September 15, 2025 | Cushioning the Downfall

Happy Monday Morning!

As we discussed in our note last week, the economy is contracting and job losses are mounting, and so it’s chopping Time Again. The Bank of Canada is on deck with markets pricing in nearly 80% odds of a 25bps rate cut.

According to BMO, there could be more coming.

“We see scope for 75 bps of further easing through the spring of 2026. That would leave rates at the low end of the neutral range and give the economy a little bit of extra support that it seems to need,” writes Robert Kavcic, senior economist at BMO.

If this comes to pass it would bring variable mortgage rates down to about 3.4% by next spring.

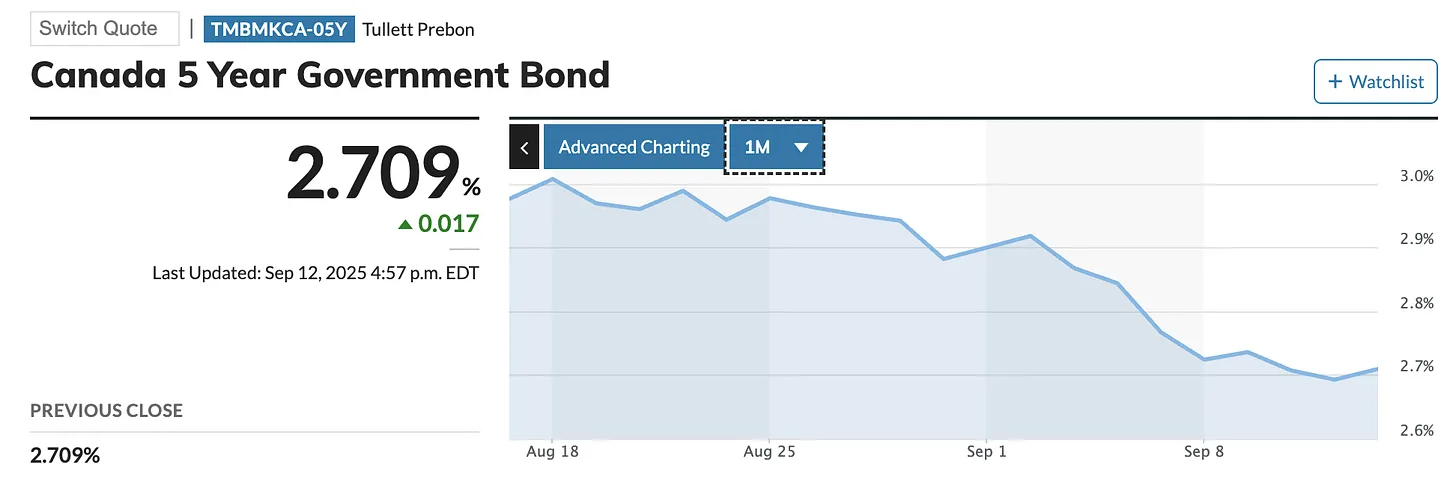

We’re also seeing movement on the fixed rate side with bond yields sliding lower in recent weeks. The Canada 5 year bond yield which closely tracks 5 year mortgage rate is now down 30bps over the past month. Mortgage rates should slide under 4% across the curve in coming weeks. Homeowners rejoice?

Mortgage rates in the 3’s is a huge relief for the 60% of borrowers renewing a mortgage over the next eighteen months. It would appear the mortgage renewal wall avoided the doomsday scenario. Just two years ago mortgage rates were hovering above 6%. Imagine the pain if rates held at those levels.

So while mortgage relief is on the horizon, we’re not out of the woods yet. Inventory levels remain bloated, and demand remains impaired, with a large cohort of investors scarred from the trauma of surging rates, falling prices, and disastrous tenancy laws that left investors holding the bag on illiquid, rent controlled condos.

Despite what the Bank of Canada does this week, expect more downwards pressure on prices in the months ahead. There’s a backlog of inventory that will take awhile to clear.

