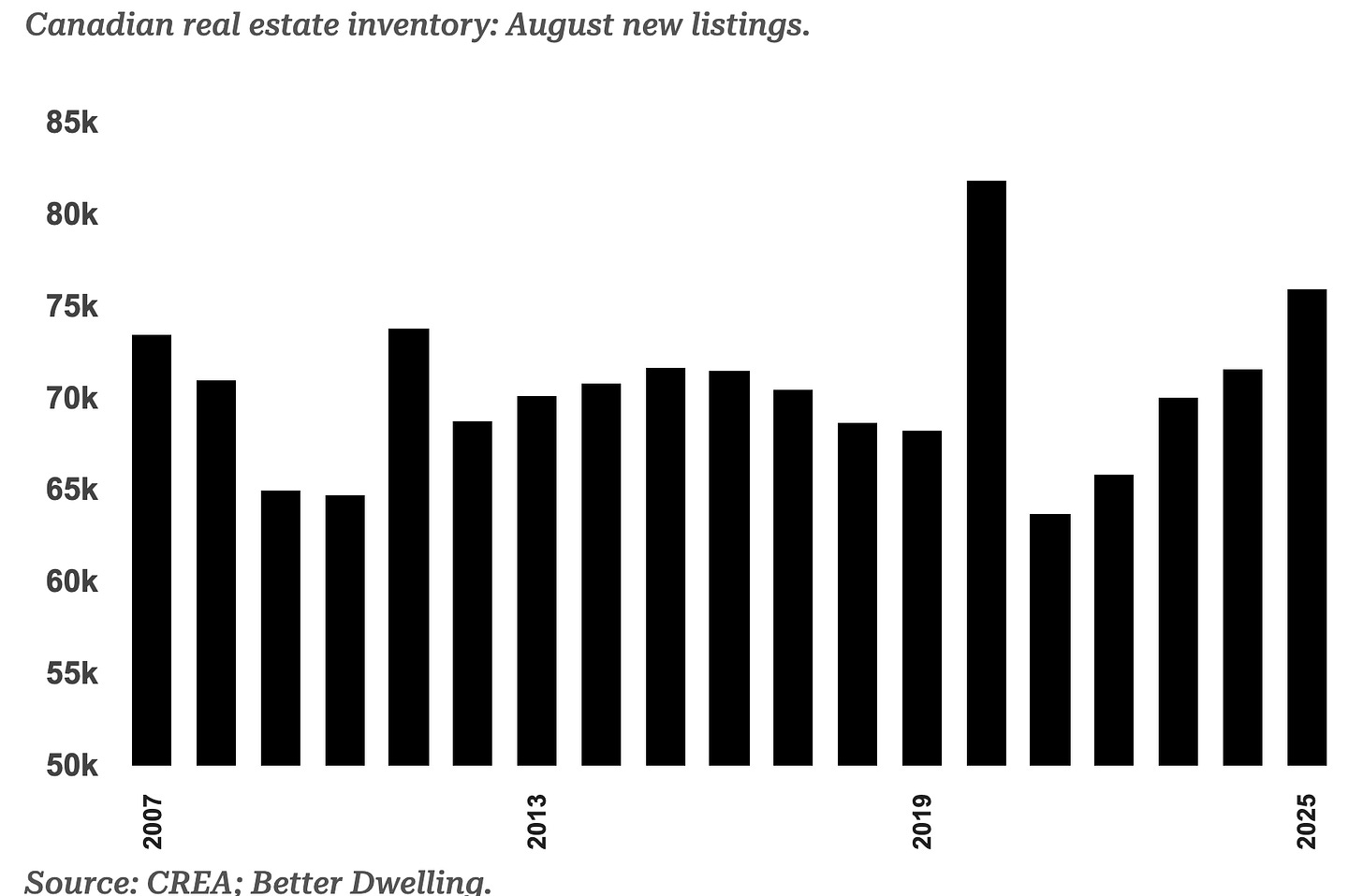

What’s more concerning is the onslaught of new listings that continue to hit the MLS.

There were just over 75,000 new listings in August, the second highest tally in twenty years! New listings are growing at a pace over three times greater than sales.

In other words, inventory continues to outpace sales, putting further downwards pressure on home prices. The national home price index leaked lower, dropping 0.1% from last month, and falling 3.4% from last year. Given the bloated inventory levels it seems reasonable to expect further pressure on prices in the months ahead.

We are not sure why RBC believes rising home prices could be on the horizon, but can only speculate they are hoping to improve their mortgage business.

