May 26, 2025 | A Firehose of Supply

Happy Monday Morning!

Last week we learned Canada’s new housing minister didn’t feel it was appropriate for home prices to fall. Instead, suggesting “We’ve got to create some incentives and opportunities for people to get into the market, we got to make sure that peoples assets are obviously protected, and that’s the market housing. But a big focus now on affordable housing.”

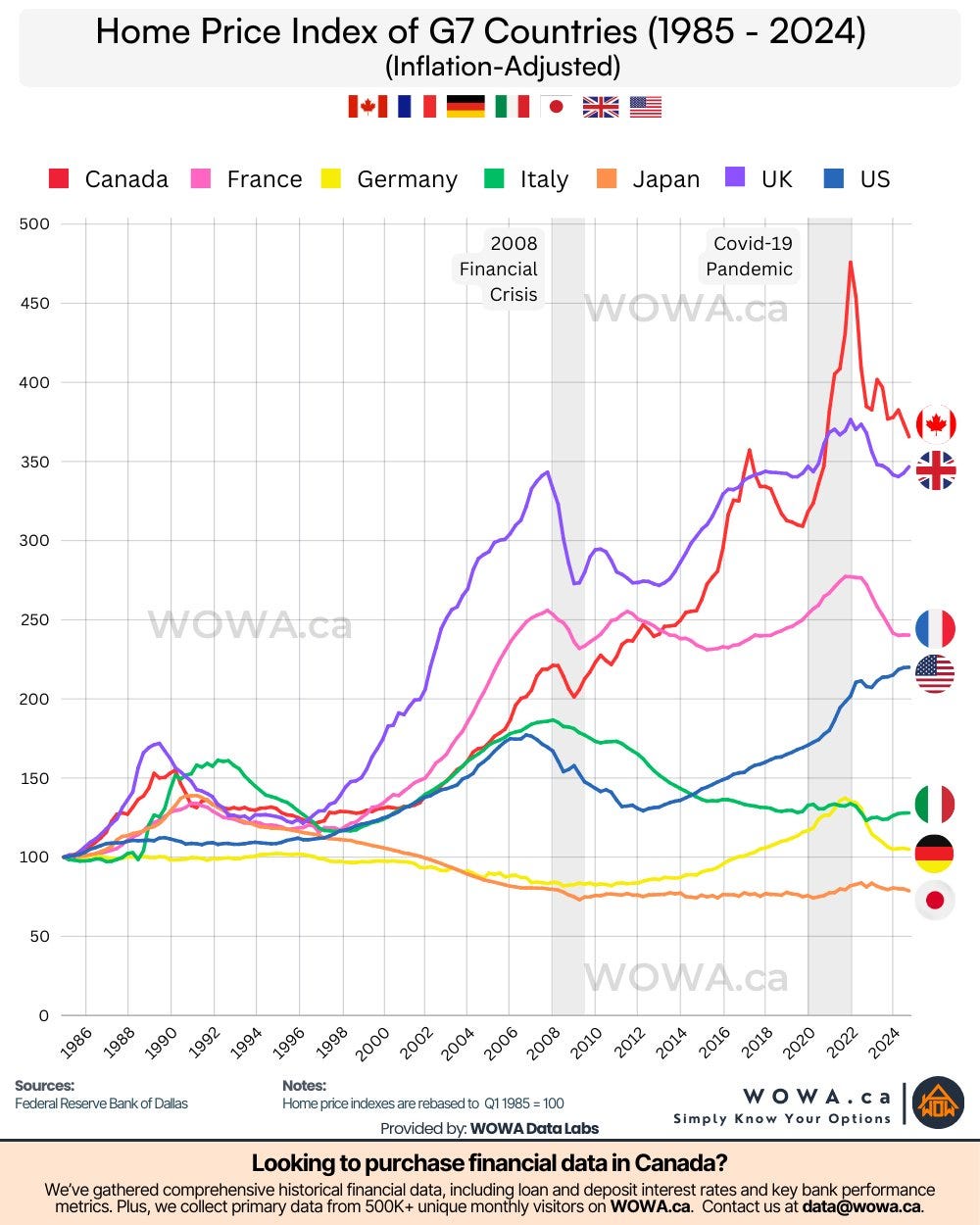

The notion that house prices should be allowed to fall borders on treason in a country that has made itself reach by selling each other houses at ever higher prices. Using borrowed money, I should add.

