December 8, 2025 | Self-Inflicted

Happy Monday Morning!

The Canadian economy added 54K jobs in November, marking the third consecutive month of surprising job gains. The unemployment rate plunged to 6.5%, the lowest since July 2024 and down from 6.9% last month. The “suddenly hot” labour market is rather perplexing considering all the news headlines about layoffs (especially in the real estate industry).

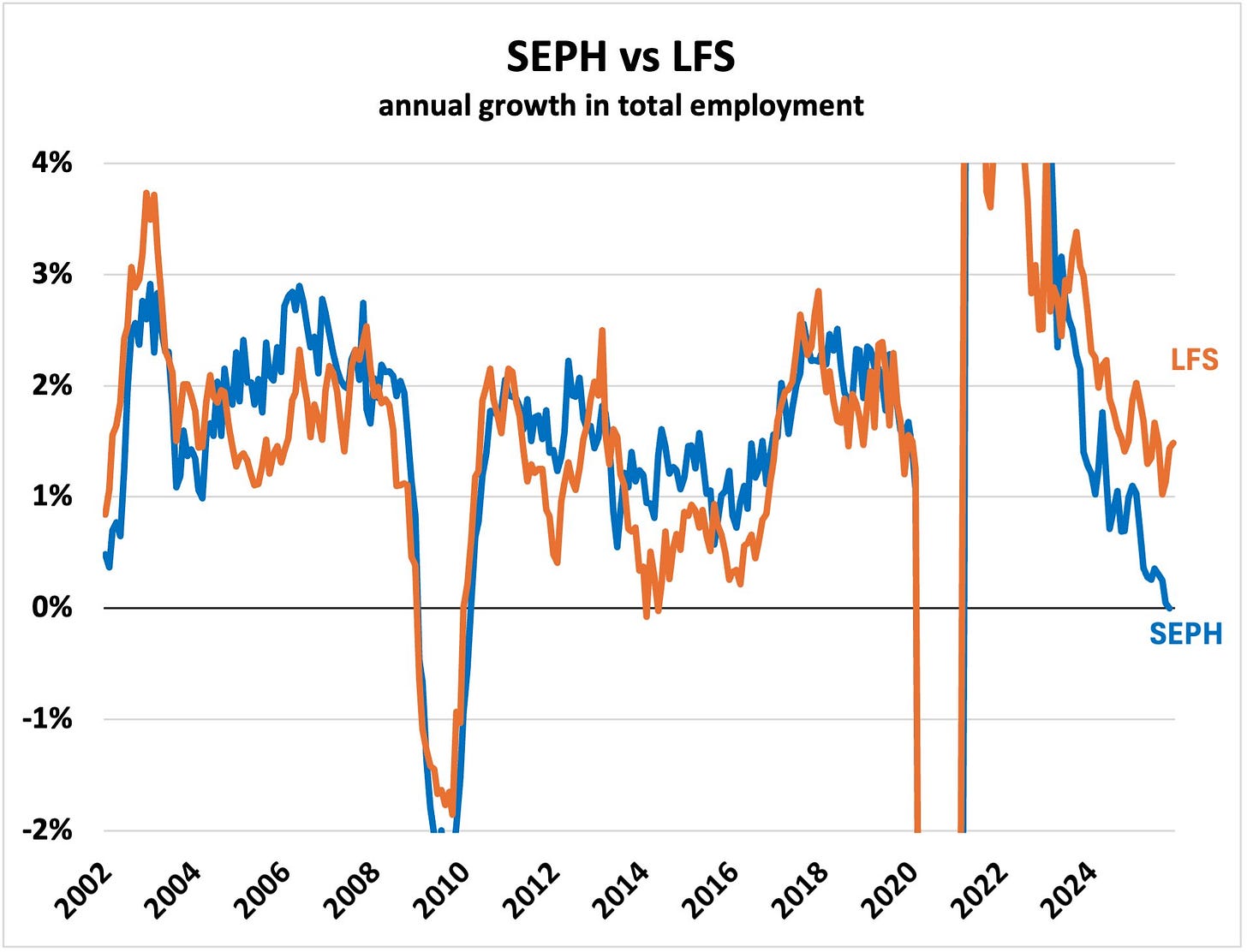

However, as our friend Ben Rabidoux with Edge Analytics notes, the “suddenly hot” labour force survey continues to diverge from Stats Can survey of employment, payrolls, and hours (SEPH). They both can’t be right.