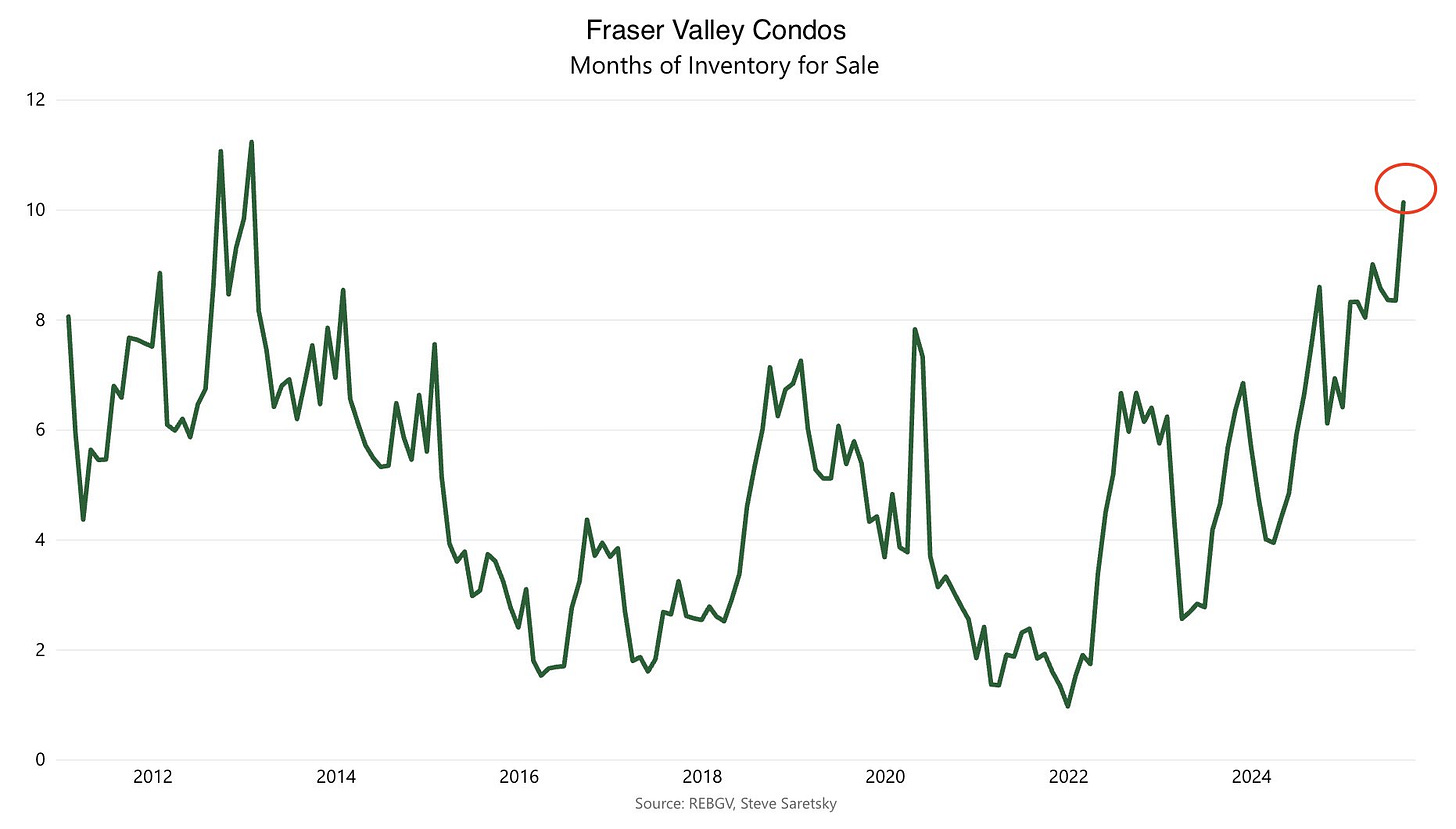

For example, in what used to be one of the frothiest markets, the Fraser Valley suburban condo market is now sitting on 10 months of inventory for sale. A nearly tenfold increase from the height of the bull market back in early 2022.