Yet, falling prices is the unfortunate remedy if one was actually seeking housing affordability.

Friend of the newsletter, professor and policy advisor Mike Moffatt, has crunched the numbers on how long it would take for housing to return to 2005 levels of affordability if the average home price held steady while wages increased at a nominal pace of three per cent annually.

Across Canada, it would take 18 years to return to more affordable home price-to-income ratios — while in Ontario and British Columbia it would take roughly 25 years.

So home prices must fall, and they are. They’ve already declined 18% since peaking in early 2022, and are now down 29% adjusted for inflation.

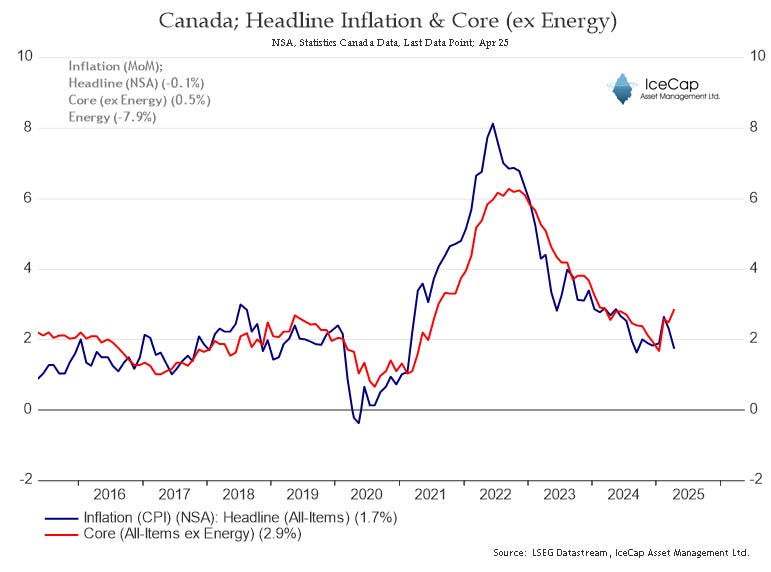

Speaking of inflation, core inflation came in hotter than expected in April. CPI excluding energy rose 2.9% in April, up from 2.5% in March. The Bank of Canada’s preferred inflation measures—CPI trim and CPI median—also ticked up, reaching 3.1% and 3.2%, respectively.

This has pushed bond yields higher. The Canada 5 year bond yield is now hovering near 3%, levels we last saw in January. In other words, fixed mortgage rates are moving higher, despite the narrative that falling rates would save the housing market this year. A trap most homeowners fell for at the beginning of the year.

So what have we seen?

A plethora of homeowners desperately optimistic that rate cuts from the Bank of Canada would save the housing market this year. And while, variable rate mortgages have dropped, fixed rates have been mostly rangebound, trapped between sticky inflation and a firehose of debt issuance overwhelming the bond market.