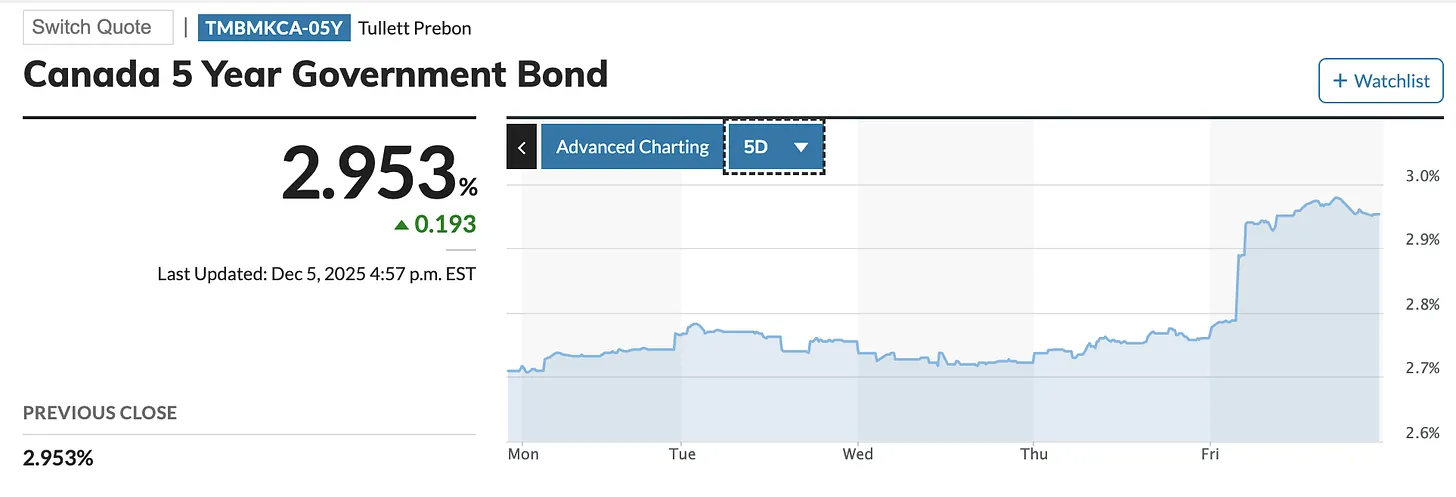

While we wait to see how this plays out, here’s what we know for sure. Bond yields are ripping, and markets believe the Bank of Canada is done cutting rates. Not only are they done cutting, but traders in overnight swaps are now fully pricing a hike from the central bank by October 2026. Colour me skeptical.

Meanwhile, the all important 5 year Canada bond yield, which prices the 5 year mortgage, is up 30bps this past week.

