May 24, 2025 | Trading Desk Notes for May 24, 2025

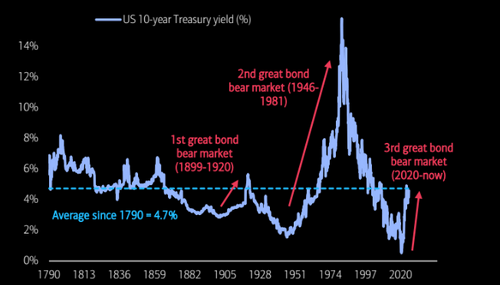

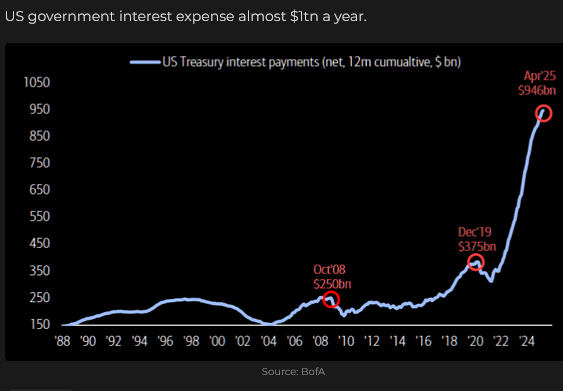

Are bond markets about to “seriously object” to soaring government deficits?

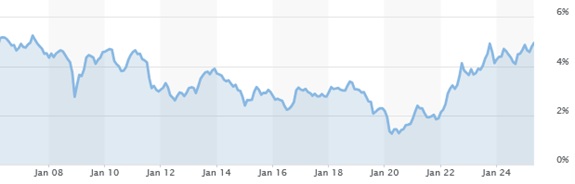

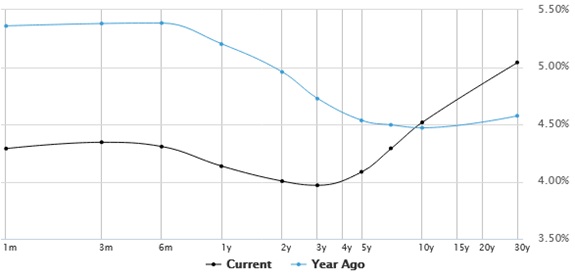

The 30-year US Treasury bond yield hit an 18-year high of 5.15% on Thursday.

Bond market stress increases as yields rise, especially if they rise quickly.

The US 10-year Treasury yield hit a historic high of ~15% in 1981, fell to a historic low of ~0.50% in August 2020, and is currently ~4.5%.

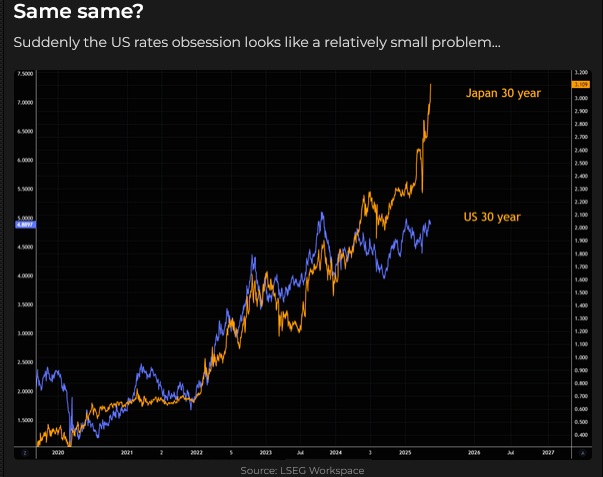

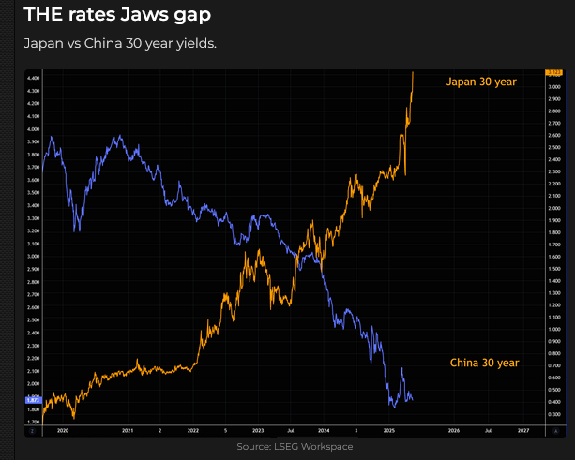

Last week, the Japanese 30-year yield hit an all-time high of 3.15%.

The BoJ kept bond yields low for years with yield curve control—it bought about half of all Japanese government bonds.

