August 16, 2025 | Trading Desk Notes for August 16, 2025

Quote of the week

“Mood is now more important than earnings to the stock market.” Alyosha, Market Vibes, on Substack.

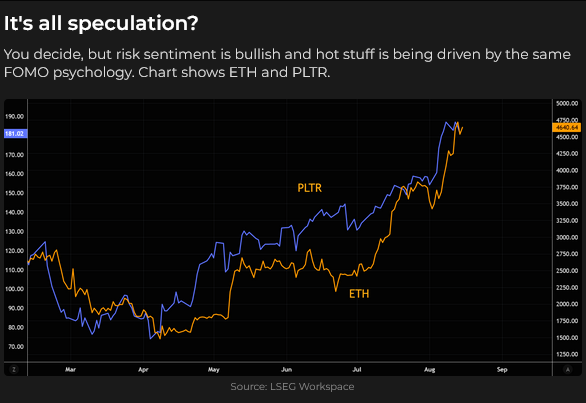

The bullish mood is driving global stock indices to record highs. Long live FOMO, TINA, and YOLO.

The S&P is up ~35% from the April lows, the NAZ is up ~45%, the TSE is up ~27%, the DJIA is up ~25%, the EuroStoxx 50 is up ~23%, the FTSE is up ~23%, and the Nikkei is up ~38%. The S&P market cap is ~$57 trillion, up from ~$44 trillion at the April lows.