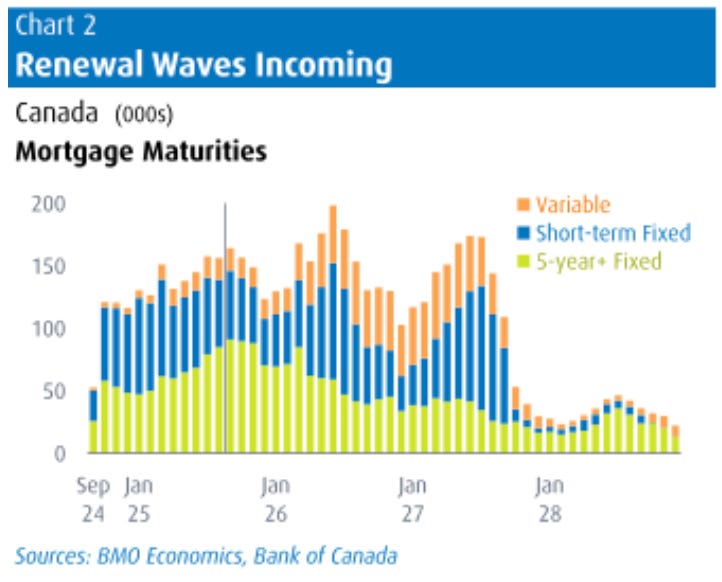

Not good news for the wave of renewals coming due in 2026. There are roughly 1.8 million mortgages renewing over the next year, with the absolute peak expected in June 2026. The time to call your bank for a rate hold was a week ago.

