January 16, 2026 | A Fight The Fed has Never Seen Before

Sunday night delivered an extraordinary development: the U.S. Federal Reserve was served grand jury subpoenas suggesting potential criminal charges against Chair Jerome Powell. The allegation is that Powell misled Congress last year regarding the refurbishment of Federal Reserve buildings. The reaction across the policy and financial community was swift. Former Fed governors, central bank leaders globally, and U.S. senators from both parties publicly defended Powell, underscoring how unprecedented this situation is.

Shortly after the subpoenas became public, Powell released a video statement directly addressing the issue. He argued that the investigation has little to do with construction projects and everything to do with the Federal Reserve’s refusal to lower interest rates at the request of President Trump. Powell stated plainly that the refurbishment concerns are “pretexts,” adding that the threat of criminal charges stems from the Fed setting policy “based on evidence and economic conditions” rather than political preference.

Tension between presidents and the Federal Reserve is not new. Ronald Reagan clashed with Paul Volcker, and George H. W. Bush was openly frustrated with Alan Greenspan. Presidents generally prefer lower interest rates because they support short‑term economic momentum. In this case, the pressure is heightened by the political calendar, with 2026 being a midterm election year. What is new, however, is the use of legal threats, valid or not, against a sitting Fed chair. Such actions risk undermining confidence in the U.S. dollar and the broader monetary system.

Central bank independence is one of the defining features separating developed markets from developing ones. Investors rely on the idea that monetary policy will be guided by inflation, employment, and economic data not political influence. When that independence appears threatened, markets react quickly.

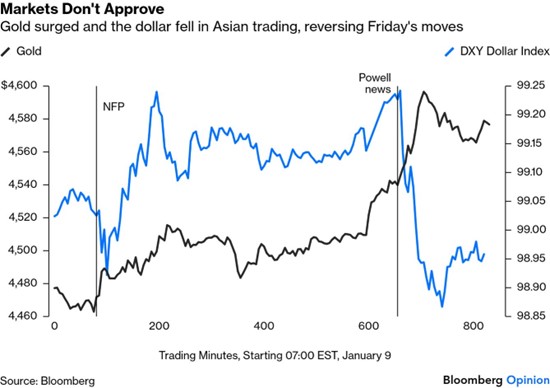

That is exactly what happened. Gold, a traditional safe haven, rose sharply, while the U.S. dollar weakened as investors reassessed the stability of U.S. institutions. The concern was not about construction budgets; it was about whether the world’s most influential central bank could continue operating without political interference.

Powell’s long public‑service career adds another layer to the story. He began working in government in 1990 at the U.S. Treasury under President George H. W. Bush and was appointed Fed Chair in 2017 during President Trump’s first term. Tensions between the two emerged almost immediately, as Powell declined to adjust interest rates to suit political preferences. His tenure has not been without missteps—keeping rates at zero throughout 2021 as inflation accelerated will remain a lasting critique—but the Fed’s job is inherently imperfect. Its tools are blunt, its mandate narrow, and its influence broad. Historically, Fed actions have sometimes contributed to recessions or, in the post‑financial‑crisis era, to surges in risk assets.

Powell is unlikely to face jail time. The larger question is how much institutional damage this episode may cause. Already, the subpoenas have pushed borrowing costs higher globally, including in Canada. Until markets regain confidence that the Federal Reserve remains truly independent, investors should expect continued volatility.

Fraser Betkowski

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Richardson Wealth Limited is a subsidiary of iA Financial Corporation Inc. and is not affiliated with James Richardson & Sons, Limited. Richardson Wealth is a trade-mark of James Richardson & Sons, Limited and Richardson Wealth Limited is a licensed user of the mark. Richardson Wealth Limited, Member Canadian Investor Protection Fund.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth January 16th, 2026

Posted In: Hilliard's Weekend Notebook