June 18, 2025 | Recession Watch: Should We Really Be Piling Into Equities and Options?

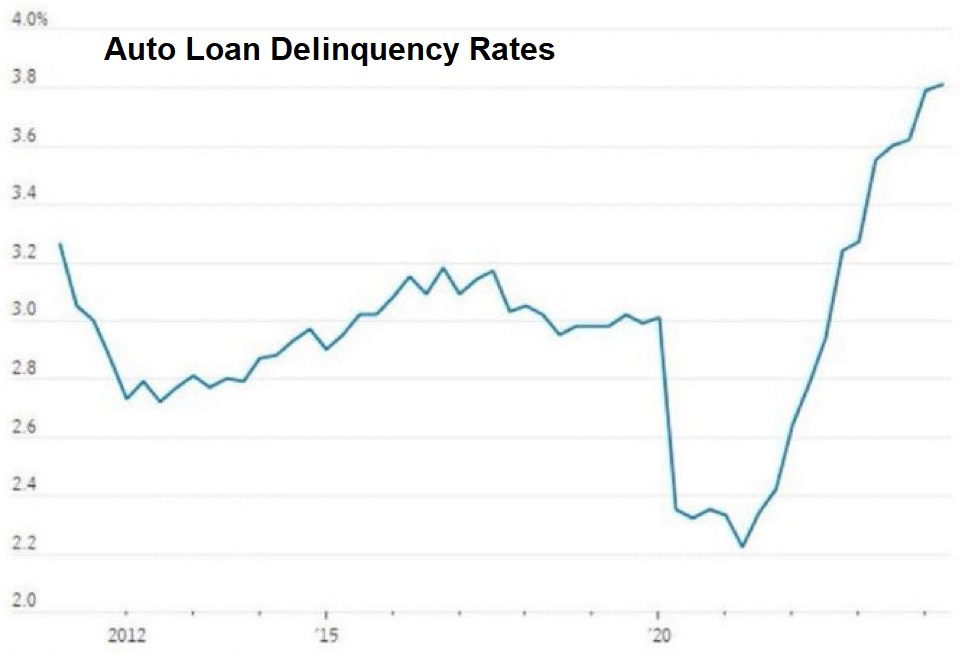

Auto prices have soared in the past decade, while auto loan interest rates have more or less doubled in the past two years. The result: hugely expensive “car mortgages” and spiking loan delinquencies:

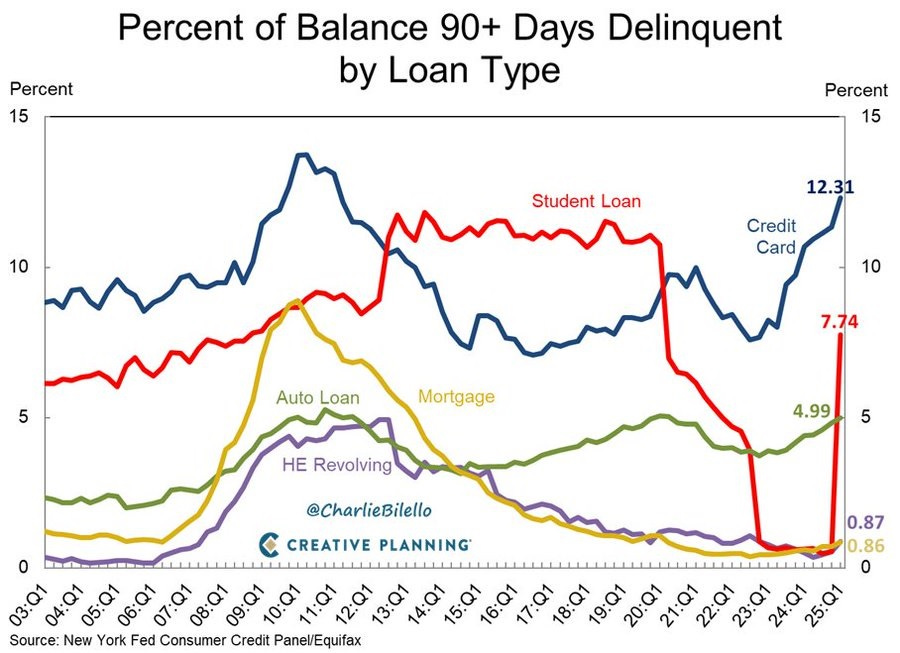

But as ominous as auto loans seem, they pale next to credit cards and student loans, where delinquencies have gone parabolic.

