June 22, 2025 | It’s Official: We’re Back in the 1970s But with Even Bigger Risks and Opportunities

Okay, let’s see:

We now (as of yesterday) have a Middle East war that’s threatening to interrupt the supply of oil. And…

- Deteriorating government finances.

- Civil unrest and political chaos.

- A revolting bond market.

- Soaring gold and rising silver.

Yep, it’s official. We are back in the 1970s, which, for younger readers, was a decade of existential risks and commensurately huge opportunities.

What Happened Back Then?

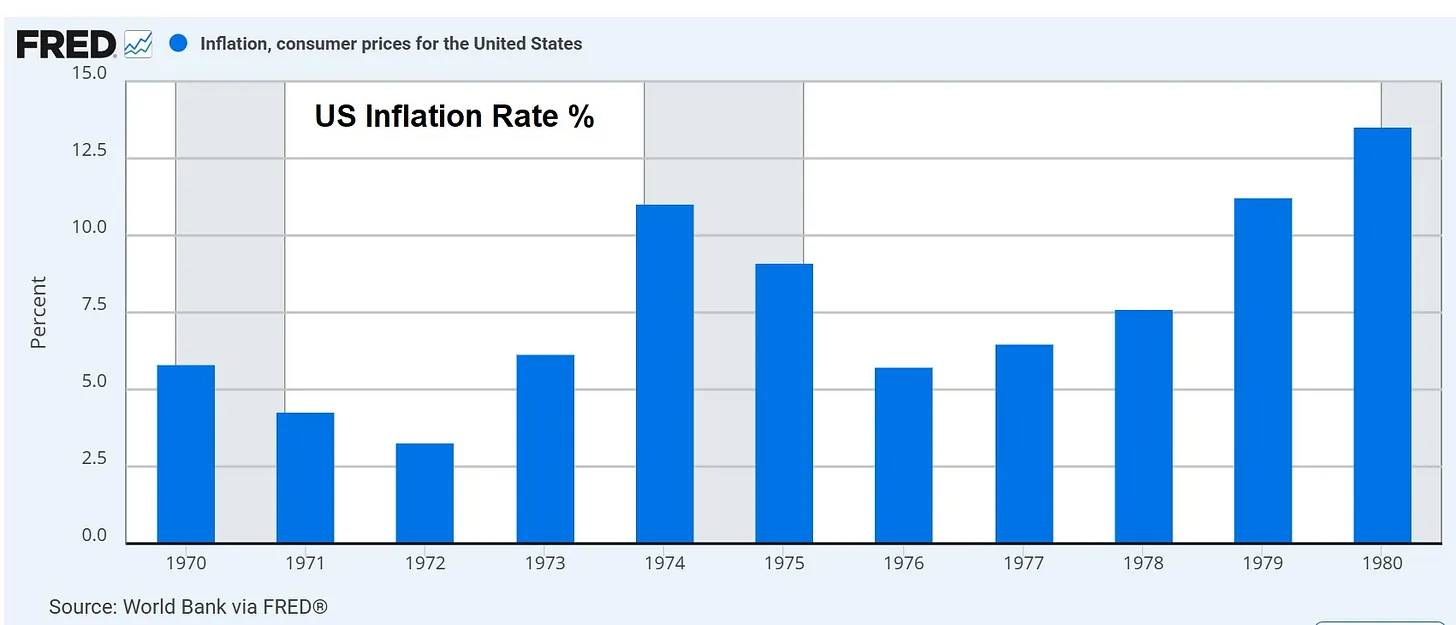

Inflation spiked:

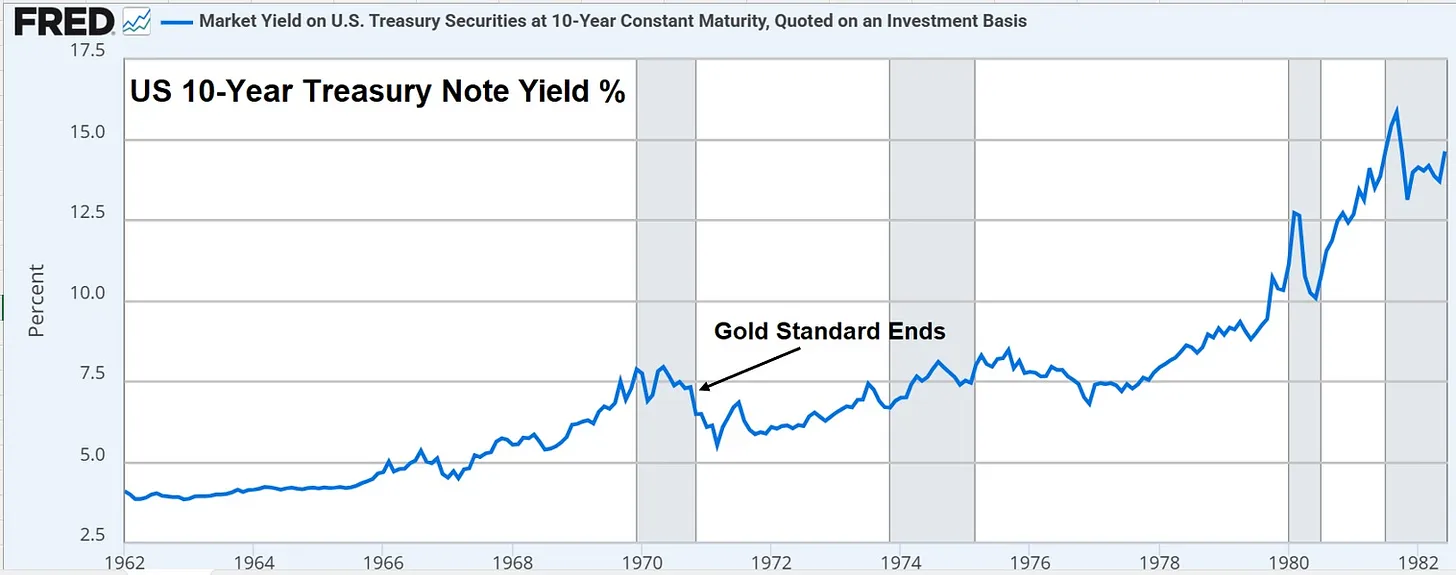

Interest rates rose even more:

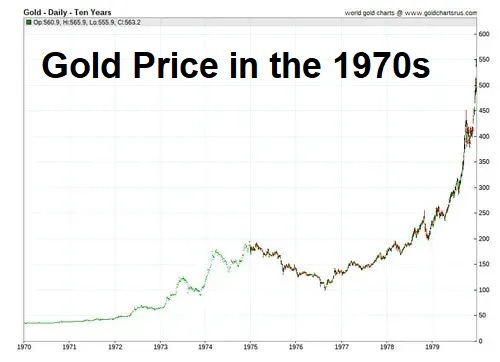

And everyone piled into precious metals, making life-changing money for a prescient few:

Where Are We Now?

