August 23, 2025 | Trading Desk Notes for August 23, 2025

Powell was more dovish than expected at Jackson Hole

Powell’s speech on Friday morning was the most anticipated financial event of the week. Following the hotter-than-expected PPI report last week (which may have foreshadowed higher tariff-induced inflation ahead), markets were positioned for Powell to maintain his inflation hawk role.

Following the August 14 PPI report (blue ellipse), and before Powell’s speech, 1) short-term interest rate markets had reduced expectations of FOMC cuts,

2) Bond prices had fallen,

3) The USD had trended higher, and

4) The S&P had trended lower. All of those week-long trends reversed following Powell’s speech.

Markets viewed Powell as an inflation hawk, expecting him to resist rate cuts if inflation appeared too strong, even if job losses increased. However, Powell noted, “The shifting balance of risks may warrant adjusting policy…the downside risks to employment are rising.”

I believe a significant portion of Friday’s initial sharp moves in stocks, interest rates, and FX were driven by short-term position unwinding, given the price moves since the PPI report, rather than a harbinger of a significant shift in Fed policy. Markets were, and still are, pricing a 25 bps cut at the September 16/17 FOMC meeting. (An “insurance” cut?) However, if the September 5 employment report shows a dramatic weakening of employment, the market will likely shift to expecting a 50 bps cut in September, and that would be a significant shift in Fed policy.

A fundamental “significant shift” in Fed policy may be brewing at the White House, which would see monetary policy assisting (rather than leaning into) a “run hot” fiscal policy.

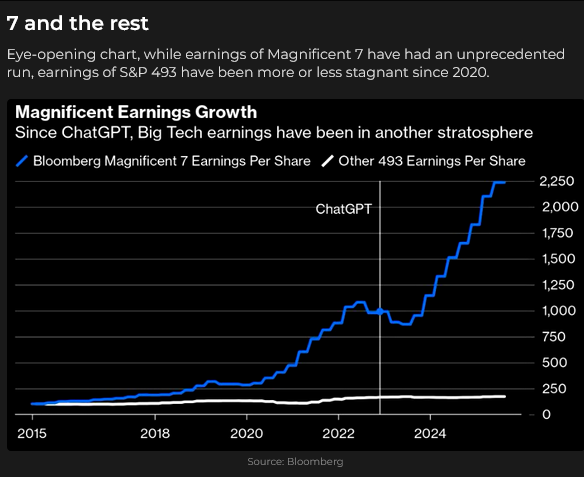

Rotation / broading out

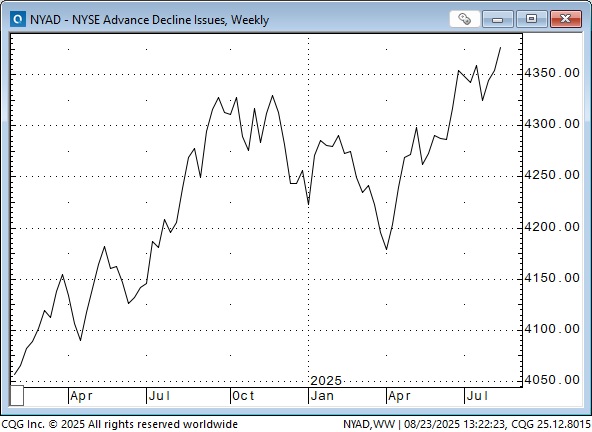

The DJIA and the Russell 2000 surged higher on Friday, with the DJIA closing at new all-time highs. These indices have previously lagged the NASDAQ and the S&P.

The surge in the DJIA and the Russell 2000 helped the A/D line to rise to new all-time highs.

The Toronto Composite index rose to an all-time high this week, up ~6% MTD, ~14% YTD.

The Shanghai Index has trended higher for the past two months and closed this week at the best levels in 3.5 years.

Interest rates

The Japanese 30-year bond yield rose to a new all-time high of 3.22% this week.

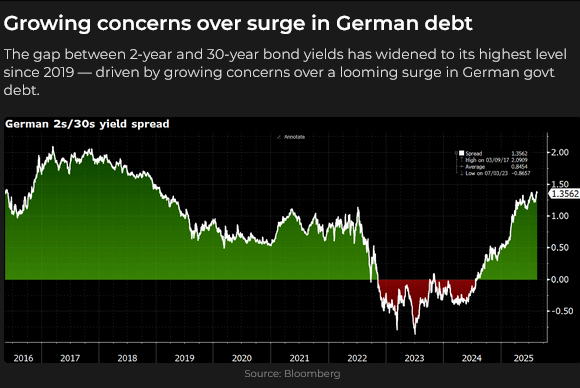

The German (2/30) yield curve has steepened to a 6-year high.