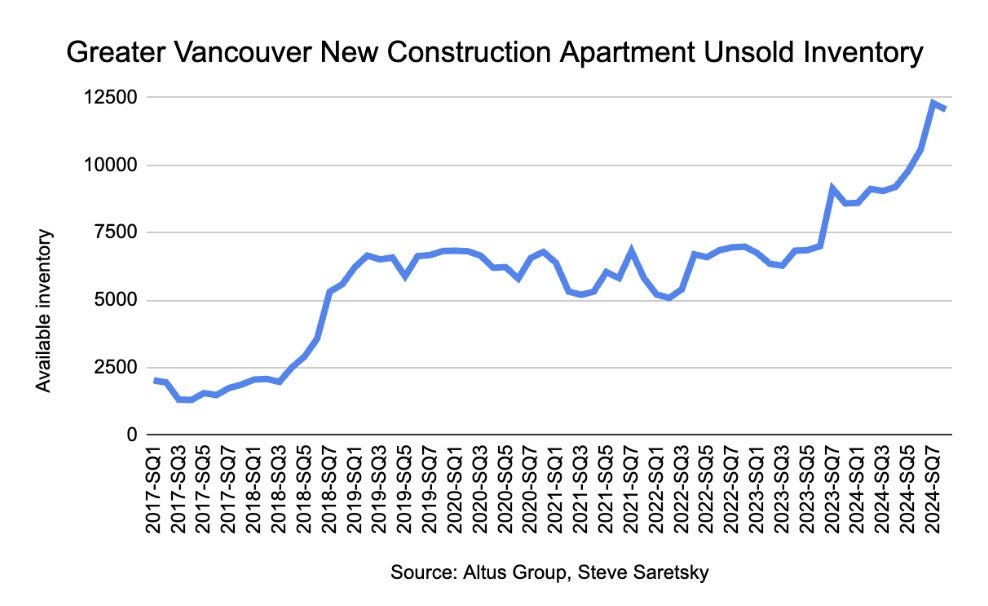

And that’s just the resale market. As we’ve highlighted before, the fireworks are in the pre-sale market. Unsold inventory on developer balance sheets, aka shadow inventory, sits at record highs.

Based on my conversations with commercial lenders and land brokers, things are getting worse, not better. Developers are hemorrhaging cash, paying millions in interest on sites that are uneconomical to develop and too illiquid to sell. And so, they’re stuck, with more drifting towards insolvency.

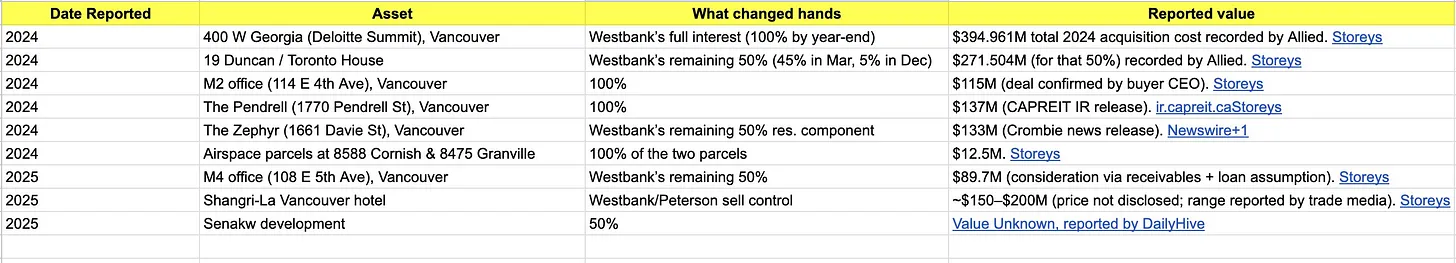

The small and medium sized developers are most at risk. But even the big players are not immune.

Over at WestBank, the liquidating has been ongoing. The most recent sale of the Senakw housing project was perhaps the largest. So far, there’s been over $1B in publicly reported asset sales by the media.

This week we learned Wesgroup (not to be confused with WestBank) has cancelled Ardea, a 204-unit waterfront project planned for its River District community in Vancouver, despite selling close to 50% of available units, per Altus Group.

This comes on the heels of significant layoffs at Wesgroup, one of the more well capitalized developers. Back in June Wesgroup laid off 12% of its staff in what it calls “a cost of delivery crisis.”

