December 6, 2025 | Trading Desk Notes for December 6, 2025

Run it hot

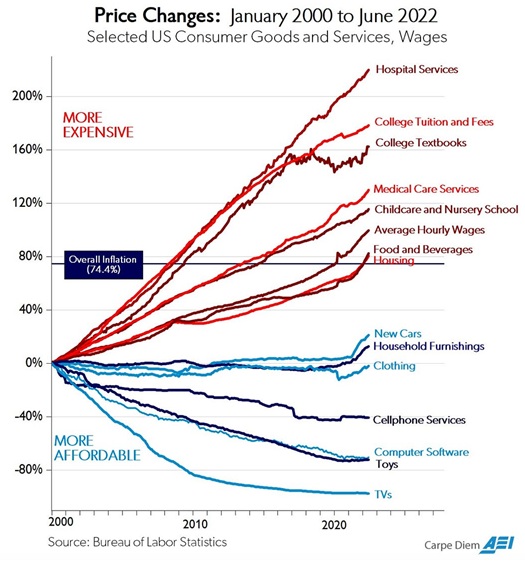

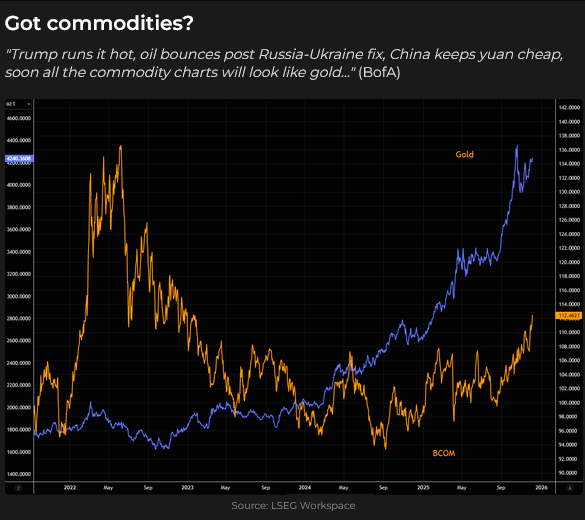

The rally in risk assets is supported, in part, by ideas that governments around the world will “Run It Hot” (with stimulative fiscal and monetary policies) to ramp up economic growth as they try to outrun the consequences of the global sovereign debt crisis.

The “debasement trade” involves buying risk assets as a hedge against governments inflating away unsustainable levels of public debt, which diminishes the purchasing power of fiat currencies, which is the essence of “inflation.” The debasement trade is an inflation hedge.

Equities

The S&P and the NAZ rallied to record highs in late October, corrected lower to November 21 (the S&P dropped ~6%, the NAZ ~9%), and have since recovered ~80-90% of the correction.

The Toronto Composite Index reached record highs in mid-October, drifted sideways to November 21 (as the S&P and the NAZ had their corrections) and then rallied to new record highs this week.

The Nikkei had a pattern similar to the S&P, peaking around the end of October, correcting to November 21, and bouncing back.

The Euro STOXX 50 had a short, sharp correction in mid-November, bottoming on November 21, and has bounced back, recovering about 80% of the correction.

Metals

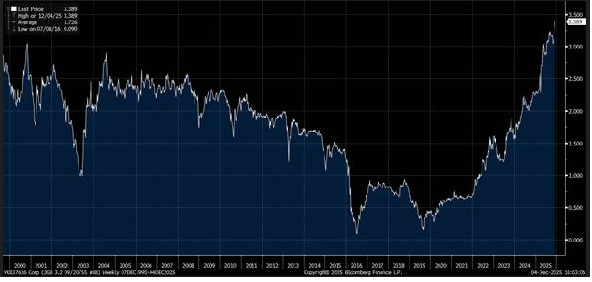

Metal prices have rallied as the “leading edge” of the debasement trade, and lately, especially with silver and copper, the rally has been accelerated by physical “shortages” of metal.

