January 31, 2026 | Trading Desk Notes for January 31, 2026

Margin Call

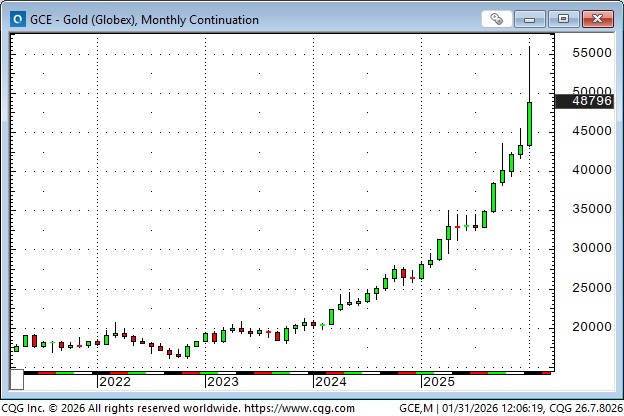

Comex April gold futures reached a record high of ~$5,627 during the overnight session on Wednesday (January 28). Then they began a dramatic 40-hour sell-off that reached a low of ~$4,700 during the Friday day session. Top to bottom, the sell-off was ~$927, or ~16.5%.

Despite the swift decline, Comex gold posted a record-high monthly close in January, ~$550 above December’s close.

Comex March silver futures reached a record high of ~$122 on the opening of the Thursday (January 29) day session, and then began a dramatic 34-hour sell-off that reached a low of ~$74 during the Friday day session. Top to bottom, the sell-off was nearly $48, or ~39%.

Despite the swift decline, Comex silver posted a record-high monthly close in January, ~$14 above December’s close.

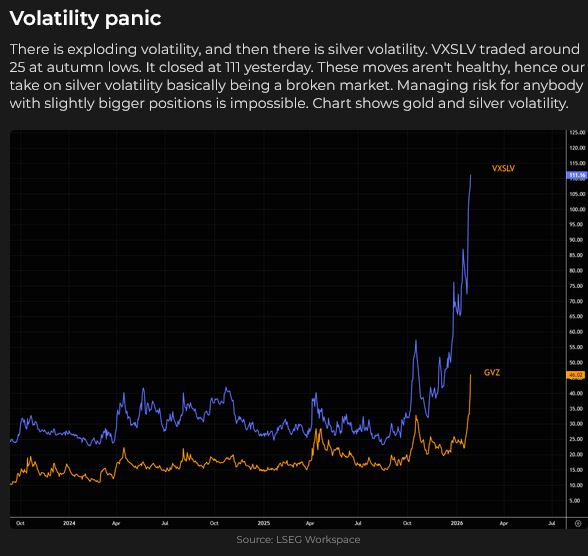

Option VOL for Comex metals soared.

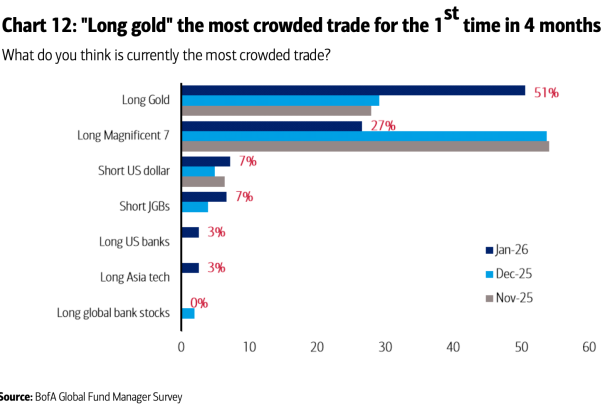

In last week’s TD Notes, I wrote that I didn’t know why gold and silver had “gone vertical” lately, but it reminded me of commodity spikes, like WTI crude oil, which tripled from January 2007 to July 2008.

