November 24, 2025 | Proformas

Happy Monday Morning!

Last month we wrote a piece titled ‘Hold the Applause’ in which we cautioned the Carney Government for taking a victory lap following a bounce in September housing starts. For the record, we believe his policy team knows better, but couldn’t resist a good tweet.

As we noted,

The seasonally adjusted annualized rate of housing starts was 279,234 units, up from a revised 244,543 units in August. Remember, housing starts are reflective of investment decisions performed several years ago. A housing start, as defined by CMHC, is counted once the foundation is built back to grade. In other words, after the land was sourced, permits approved, pre-sales sold, land excavated and foundation poured. In other words, a seriously lagging indicator that gets muddied further with seasonal adjustments.

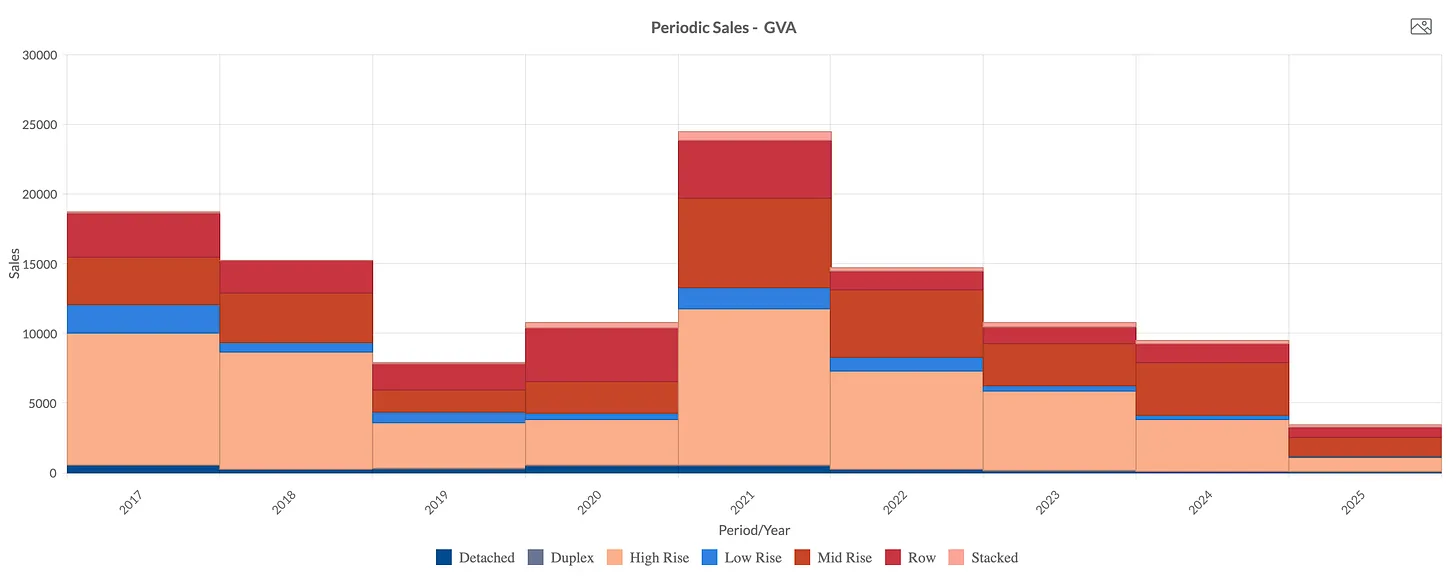

New home sales in Greater Vancouver are sitting at 3400 year to date, and should finish the year down about 60% from 2024, and nearly 85% below levels seen at the height of the bull market.

