December 8, 2025 | Next Year’s Wild Card: The Yen Carry Trade

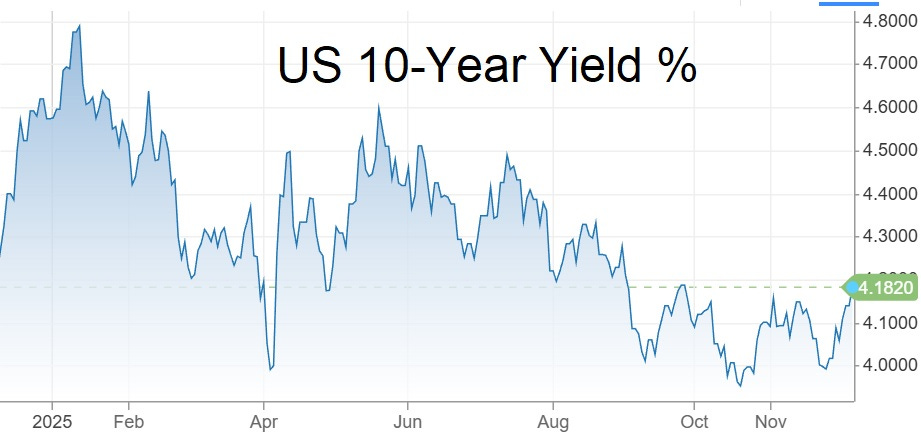

Most countries’ sovereign bond markets have been pretty tame lately. Here, for instance, is the yield on US Treasury notes:

But it’s different in Japan, where money is getting dramatically tighter:

Normally, when the world is moving in one direction and a single country breaks ranks, it can be dismissed as a temporary glitch that will disappear as markets work themselves out.

But maybe not this time. Japan’s mountain of government debt is forcing it to raise interest rates. And the result is potentially huge, because of something called the “yen carry trade.” Here’s a quick overview:

What Exactly Is a Yen Carry Trade?

(Discovery Alert) – The yen carry trade operates through a relatively straightforward mechanism that has generated substantial profits for institutional and retail investors alike. Market participants borrow Japanese yen at near-zero interest rates, convert these funds to foreign currencies, and invest in assets offering superior returns. The profit emerges from the interest rate differential between Japan’s ultra-low borrowing costs and higher yields available in US equities, European bonds, emerging market securities, and global real estate ventures.

This strategy’s effectiveness depends on two fundamental market conditions: Japan maintaining its accommodative monetary policy stance and yen exchange rates remaining stable or depreciating against major currencies. For three decades, these assumptions proved remarkably durable, enabling trillions of dollars in capital flows that supported asset price appreciation worldwide.

The Three-Decade Foundation That Built Global Markets

Japan’s commitment to ultra-low interest rates created an unprecedented source of cheap funding that institutional investors utilised to amplify returns across asset classes. The Bank of Japan maintained its benchmark rate near zero percent for approximately thirty years, with periods of negative interest rates following the 2008 financial crisis. This policy stance effectively subsidised global risk-taking by providing virtually free capital to sophisticated market participants.

The carry trade mechanism operated as a “silent money printer” that channelled Japanese savings into worldwide investments without drawing significant regulatory attention or public scrutiny. Unlike quantitative easing programmes that generated substantial political debate, carry trades functioned through private market transactions that escaped broader policy discussions despite their systemic importance.

The Great Unwind

As Japanese interest rates rise, the yen carry trade becomes unprofitable, forcing the unwind of trillions of dollars of leveraged “investments”. And just like that, the steady tailwind of the past three decades becomes a headwind. Not only in the US but globally across multiple asset classes. More from the above article:

The Mathematics of Carry Trade Destruction

When Japanese interest rates rise while foreign asset values simultaneously decline, carry trades encounter a devastating double impact. Borrowing costs increase precisely when investment returns deteriorate, creating negative carry scenarios that force rapid position liquidation. Furthermore, the yen’s safe-haven status is shattering as global market dynamics shift, with the currency’s concurrent strengthening compounding these losses as investors must repay yen-denominated obligations with an appreciating currency.

This mathematical relationship explains why relatively modest Japanese rate increases can trigger disproportionate market disruptions. Leverage amplifies both profits during favourable conditions and losses when market dynamics reverse. Institutional investors who utilised 10:1 or 20:1 leverage ratios to enhance carry trade returns face magnified losses when positions move against them, contributing to the current yen carry trade collapse.

Is Bitcoin the First Domino?

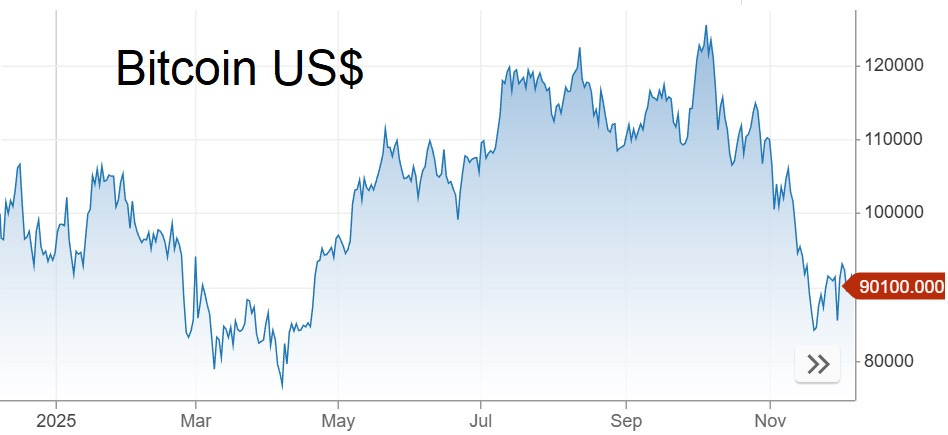

So far, the most notable case of momentum reversal has been bitcoin, which fell from $120 to $90 in less than a month:

Digital assets are sensitive to global liquidity, volatility across the crypto universe is likely in 2026.

But real estate, government bonds, and tech stocks also require liquidity, so expect the US and Europe to aggressively ease monetary policy to replace those carry trade trillions. The result: asset price volatility and currency depreciation. All roads, these days, seem to lead back to gold and silver.

I’ll leave you with a video that goes into a little more detail:

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino December 8th, 2025

Posted In: John Rubino Substack