July 15, 2025 | Housing Bust Intensifies As Inventories Surge

One of the reasons so few houses were on the market over the past few years was the disparity between 7% current mortgage rates and the 3% mortgages that many homeowners had. It made no sense to sell a house with a cheap mortgage and buy a new house with an expensive mortgage, so millions of potential sellers didn’t bother.

But now mortgage rates have been elevated for a couple of years, and the number of people paying more than 6% is high enough to make cheap-mortgage “lock in” less of an issue.

Meanwhile, we Baby Boomers own 40% of U.S. houses and condos, which translates to approximately 60 million units. Over the next decade, most of these will change hands, either through sale or inheritance, producing an avalanche of inventory.

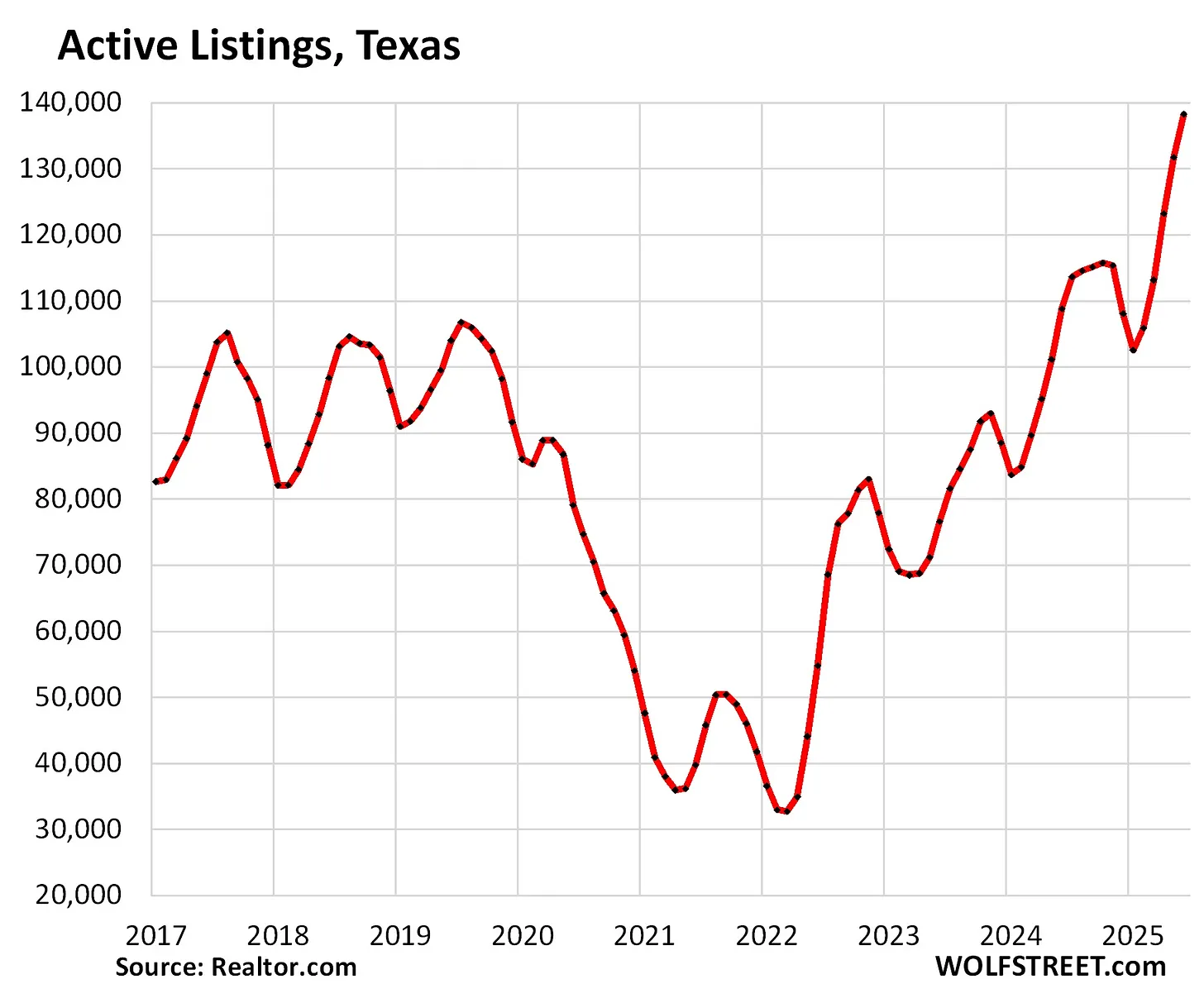

And right on cue, the number of homes for sale is spiking, especially in formerly hot markets like Texas and Florida:

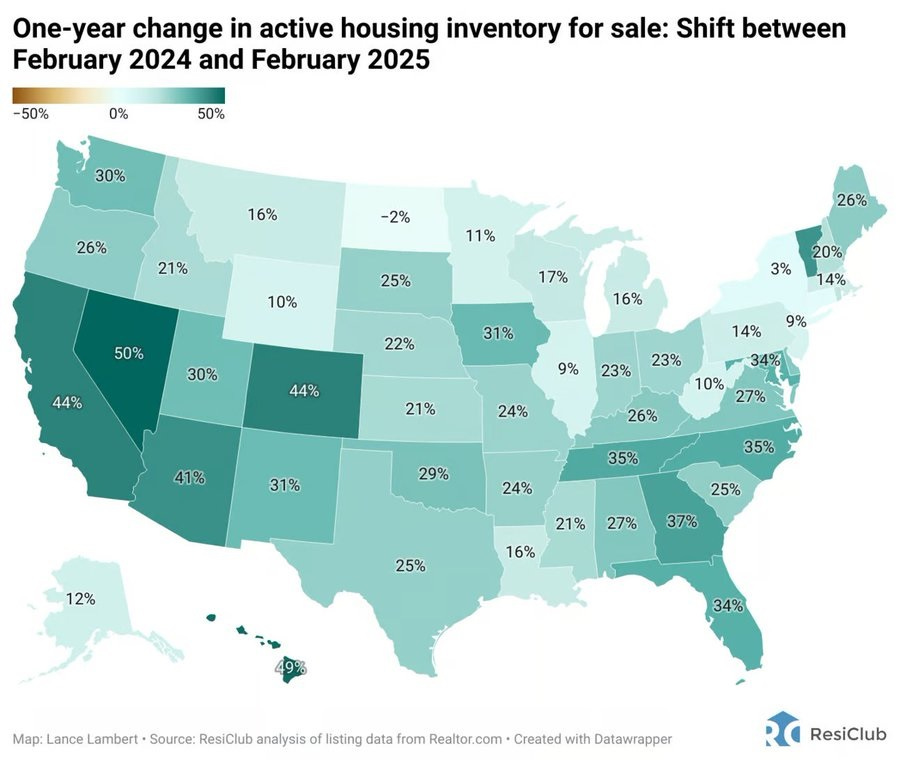

Here’s a state-by-state map of increasing inventories. Note the double-digit growth just about everywhere:

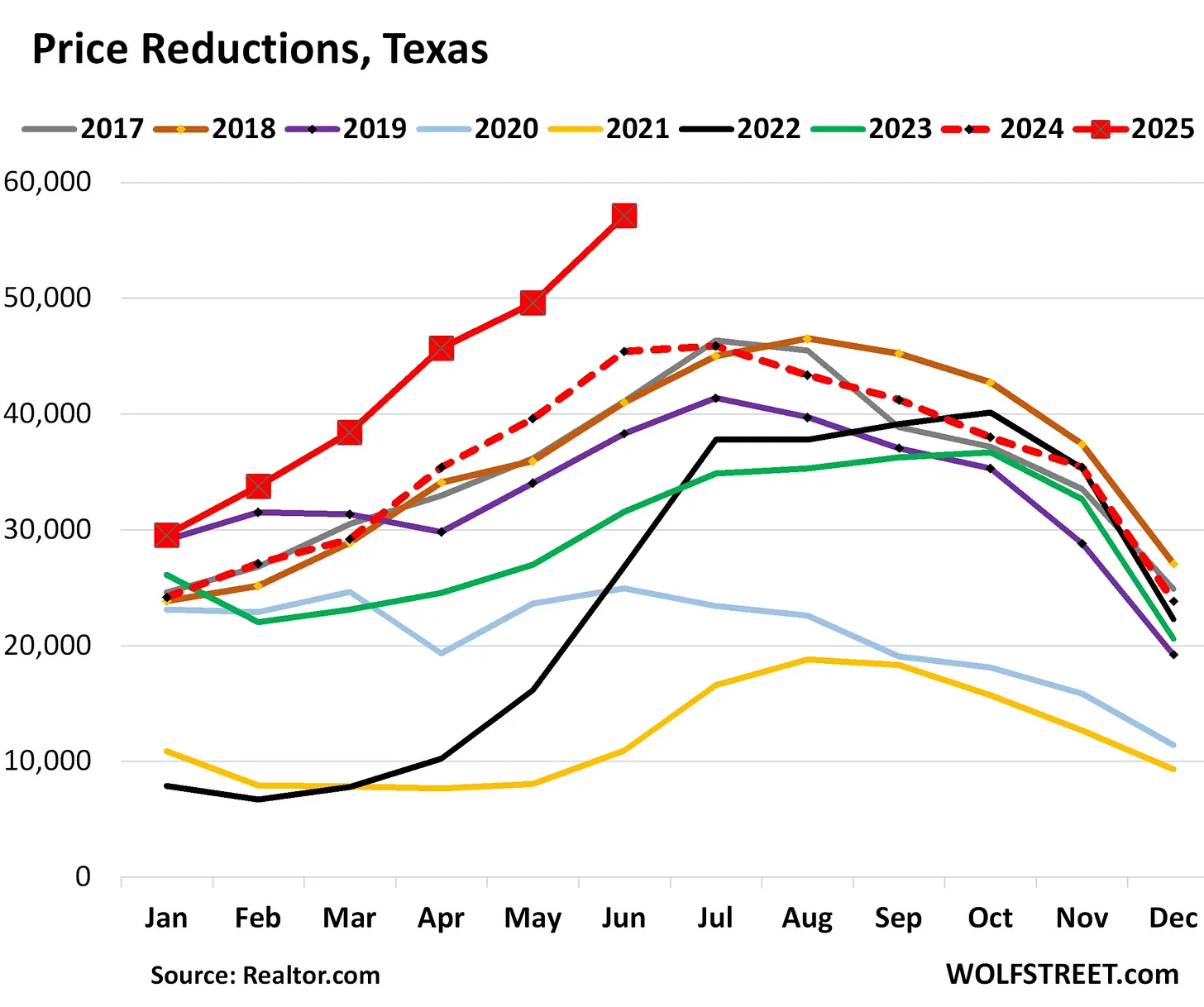

Prices at a tipping point

When supply increases faster than sales, a market eventually reaches a tipping point where those who have to sell bite the bullet and take whatever is offered. That’s now beginning.

However, the gap between asking prices and sale prices is widening, which means that, despite their tentative price cuts, sellers are still asking way too much. The “panic sale” part of the cycle hasn’t yet arrived.

How low can home prices go?