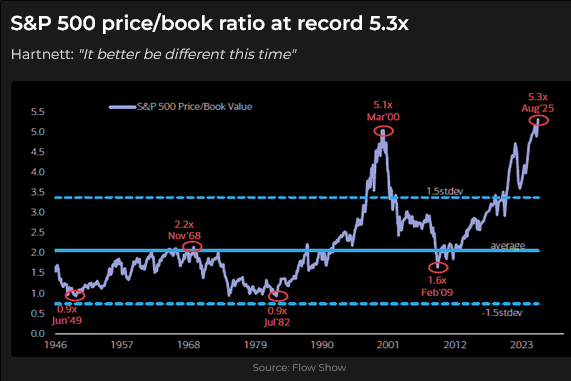

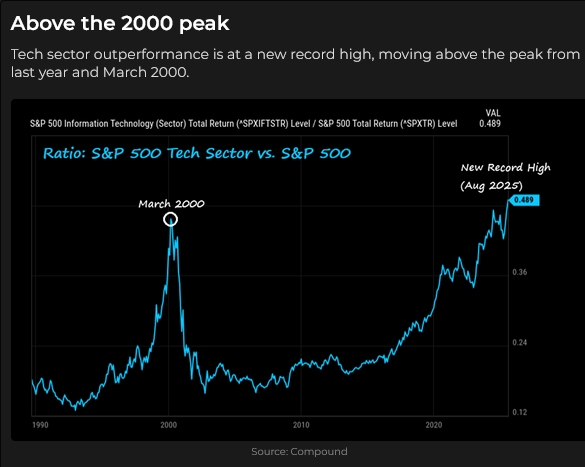

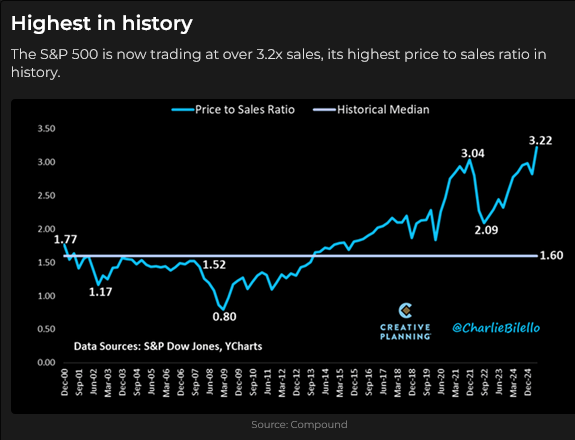

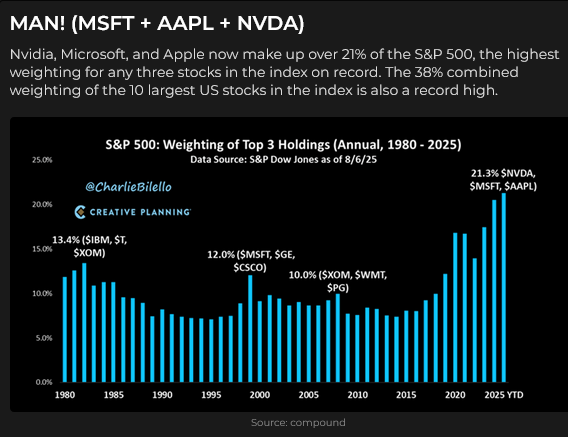

Key metrics are at or near record highs, concentration is intense, and there is more than a whiff of speculative excess.

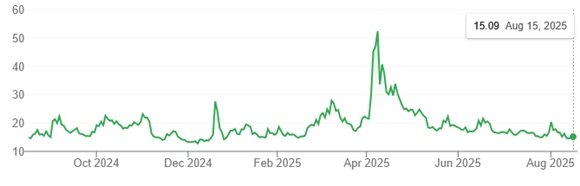

Volatility is low.

Trump’s policies are equity-friendly, not so much for bonds.

Interest rates

The long bond futures rallied to 3-month highs on the much weaker-than-expected August 1 employment report (blue ellipse) that may foreshadow a weakening economy, but gave those gains back on Thursday and Friday this week (pink ellipse) following a much hotter-than-expected PPI report that may foreshadow higher tariff-induced inflation.

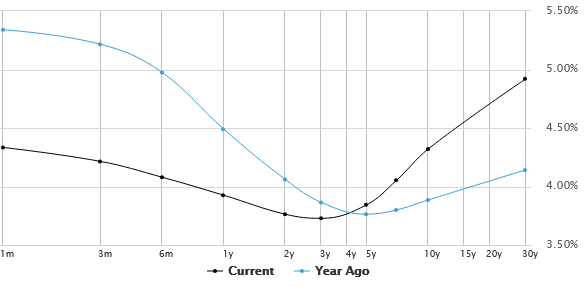

Short rates traded in a similar pattern (prices up on the employment report, and down on the PPI report), but clearly, the bond market is more concerned than the short end about a possible rise in inflation.

The Jackson Hole Symposium this coming Friday and Saturday is about the “Labour Market In Transition.” (No kidding!)

The next FOMC meeting is on September 16/17, and the market is currently pricing nearly a 100% chance of a 25 bps cut. The September 5th employment report may change that calculus. (If it is another weak report, they will go 50 bps and probably lean towards another 50 bps before year-end, unless inflation rises.)

The yield curve continues to steepen. (Chart from marketwatch.com.)

Trump and Bessent continue to “recommend” that the Fed should cut short-term interest rates aggressively, to reduce the government’s debt service costs and to spur economic growth.

“What” are we trading when we trade bonds?

On May 22, the 30-year Treasury yield reached ~5.15%, an 18-year high (blue ellipse). The consensus then was that foreign buyers, post the Liberation Day fiasco (pink ellipse), were losing their appetite for USD-denominated bonds, and the coming issuance tsunami to finance the growing US federal deficit was increasing the “term premium.” Japanese long bond yields were at record highs, and the German government had just changed its constitution to enable running a fiscal deficit to fund infrastructure and defence projects. (See the May 24 Trading Desk Notes for more detail.) Some market participants were likely also concerned that Trump’s potential firing of Powell could trigger a financial crisis.