Silver prices reached record highs this week, up ~100% YTD. The March 2026 Comex contract is now the lead month, and it came within a dime of $60 per troy ounce on Friday. Silver has been in a structural deficit for several years, as annual physical demand has exceeded supply, and those shortages are “coming home to roost,” causing severe stress around Comex deliveries.

The Gold/Silver ratio soared to over 100 (100 toz of silver = 1 toz gold) around the Liberation Day fiasco, but has dropped to ~72 this week as silver has outperformed gold over the past nine months.

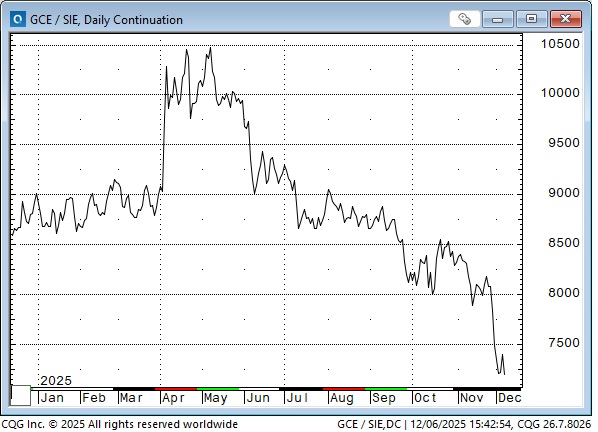

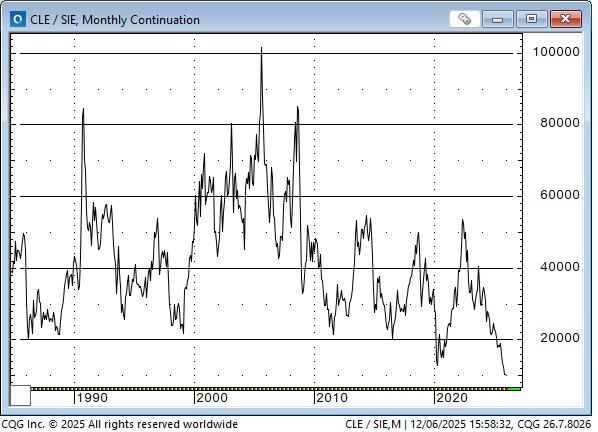

The ratio of silver to WTI crude oil has soared to an all-time high, with one troy ounce of silver at ~$60, now about equal to one barrel of WTI at ~$60 (42 US gallons weighing ~300 pounds). In 2005, the value of a barrel of WTI was equivalent to ~10 ounces of silver.

Comex gold prices were up ~$1,700 (~65%) YTD at their October highs.

Twenty-five years ago, in 2000, Comex gold traded as low as $250.

LME copper prices reached an all-time high this week, and Comex prices (at ~$5.40) would also have been record highs if they had not spiked in July when the Trump administration was “unclear” about how copper imports would be tariffed. (Comex prices tanked over a dollar a pound on July 30 when the government clarified that imports of unmanufactured copper would not be subject to tariffs.)

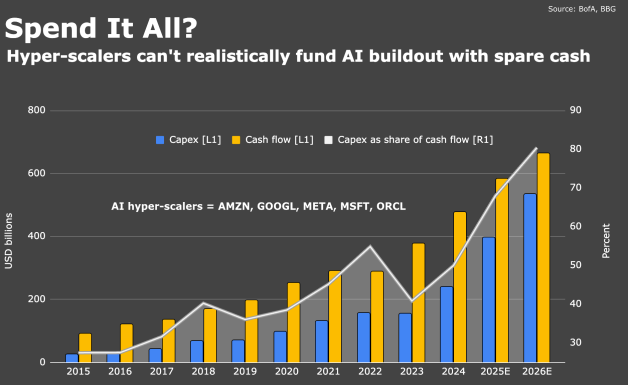

Copper prices have been bid higher over the past five years on the “electrification of everything” story, with that bid intensifying lately on supply shortages and anticipated AI-related demand.