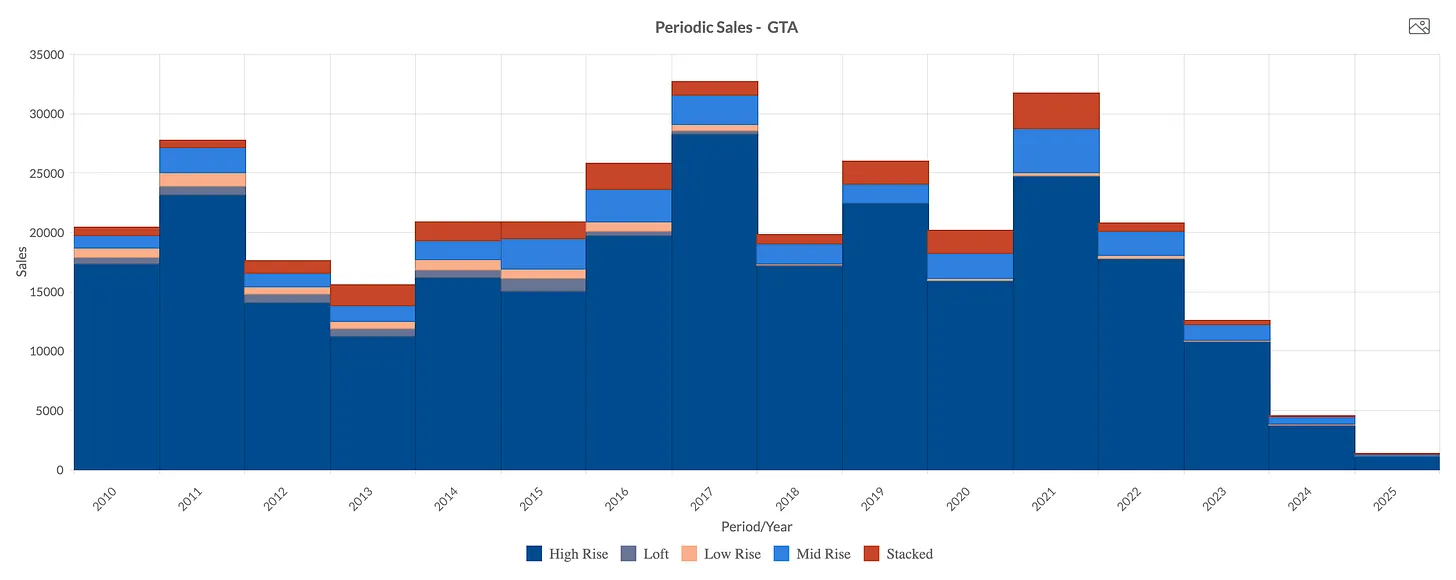

Things are even worse in the GTA where there’s been less than 1200 new home sales for the entire region. The average over the past decade is around 20,000 new home sales for the year. In other words, new home sales are effectively non existent in the GTA.

One can’t emphasize just how bad the pre-sale market is. The industry is on life support.

Cue the October headline.

Canadian housing starts plunged in October, with the SAAR (seasonally adjusted annualized rate) falling 17% to 232,800 units, according to CMHC.

“That brought the year-to-date average down to 256,000, a bit below our call for the year (260k) but still above last year’s overall result (245k),” notes BMO’s Robert Kavcic.