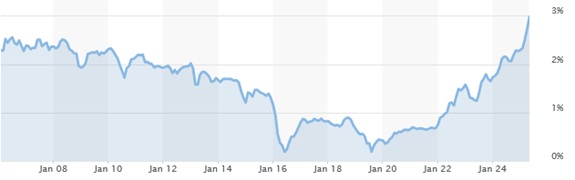

Chinese yields have tumbled to historic lows while US and Japanese yields have soared. (Five-year chart.)

In March, the German bond market had a hissy fit when the government voted to amend the constitution to allow deficits to fund spending on rearming and infrastructure projects.

The US Treasury curve has steepened sharply over the last year, as investors demand a higher yield for increasing duration risk.

The US Treasury’s “term premium” reflects rising fiscal risk as well as duration risk.

Since the “Liberation Day” debacle in early April, bond yields have risen, and the US Dollar has fallen. Does the “term premium” for foreign buyers of US Treasuries include “currency risk?”

For years, I have noted that capital came to America for safety and opportunity. This capital flow became a “virtuous circle” as the inflow caused American asset prices to rise, and rising asset prices attracted even more inflow. Foreign capital inflows (including recycled trade surpluses) contributed to “American exceptionalism,” enhancing the “exorbitant privilege” that came from the US dollar’s status as the world’s reserve currency.

In equity market terms, American exceptionalism peaked in January/February as leading foreign equity indices outperformed the leading American indices (after woefully underperforming the US indices for years).

The mercantilist Trump tariff policies that contributed to “volatility” in the American stock indices this spring likely also contributed to “capital repatriation” from the USA to foreign equity markets.

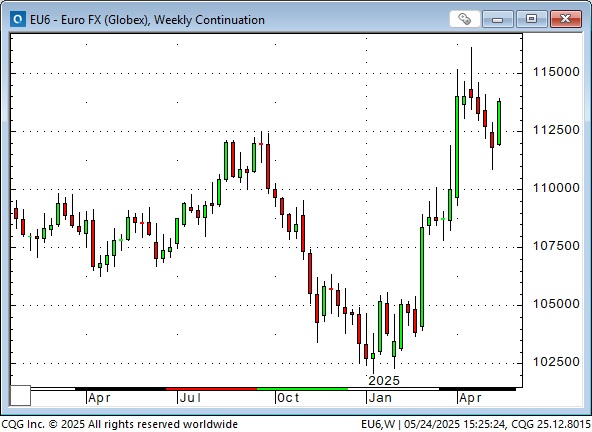

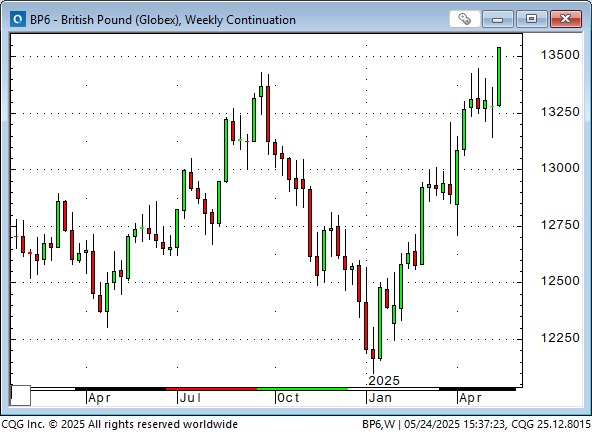

Currencies

The US Dollar Index reached a 23-year high in January (X a few weeks in late 2022), while the trade-weighted US Dollar index (with a greater weighting of Asian currencies) hit all-time highs. Since January, the USDX is down ~10% and closed this week at a 3-year low.

The pessimistic outlook on the USD may be somewhat influenced by the notion that the USA wants the Dollar lower to help “rebalance” trade. I recently saw this headline: “A 40% decline in the dollar’s value would eliminate the US trade deficit.”

The Euro has risen ~10% since January. (I call it the Anti-Dollar because it’s the most liquid alternative to the USD in the currency markets).

The Yen has risen ~10% against the USD since January. (The Yen hit all-time highs against the USD in 2012, then trended lower to July 2024, falling ~50% to 33-year lows.)

The British Pound has rallied ~12% against the USD since its January lows, closing at a 3-year high this week. It is up ~30% from its “Liz Truss moment” in September 2022 when the collapse of the Pound and the British bond market forced the resignation of the UK Prime Minister.

The Canadian Dollar tumbled to a 22-year low on February 3 when Trump announced 25% tariffs on Canada and Mexico. (It had its biggest 1-day rally in years later the same day when Trump paused the tariffs.) It has rallied ~5 cents (~8%) since then and closed at 8-month highs on Friday.

