August 15, 2025 | Canada vs. Trump: Is Confrontation The Only Option?

Canada, under Prime Minister Mark Carney, is taking a beating from U.S. tariffs. But Carney refuses to cave to President Donald Trump’s demands—raising the question: Is confrontation with the U.S. Canada’s only choice?

The trade war between Canada and the U.S. intensified on August 1, 2025, when Trump slapped a new 35% tariff on Canadian goods (energy products and potash were the rare exceptions). (Don’t worry if you’ve lost track; even I needed a primer — thanks, Joanna Smith in The Logic.) The good news is that a blanket exemption – U.S.-Mexico-Canada Agreement (USMCA) – covers most trade – more on that later.

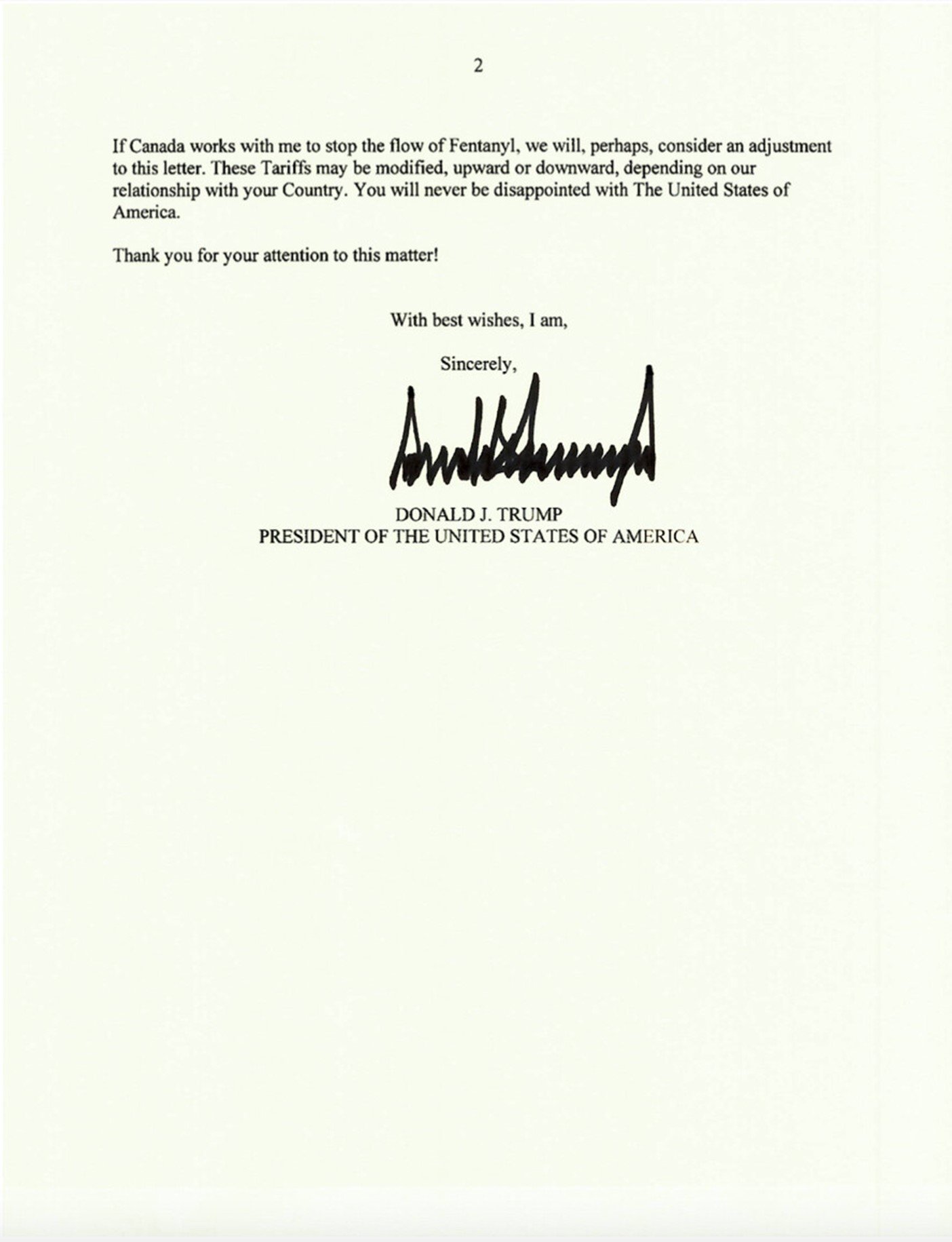

In July, Trump sent Carney a letter with a litany of complaints:

Source: The White House

Trump’s trade obsession flows from a simplistic belief: if Country A runs a trade surplus with Country B, then A must be ripping off B. By that logic, if you pay your hairdresser every month but she never buys anything from you, she’s “taking advantage” of you. (Never mind that you’re getting a good haircut out of the deal.).

Meet Peter Navarro, a key architect of Trump’s tariff crusade. Navarro caught Trump’s eye with a book called Death by China (claiming Beijing cheats at trade). He’s one of the few aides from Trump’s first term back for round two — he showed his loyalty by enduring four months in prison for defying Congress during the Jan. 6 probe. Elon Musk once labeled Navarro “dumber than a sack of bricks.” Musk is gone; Navarro remains.

Ironically, while Navarro first helped aim Trump’s ire at China, on August 12 Trump announced another 90-day pause on China tariffs — right after hammering Canada.

Things are not as bad as the headlines suggest, however. Thanks to USMCA, roughly 94% of Canadian exports are eligible to dodge these tariffs. (In June, about 92% of exports did cross duty-free.) Still, plenty of exports are getting walloped. Here’s a partial list of announced tariffs:

- Steel & aluminum: 50%.

- Autos & auto parts: 25% (with some exceptions).

- Copper: 50% (refined metal excluded).

- Softwood lumber: 35.19%.

- Small shipments: The $800 “de minimis” duty-free threshold is ending, so even low-value FedEx packages will be taxed.

- Trans-shipping: Goods routed through third countries face a 40% penalty.

So, is confrontation the only choice? Canada has significant leverage as the main supplier of crude oil to the U.S. — 4.2 million barrels per day. But playing that card would be a major escalation and invite a nasty confrontation between Ottawa and Alberta.

At this point, Carney’s best option is to stand firm and lean on the USMCA to blunt the damage. There’s little to gain from enabling the erratic demands of a bully with a shaky grasp of economics. Taking a strong stance and waiting for sanity to return to Washington is Canada’s best path forward.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth August 15th, 2025

Posted In: Hilliard's Weekend Notebook

Mask wearing order following Canadians with TDS keep shooting them self in the feet. They hate Trump more then they love themselves. Why wouldn’t Canadians want to try to fix a drug problem? Blame our bad economy on Trump instead of high taxes, regulations, climate BS, covid lock downs, sending money to war mongering Zillinky, open boarders etc.The war mongering Neocons and main stream media demonize a president that is for piece. I never saw Trump wear a mask during the Covid BS or telling people to mask up. Trump was one of the only presidents to tell the people to liberate their state. During the BS covid the real bullies and gutless order folllers were exposed. Anyone that enforced wearing a mask or having to be vaccinated to enter are the true bullies. Probably about 99 percent of Canadian politicians are the real bullies along with thier followers. Provinces had tariffs against other provinces.