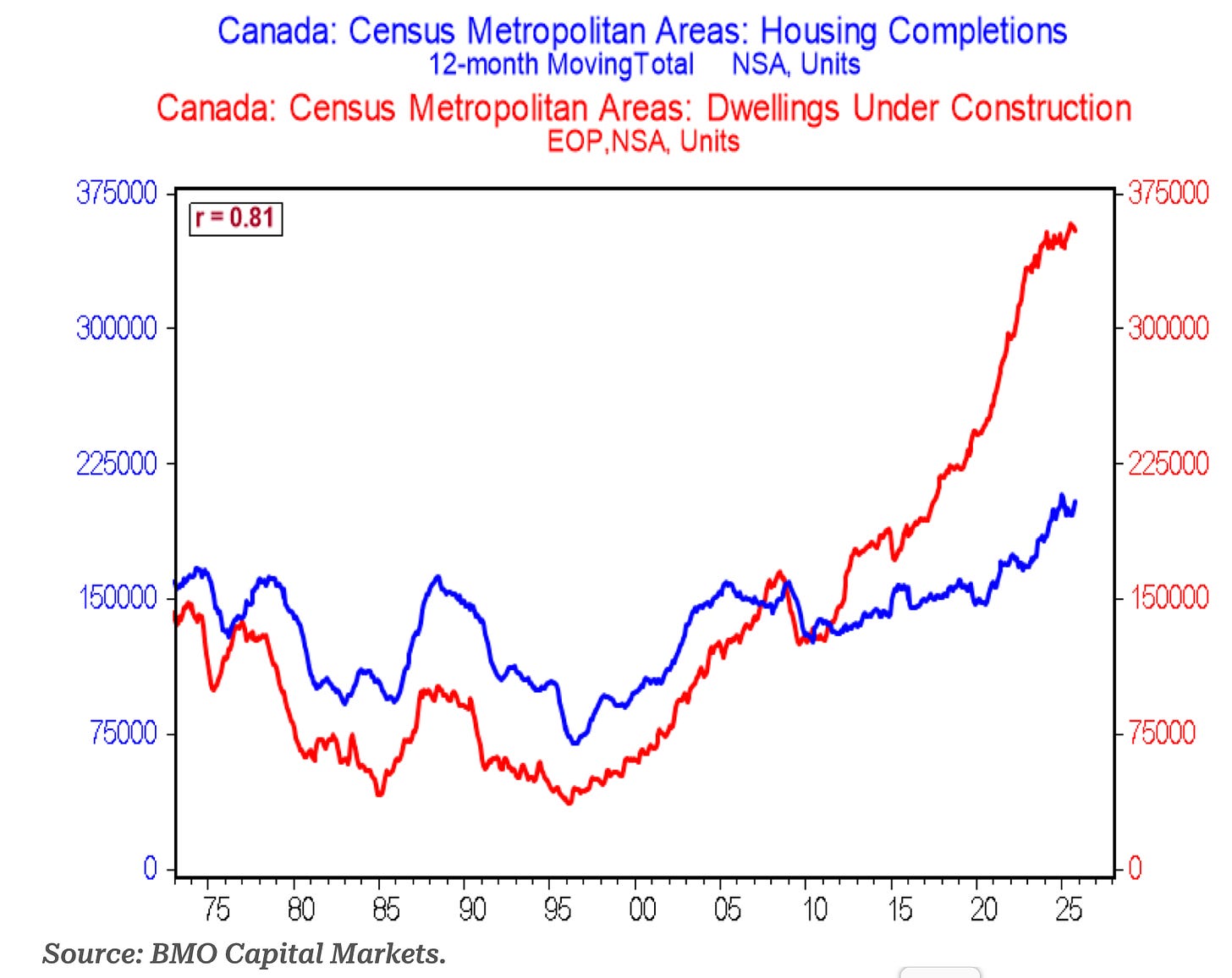

Adding, “completions are poised to challenge last year’s record high, adding heavily to supply and helping contain prices.”

In other words, housing starts are slowing, and the media headlines will look very bad sometime in 2026.