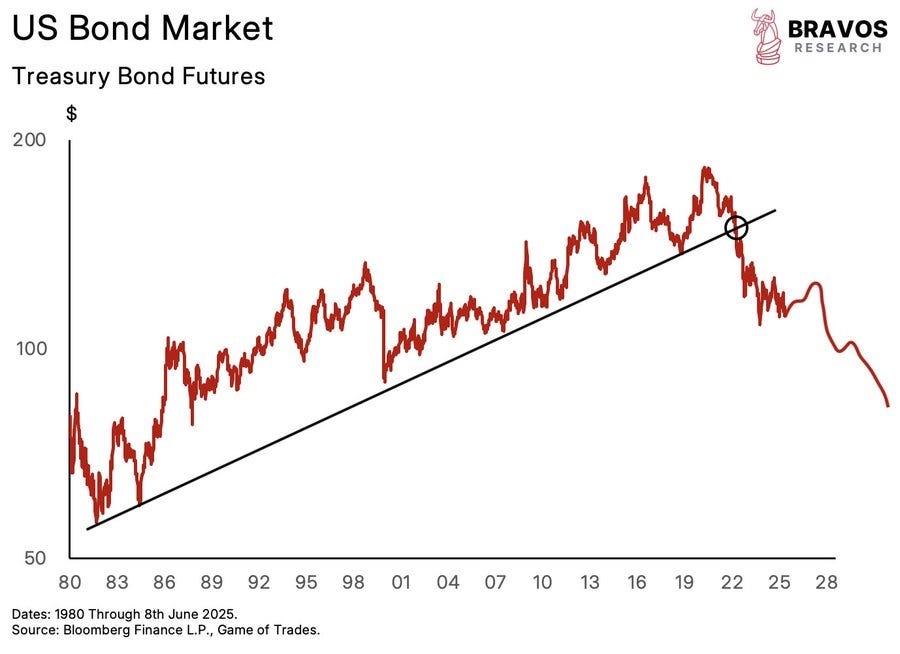

A multi-decade bond bubble (characterized by falling interest rates and rising bond prices) has burst. The past few years have been catastrophic for pension funds and retirees who bet big on Treasury bonds and similar things.

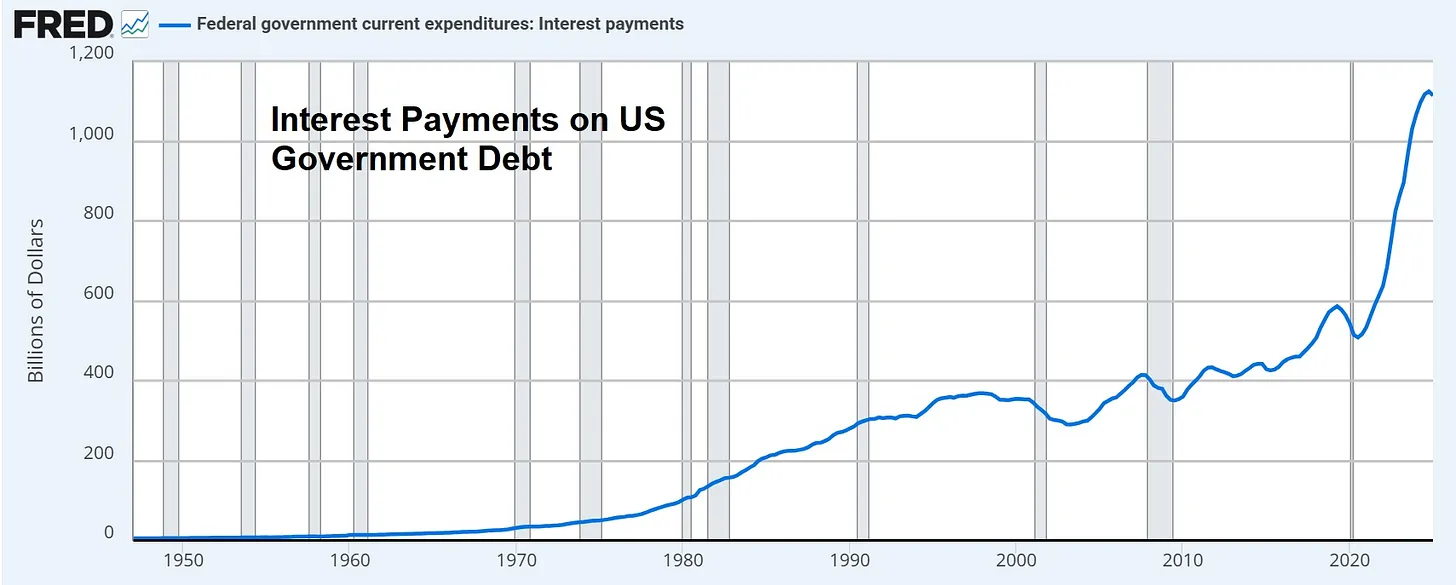

Falling bond prices mean higher bond yields, so as interest rates and government borrowing both rise, the cost of carrying US debt is spiking:

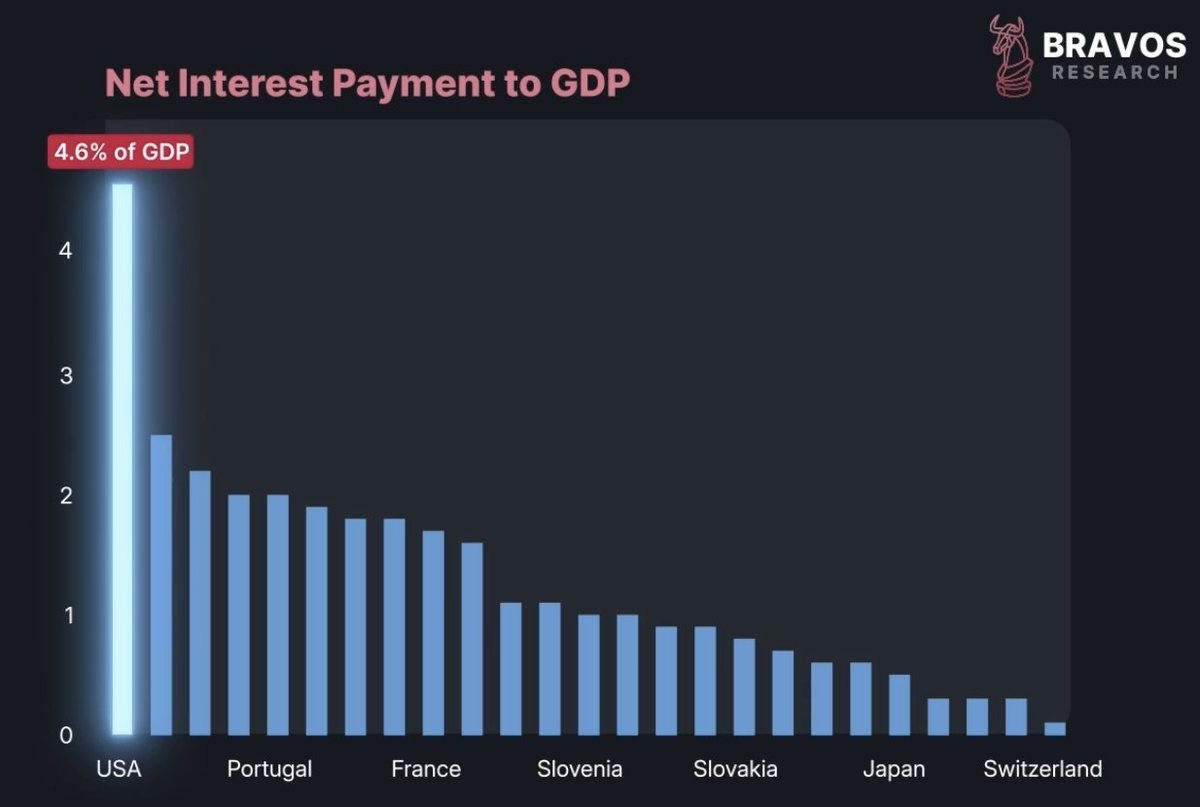

Here’s an even more ominous way of looking at this number, as a percentage of GDP compared to other countries:

Interest rates clearly need to fall to prevent government finances from spiraling out of control, and central banks around the world are moving in that direction, with the US Fed facing pressure to join the march to zero and beyond. Three related articles:

Europe’s central banks are all cutting rates, even as tariffs tie the Fed’s hands

(Politico) – Central banks in Switzerland, Sweden and — for the first time in five years — Norway have all cut their official interest rates this week, adding to similar moves last month from the European Central Bank and the Bank of England.

