June 20, 2025 | Israel and Iran are at War But Investors are Unfazed

The Middle East has entered yet another war, this time between Israel and Iran. The U.S. appears poised to get directly involved, on top of its already substantial role as Israel’s main backer.

So far, markets haven’t blinked. The S&P 500 is still trading within 2% of its all-time high, and oil is up only 5% since missiles started flying.

Are investors right to shrug this off?

Looking at past geopolitical shocks, the market’s reaction — or lack of one — isn’t that unusual. History shows that markets often absorb these kinds of events with surprisingly little disruption. In fact, the S&P is behaving much as expected since last Thursday’s Israeli strike on Iran.

Andrew Garthwaite, a top-ranked analyst at UBS, notes that markets usually overreact in the short term to geopolitical events. But this time, there’s hardly been any reaction at all.

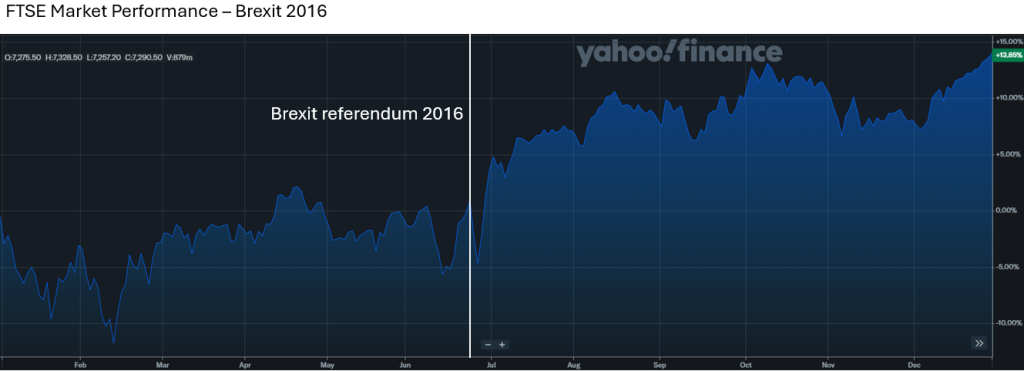

Consider other surprises in recent years: Brexit, Trump’s 2016 election win, this year’s tariff announcements — initial market jitters faded quickly. Even 9/11, which shut down U.S. markets for a week, didn’t have a long-lasting impact. That attack came during a bear market already in progress after the dot-com bubble burst in 2000. Stocks didn’t bottom until late 2002, but 9/11 didn’t drastically change the trend.

For example, here’s a chart of the UK stock market before, during and after the referendum vote on Brexit, which was a surprising result to many:

Source: Yahoo Finance, Bloomberg

Now, if we go further back, there have been geopolitical shocks that moved markets more dramatically. The 1990 invasion of Kuwait, which cut global oil supply by 3%, doubled oil prices. The 1974 OPEC embargo tripled oil prices and helped push the U.S. into a deep recession. But back then, oil made up a much larger share of global GDP, and price shocks had a much bigger impact — especially on inflation.

Today’s situation with Iran looks different. Iranian oil exports are relatively small — about 1.7 million barrels per day, mostly going to China due to U.S.-imposed sanctions on Iran. OPEC has around 6 million barrels per day of spare capacity. U.S. oil production is now above 13M b/day and the U.S. is now exporting some oil. Even if Iranian supply were entirely removed, the impact on global oil markets would likely be modest.

So, if the Israel-Iran war doesn’t move markets, what might?

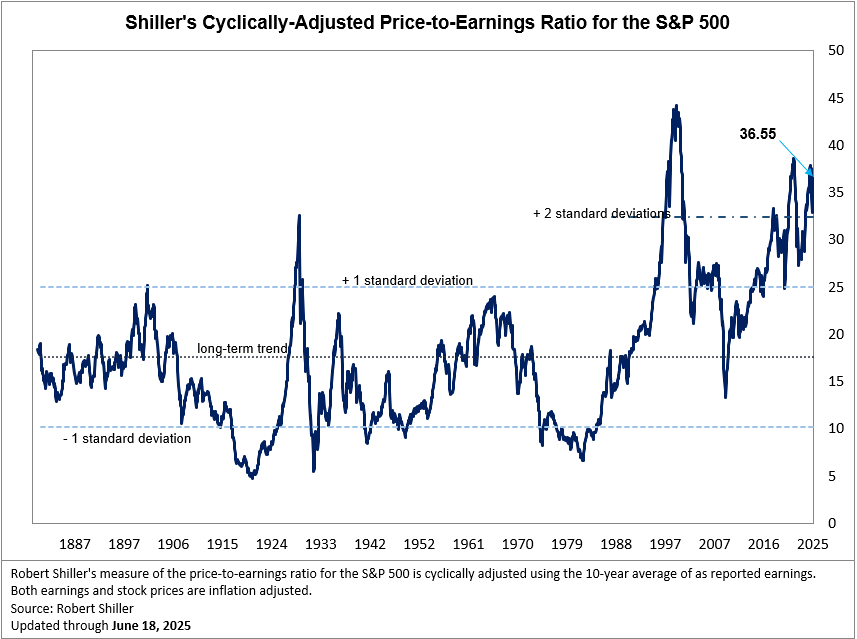

The real risks lie elsewhere. U.S. equity valuations are extremely stretched based on standard measures such as the Shiller P/E ratio (CAPE) and Warren Buffett’s favorite measure — stock market cap to GDP. There’s growing concern about a potential recession. Consumer spending is softening amid tariff uncertainty, and business investment is slowing as companies wait for clarity. On top of that, parts of the Biden-era Inflation Reduction Act — especially the generous tax credits — may be rolled back, reducing fiscal support.

Markets may continue to ignore the war for now. But they may not be able to ignore these other mounting pressures for much longer.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth June 20th, 2025

Posted In: Hilliard's Weekend Notebook