June 21, 2025 | Trading Desk Notes for June 21, 2025

Market reaction to the Israel/Iran war has been muted

Israel and Iran are at war, but you wouldn’t know it from looking at this S&P futures chart.

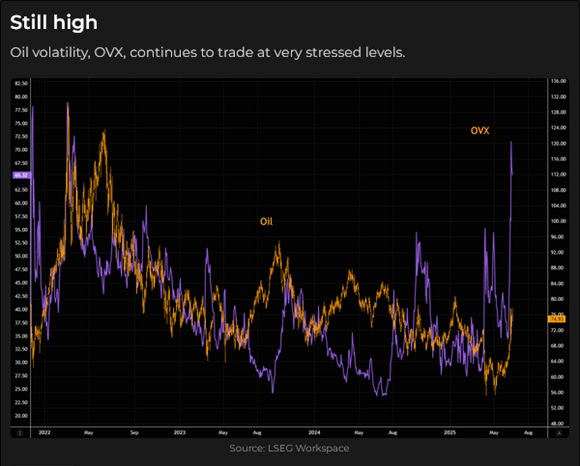

The daily WTI crude oil chart shows a bigger price reaction, with prices up ~25% since the beginning of June.

However, on the monthly chart, prices around $73 don’t reflect anywhere near the stress that the Russian invasion of Ukraine inspired in February 2022, when prices soared to approximately $130. (Yes, the supply/demand picture was much different in early 2022 than it is now, but still, $73 certainly doesn’t reflect much fear.)

Oil VOL is sharply higher.

I highly recommend this Maggie Lake video interview with my friend, John Johnston (he is Alyosha on Substack and the author of Market Vibes), which was posted on June 21. JJ is a veteran New York commodity floor trader, and he discusses oil (we’re oversupplied), equities, metals, gold miners, and trading techniques. I’ve interviewed him on Moneytalks, and I subscribe to his twice-daily Substack reports.

Gold futures rallied ~$150 from bottom to top last week (but did not make new highs) and then fell ~$120 from top to bottom this week, closing below where it closed on June 2, the first trading day of the month.

The US Dollar Index has rallied just 1% from 3-year lows since Israel attacked Iran directly last week, hardly a dramatic “flight to safety,” especially considering it was down ~12% from its January highs.

The US long bond briefly rallied to 4-week highs following the Israeli attack (blue ellipse), but closed lower on the day and has been sideways to lower since – again, no sign of a “flight to safety.”

What’s the “takeaway” from this subdued market reaction?

It appears that markets don’t expect this war to spiral out of control. If you had asked me a year ago how markets would react to a full-on Israel/Iran war, I would have said, “Oil north of $100, gold at new highs, stocks down, bonds and the USD up on a flight to safety.”

A lot of people have strong opinions about what will happen, what “ought” to happen and whether or not the USA should get involved. I highly recommend this 45-minute Maggie Lake video interview with Doomberg, posted on June 17. I started following Doomberg when he was on Grant Williams’ podcasts and became a paid subscriber the moment he went live on Substack.

My view is that this war started on October 7, 2023, when Hamas attacked Israel. As it progressed, and as Israel engaged Hamas, Hezbollah, and the Houthis, I realized that the Israelis were determined to “finish the job” this time, despite what anyone said, and that it was inevitable they would “face off” with Iran. I have no idea where this war will go, who will get involved, how long it will last or what the Middle East will look like when it is done, and I will not make any trades on the assumption that I “know” what will happen.

Stocks

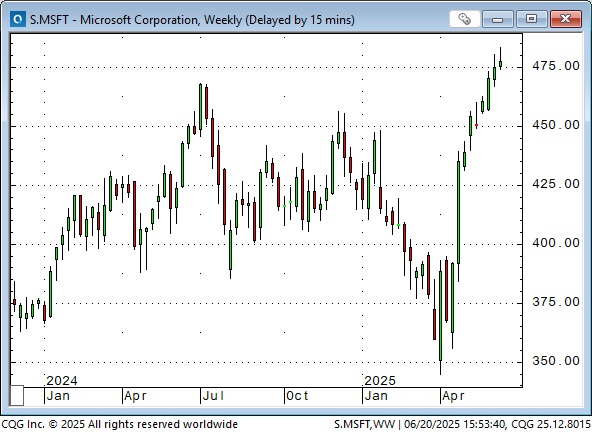

MSFT is up ~40% in two months, trading at all-time highs, with a market cap of ~$3.57 trillion, the largest of any publicly traded corporation anywhere. ( NVDA is ~$3.54, AAPL is ~$2.94. The total market cap for the three companies is ~$10 trillion. The current inflation-adjusted GDP for the USA is ~$23.5 trillion.)

My question is: Would you buy MSFT here?

