November 1, 2025 | Trading Desk Notes for November 1, 2025

Sell the news?

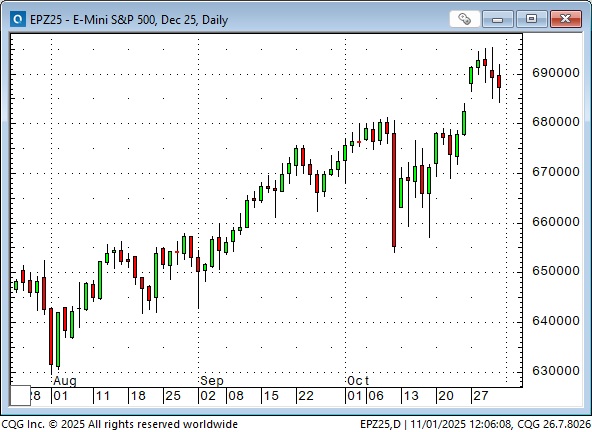

Leading global stock indices were at or near all-time highs this week, as Trump’s Asian tour reduced trade tensions, the FOMC cut interest rates, and Big Tech’s quarterly reports, on balance, were positive. Oh, and NVDA briefly reached a $5 trillion market capitalization, which is more than twice the size of Canada’s national GDP.

Despite all the positive news, Friday’s close was the lowest close of the week.

At this week’s highs, the S&P was up ~43% from the April lows, and the NAZ was up ~61%.

The Nikkei was up ~ 73%.

NVDA was up ~147%. Their quarterly report is scheduled for November 19.

META shares gapped sharply lower following Wednesday’s quarterly report, prompting a flurry of articles in the “financial press” suggesting that investors were concerned that massive AI capex might never produce a decent ROI.

Is AI in a “Drill baby, drill” phase?

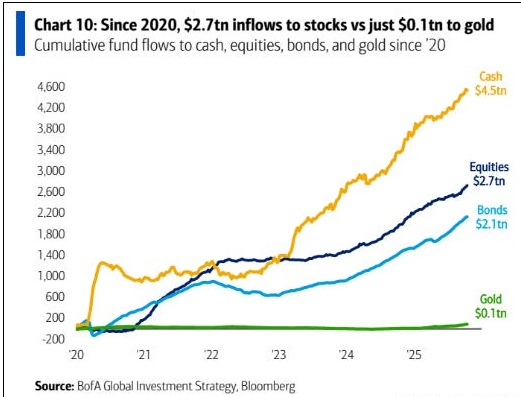

I’m inclined to think so, if that means investors may “step back” if they start to question whether the vast sums being spent on AI infrastructure will ever yield vast profits. I understand some folks believe AI will blossom into the Biggest Thing Ever. They may be right, but from a short-term trading perspective, I’m willing to bet that AI (and AI is the market) is vulnerable to at least a correction. Here’s a fantastic quote from Stephen Innes (a veteran trader I highly recommend you check out on Substack): “Momentum without cash flow is just gravity deferred.“

The stock market’s vulnerability isn’t limited to just a “rethink” about the ROI on massive capex. I think this week’s price action (new highs on “bullish” news, followed by the lowest close of the week on Friday) indicates that the market is also vulnerable to exogenous news.

It’s interesting to see CAT shares up more than 100% from the April lows, and ~50% over the past eight weeks. I guess building AI infrastructure requires a lot of heavy equipment!

Currencies

Channelling Bruce Kovner: What is the consensus trade that the market is not confirming? I’d say it’s the “dollar debasement trade”, specifically the widely held idea that the US Dollar is going to decline significantly.

The DXY US Dollar index had its highest weekly close this week since May, up ~4% from the lows made on September 17 (blue ellipse) – the day the Fed cut interest rates for the first time since December 2024.

The Euro (I like to call it the Anti-Dollar) briefly spiked to a 4-year high on September 17 (blue ellipse), following the FOMC’s interest rate cut, but, at this Friday’s close, it was down ~3.5% from those highs.