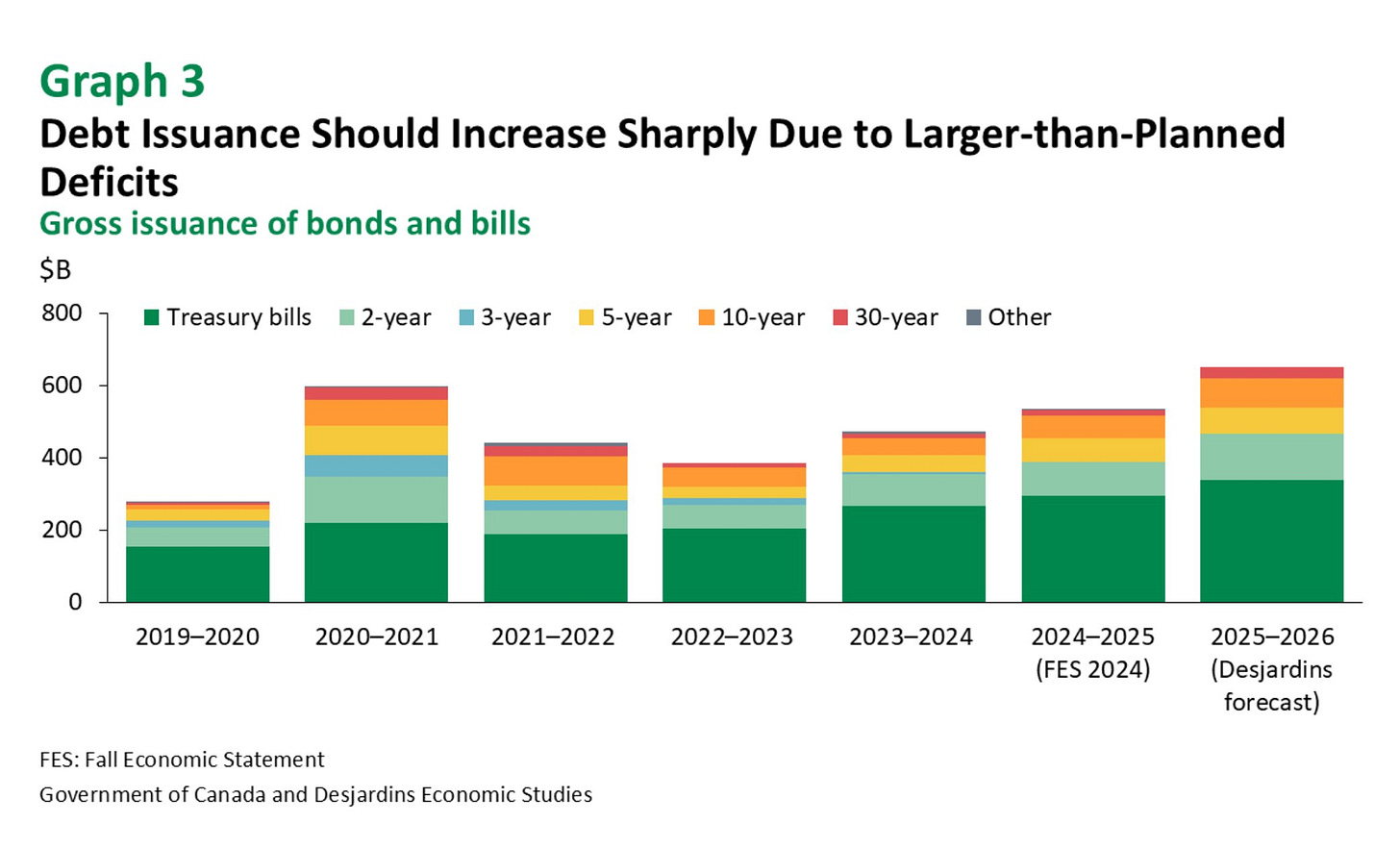

According to Desjardins forecast, Canada will issue more debt in 2025-2026 than they did during the pandemic.

There’s a whopping $600B of debt issuance coming, which could put further pressure on bond yields moving forward. The implications are significant for the near 60% of mortgages renewing over the next 24 months.

Again, remember the bull thesis for housing this year was falling rates. Sellers have been reluctant to cut prices because rates were supposed to come down and house prices were supposed to go up.

Instead, mortgage rates only fell modestly, and demand has languished. And so here we are, left with bloated inventory levels we haven’t seen in decades. There’s so much standing inventory for sale we’re running out of signposts.

Sellers are learning a hard lesson, there’s been no quick rebound this time, we’re now in year three of the housing bear market. This is looking a lot more like the 1990’s lost decade than the short corrections experienced in the 2000’s.

The only way inventory starts to clear is if sellers adjust their prices. You’ve been warned.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky May 26th, 2025

Posted In: Steve Saretsky Blog