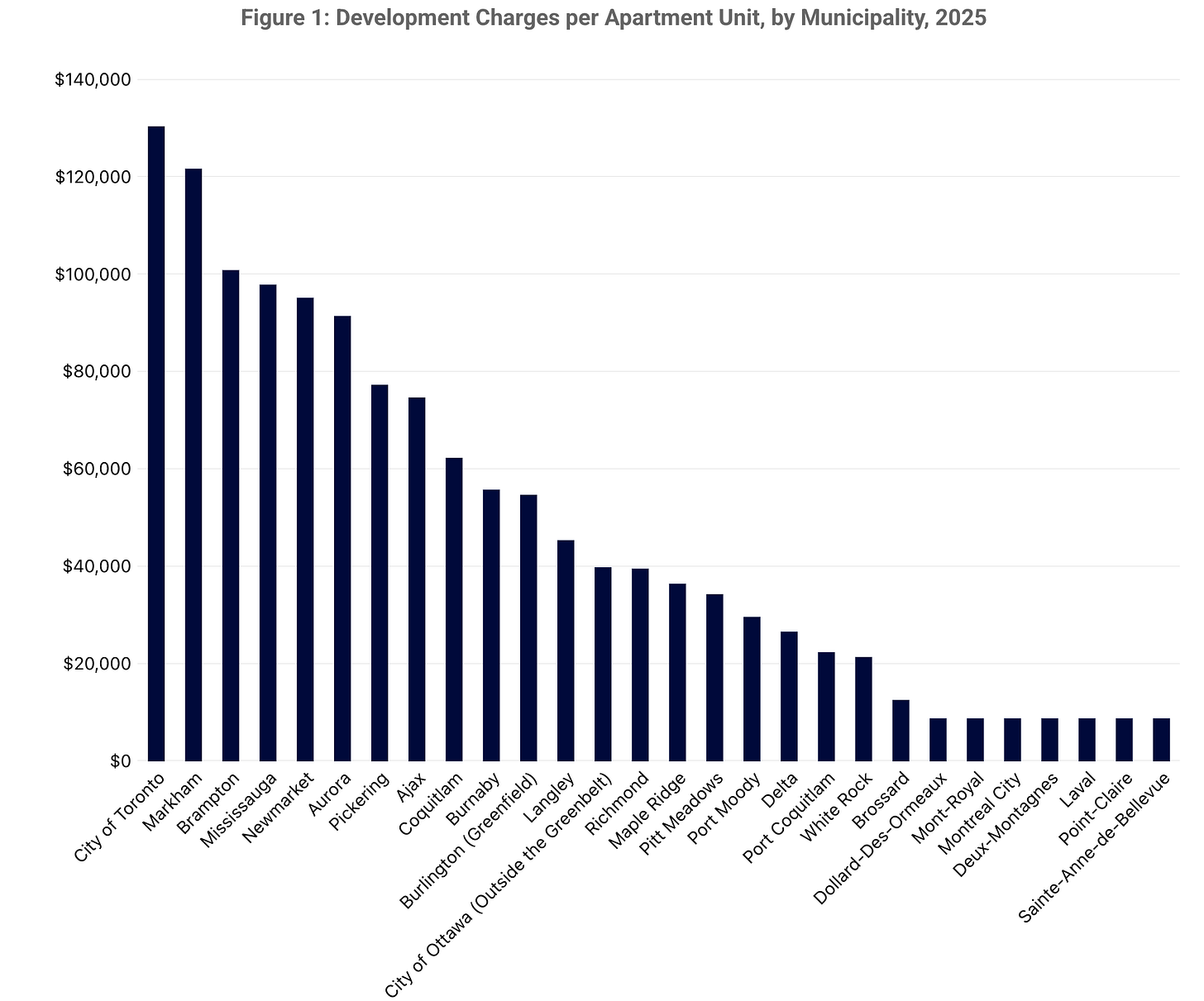

In other news, we noticed that CMHC has started tracking a new data series, development charges. These development charges amount to a whopping $130,200 per apartment unit in Toronto.

Unfortunately, CMHC wasn’t able to obtain data from the City of Vancouver, but I can assure you they aren’t far behind.

As we have highlighted before, there are a list of ingredients that go into a new housing unit, most of which can’t be changed easily. Land (typically a fixed cost already paid), interest rates (set by the market), construction costs (largely set by commodity markets). And then you have development charges. If you wanted to change a developers proforma overnight you could lower development charges with the stroke of a pen.

Voila.

The city is immediately reducing development charges by 20%, and has proposed a two-year Rental Development Relief Program (RDRP), a new initiative intended to rescue rental projects that are faltering under current economic conditions. The program would relax affordability requirements which currently require below-market rental housing to be priced at least 20% below CMHC city averages.

The article goes on to say,

Although the reduction will shrink the municipal government’s available revenue for growth-related infrastructure and amenities by an estimated $45 million over the next capital plan period, City staff emphasize that the change strengthens the City’s eligibility for new federal housing-enabling infrastructure funding and could prevent further project cancellations.

As we have long argued, one of the biggest beneficiaries of the housing bull market over the past decade has been government coffers. As Real Estate prices surged, so too did development fees. It wasn’t a problem because prices kept going up, and pre-sale buyers were seemingly enthusiastic to absorb it.

Now that the music has stopped and pre-sales have collapsed to multi-decade lows, governments are realizing that taking a little bit of something (20% less), is better than nothing.

If you want to trim building costs further, governments should also consider rolling back their arbitrary building code requirements. Governments who continue to push for higher energy efficiency requirements on new housing are inflating costs. It turns out, the true cost of this green washing is an extra $50K per unit.

A recent note from the Urban Development Institue,

The implementation of the Energy Step Code and Zero Carbon Step Code has also advanced far faster than the sector can absorb. Municipalities have adopted higher steps at different speeds. Eighteen communities already mandate EL-4, the highest electrification level. This is contributing to delays in securing electrical connections and forcing utilities to overbuild costly infrastructure to prepare for peak winter loads in fully electrified buildings. The step codes themselves are adding substantial project costs. At the Planning Institute of BC conference, one builder noted that moving from Step 1 to Step 3 added roughly $3 million to a project budget. Axiom Builders, working with several UDI members, assessed the impact of moving a concrete rental tower from Step 2 to Step 4 under the ESC and to EL-4 under the ZCSC. The construction cost increase was up to $50,000 per unit. When financing and other development-related costs were included, the total incremental cost rose to $65,000 per unit. These upfront costs are not offset by lower operating expenses, particularly when residents in fully electrified buildings are facing higher energy bills.

Perhaps the lowest hanging fruit is the natural gas ban, which is no longer allowed as a primary heating source in most new homes across the lower mainland. Not only is Natural gas cheap, abundant, and already piped on site, but in BC we export over 2 trillion cubic feet per year to the rest of the world. In other words, it’s good enough for the rest of the world, just don’t use it here.

When you read this, one can’t help but conclude our cost of living crisis is mostly self-inflicted.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky December 8th, 2025

Posted In: Steve Saretsky Blog