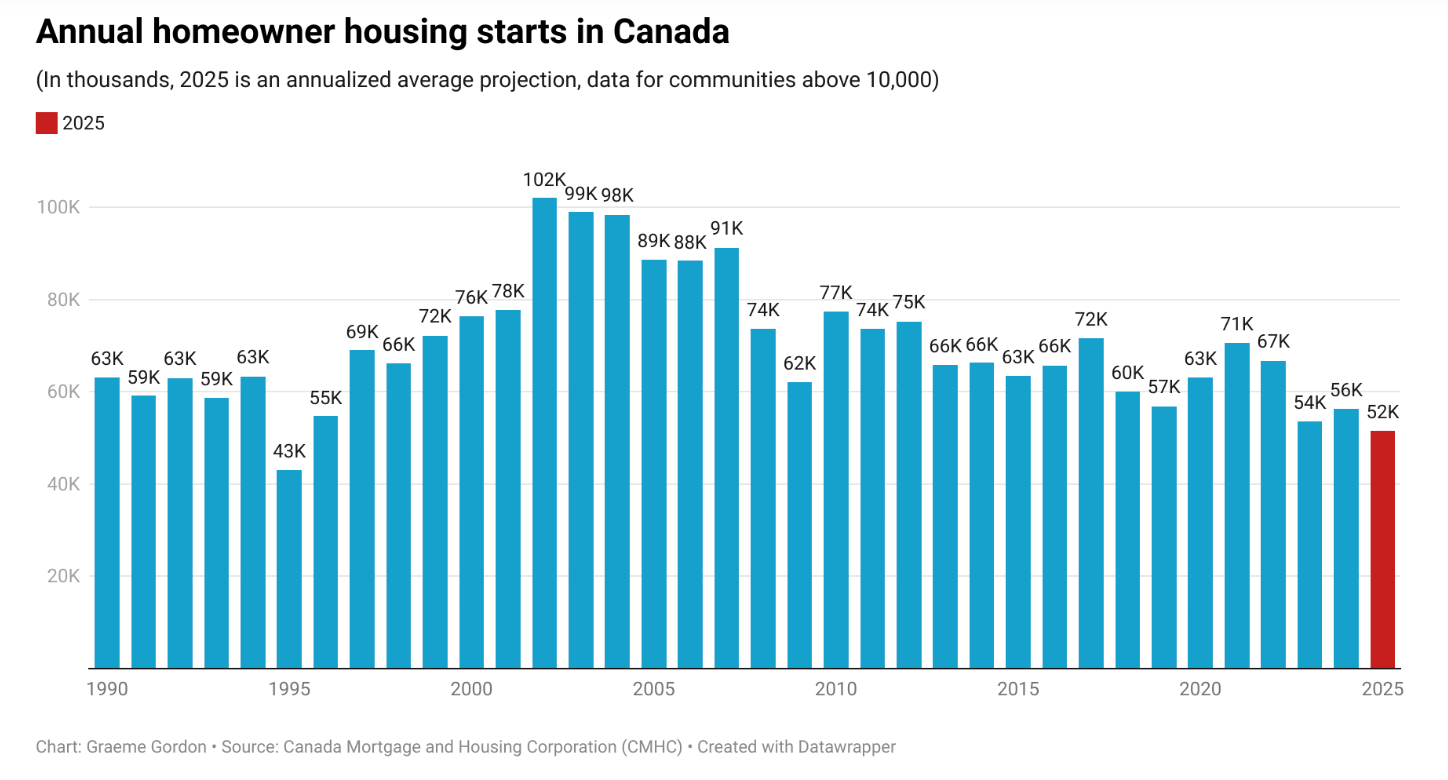

In fact, when you parse through the data it’s already concerning. Homeowner housing starts in 2025 show an average annualized rate of new builds tracking a 30 year low with only 41,384 homeowner housing starts recorded from January through October for cities or towns of over 10,000 people. We are on pace for just 51,545 new homeowner units started in 2025 per the Hub.

The only thing holding up housing starts is rental construction, which we believe is the next shoe to drop.

With condo pre-sales at a standstill more and more developers have been pivoting projects to rental, simply to keep employees on payroll and investors happy. We couldn’t help but notice the announcement from Marcon this month. Marcon launched presales in Spring 2025 and 102+Park was the only new concrete high-rise project to launch presales in Metro Vancouver in the first half of this year. It’s now pivoting.

While many developers are still pivoting to rental, we believe rental proformas are deteriorating quickly. Rents are falling, CMHC insurance premiums have surged, and population growth is heading to zero over the next two years. Lower rents and higher vacancies are a near certainty for many of these projects upon completion.

Any monthly bounce in housing starts should be faded. The trend is lower, much lower.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky November 24th, 2025

Posted In: Steve Saretsky Blog