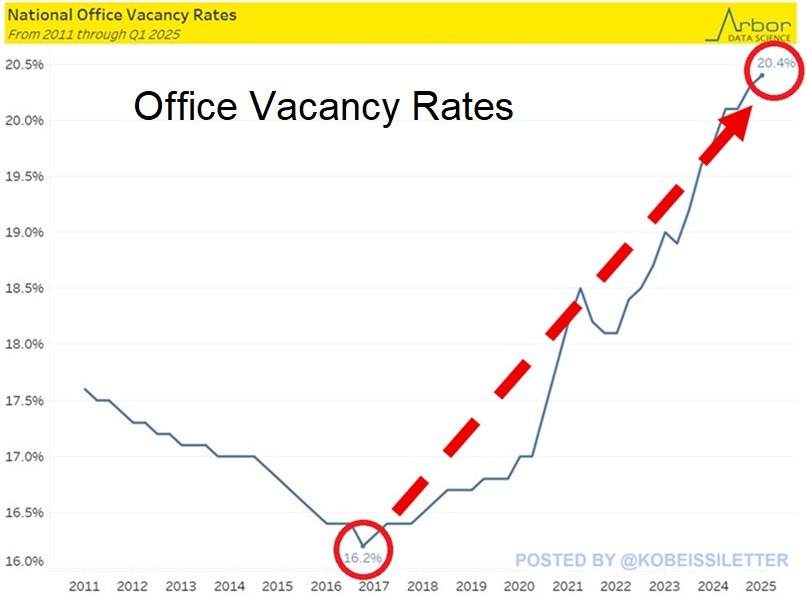

Over in commercial real estate, offices continue to empty out:

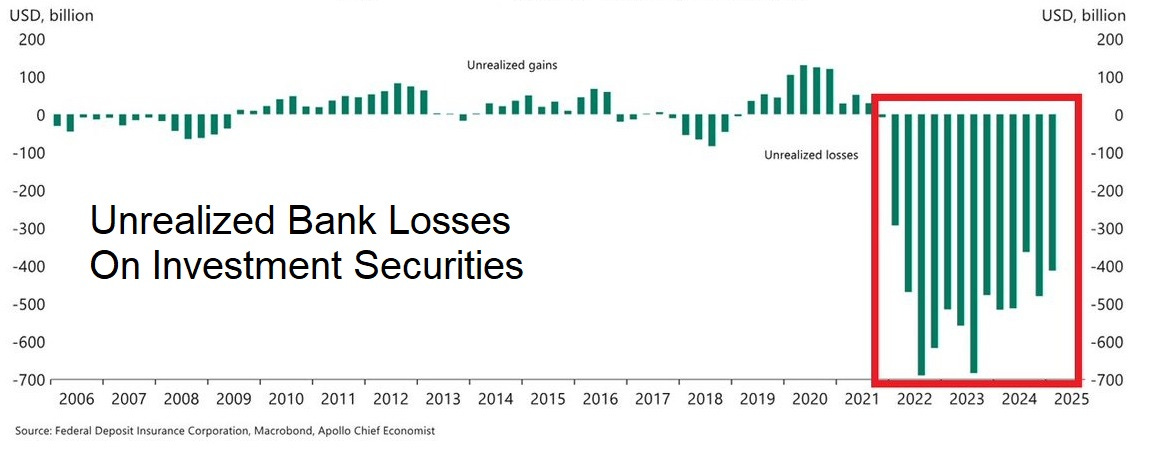

Banks, which own a lot of the resulting bad office building paper, will have to report big losses in the year ahead:

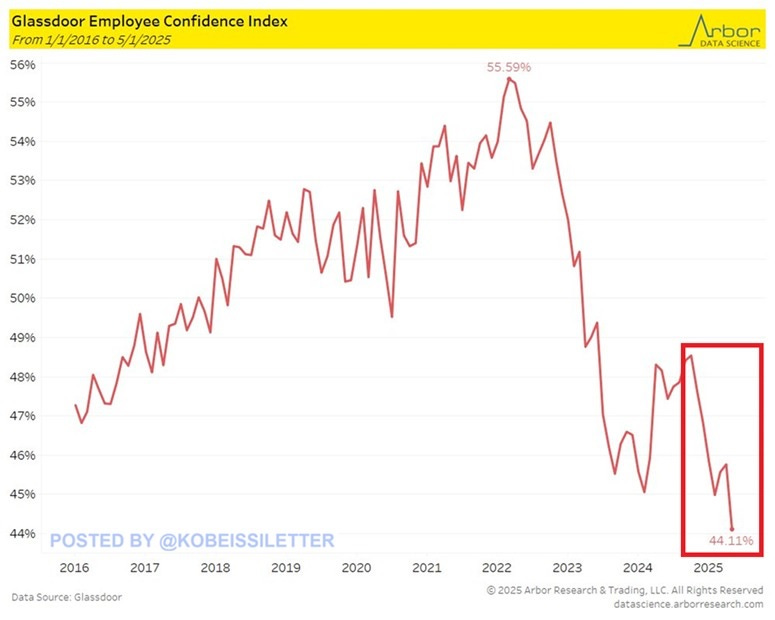

Main Street Losing Confidence

Not surprisingly, given the above, workers are getting worried. The share of American employees with a positive view of their employer’s business outlook over the next 6 months is now 44.1%, a record low.

