December 20, 2025 | Trading Desk Notes for December 20, 2025

Some brief comments and some interesting charts ahead of Christmas week

Stocks:

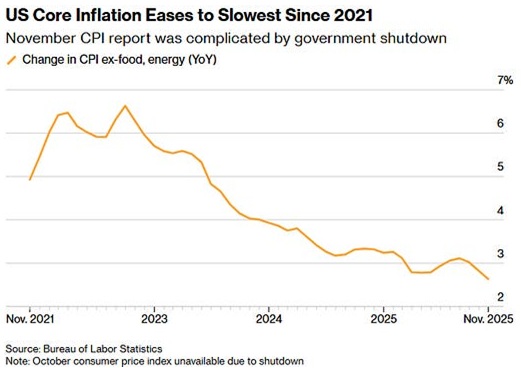

S&P futures closed last Friday near their lows for the week, and the selling continued Monday through Wednesday this week as investors had 2nd thoughts about the AI trade and rotated into defensive issues. The market pivoted on Thursday morning, on the “much-better-than-expected” CPI data and “buy-the-dip” enthusiasm rallied the market to close the week unchanged. The quarterly roll and a record-sized OPEX contributed to a high-volume week.

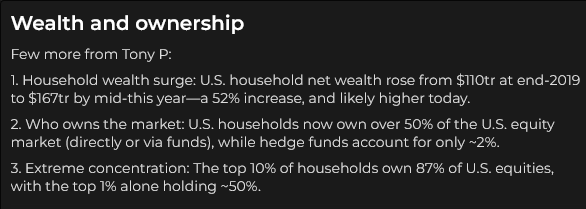

This comment from Tony Pasquariello, Goldman’s Global Head of Hedge Fund Coverage

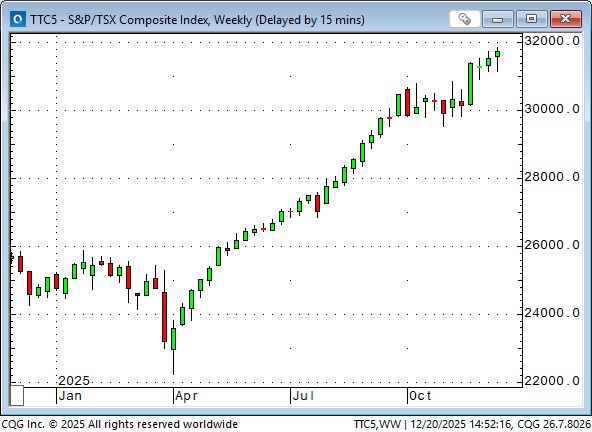

The Toronto Composite Index closed at new all-time highs this week, after an impressive (+43%) run from the April lows.

Interest rates:

Long bond futures have trended lower since the FOMC cut short-term rates on October 29 (blue ellipse), but have bounced back this week from 3-month lows.

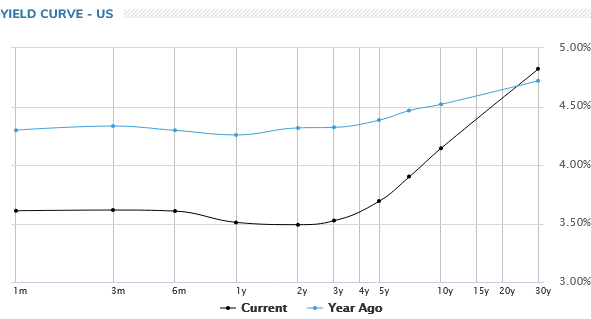

The US yield curve continues to steepen ( although a 68-point spread between the 10-year and the 30-year is not steep from a historical perspective – h/t to my bond-trading friend, Levente!)

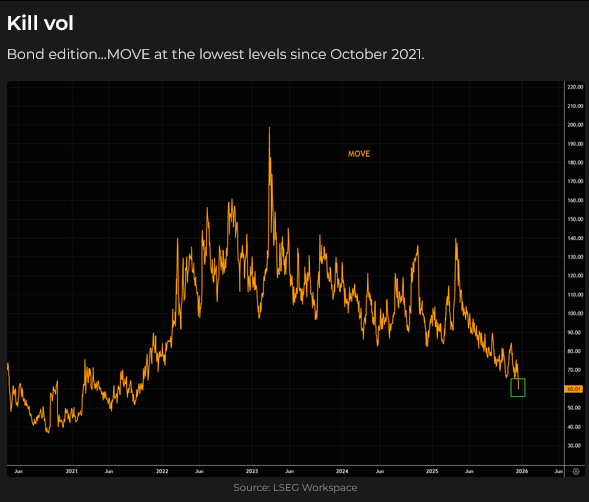

Bond VOL, as measured by the MOVE index, is at a 4-year low.