Bond prices have risen from the May lows, with the 30-year yield at ~4.9% at Friday’s close. I’ve been predisposed to fade the recent bond rally (I think a combination of rising tariff costs and Trump wanting to run the economy “hot” will keep inflation well above “target”). Still, I wondered if bonds were being bid higher on expectations of a weaker economy and, to a lesser extent, as a hedge against speculative excesses in the stock market.

Currencies

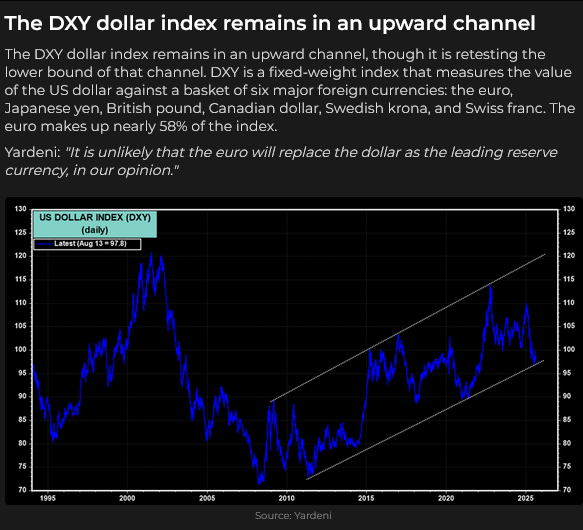

The trade-weighted US Dollar was at an all-time high in January. The DXY index (heavily weighted with European currencies) was effectively at a 23-year high, outside of a few weeks in 2022. By the end of June, the DXY was down over 12% at 3-year lows, its worst H1 performance in years.

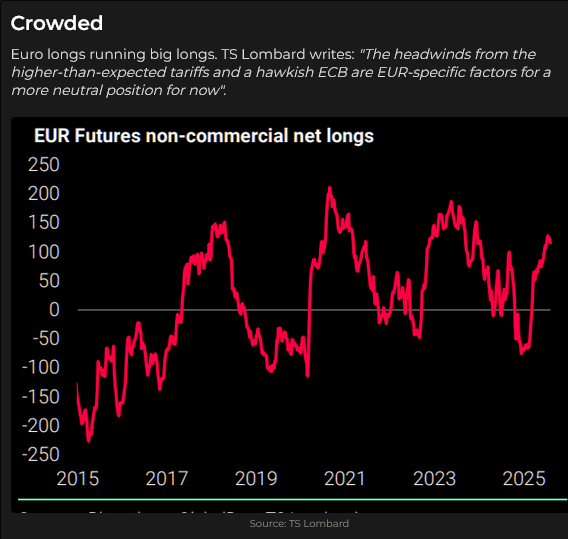

The Euro was at a 2-year low in January but rallied ~16% to 4-year highs by the end of June. Common themes during the Euro’s rally were “the end of American exceptionalism” and “anything but Trump.” Net speculative long positioning in the Euro futures market rose to a 2-year high.

The rally in the Euro accelerated following the April 7 “Liberation Day” (blue ellipse), and peaked at the end of June (pink ellipse).

Some people saw the USD decline in H1 as part of Trump’s MAGA plan. Trump and people in his administration believed that foreigners had been taking advantage of the USA by keeping their currencies artificially low. If the dollar were weaker, it would create a more level playing field.

I believe Asian countries engaged in mercantilist policies (Abe’s three arrows program started in 2012, and other Asian countries had to compete with Japan) that included a weak currency to facilitate exports to North America and Europe. These policies contributed to the massive Asian trade surpluses with the USA, which inspired Trump’s tariff crusade.

