Most people are worried about missing upside, not downside.

And usually to their detriment.

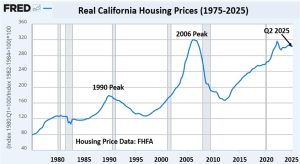

The chart shows the two-year time period (1990-1992) that I made my biggest profit ever in real estate. As shown HERE, my net profit was $600,000 – and my ROI was 100%.

Could I do something similar in today’s market?

Maybe, but probably not. Nor would I be eager to try.

First off, that same ordinary home I paid $500K for in 1990 would cost around $3.5 million today. Second, if I had to spend $300K to $400K to make that ordinary home beautiful and amazing, I would have to sell the property for almost $8 million to make the same 100% ROI as I did in the early 1990’s – and I doubt that would be possible.

But after what I anticipate will be a sizable correction in California home prices, I would be willing to buy that home for $2 million, put $300K into it, and then sell it for $4.5 to $5 million a year or two later.

Creating value in a low risk market. It doesn’t get any better than that.