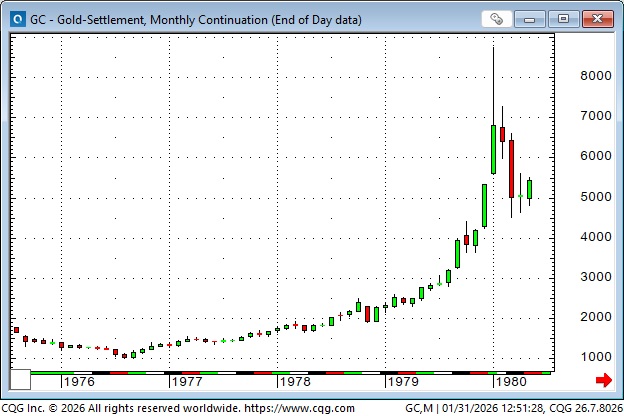

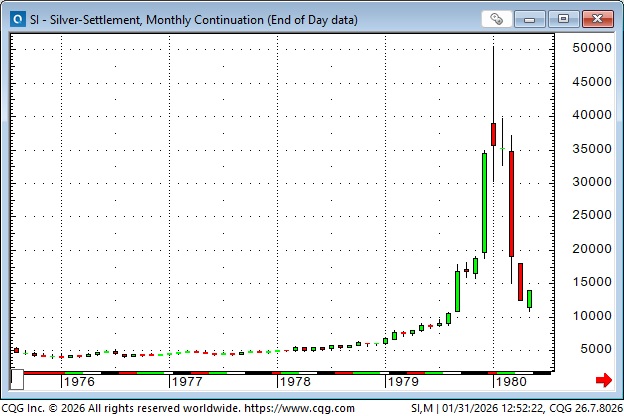

The recent price action in gold and silver also reminds me of the price action in 1979 to early 1980.

The high for Comex gold in January 1980 was ~$850. It did not trade above that level until January 2008, 28 years later. The high for Comex silver in January 1980 was ~$50. It did not trade above that level until October 2025, 45 years later.

Like the 1979 – 1980 period, retail traders have been buying metals aggressively. I think “Margin Calls” accelerated the sell-off on Thursday/Friday.

The gold miners ETF more than tripled from January 2025 to this week’s record highs. The sharp sell-off from Thursday’s highs to Friday’s lows saw the market drop ~18%. Like the metals, GDX also registered a record-high monthly close despite the sharp sell-off, closing January ~9.5% above December’s close.

Uranium is not a “precious metal” (maybe it should be), but my barometer for the uranium market is the Cameco share price, which has risen nearly 4X from the April 2025 lows. It dropped ~10% from Thursday’s record highs to Friday’s lows, but still posted a record monthly high, up ~35% from December’s close.

Comex March copper futures reached a record high of ~$6.58 on the opening of the Thursday (January 29) day session, and then began a dramatic 34-hour sell-off that reached a low of ~$5.76 during the Friday day session. Top to bottom, the sell-off was nearly $0.82 or 12.5%.

Despite the swift decline, Comex copper posted a record-high monthly close in January, ~$0.28 above December’s close. Trading volumes across Comex metals were heavy this week.

The Bloomberg Commodity Index has been buoyed by rising metal prices, reaching a 4-year high this month.

The TSX Composite Index has also been buoyed by rising metal prices, reaching an all-time high on Thursday, up ~50% from the April 2025 lows. The Index dropped ~5% from Thursday’s highs to Friday’s lows, but, like the metals, it managed to record a new monthly high, albeit by only a whisker.

Stocks

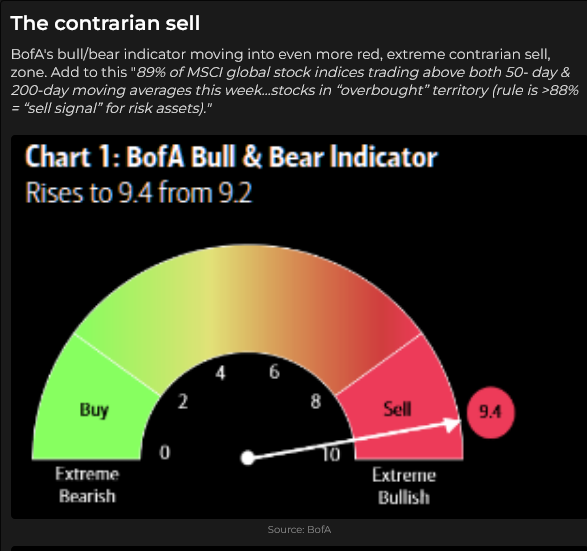

S&P futures hit a record high at 7,043 on Wednesday, but dropped ~140 points to Thursday’s low as cross-asset investor sentiment was becoming a little sketchy. Quarterly corporate reports were not driving the market to new highs. (In last week’s Notes, I suggested that if the broad market did not rally on strong corporate reports, that could be viewed as a “news failure,” and might lead to a sell-off, given very bullish investor positioning).

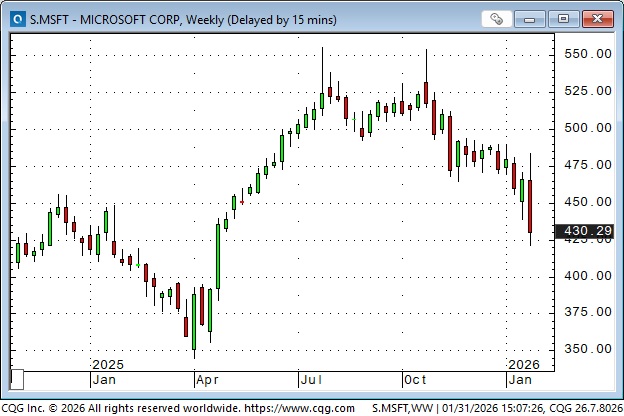

MSFT had a bad week.