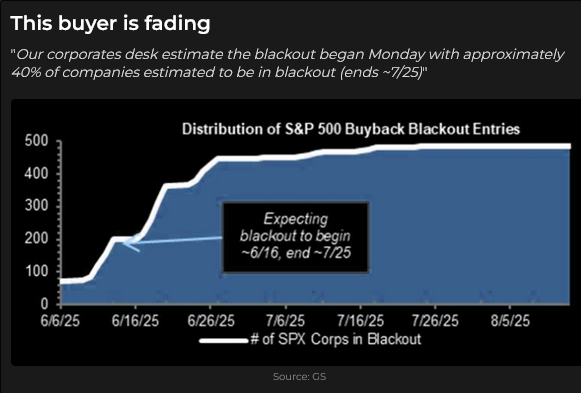

Corporate buybacks are the most significant buyers of US stocks. Over the next few weeks, corporate buybacks are expected to “dry up” as blackouts are imposed ahead of quarterly reports.

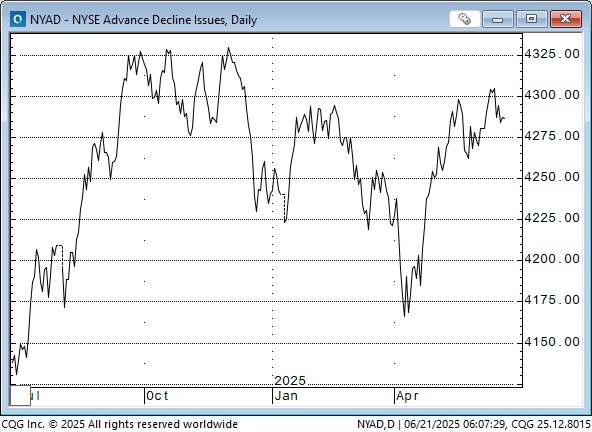

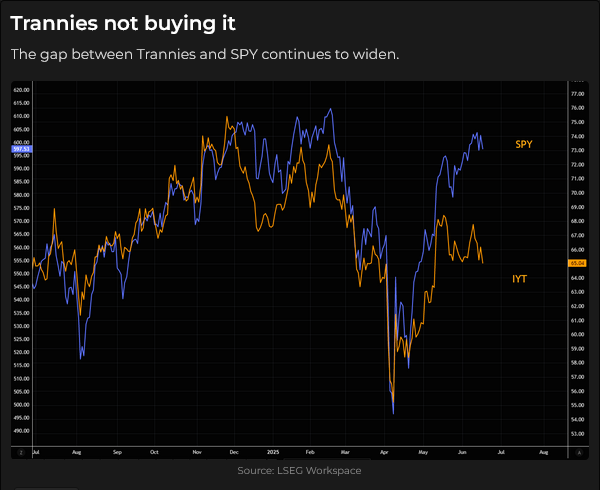

Tech and AI are leaving the broader market behind.

Currencies

The trade-weighted US Dollar Index hit all-time highs in January, around the same time this DXY index (heavily weighted with European currencies) hit 2-year highs. (Outside of a few weeks in late 2022, this index was at a 23-year high.) This index fell ~12% from January’s high to last week’s lows as markets adopted a “Sell America” sentiment (Trump is bad and American exceptionalism is over).

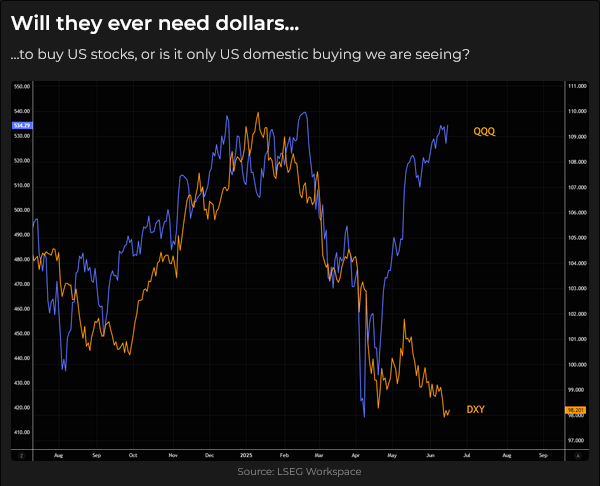

Interestingly, US stocks and the US Dollar Index fell together from February to early April, but since then, stocks have recovered dramatically while the USDX has continued to weaken. (In this chart, from August of last year to this week, the QQQ is the blue line, the DXY is the orange line.)

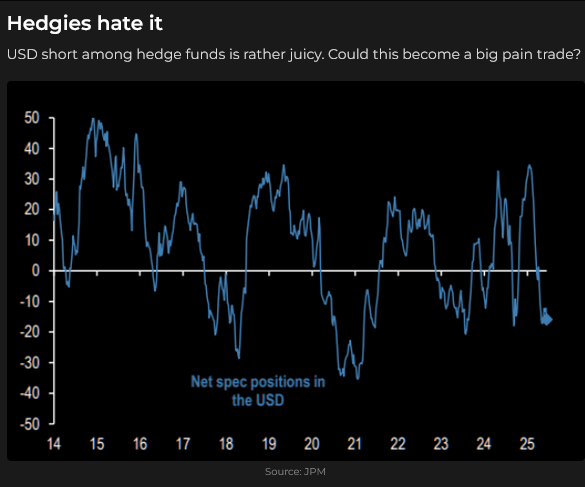

Market sentiment is very USD bearish. This is the Bank of America Fund Manager Survey (FMS).

