July 25, 2025 | Lofty Valuations for Tesla are at Risk

Tesla: Lofty Valuation, Slipping Fundamentals

Tesla still carries a sky-high valuation — more than 100 times its projected profits. That kind of multiple has only shown up a handful of times in history, and only for a few companies.

So, do the fundamentals support this kind of price?

Let’s take a look.

Tesla hit a peak market cap of $1.5 trillion in December 2024, but after this week’s results, it slipped below the $1 trillion mark. Financial results were weak, and the quarterly call with analysts didn’t do much to ease growing concerns about the company’s future.

The share price peaked at $488 in December 2024. Today, it’s closer to $300.

That’s a steep drop — and it puts Tesla behind its Magnificent Seven peers, a group that now makes up about one-third of the S&P 500’s total value.

Here’s where the Mag 7 stand, by market cap (in trillions):

- Nvidia: $4.3

- Apple: $3.3

- Microsoft: $2.8

- Amazon: $2.4

- Alphabet: $2.3

- Meta: $1.8

- Tesla: $1.0

Tesla may be the smallest by market cap, but it trades at the highest valuation multiples — a Price-to-Sales ratio of 10x and a P/E of over 100x.

Elon Musk prefers to keep the spotlight on the future, not the present. After Wednesday’s earnings, he doubled down on robotaxis:

“We’ve made clear demonstrable progress in autonomy that a lot of naysayers said we would not achieve. Now the naysayers are sitting there with egg on their face.”

And:

“Once we have a physical product, the autonomy is what amplifies the value to stratospheric levels.”

But Tesla’s core business isn’t robotaxis — and that core isn’t growing. In fact, it’s shrinking. High-growth companies (think 30–40% annual gains) are the only ones that can justify these kinds of valuations. Tesla’s latest results? Not even close.

Profits dropped 16% from the prior quarter. Deliveries fell 13.5% year-over year. Revenue declined just as much.

China — the most important EV market — is seeing rising competition, hurting Tesla’s sales. European sales also suffered after Musk’s controversial political moves last year. And this fall, the U.S. will remove key EV purchase incentives.

Even Musk admitted that a “few rough quarters” could be ahead.

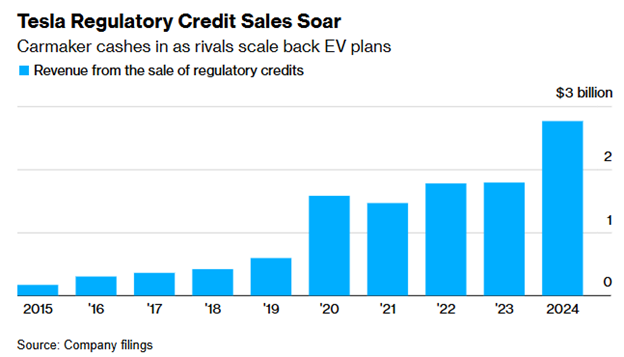

There’s also a lesser-known but crucial revenue stream: regulatory compliance credits. Other automakers buy them from Tesla to meet fuel economy rules. These credits are bigger than Tesla’s net profit and make up about 25% of total revenue.

But the “Big, Beautiful Bill” passed this month could end most of that revenue stream.

So: shrinking sales, disappearing incentives, and the loss of regulatory credit income — not exactly a recipe for a premium valuation.

And when a high-flyer like Tesla starts falling? The market can be ruthless.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth July 25th, 2025

Posted In: Hilliard's Weekend Notebook