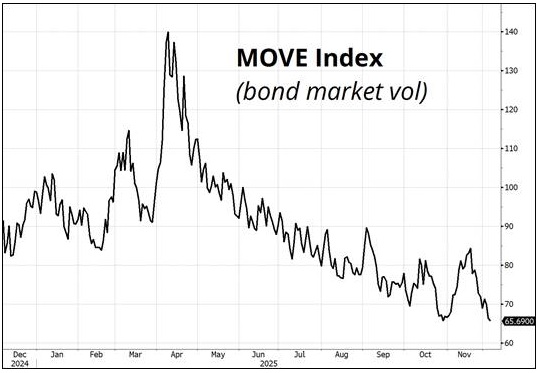

Interest rates

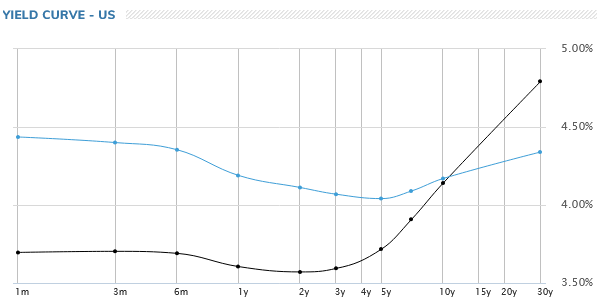

The FOMC is expected to announce a 25-bps cut on Wednesday. Trump is expected to announce his nomination of Kevin Hassett as Fed Chair early in 2026. The bond market is not happy, with the 30-year yield at ~4.8%. From a “debasement trade” perspective, bonds are a short, but if markets believe unemployment will rise and the economy will slow (especially if stocks fall as the economy slows), bonds may catch a bid. My friend JJ (Market Vibes on Substack) has proposed that the AI play may be deflationary, and if so, bonds may rally.

The recent steep rise in Japanese bond yields is putting pressure on the global bond market.

Currencies

The DXY US dollar index has drifted broadly sideways, with low volatility over the last eight months. It has drifted lower over the past two weeks as the market prices a narrowing of the USD-weighted yield premium over other currencies.

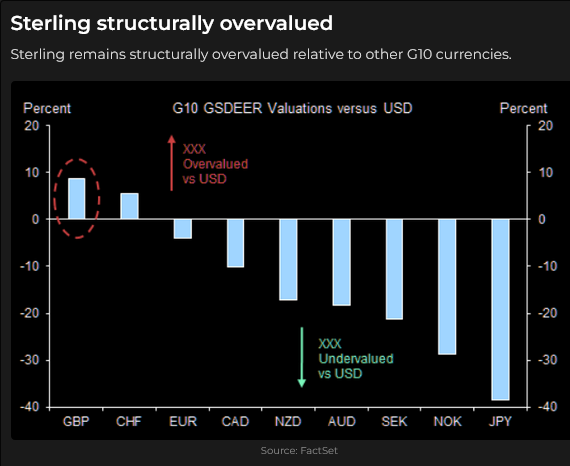

The chart above from FactSet surprised me. I had no idea that the British Pound was “structurally overvalued” against other G10 currencies. (I understood the Swiss was overvalued and the Yen was substantially undervalued, but I was honestly puzzled that they ranked the Pound even more overvalued than the Swiss.) I think the key is “relative to other G10 currencies,” rather than “relative to the USD,” which they also have on the chart. Given my read on British energy policies and “all things UK”, I could happily short the pound against the USD and other currencies.

I’ve been surprised (and wrong about) the weakness of the Yen since October, even though it has inched higher over the last two weeks. I’ve believed that it “had” to rally, and it hasn’t. (For years, I’ve said that currency trends often go WAY further than seems to make any sense, and then they turn on a dime and go the other way.)

Rather than explain the bull and bear cases for the Yen, here are links to excellent short essays (5-minute reads) on both the bullish case and the bearish case for the Yen. I favour the bullish case, if only because speculators are massively short the Yen.