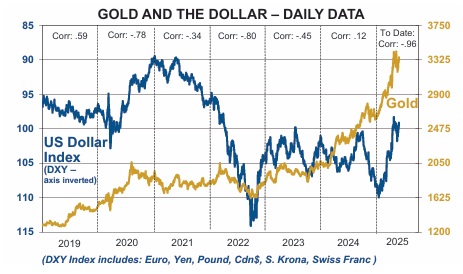

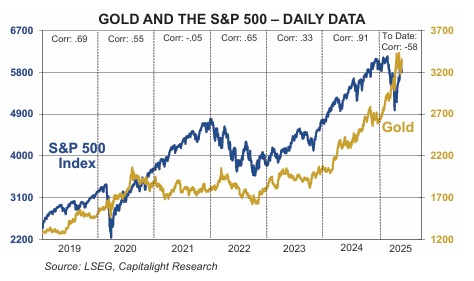

Gold

Front-month COMEX gold futures had their highest ever weekly close on Friday at ~$3,358.

According to the GOLD MONITOR, the YTD correlation between rising gold prices and a falling USD has been a near-perfect -96.

The GOLD MONITOR also notes that last year’s near-perfect correlation between rising gold prices and the rising S&P had “broken down” dramatically this year.

“Sell America?”

The “Sell America” macro idea is that “American exceptionalism” has buoyed US assets, including the Dollar, bonds, and equities, to extraordinary and unreasonable valuations relative to foreign assets (the US equity market in January was the most over-valued versus the rest of the world in 60 years), and US assets are therefore vulnerable to a correction if/when capital flows reverse. The reversal might be triggered by foreigners “losing faith” in America, or some kind of VAR (value at risk) event. Some analysts suggest that such a reversal would represent a turning point in American hegemony.

According to calculations by Apollo Global Management, foreigners own 30% of federal government treasuries, 30% of corporate debt, and 20% of the stock market.

I imagine American hedge funds would likely try to front-run any foreign repatriation, accelerating the reversal.

One argument against the “sell America” macro idea is that foreign markets couldn’t handle the “size” of massive capital outflows from American markets.

Another argument is that, despite American assets being “richly priced” compared to foreign assets, capital would rush back to America in times of “crisis,” and the current geopolitical environment provides plenty of opportunities for a crisis to develop.

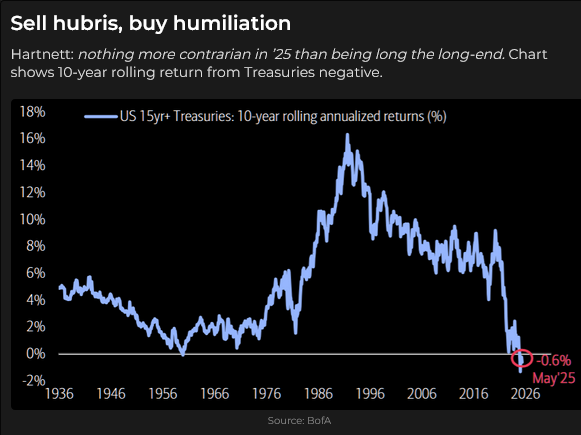

Yet another argument against the macro idea that bonds and the USD are about to suffer a precipitous fall is that it is the current consensus view; a contrarian would be buying bonds (and the USD) here!

My short-term trading

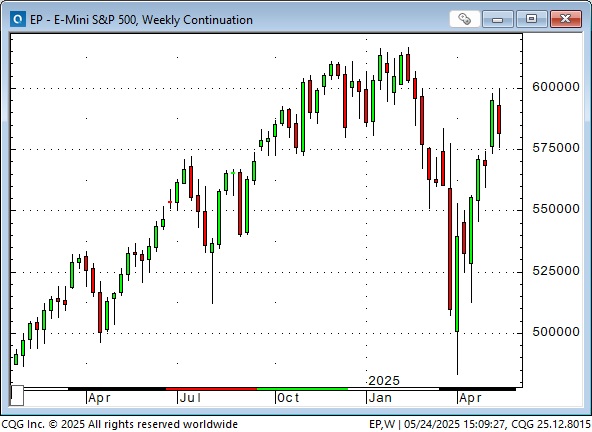

I started this week flat and shorted the S&P on Sunday night (after patiently waiting all last week for signs that the rally had gone too far). I covered for a slight loss on Monday when retail came storming in (buy the dip) and rallied the market to its highest close since February.

I re-shorted the S&P on Tuesday and covered on Thursday for a gain of ~100 points. I bought it late Thursday, looking for a bounce, but was stopped for a slight loss. I was flat overnight Thursday and missed the 100-point break following Trump’s announcement of a 25% tariff on AAPL and a 50% tariff on imports from the EU.

My P&L had a modest gain on the week, and I was flat going into the Memorial Day long weekend.

The Barney report

My wife rescued a small bird that flew into one of our patio windows, and Barney was fascinated by the tiny creature!

Listen to Mike Campbell and me discuss the recent drama in the bond market

On the Moneytalks show this morning, Mike and I discussed why traders were intensely focused on the bond market this week. You can listen to the entire show here. My spot with Mike starts around the 44-minute mark.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair May 24th, 2025

Posted In: Victor Adair Blog