The Yen has been the weakest of the G10 currencies YTD, reversing down nearly 10% against the USD from its April high, after it had surged ~13% in the first four months of the year.

The Yen tumbled ~4.5% in the week following Takaichi’s election as head of the LDP party (blue ellipse) as traders may have suspected that, as an Abe protege, she would want a weaker Yen, and fell to an 8-month low after her meeting in Tokyo with Trump (pink ellipse) when there was no pressure from Trump to revalue the Yen, and the BoJ did not raise interest rates Friday morning (Tokyo time).

The Yen fell to an all-time low against the Euro (and the Swiss Franc) this week. (The Yen is near a 30-year low against the CAD.) The Yen has fallen ~35% against the Euro since 2020, and is down nearly 50% since 2012 (when Abe introduced his Three Arrows program to stimulate the moribund Japanese economy).

The Yen fell to a 34-year low against the USD (around 1.60 in interbank terms) in July 2024 (blue ellipse). It had become the leading “carry” currency (traders borrowed Yen at low interest rates and invested in other markets at higher rates, and also pocketed FX gains), so when the Japanese authorities interveened in the FX market in July, the Yen spiked ~15% in five weeks on massive short-covering.

The Yen weakened from October 2024 to year-end as the US Dollar rallied against all currencies, but then turned higher from a “higher low” (pink ellipse) in early January as the USD fell against all currencies (there was some expectation that Trump wanted a lower dollar, and there was also the “end of American exceptionalism” trade).

From the “higher low” in January to mid-April (approximately two weeks after “Liberation day”), speculators bought the Yen aggressively, with open interest rising by over 100%, as the “dollar debasement” idea gained popularity. Since then, as the Yen weakened, speculators have substantially reduced their bullish bets. It’s interesting to note that as the Yen weakened by ~10% from the April highs, the Nikkei rallied over 70%.

I think there are good reasons to expect the Yen to turn higher, although after trading currencies for nearly five decades, I’m very aware that trends in the currency markets often go “way further” than I think they should! My reasons: 1) Asian currencies are significantly undervalued against the USD (and the Euro) as a result of mercantilist trade policies (and because they compete with one another to export to the rest of the world), and there may be pressure from the Americans to revalue Asian currencies. 2) Traders are aware that Japanese authorities may intervene to keep the Yen from weakening. Any intervention could cause the Yen to spike higher as it did last year, and 3) I can imagine a possible “repatriation” of Japanese capital as Takaichi “reinvigorates” the Japanese economy, and 4) The market expects the BoJ to continue raising interest rates.

The Canadian dollar has been largely the “flip-side” of the USD for the past year. It weakened last fall as the USD rose, rose in the first half of this year as the USD fell, and then fell again as the USD rose from its lows at the end of June. As I have often noted, the CAD seems to rise and fall more as a result of “events” outside of Canada than “Canada-specific” events. The premium of US short-term rates over Canadian rates puts pressure on the CAD, while Trump’s tariff tantrums against Canada also hurt the Loonie.

On a longer-term basis, the CAD has fallen by ~13% from its June 2021 highs, while the DXY US Dollar Index has risen by ~11% during the same time period.

Gold

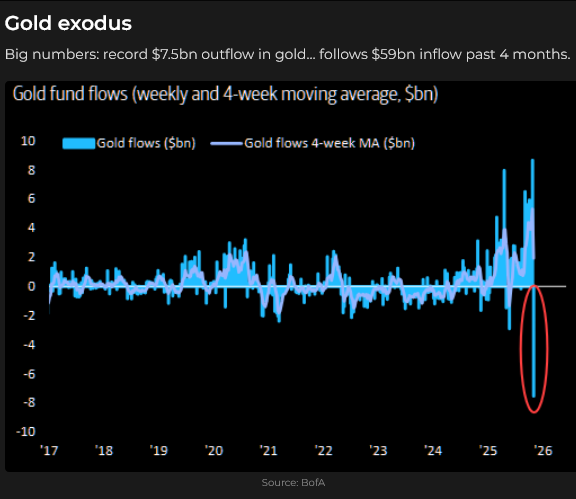

December 2025 Comex gold has closed red for the last two weeks after closing green for the previous nine weeks. Prices have corrected by ~$500 (~11%) from the highs to the lows of the past two weeks.