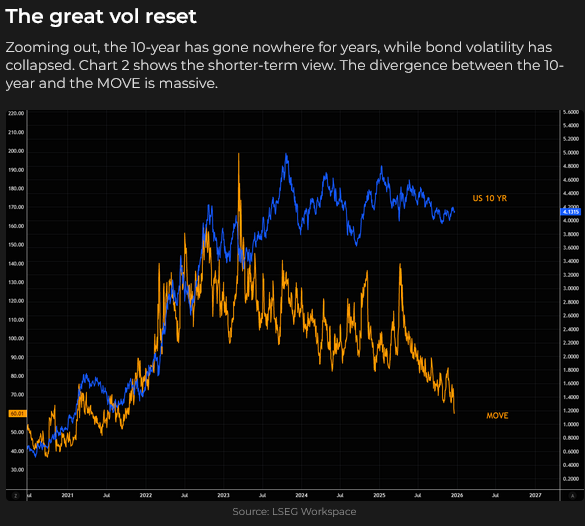

And why not? Since the yield spike in October 2023 (When Janet Yellen was the Treasury Secretary), 10-year yields have gone broadly sideways.

Some people “took issue” with the validity of the CPI data reported this week, and they may be right to question the report, but the “free market” seems to be pricing a declining trend in inflation.

Currencies

The DXY US Dollar Index has been in a relatively narrow sideways range for the past few months after plunging ~14% in H1 following Trump’s inauguration.

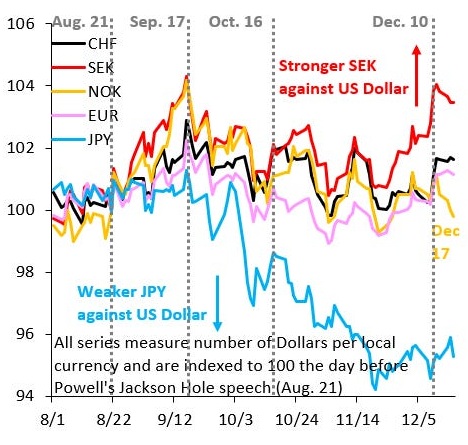

The Euro accounts for 57.6% of the DXY, and, together with the GBP, SEK, and CHF, European currencies account for ~77% of the Index, while the JPY accounts for 13.6% and the CAD for 9%. The DXY would have looked much weaker recently if not for the Japanese Yen’s weakness.

This chart by Robin Brooks:

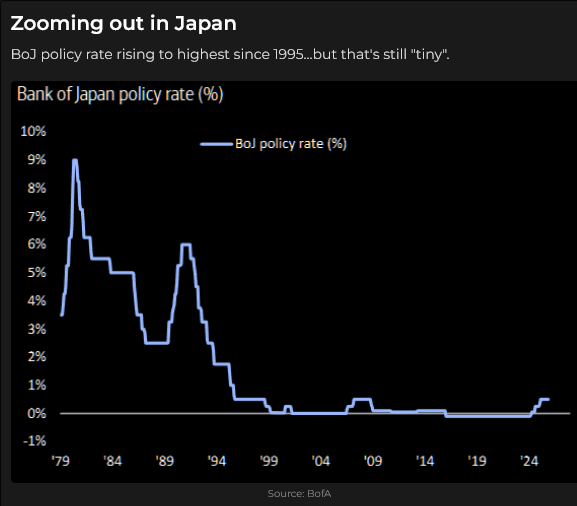

The Yen has fallen by ~7% since Ms. Takaichi became the leader of the Liberal Democratic Party on October 4 (and subsequently became the Prime Minister of Japan on October 21). The sharp drop on Friday (blue ellipse) followed a “dovish hike” by the BoJ.

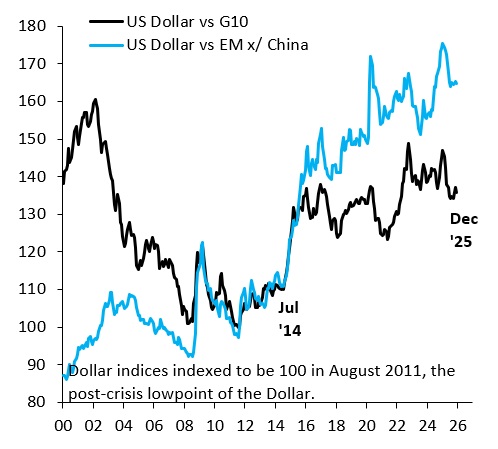

Here’s another FX chart from Robin Brooks showing the strength of the USD against 1) the G10 currencies and 2) EM currencies, X China (he excludes China because they actively “manage” their exchange rate). Since the pivotal lows in 2011, the USD is up ~35% against G10 currencies and ~65% against EMXC. (It is up ~50% against the Yen and ~70% against the Indian Rupee.)