Currencies

The DXY US Dollar Index fell ~4% from last week’s highs to this week’s 4-year lows, before bouncing back Wednesday through Friday. (Tuesday’s low came just minutes after a reporter asked Trump if he was worried about the falling USD, and Trump said he thought the dollar looked fine).

With the USD weak, the Euro and the British Pound reached 5-year highs on Tuesday, but sharply reversed on Wednesday to Friday. The Swiss Franc hit record highs, outside of a very brief spike in 2011.

Given the disastrous energy policies in the Eurozone and the UK, people must REALLY not like the USD to bid the EUR and the GBP to 5-year highs! There has been a lot of “chatter” about foreigners repatriating money from the USA because of “Trump.” So far, US stock indices don’t look like a wave of selling is hitting them, but perhaps, instead of selling US equities, foreigners are increasing their FX hedges, which is weakening the USD while stocks stay near their highs.

The Yen rallied on Friday of last week on reports of Japanese and American authorities “rate checking” with FX dealers, and sustained those gains early this week, especially after Trump said the Chinese and Japanese currencies were “way too weak” and should be much higher. (There is a “school of thought” that Trump thinks foreigners, and especially Asians, have kept their currencies too low to facilitate exports to the USA, costing US jobs, and this has to change). The Yen fell back later in the week, but traders may be cautious about pushing it lower due to the risk of intervention. Takaichi appears set to win a majority in the Federal election on February 8.

The Canadian Dollar rallied over 2 cents from last week’s lows to this week’s 15-month highs, as the USD fell against virtually all currencies and commodity markets rallied, especially crude oil, amid concerns about US-Iran tensions. The CAD reversed sharply on Friday as metals broke hard.

The Australian Dollar soared 4 cents from last week’s lows to this week’s highs.

Energies

Nymex WTI futures touched a 4-year low at $55 in December but have since rallied to $66, with US-Iran tensions helping push prices higher.

The wicked volatility in natural gas since early December has continued with a brutal winter storm in the USA boosting demand.

Cuba

Market drama, Iran and Ukraine have overshadowed Cuba, but Cuba could become big news as the Trump oil embargo cripples domestic power generation. Trump appears to be pushing for “regime change” in Cuba in line with the “Donroe Doctrine,” but foreigners could see this as another “land grab” along with Greenland and Venezuela. Russia and China may use Trump’s behaviour to justify “land grabs” in their own areas of influence.

A new Fed Chair

Trump has nominated Kevin Warsh to become the Fed’s Chairman once Powell’s term ends in May. In recent years, the Fed’s monetary policy seemed to be “the most important thing” to the markets. These days, fiscal policy appears to be more important than monetary policy, and perhaps Warsh will take the Fed further in that direction.

My short-term trading

I started this week with a bullish option call spread on the Yen and a short S&P position.

I stayed with the Yen trade; it has been working fine, but I will take it off this week, or let it expire on Friday.

I covered the short S&P Sunday afternoon for a modest gain when the market gapped lower, but then started to rally.

I shorted the CAD a couple of times mid-week, and took small losses (the CAD continued to rally even as the European currencies and the Yen weakened). I shorted it again early on Friday as the metals were falling, and held the trade into the weekend as it fell sharply later in the day.

I shorted the S&P on Thursday and kept that into the weekend.

The Barney report

I try to let Barney go off-leash as much as possible when we’re out walking. He likes that, and I do too, because he’s happy and he’s not constantly tugging at his leash! He loves chewing on sticks! The only thing he likes more is proudly running with a stick – the bigger the better!

There will be no Trading Desk Notes next week – I will be in Vancouver to participate in the World Outlook Financial Conference at the Bayshore Hotel. I’d love to meet and chat with any readers who are also at the conference.

The annual World Outlook Financial Conference will be at the Bayshore Hotel on February 6 & 7, 2026. I will be the lead-off speaker on Friday afternoon. You can view the agenda, see the list of speakers, and purchase a ticket here.

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the wild action in the metals markets and its impact on the Toronto stock market. We also discussed equities, currencies and Cuba. You can listen to the entire show here. My spot with Mike starts around the 43-minute mark.

Listen to Jim Goddard and me discuss markets

I recorded my monthly 30-minute interview with Jim on the This Week In Money show yesterday. We talked about gold and silver, the TSE, currencies, stocks and crude oil. We also discussed my upcoming speech at the Outlook Conference, where I plan to focus on why risk management is more critical than ever amid market volatility. You can listen here.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair January 31st, 2026

Posted In: Victor Adair Blog

Next: Zelensky the War Criminal »