August 24, 2025 | Soaring Inventory Is (Finally) Cutting Home Prices

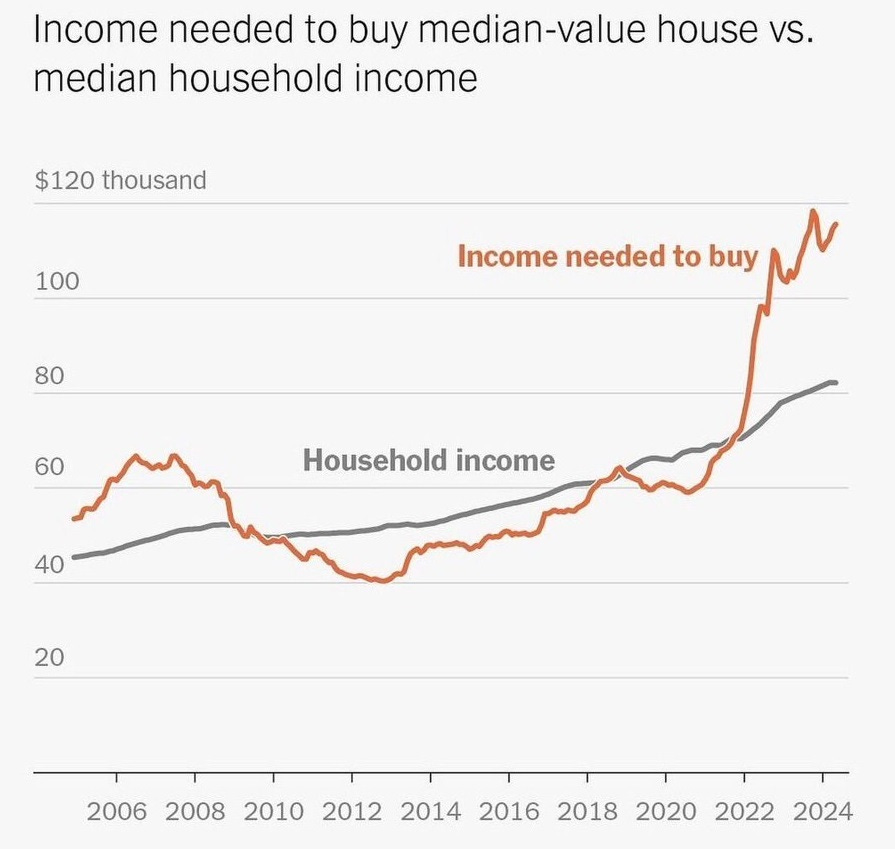

In just the past few years, US houses have gone from pricey to historically unaffordable:

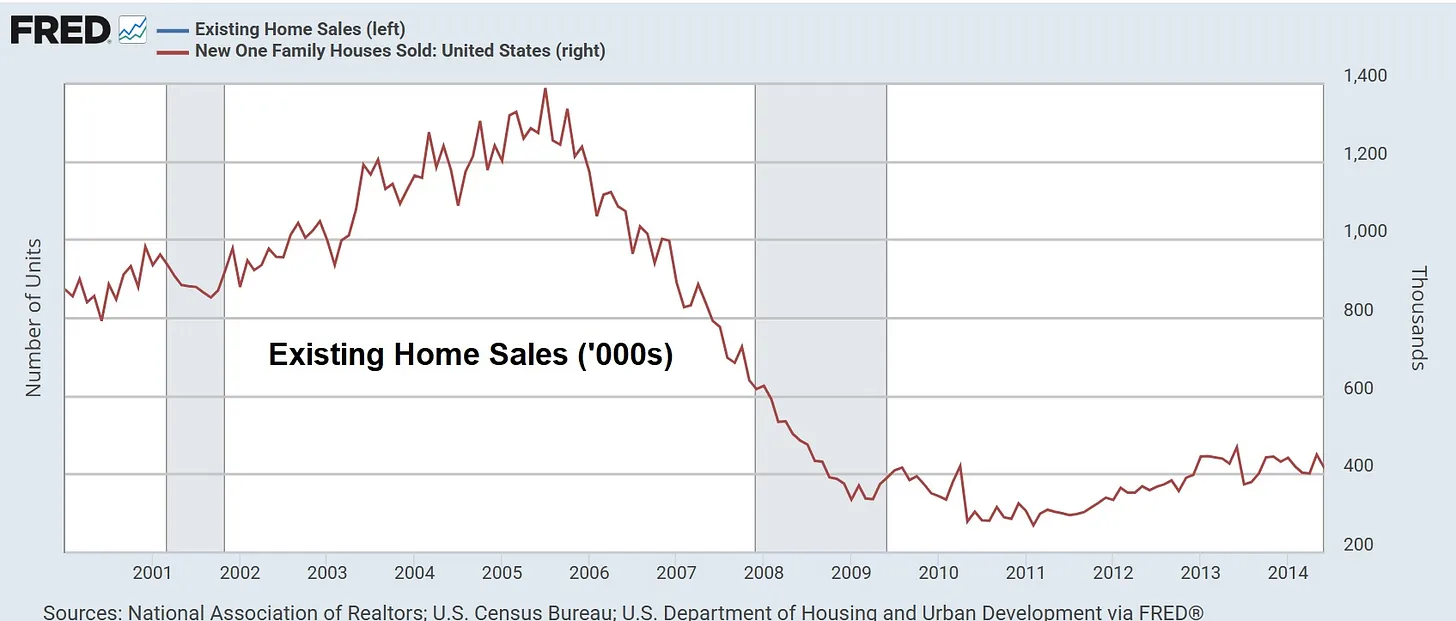

Since people can’t buy what they can’t afford, home sales have cratered to ridiculously low levels:

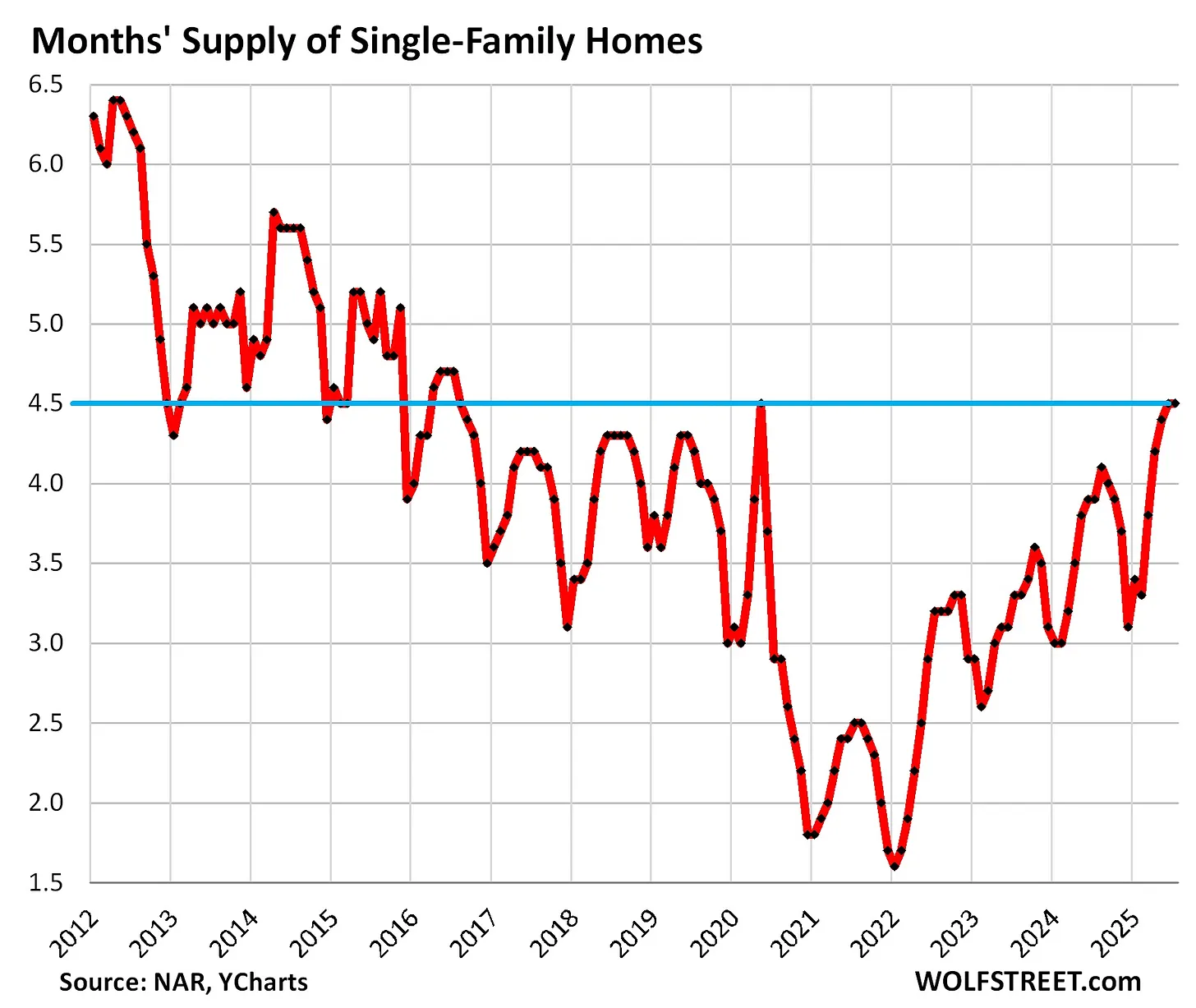

History now predicts a housing crash

In a typical housing bubble, prices get too high, buyers go on strike, and then sellers panic. Unsold inventory piles up and prices start to fall, (to use the old Hemingway quote), gradually at first and then all at once.

We’re now entering the “all at once phase.” Inventories of homes for sale are heading back to Great Recession territory:

And prices are starting to fall. From Wolf Street:

In 12 bigger cities, prices of mid-tier single-family homes have already dropped by 10% or more from their peaks through July, seasonally adjusted. In two of them, prices have dropped by 23% so far.

- Oakland, CA: -23%

- Austin, TX: -23%

- New Orleans, LA: -18%

- Cape Coral, FL: -18%

- San Francisco, CA: -16%

- Birmingham, AL: -15%

- Washington, DC: -12%

- Fort Myers, FL: -12%

- Denver, CO: -10%

- Portland, OR: -10%

- Phoenix, AZ: -10%

- Sarasota, FL: -10%

Just the beginning

Real estate cycles are not gentle. Buildings are big, illiquid assets bought with aggressive financing. Once in motion, such a market tends to continue until it reaches extreme territory.

So low double-digit price declines are barely a blip on the chart that houses are now tracing out. To return to normal levels of affordability, prices and/or mortgage rates must fall sufficiently to cut the average mortgage payment in half.

Imagine what that means for boomers who have waited too long to downsize, homebuilders who are sitting on mountains of raw land, Airbnb entrepreneurs whose portfolios have gone cash-flow negative, and private equity “landlords” who have borrowed billions to buy houses at yesterday’s bubble prices. Even relatively modest price declines can cause trouble for some of these guys. A 40% drop will cause mass extinction.

Adam Taggart just interviewed a housing analyst who spells out the implications of what’s coming:

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino August 24th, 2025

Posted In: John Rubino Substack