The GDX (an ETF of gold mining shares) outperformed gold for most of this year, as mining companies have positive leverage when bullion prices rise faster than production costs. However, the reverse happens when gold prices fall, and the GDX fell ~20% from the high to the low over the past three weeks.

Interest rates

Credit markets reacted sharply to Powell’s remarks (at the post-FOMC press conference), indicating that another interest rate cut at the December meeting was not a foregone conclusion.

10-year Treasury yields had been trending lower from 5% in mid-July to a low of ~3.95% in mid-October, but closed this week at ~4.08%.

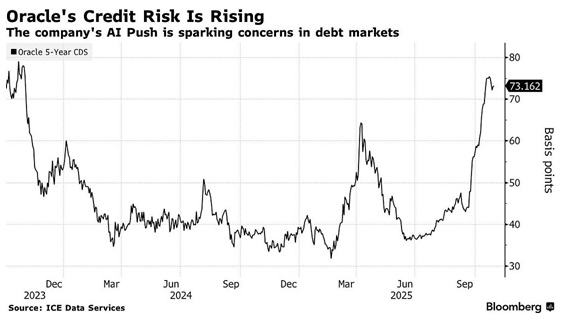

Credit risks appear to be rising, and not just on auto loans.

Crude oil

The front-month Nymex WTI contract traded with a $56 handle last week (and the forward curve had shifted to a mild contango) before Trump announced sanctions on the two largest Russian oil companies. Speculators were heavily short WTI and rushed to cover, driving prices to ~$62. Price action has been subdued since then, and OPEC is expected to announce another production increase this weekend.

Soybeans

The market appeared to front-run Trump’s announcement that China had agreed to resume buying American soybeans. Front-month prices closed this week at 15-month highs.

My short-term trading

I shorted WTI around $62 last week and stayed with the trade this week.

I had good profits from shorting gold the previous week, but didn’t want to remain short over the weekend. I reshorted it on Monday and covered for a gain of ~$60 oz. on Tuesday.

I bought OTM December Yen calls on Monday and added to them on Tuesday, “dipping my toes” into a long Yen trade. The market moved my way on Tuesday and early Wednesday, then turned against me on Thursday/Friday. I stayed with the trade into the weekend, but if there is no improvement next week, I’ll cut the trade. Being “early” on a trade is about the same thing as being “wrong” on a trade. The previous head of the BoJ, Mr. Kuroda, spoke after the BoJ meeting (when interest rates were left unchanged), stating that the Yen was significantly undervalued and expected it to rally to 120/130 (~20%), although he didn’t specify when.

I shorted the S&P on Thursday after the market reversed from record highs. I held the position into the weekend.

My general thought is that there is TOO MUCH LEVERAGE across markets, especially in equities, and that is their Achilles heel.

The week ahead

The U.S. Supreme Court is scheduled to begin hearing arguments regarding the legality of Trump’s tariffs on November 5. Two lower courts have ruled against Trump.

New York City has an election for Mayor on November 4. A hard-left socialist, Zohran Mamdani, appears to be the front-runner.

The Barney report

Barney and I were out in the pouring rain at noon today, with both of us decked out in our rain gear. I towelled him off before we came back into the house, and he’s been patiently dozing beside me while I write today’s Notes. The weather looks better now, so our before-dinner walk won’t be in the rain.

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the three significant market events this week: 1)Trump’s Asian tour, especially his meeting with Xi, the FOMC meeting and the quarterly reports from the big five tech companies. You can listen to the entire show here. My spot with Mike starts around the 1-hour, 1-minute mark.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair November 1st, 2025

Posted In: Victor Adair Blog

Next: Readers Have Questions »