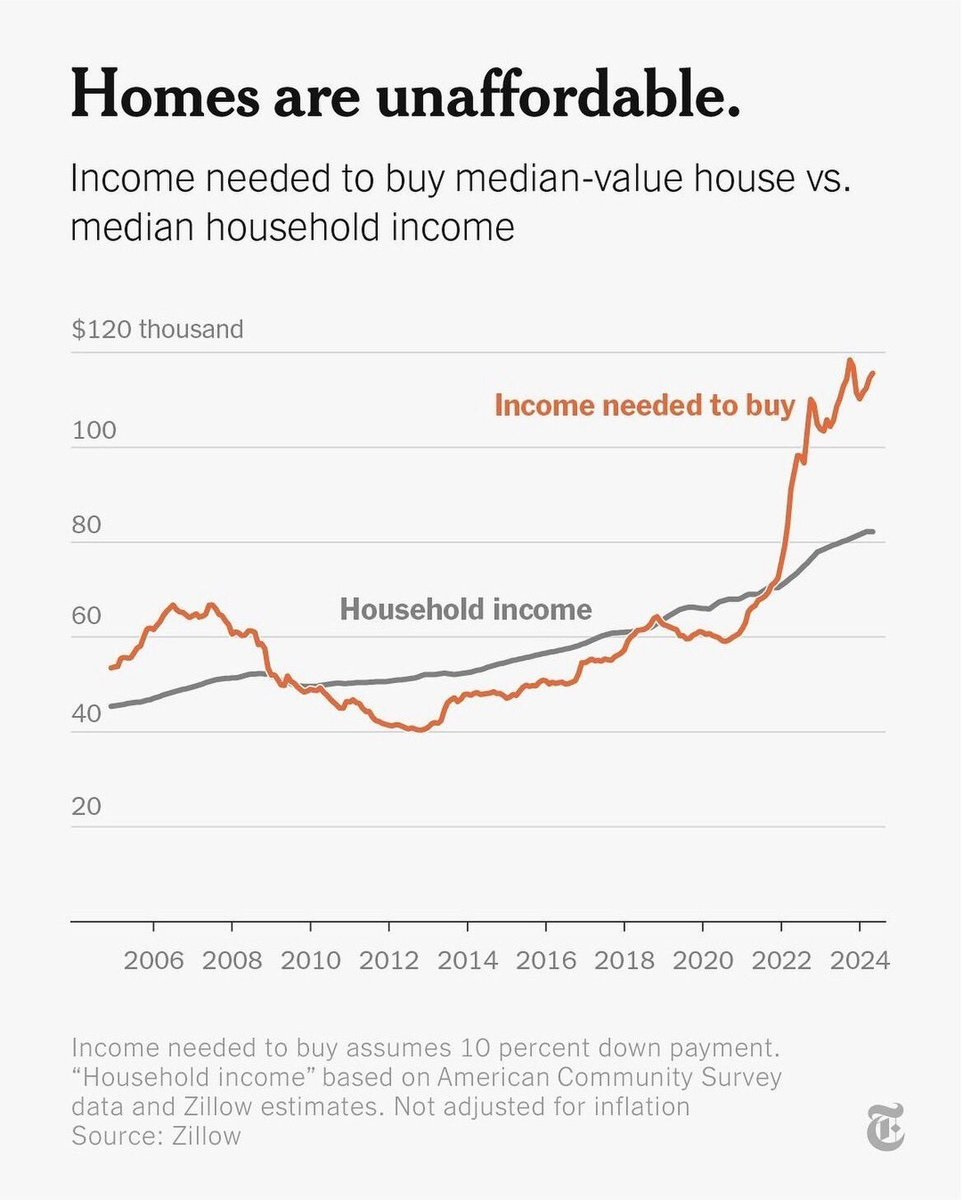

Normally, home prices fall until a typical buyer can once again buy a typical house. That is, when houses are affordable again. Based on the following chart, the cost of homeownership (purchase price and mortgage rate) will have to fall by at least one-third in the next few years. For a $500,000 house, that’s a $160,000 decline.

Actionable advice

If you need to sell, remember the saying “He who panics first panics best.” Price your property aggressively, and if possible, offer financing help and other perks to get buyers’ attention. If you’re a potential buyer, relax and let the desperate sellers come to you. The fun is just beginning.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino July 15th, 2025

Posted In: John Rubino Substack

Next: Japan & MNRA Studies »