Here’s a chart of the Indian Rupee. It has fallen to record lows against the USD, down ~40% since 2012. The MSCI India ETF is up ~175% from the 2020 lows; CPI inflation is near zero; annual GDP is ~8%; short-term interest rates are ~5.5%; and the 10-year yield is ~6.5%. Why is the Rupee in the tank?

The Yen is down ~50% from 2012, and the Korean Won is down ~28%. Asian currencies, including the Chinese RMB, are all undervalued due to mercantilist policies and because they compete with one another for a share of the export market.

The Canadian Dollar has had a good two-week run, up ~1.5 cents, as reports of stronger-than-expected GDP and employment have probably inspired some of the substantial short positions to be covered. The AUD and the NZD have had similar rallies over the past two weeks. (I posted a photo of a happy Mark Carney on the front page of this report – he may think the CAD rally is a vote of confidence in his policies.)

The Canadian dollar also has a long-term positive correlation with commodity prices.

Energy

Nymex January 2026 natural gas has jumped ~40% from the October lows on cold weather in North America and strong LNG exports.

Nymex January WTI is ~ $60, up ~$4 from the October lows.

The prices of oil company shares are outperforming oil prices.

Nymex RBOB gasoline futures are trading at 4-year lows, while the average retail gasoline price across the USA is under $3 a gallon for the first time in 4 years.

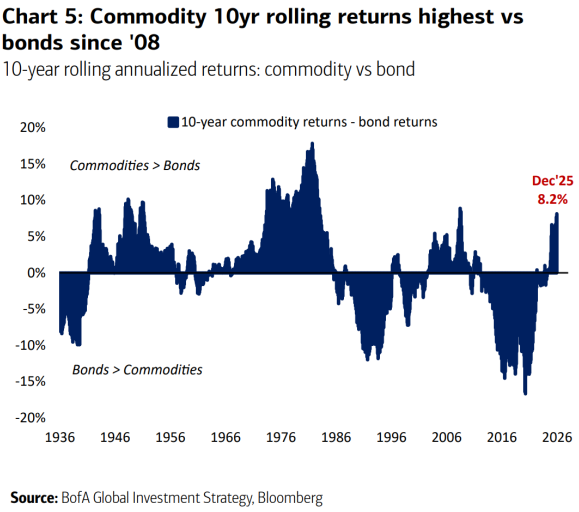

Mike Harnett at BoA thinks oil prices will rebound and may be the best “debasement trade”.

My short-term trading

I started this week long CAD and the Yen. (I also had some Yen call “lottery tickets” that I bought in October that were way out of the money and expired worthless this week.) I held those positions through the week and into this weekend, with the substantial (unrealized) gains in CAD more than offsetting the losses on the expiring Yen calls.

I shorted the S&P twice early in the week as the rally looked tired, but closed those trades for tiny losses.

The Barney report

Barney and I are home alone again this week with my wife in Vancouver, visiting her daughter and twin baby girls. The Barns has been very patient with me, as I’ve had a busy week. Here’s a photo of him “chilling” on top of the living room couch.

Listen to me hosting the Moneytalks show

I hosted the Moneytalks show this week while Mike Campbell was away. I had a great chat with Peter Grandich about metal prices and mining companies. Rob Levy gave us a lot more colour on the metals market, while Ozzie and I discussed falling real estate prices across Canada and how the costs of building a home have soared. Grant Longhurst and I discussed Michael Green’s terrific essay on the poverty line in the USA. Grant also did a solo report on where the money actually goes in a socialist society – and it’s not to the poor people! You can listen to the show here.

I also did my monthly interview with Jim Goddard on the This Week In Money Report. Jim and I discussed “Run It Hot” policies and the debasement trade, the Santa stock rally, the wild price action in silver, interest rates, currencies (with a focus on the Canadian dollar), as well as WTI and natural gas. You can listen to the interview here.

Mike Campbell’s 2026 World Outlook Financial Conference will be on February 6 & 7 at the Bayshore Hotel in Vancouver. Click here for information and to buy a ticket.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair December 6th, 2025

Posted In: Victor Adair Blog

Next: Poverty Level Discourse »