September 12, 2025 | Bank Mortgage Lending Created The Canadian Housing Bubble

Substantial acceleration in bank mortgage lending for residential real estate was essential in creating the Canadian housing bubble. Now that the housing bubble is bursting new mortgage lending could slow or even decline. If the rate of increase in new mortgage debt slows sharply home prices will drop leading to a crash in the housing market that could be the worst in living memory going back to 1970.

Canada’s housing bubble ran on the fuel of accelerating mortgage debt

Economist Steve Keen explains (in a 17-minute video) that the rate of increase in the change in mortgage debt (acceleration) is the key factor in any house bubble. Keen uses Australia as an example of a “bubble” housing market but Canada is similar. Australia and Canada have concentrated banking sectors (with enabling regulators and governments) that underpinned house price inflation going through the Global Financial Crisis (2006-10) and in the post-COVID era.

The U.S., on the other hand, had a bubble and a crash through the GFC, 2006-10. A deceleration in mortgage credit post-GFC in the U.S. was the crucial difference leading to a crash in the U.S.

Canada has been a “bubble” country, thanks to mortgage lending growth. But if Canada is now entering a long deflationary period in property prices housing from now on will do much worse than in the post-GFC era and Canada will join the “crash” club.

Mortgage debt growth has flattened as house prices are sliding

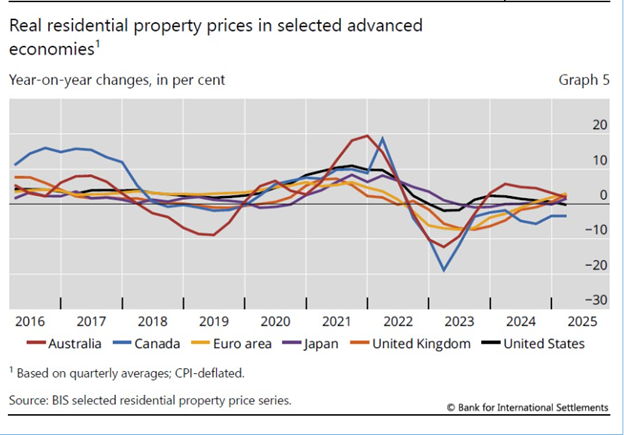

Since 2022 Canadian housing is the worst performer of all advanced economies, but it is too soon to know if this cycle will end before the bubble bursts fully.

If we apply Keen’s analysis identifying acceleration in mortgage lending as the crucial factor, Canada will need a burst of new mortgage lending to counteract deflationary pressures.

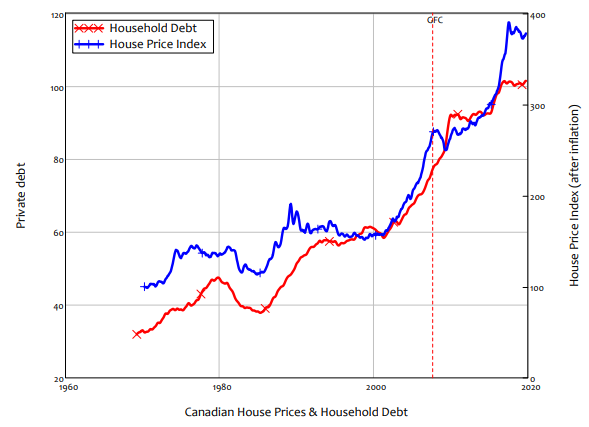

Here is Keen’s chart of Canada showing the correlation of household debt and inflation-adjusted house prices:

Source: Steve Keen

During the entire period from 1970, every time house prices slowed or dropped as in 1982, 1990 and 2009, the rate of change in household debt (mostly mortgage debt) accelerated and house prices eventually resumed their relentless trend higher. In the recent cycle post-2022 house prices have been declining as shown and household debt has flattened. Without a positive impulse from an acceleration in the rate of change in mortgage debt, house prices in Canada will fall much further. A complete bursting of the bubble implies a peak-to-trough plunge in house prices that could reach 40 per cent or more.

Without a new acceleration of mortgage credit, a housing crash is inevitable

Bank regulators, the Bank of Canada, bank executives, the Department of Finance, economists and some market analysts will be studying the deflationary scenario — although perhaps not Dr. Keen’s analysis — but they will likely dismiss it as unrealistic as history shows that Canadians have been willing to increase their borrowings for real estate in every cycle for more than five decades.

Will this time be different?

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth September 12th, 2025

Posted In: Hilliard's Weekend Notebook