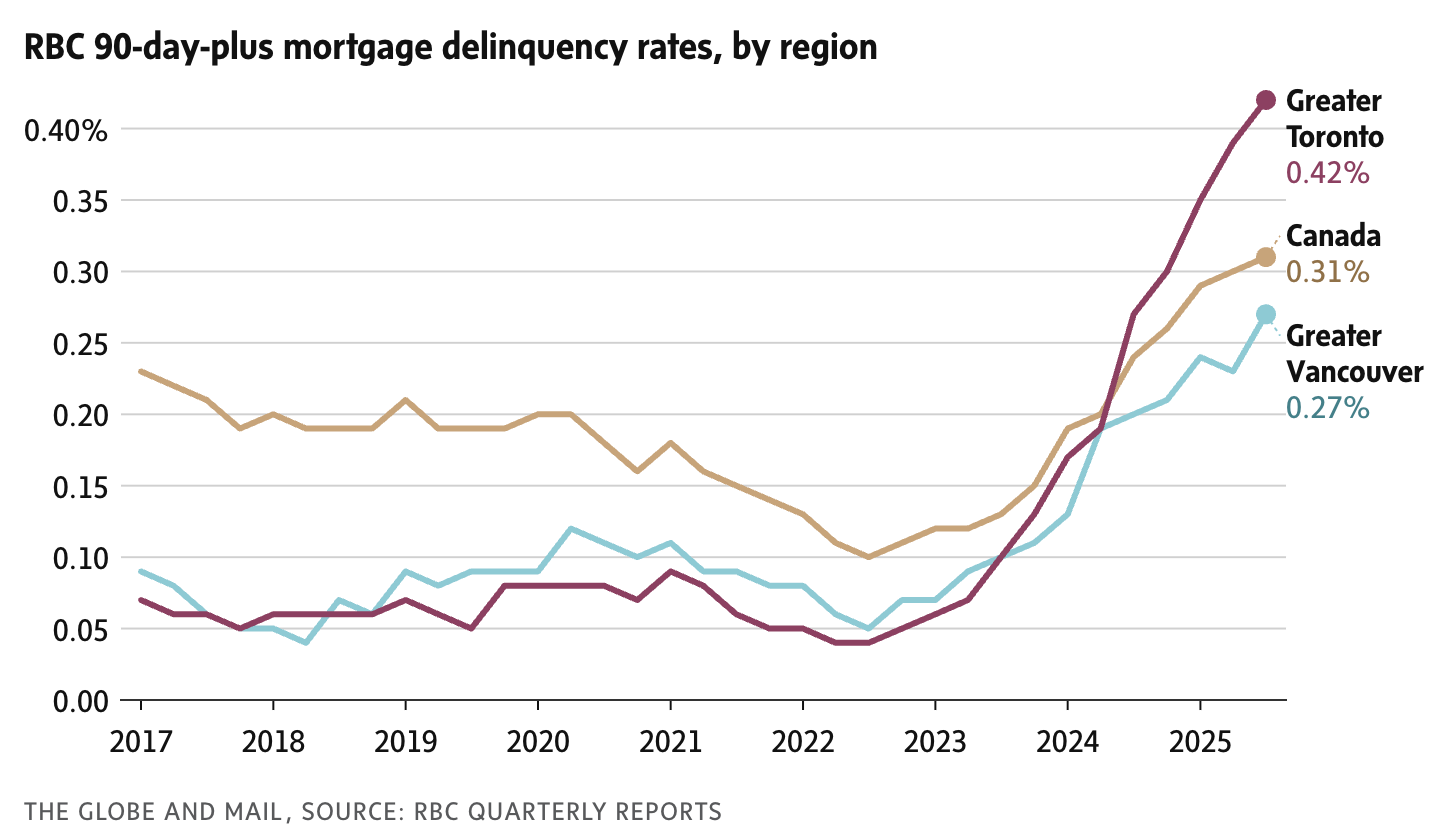

RBC’s non-performing mortgages are historically low, but are on the rise. Nationwide they’ve gapped up to the highest levels in at least eight years. Things are more worrisome in the GTA where the figure of non-performing loans is approaching 0.42 per cent – a seven-fold surge in only a few years.

We see no reason for an imminent bounce in home prices this year. It’s true lower mortgage rates should stimulate demand. If markets are right, variable rate mortgages should be in the mid 3’s by the end of the year. However, bloated resale inventory levels and a record number of unsold new condos sitting on developer balance sheets should continue to tilt the risks to the downside in the near term.

Furthermore, we have yet to see much improvement on the fixed rate mortgage side this year, as it’s predominately set by the bond market. A looming fiscal bazooka from the Carney government set to be unveiled on November 04th could stir the bond vigilantes and surprise a wave of mortgage borrowers. However, that’s a conversation for another time.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky September 22nd, 2025

Posted In: Steve Saretsky Blog