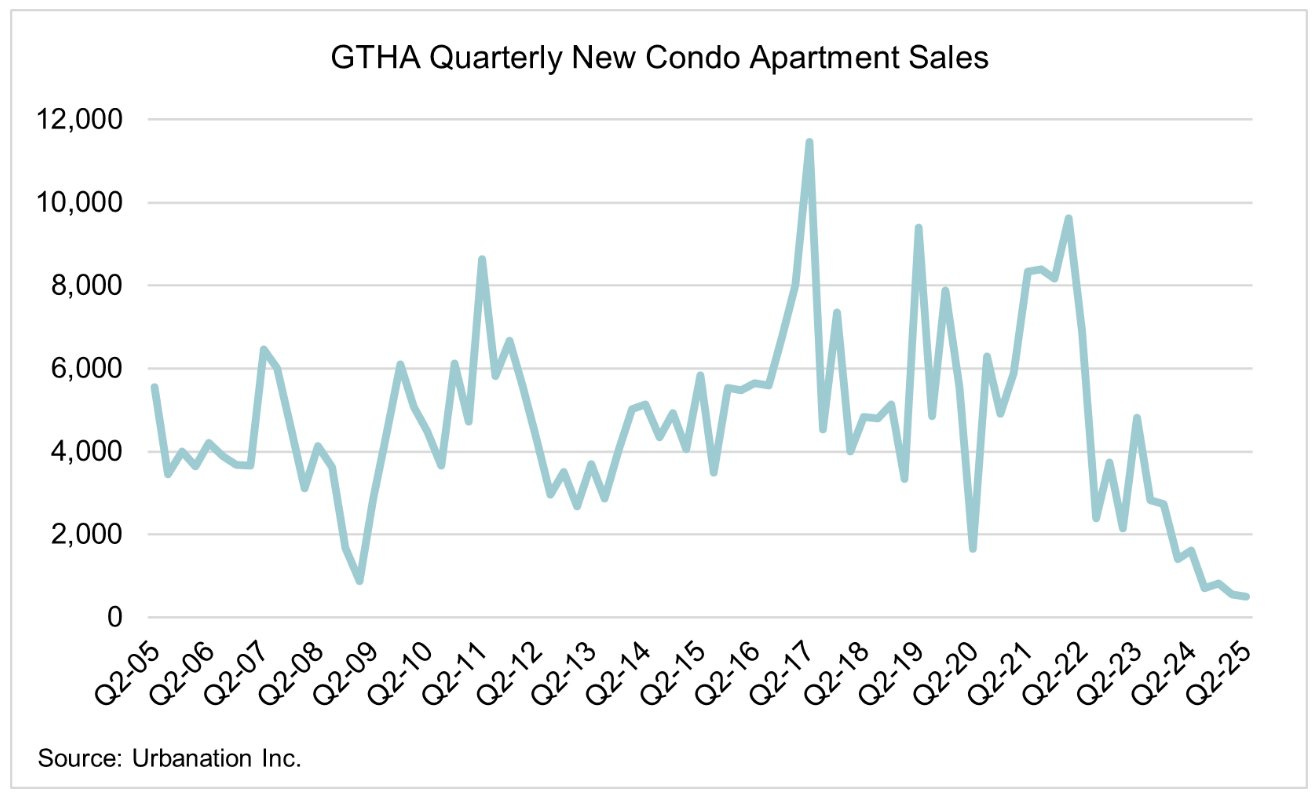

If this all sounds bad, its even worse in the GTA.

You have to wonder if policy makers are about to flinch. In fact, you could argue they already have. OSFI has effectively turned a blind eye to blanket appraisals, allowing underwater condos to get financing based on stale valuations so pre-sale buyers can close. In some cases we’ve seen loans hovering near 100% LTV.

