December 1, 2025 | Under the Hood

Happy Monday Morning!

The Canadian economy showed surprising resilience in the third quarter, with GDP expanding 2.6% on an annualized basis, well above expectations from both the Bank of Canada and a poll of economists which had pegged growth at just 0.5%.

However, under the hood, there was cause for concern.

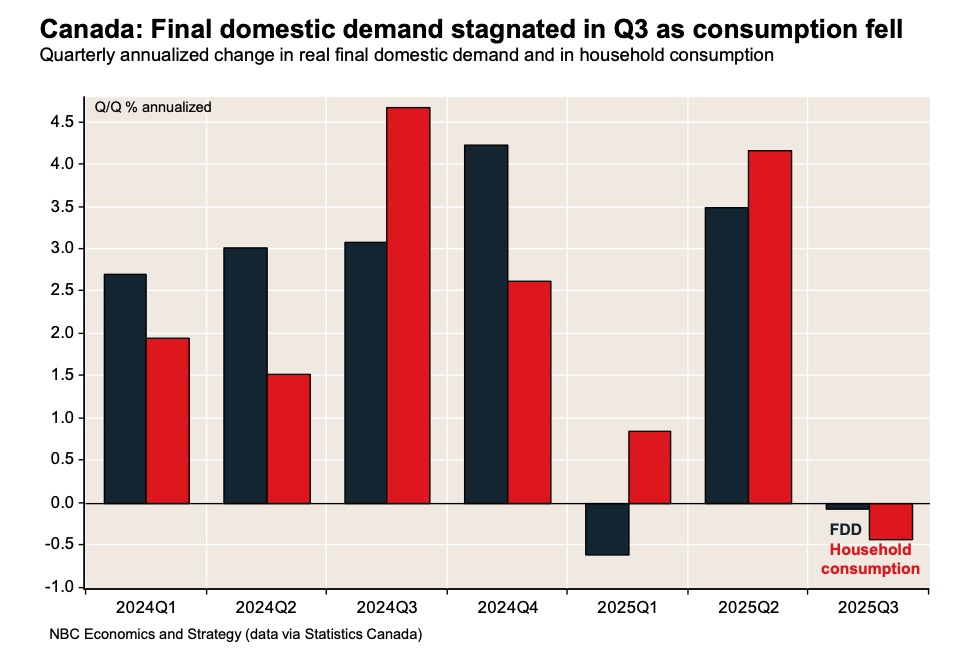

The surge in growth was almost entirely due to a decline in global imports. Per National Bank,

“The sharp drop in imports alone accounts for all of the growth in the quarter, while exports essentially stagnated after last quarter’s strong decline. We note that Statistics Canada pointed out that, given the U.S. government shutdown that took place in October, it did not receive data on Canadian exports to the U.S. for the final month of the quarter and thus resorted to special estimates.”

Meanwhile, household consumption plunged 0.4%, its worst quarterly performance since the pandemic, suggesting households are tightening their belts.

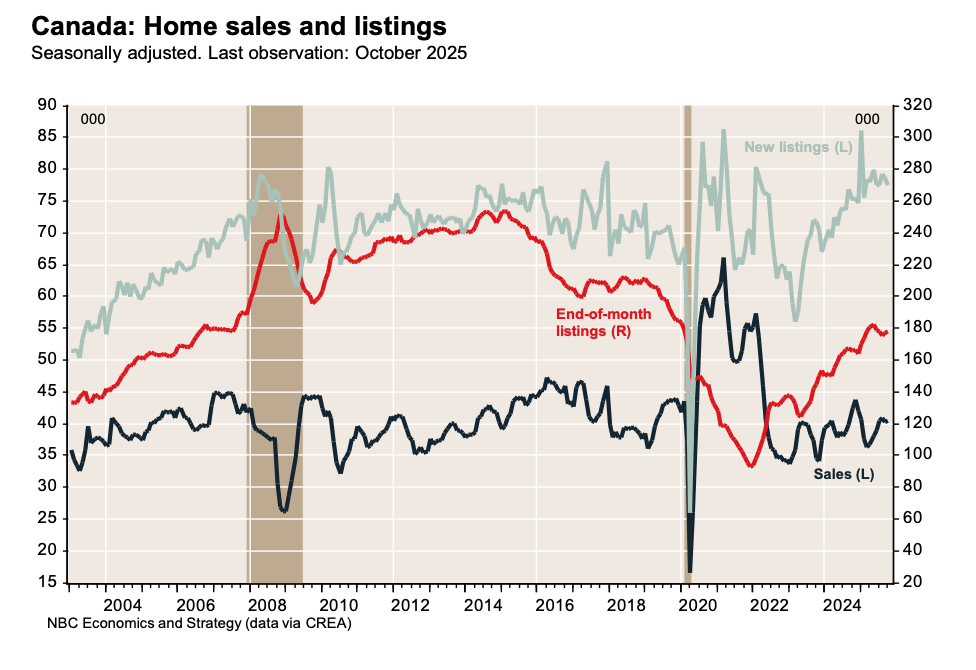

On a more positive note, it was discovered that investment in residential structures surged, rising at a 6.7% annualized pace, led by housing resales. Is the Bear market over?