President Trump believes that many countries have “manipulated” their currencies to gain an “unfair” trade surplus with the USA, and he has tried to “correct” these trade imbalances with tariffs. Before his inauguration, some analysts believed he would pressure certain countries to “up-value” their currencies to correct trade imbalances and create more jobs in the USA; he may still try to do that (and if he does, we will have another version of “currency wars” and currency market volatility will soar).

Energy

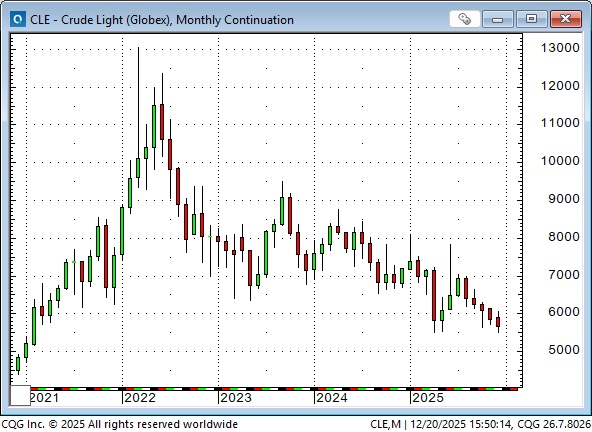

WTI futures spiked to ~$130 following the Russian invasion of Ukraine, but have trended lower since then, and have fallen from ~$70 in August to below $55 this week, the lowest prices in over four years.

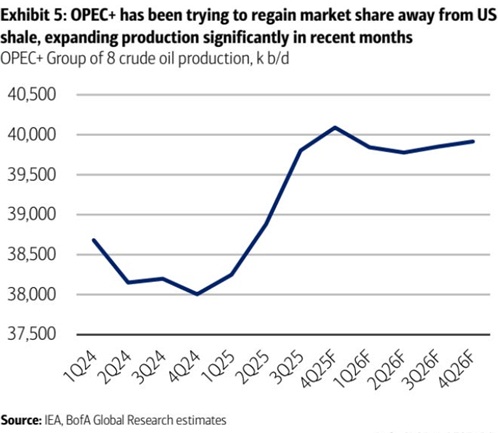

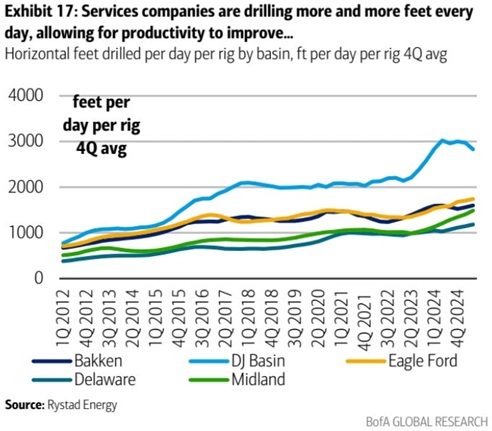

Global supply appears to exceed global demand, as both OPEC and non-OPEC production have risen.

Share prices of oil and gas companies have not followed oil prices lower.

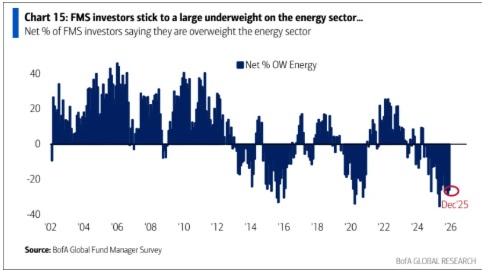

However, the Bank of America survey of investors shows that they are currently underweight in the energy sector.

Natural gas prices spiked on the Russian invasion, and subsequently fell sharply. However, natural gas prices have significantly outperformed WTI prices over the past two years.

Share prices of uranium companies have performed well this year.

Cameco is my bellwether for the uranium market, with a long track record of production from the rich deposits in the Athabasca Basin and with vertical integration as a co-owner of Westinghouse Electric.

Metals

Silver remains the “wild child” of the metals market, with Comex March 2026 futures reaching a record high of ~$67.65 on Friday, up ~$40 (~140%) from the April lows.

The implied volatility of Comex silver options has soared.

Comex platinum futures have soared by ~$500 (~30%) in the last four weeks to 17-year highs.

Comex February 2026 gold registered an all-time high weekly close ($4,369) on Friday, up ~$1,420 (~48%) from the April lows.

Comex March 2026 copper closed the week at $5.48, up ~$1.45 (~36%) from the April lows.

