June 22, 2025 | Wall Street’s Epic Bunco Game

Tulipmania and the South Sea Bubble have nothing on the bunco game Wall Street has been running with Microsoft shares. I write on this subject often because the numbers are so huge, and because the game, which is intertwined with the biggest financial con-job in history, is not one you will ever read about in The Wall Street Journal or on Bloomberg.com. It thrives on the madness of crowds and grows bigger with every uptick in MSFT and the galaxy of stocks in its vortex. Microsoft’s share price has gone from 393 to 483 since April, adding roughly $687 billion to the macro ledger. That is twice the size of California’s budget for 2025. It would buy a Porsche 911 for every man, woman and child in New York and Chicago, or a super-deluxe Disney World vacation for every family in America.

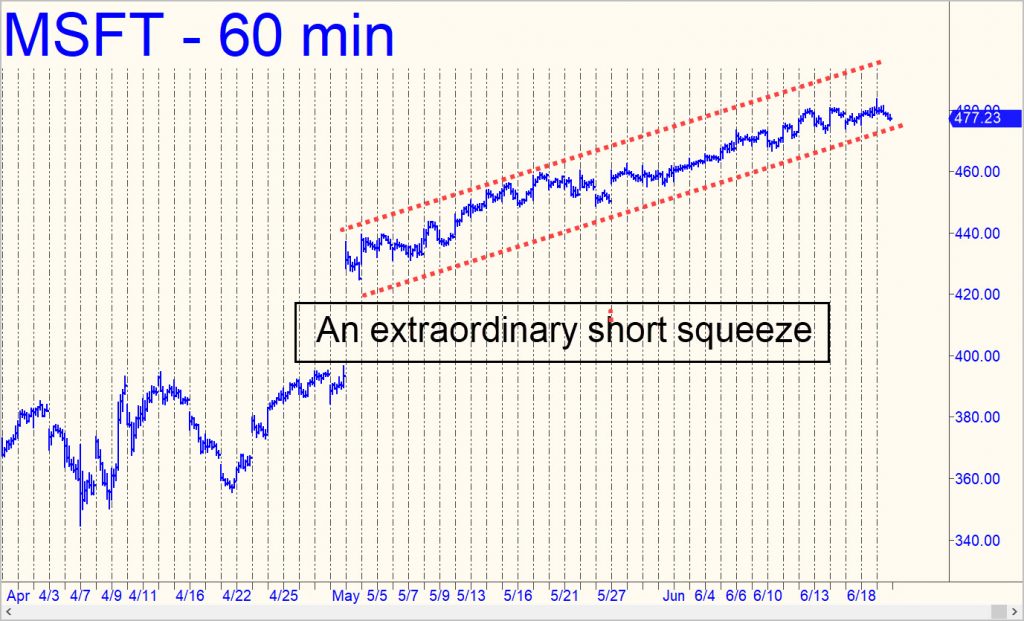

A clue to how the game works lies in the relentless smoothness of MSFT’s ascent. You could comb through a thousand charts without finding one remotely like the one pictured above. You don’t have to be a technical analyst to see that the long rally has been tightly controlled every step of the way. This kind of price action is quite rare, but what makes it extraordinary is that it is not happening to just any stock, but rather to the most valuable stock in the world, a $3 trillion company with a lock on the operating systems of a billion-and-a-half desktop computers. The stock has been ratcheting higher on relatively thin volume and a dearth of bullish buying. Short-covering has done most of the lifting, with more urgency and power than merely optimistic investors could ever supply.

Ka-Ching!

MSFT’s manipulators knew what they were doing when they goosed the stock into a sensational short squeeze on April 30. On that day, after the close of business, Microsoft announced earnings of $3.48 per share on revenues of $70.07 billion, beating the consensus estimate by 24 cents a share. That might not sound like much, but it was enough to spook wrong-way bettors into gapping MSFT $48 higher on the opening bar the next day. Ka-ching! Another $366 billion worth of instant wealth-effect. Even Wall Street’s perpetually bullish analysts couldn’t have imagined the rally would add another $321 billion of unearned gains since then. And yet, here we are, with the stock in record territory and no top in sight. It doesn’t get any better than this, which is why MSFT cannot continue to climb. When it falls hard for no apparent reason, which it will, that will mark the end of the bull market and the hubris that has sustained it for 16 years.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman June 22nd, 2025

Posted In: Rick's Picks