All five have cut their growth forecasts in recent weeks. The common theme has been that uncertainty over the trade outlook has undermined confidence and depressed activity since Trump’s “Liberation Day” tariff announcement on April 2.

Trump rips Powell, suggests appointing himself to Fed

(Hill) – President Trump ramped up his criticism of Federal Reserve Chair Jerome Powell and suggested appointing himself to the central bank.

“Maybe I should go to the Fed,” Trump mused at the White House on Wednesday, hours before the central bank was set to announce its latest interest rate move.

“Am I allowed to appoint myself at the Fed?” he continued. “I’d do a much better job than these people.”

Switzerland enters era of zero interest rates

(CNBC) – The Swiss National Bank on Thursday cut interest rates by a further 25 basis points to 0% — adding to concerns over a potential return to negative rates.

Adrian Prettejohn, Europe economist at Capital Economics, told CNBC ahead of Thursday’s interest rate decision that he expects rates to be cut to -0.25% this year, but noted that the SNB could go even lower.

“There are risks that the SNB will go further in the future if inflationary pressures don’t start to increase, and the lowest the policy rate could go is -0.75%, the rate it reached in the 2010s,” he told CNBC.

But Bond Traders Aren’t Listening

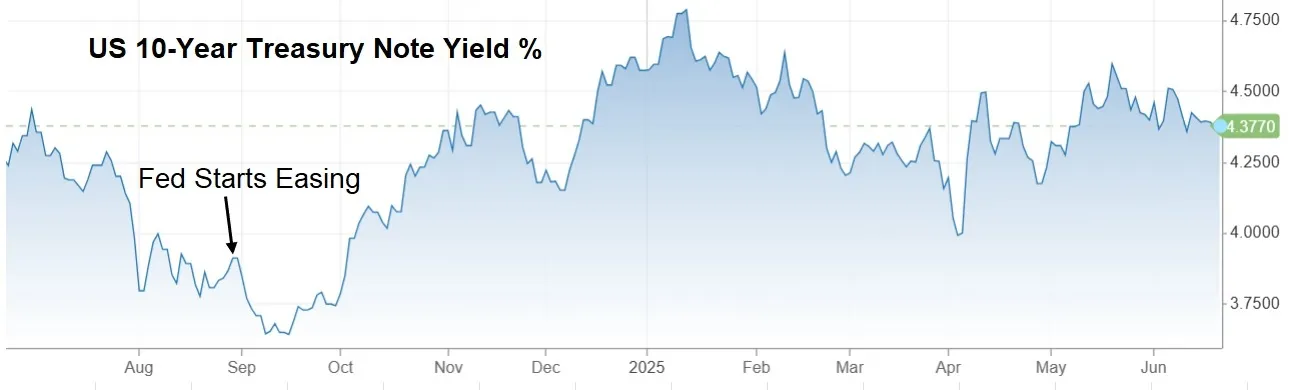

The Fed actually started easing in September of last year, but after an initial drop, US long-term interest rates rose and have stayed above 4% for most of the ensuing 10 months. No one seems to trust the Fed’s ability to control inflation.

This Time There’s No Fix

The world defeated the inflation of the 1970s with sharply positive real interest rates (that is, rates higher than inflation). They were able to do this because most major governments were in good financial shape with, by today’s standards, minimal debt and low deficits.

That’s not the case today. Double-digit interest rates would bankrupt a global constellation of debtors, bringing on another Great Depression. But aggressively cutting interest rates will spike inflation, causing currencies and related debt instruments to crash. Which leaves us with exactly zero tools capable of fixing the above problems. What’s coming, while similar in shape to the 1970s, will be vastly scarier.

So take that 1970s gold chart and add a couple of zeros. For stackers, the second half of this decade will be epic.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino June 22nd, 2025

Posted In: John Rubino Substack