It’s encouraging to see that home sales have climbed in six of the past seven months, however they remain stubbornly below long term averages, and 7.5% below their most recent peak in November 2024. New listings continue to outpace sales.

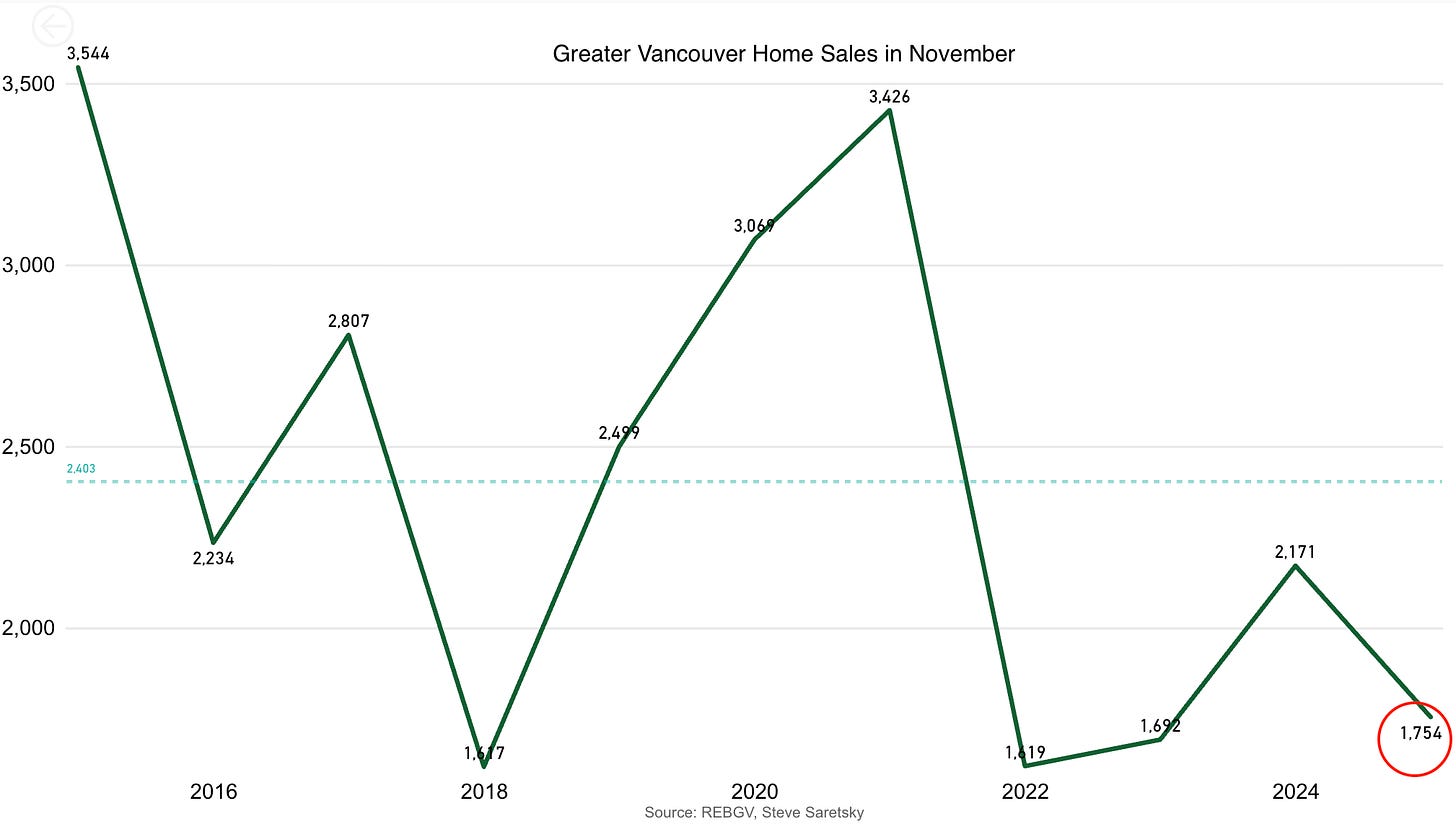

Here in Vancouver, we have home sales tracking around 1800 for the month of November. We should finish the month with home sales about 25% lower than their 10 year average. Not great.

This doesn’t include new home sales which, as we highlighted last week, should finish the year down about 60% from 2024, and nearly 85% below levels seen at the height of the bull market.

Over in the GTA we got more bad news this past week. New home sales hit historic lows for the thirteenth straight month, falling even further below last year’s record-setting low for October, per the Building Industry and Land Development Association.

There were 570 new home sales in the Greater Toronto area in October, which was down 29% from October 2024 and 81% below the 10-year average. Ouch.

Even more concerning was the non-existent activity in the city of Toronto’s condo market. There were just 25 new condo sales in the city of Toronto last month. A population of more than 3 million!

We continue to believe new housing starts will fall at an alarming rate in the year ahead once the lagging data rolls over and rental construction slows alongside the pre-sale market.

Stats Canada does their best, but sometimes we are left scratching our heads.

Housing demand and investment remains muted.

It’s worth noting that despite the positive GDP headline, markets chose to fade the noise. Interest rate expectations were virtually unchanged this past week. Hard to argue that.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky December 1st, 2025

Posted In: Steve Saretsky Blog