The CAD hit a 23-year low of ~6775 on February 3, when Trump imposed 25% tariffs on Canada and Mexico. (It had its biggest one-day rally in years later that day when Trump paused the tariffs.) The CAD rallied ~10% to this week’s high, but the chart indicates a weekly Key Reversal (blue ellipse), which may signal the end of the rally.

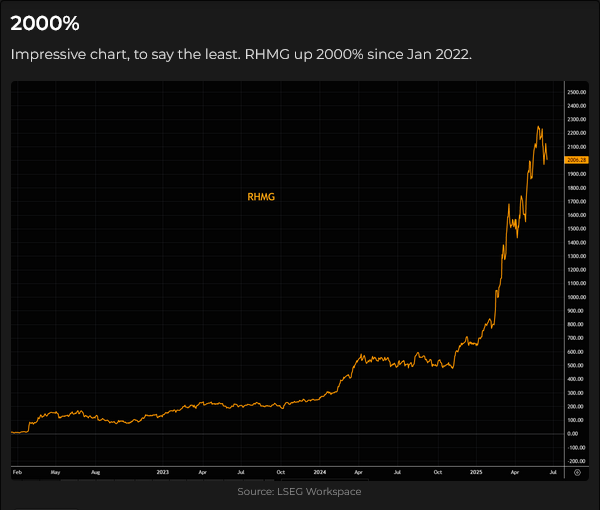

The “other side” of “Sell America” was to buy European (and other foreign) stocks. Rheinmetall, the leading German defence stock, helped boost the DAX to new all-time highs.

I’ve been thinking that USD bearishness is WAY overdone (it’s time to buy the USD), and I’ve been watching the FX charts for a confirmation that a “turn” may have started. One of my favourite “trading mantras” is that currency trends go way further than you think they will, then they turn on a dime and go the other way.

I shorted the Euro this week with a stop near the recent highs.

Uranium

Cameco has doubled since the first week of April and is trading at all-time highs. Would you buy it here? If you owned it, would you say thank you and sell some?

Closing thoughts

The 3-month pause on the Liberation Day tariffs is up on July 9, 13 trading days away. How many trade deals have been done? Will Trump extend the pause for another three months? Does the stock market even care about trade deals anymore? People in the real economy care, but the stock market may be a different matter.

Is the Big Beautiful Bill making any progress?

Silver is up ~$8 (28%) since the beginning of April, reaching 14-year highs, and open interest is at 5-year highs (specs are chasing silver higher). The bullish narrative includes AI and missile demand. The gold-to-silver ratio was 15 in 1980 and over 100 in May; it is now 94. If the gold-to-silver ratio returned to 1980 levels, silver would be ~$220. In inflation-adjusted terms from the $50 highs in 1980, silver would be ~$200 now. Silver is a commodity; gold is gold.

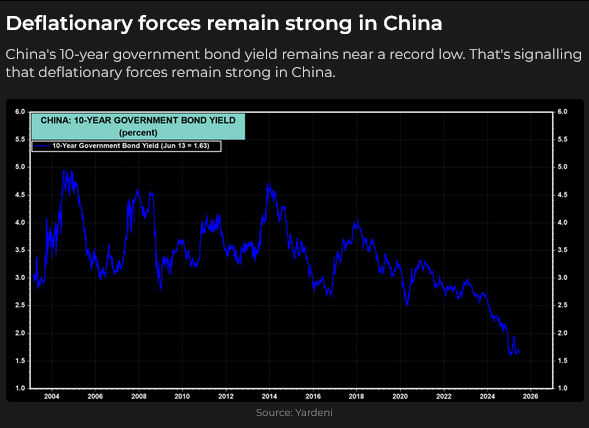

China still appears to be in a balance sheet recession, which may mean that it will continue to export goods at a discount to the rest of the world.

This week’s Trading Desk Notes are shorter than usual because I have a golf club championship this weekend, and I’ll be playing both days.

The Barney report

Barney can’t wait for me to stop playing around on my computer and take him outside for a long off-leash walk.

Listen to Mike Campbell and me discuss markets on the June 18 Moneytalks podcast

Mike and I agreed that muted price action likely signals markets don’t expect this war to spin out of control. We discussed gold, crude oil and stocks. You can listen here. My spot with Mike starts around the 46-minute mark.

Listen to Victor talk with Jim Goddard on the June 21 “This Week In Money” podcast

During my monthly 30-minute interview with Jim, we discussed the muted reaction across markets to the Israel-Iran war, then delved into a discussion of stocks, metals, crude oil, currencies, and interest rates. My spot with Jim starts around the 16-minute mark, right after my good friend Ross Clark. You can listen here.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair June 21st, 2025

Posted In: Victor Adair Blog

Next: Strategic Investment Conclusions »