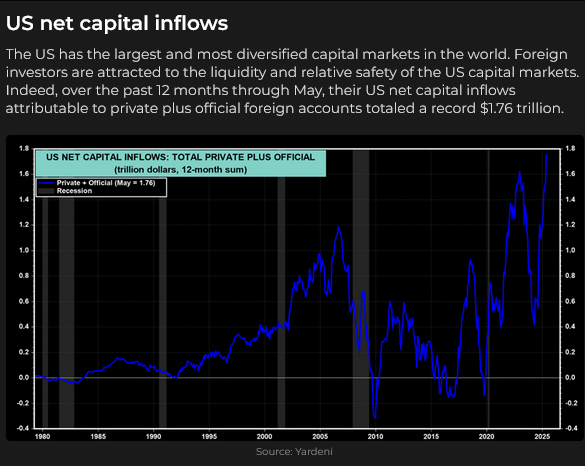

I also believe that (as I’ve said so many times over the last 40 years) “capital comes to America for safety and opportunity.” As that capital flowed to America, it caused the USD to rise, leading to a virtuous circle of a rising USD becoming an additional magnet for more capital flows.

Another “currency mantra” that I’ve repeated over the years is that trends in the currency markets become self-reinforcing and run far longer than seems to make sense before turning on a dime and going the other way.

I think the USD was overdue for a correction in January. So far, the correction has lasted for about six months. We’ve seen some capital flow to “bargains” in capital markets outside the USA, but I don’t think the era of capital coming to America for safety and opportunity is over. Let’s see what happens if there is a need for “safety,” or if the investment opportunities outside the USA lose their attraction. In short, I don’t believe that “American exceptionalism” is over.

I can understand why some folks (who are not currency traders) think “the Dollar is doomed” when they see how its purchasing power has shrunk. But, (to reuse that old chestnut) in the world of trading one currency against another, the USD is the cleanest dirty shirt in the laundry hamper!

Since Liberation Day the DXY is down ~5%, the Euro is up ~7%, the Swiss ~7%, the British Pound ~6%, the AUD ~10%, the NZD ~8%, the MEX ~15%, the Yen is about flat, the Euro/Yen is up ~9%, while Euro/Swiss is about flat.

The trade that interests me (and this is NOT investment advice) is the EURYEN, which is trading around all-time highs. On a purchasing power parity basis against the USD, the Yen is much more undervalued than the Euro (the Swiss is WAY overvalued against the USD). If Trump wants to “level the field” in currency valuations (the Mar-a-Largo Accord), there could be much more pressure to up-value the Yen than the Euro.

My short-term trading

It’s summertime, and I’m not trading much. I started this week with small short positions in the S&P and the Euro. I was stopped for slight losses on both positions on Tuesday when the CPI didn’t frighten anybody.

I took a small short position against the S&P ahead of the close on Friday as sort of a “no confidence” vote. I held the position into the weekend.

Recommendation

I read a lot of different research/market comments from a variety of sources (check out the recommended button at the top of the page – I should update that list one of these days), and I subscribe to several excellent services. (I will list them all soon). I recently discovered “The Dark Side Of The Boom,” written by Stephen Innes, a veteran Canadian trader living in Thailand. He posts on Substack. If you’re a trader, check it out. He’s an entertaining writer with good ideas. You can subscribe for free; he hasn’t gone behind a paywall yet.

The Barney report

There has been some smoke in the air this week from forest fires (a seasonal hazard in the Pacific Northwest Rainforest), so Barney and I have spent less time outdoors than usual this week. But he’s a resourceful dog, and finds ways to amuse himself indoors, including going for a deep dive in Pap’s bed!

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the booming global stock markets, inflation, gold, and WTI. You can listen to the entire show here. My spot with Mike starts around the 1-hour, 1-minute mark.

Listen to Jim Goddard and me discuss markets

I did my monthly 30-minute interview with Jim Goddard on the This Week In Money show this morning. You can listen to the entire show here. My spot with Jim starts at the beginning of the show. Jim and I reviewed the highlights across markets, drilling down on key areas such as interest rates and the upcoming Fed cuts, as well as currency markets and opportunities in specific commodities like copper and wheat. We concluded with my perspective that the old order is changing – these are not your father’s markets!

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair August 16th, 2025

Posted In: Victor Adair Blog

Next: Inflationary Questions »