November 3, 2025 | Worried About the Gold/Silver Correction? Don’t Be. It’s Just a “Head Fake”

Gary Bohm at Metals and Miners just posted a great analysis of the recent turmoil in precious metals and why it’s likely to be temporary. Here’s an excerpt:

The $7.5 Billion Head Fake: Why History’s Largest Gold Outflow Last Week Will Turn Out To Be A Generational Buying Opportunity!

The media has seized upon this headline as proof that the gold bull market is over, that the rally was a speculative bubble, and that the smart money is getting out. They could not be more wrong.

Nov 01, 2025

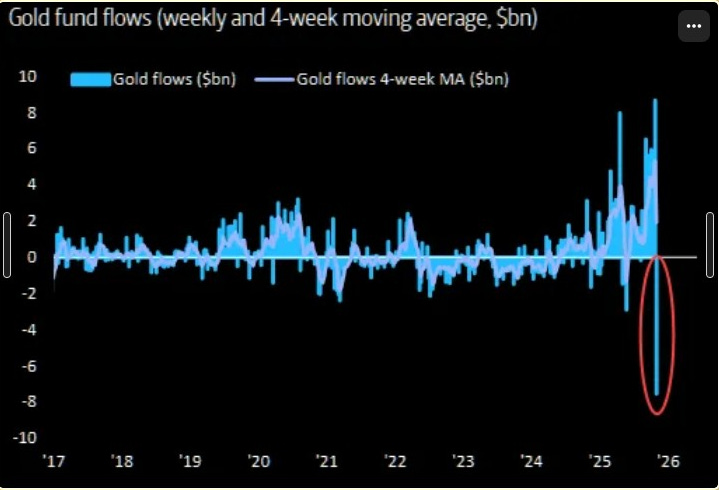

Gold just experienced the largest weekly outflow in recorded history, a staggering $7.5 billion withdrawal that has sent shockwaves through financial markets and triggered panic among weak-handed gold investors.

The financial media has seized upon this headline as proof that the gold bull market is over, that the rally was a speculative bubble, and that the smart money is getting out. They could not be more wrong.

This is not the end of the bull market. This is a classic psychological operation designed to shake out retail investors, a manufactured panic that is ultimately transferring gold from weak western retail hands to strong Asian hands and western bankers.

And most importantly, it is a historical parallel to 1973 that suggests the real, explosive phase of the gold bull market is just beginning.

The Anatomy of a Manufactured Panic

The chart above shows the magnitude of the recent outflow, a waterfall event that dwarfs any previous withdrawal. On the surface, it appears terrifying. But the context reveals a story of incredible underlying strength.

Despite this historic $7.5 billion outflow, gold still managed to close the month above the critical psychological level of $4,000 per ounce.

This is not a sign of weakness; it is a testament to the immense and unyielding demand that is quietly absorbing every ounce that the weak hands are willing to sell.

None of the fundamental drivers of this bull market have changed. The global debt crisis is accelerating, geopolitical risks are intensifying, and the de-dollarization movement is gaining momentum.

The reasons to own gold have not diminished; they have grown stronger despite this selling pressure.

So, what is this outflow really about? It is about profit-taking by short-term speculators and, more importantly, a psychological operation designed to create fear and doubt in the minds of average investors.

This is how bull markets climb the proverbial “wall of worry.” They require periodic, violent shakeouts to clear out the speculative froth and create a new base for the next leg higher.

The goal of this shakeout is to convince you that you are late to the party, that the move is over, and that you should wait for a better entry point. But by the time that “better” entry point arrives, the price will likely be thousands of dollars higher.

History Doesn’t Repeat, But It Rhymes: The 1973 Parallel

To understand what is happening now, we must look to history. The current situation is a near-perfect echo of the market dynamics in early 1973, a period that preceded one of the most explosive gold rallies in modern history.

Let’s dig into:

- The 1973 parallel

- The wealth transfer that is really happening

- The unchanged fundamentals

- And the fuel for the next leg higher…

METALS AND MINERS IS HOSTING AN UPCOMING LIVE CONFERENCE EVENT:

America’s electrical grid is on the brink of its most dramatic transformation in a century, and the investment implications are staggering.

On November 12th, join four of the market’s most prescient and prominent voices (Luke Gromen, Larry McDonald, Dr. Nomi Prins and Kevin Goldstein) as they decode the convergence of forces creating once-in-a-generation opportunities in critical metals, electrical infrastructure, and energy markets.

There will be live Q&A at the end where you can ask the experts the most pressing questions you have for them.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino November 3rd, 2025

Posted In: John Rubino Substack