Worried workers translate into concerned consumers, who now assess their current financial situation, when compared with 5 years ago, as the worst since the 1980s.

So Why Are We Piling Into Equities?

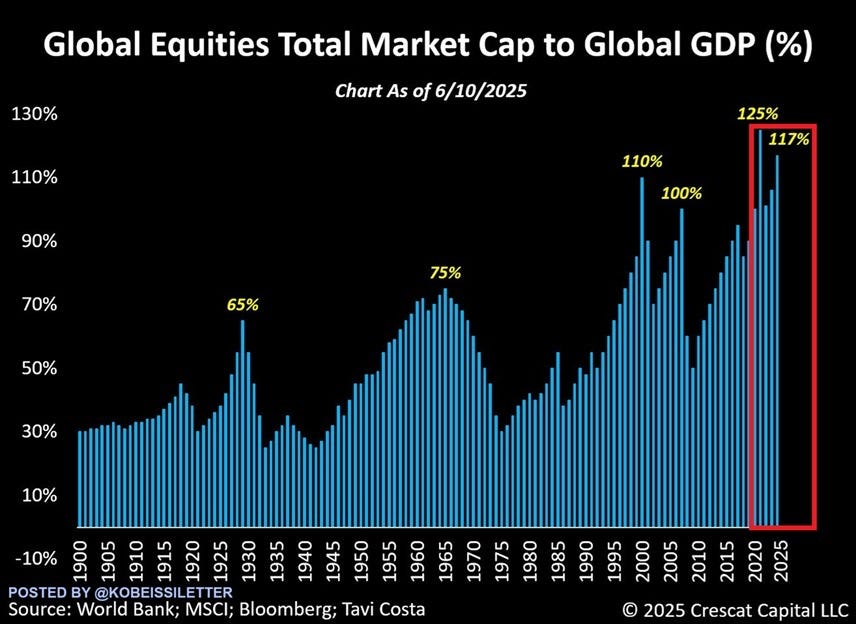

The global “Buffett Indicator” (equities market cap to GDP) is at imminent-crash highs, implying a wild level of investor overconfidence.

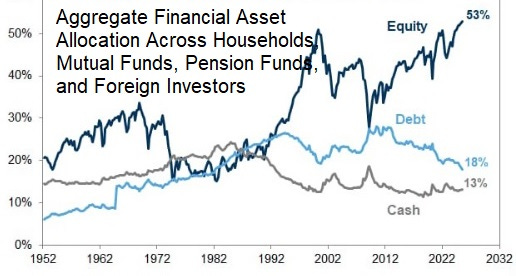

Looked at another way, the proportion of investible capital currently in equities — the riskiest major sector — now dwarfs what is in bonds and cash.

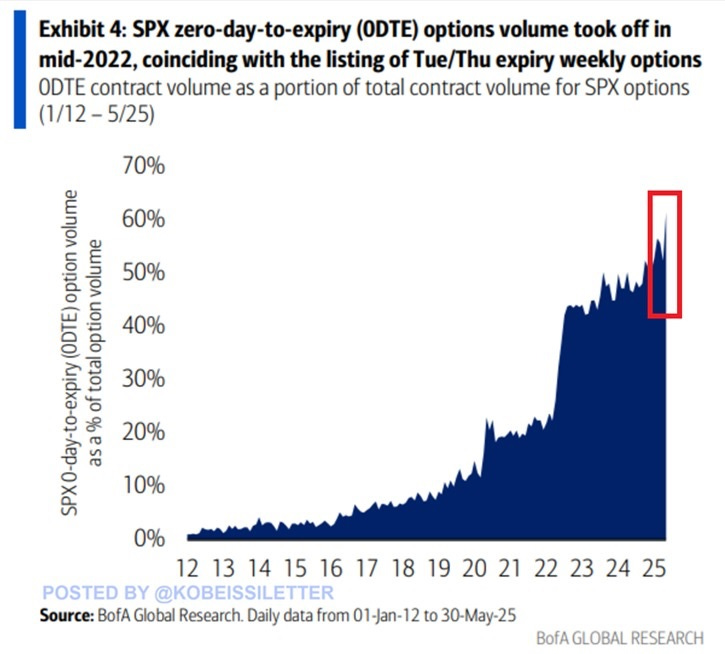

But for a growing number of “investors,” equities aren’t volatile enough. Option trading — especially 0-day contracts that expire by end-of-day — is soaring.

The Likely Resolution?

Faced with souring loans, banks will tighten their (already tight) lending standards. Borrowers stuck with unmanageable debts won’t be able to refinance and will have no choice but to default. Equities, wildly overvalued and over-owned, will do what they normally do in that situation: plunge by 40%.

In retrospect, it will all look so obvious…

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino June 18th, 2025

Posted In: John Rubino Substack