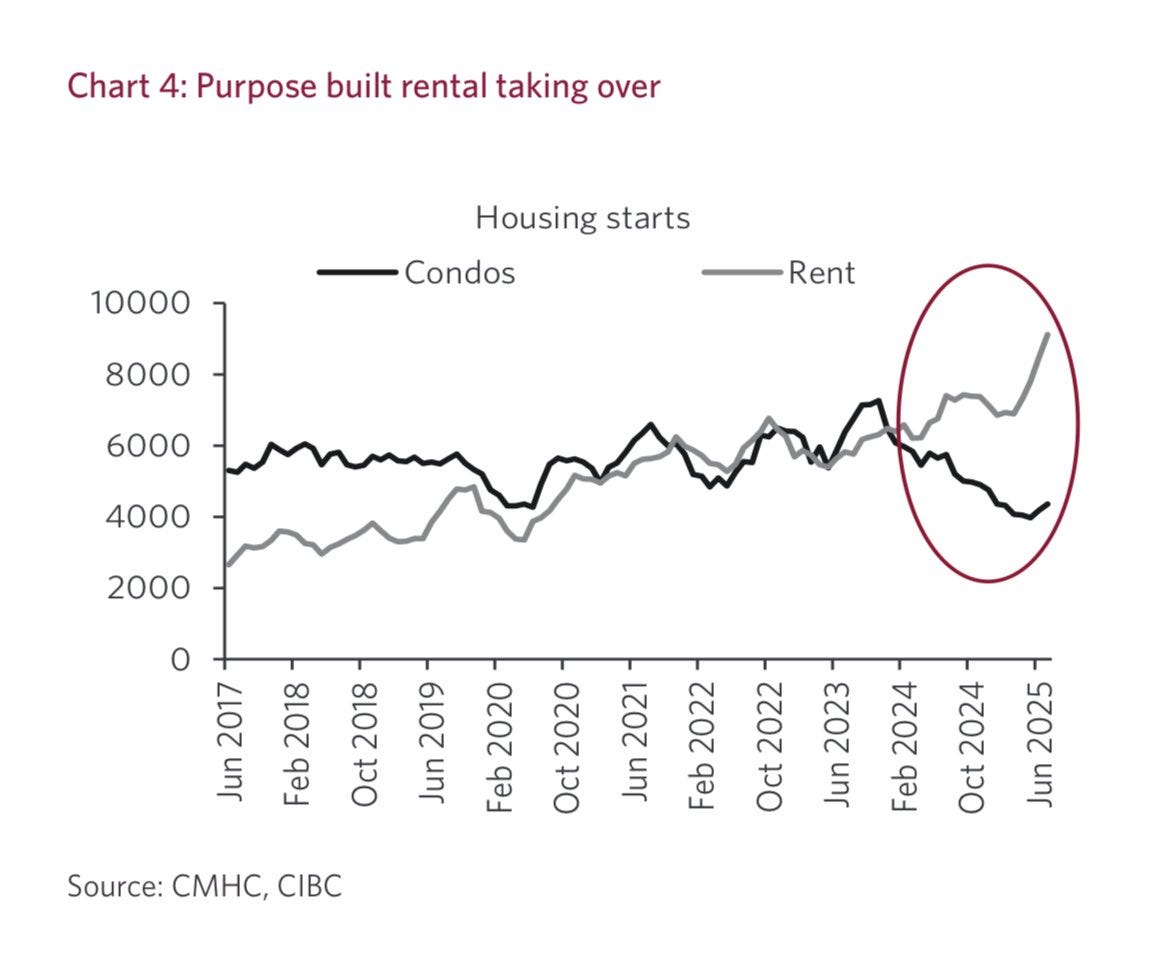

Meanwhile, CMHC is providing liquidity for developers through CMHC MLI Select financing, allowing otherwise dead pre-sale projects to switch to rental. If you need to keep the machine churning, building rental is better than building nothing at all.

More signposts policy makers are trying to grease the wheels. CMHC says they are looking at improving the program further in markets like Toronto and Vancouver where housing starts are collapsing and more equity is often required to appease CMHC debt coverage ratios. You have to admit, the timing is rather interesting.

And so, as housing starts continue to leak lower in Canada’s two major housing markets, we expect policy makers to ramp up their efforts to cushion the downfall. Although, i’m afraid, it may already be too late.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky September 15th, 2025

Posted In: Steve Saretsky Blog