China

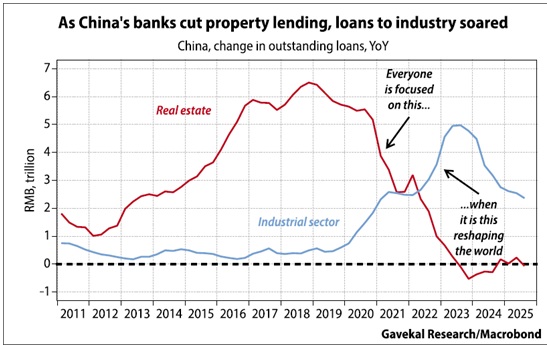

China appears to be in a balance-sheet recession. The property sector has been in decline for five years and accounts for ~60% of household assets (compared to ~36% in the USA). Household debt is ~130% of disposable income, up from ~18% in 2008. Consumer confidence is low. Retail sales are weak. China has excess capacity relative to consumer demand. FDI flows into China are at a 30-year low.

With asset prices (real estate) down and debt burdens up, China needs to inject much more capital into the economy to avoid a deleveraging spiral.

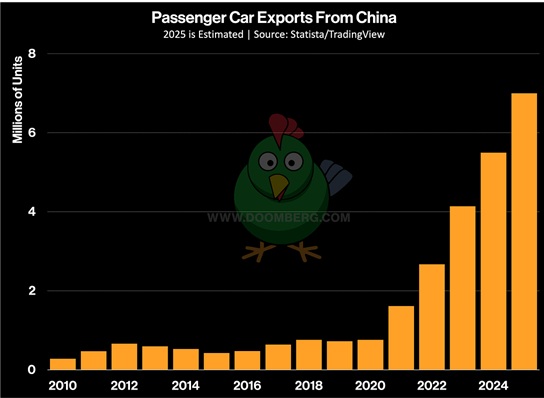

China is relying on exports to sustain the economy, but with a trade surplus of >$1 trillion YTD, will the Rest Of The World (ROW) cooperate?

I have wondered for several years whether China will be a reprise of the boom-bust cycle that occurred in Japan, which boomed in the 1980s, cratered in the 1990s, and remains in a balance-sheet recession.

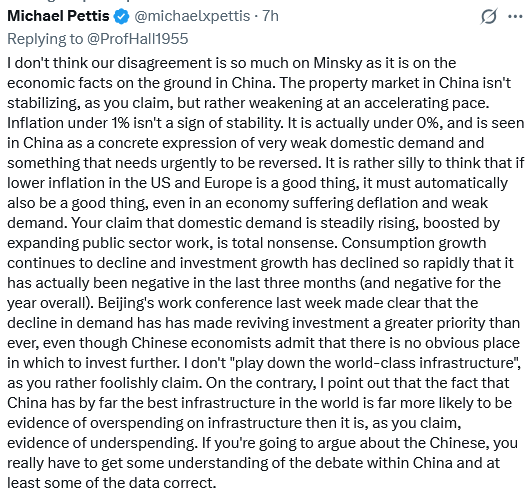

The risk is that China is already exporting deflation to the ROW through its massive trade surpluses, and if it sinks into outright domestic deflation, that too may spread to the ROW. For more details, see Michael Nicoletos on Substack. Also, check out Michael Pettis on YouTube.

The trading opportunity: If China exports deflation to the ROW, traders may want to fade the consensus view that inflation will persist and may increase as governments seek to “inflate away” excessive debt.

My short-term trading

I started this week with a short S&P position established on Friday of last week. I covered that trade for a decent gain on Monday when the market fell further. I gave those gains back on Tuesday, Wednesday, and Thursday, when I was 100% out of step with the intra-day market direction.

I wrote short-dated puts on the 30-year bond on Tuesday and held the position into the weekend with a decent unrealized gain.

I will likely not trade much for the remainder of the year.

The Barney report

Barney has been patient today as I worked on my Trading Desk Notes, but every once in a while, he gives me the signal that he’s ready to play whenever I’m ready.

I hosted the Moneytalks show this week

Mike Campbell was away again this week, and I hosted the Moneytalks show. My son, Drew Zimmerman, was my first guest, and we discussed the uranium market and his exploration company’s activities in Wyoming. Ozzie Jurock updated us on land claims issues in New Brunswick and explained why December might be a great time to sell your house. Grant Longhurst had some impressive stats on the number of pets in Canada and the billions of dollars that people spend to feed and maintain their pets. Rob Levy of Border Gold and I discussed the precious metals markets and also touched on stocks and currencies. You can listen to the show here.

The World Outlook Conference is on February 6 & 7 at the Bayshore Hotel in Vancouver. Click here for information on the conference and to buy a ticket.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair December 20th, 2025

Posted In: Victor Adair Blog

Next: The EU is Out of Control »