Currencies

The DXY US Dollar index hit a 3-year low at the beginning of July after its worst H1 performance in years. It fell sharply on August 1 (blue ellipse), following the much-weaker-than-expected employment data (especially the large downward revisions to the previous two months), and fell sharply again yesterday (pink ellipse) following Powell’s speech.

The Euro rallied to a 4-year high at the beginning of July, but then fell by ~4% during July. Net speculative bullish positioning surged higher in March and has remained near two-year highs despite the July setback, as the “end of American exceptionalism” theme seems to persist in the FX market. I’m predisposed to believe that American exceptionalism is alive and well, and I see that foreign capital flows and FDI flows into the USA remain strong. If there is no follow-through next week after the Euro’s strong Friday rally, I may short the Euro, or I may wait until after the September 5 UE data report.

The Yen hit 35-year lows against the USD in July 2024 (blue ellipse). Intervention by Japanese authorities in July 2024 ignited a Yen carry trade short-covering rally that caused the Yen to rally ~16% over 10 weeks. Most of those gains disappeared when the Yen fell back to the 2024 year-end, but another rally began this spring that saw speculative net long positioning reach multi-year highs. But that rally also died in April around the 72-cent level (~Yen 139), which has been solid resistance for the past two years, and speculators have substantially reduced their net long positions over the past four months as the Yen fell.

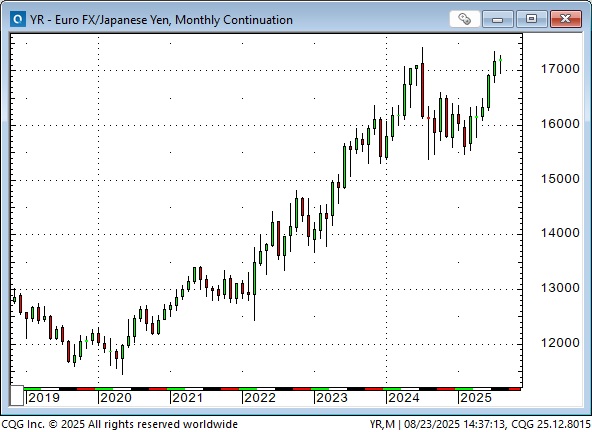

I’m intrigued by the opportunity to short the Euro/Yen near record highs. Asian currencies are grossly undervalued against the USD (mercantilist trade policies), the Euro not so much, and if the market anticipates a “Mar-A-Largo currency re-alignment”, I think the Euro would tumble vis-à-vis the Yen.

Gold

Has the spectacular gold rally that began in October 2023 gone sideways for the past four months because the Chinese official sector has stopped buying gold? (Central bank buying, especially China, was a HUGE driver of the rally.) Or have high prices been the best cure for high prices? See the August 21, 2025, FT article, “The Illegal Gold Rush Sweeping the World,” about gold produced by illegal mining, especially in Africa and South America, that is flooding into global bullion markets.

Whatever the reason, and maybe it was just the price doubling in two years, the gold rally has gone sideways for the past four months.

Gold mining shares, which underperformed bullion in 2024 (I wrote then that the Chinese and Russian official buyers wanted gold, not gold shares), have outperformed gold YTD, with the GDX ETF at 14-year highs, up ~70% YTD (gold is up ~30% YTD).

Silver closed this week at ~14-year highs, up ~30% YTD.

Nymex natural gas for delivery in January 2026 (January is frequently the most expensive month, given winter heating needs) has dropped nearly 30% from its March 2025 spike highs. Natural gas prices are traditionally volatile, with a capital “V”.

My short-term trading

I started this week with only a small, short S&P position because I was away from my desk from Monday to Thursday, visiting family. My position was as much as 100 points onside at the lows for the week, and I tightened my stop, but the “Powell” rally stopped me out for a relatively tiny loss on Friday. I reshorted the S&P late Friday, thinking that the rally had run out of steam after three or four hours, and held that position into the weekend.

NVDA reports on Wednesday, August 27.

The Barney report

I phoned home a couple of times while I was away, usually in the evening while my wife was watching TV with Barney. She told me he had been listless, waiting at the door for me to come home, but he perked up his ears when he could hear my voice on her cell. He was delighted to see his Papa when I got home late Thursday night.

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed Powell’s speech and the reaction it caused across markets. You can listen to the entire show here. My spot with Mike begins around the 1-hour, 2-minute mark.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair August 23rd, 2025

Posted In: Victor Adair Blog