November 21, 2025 | Nvidia Earnings: Strong Results, Stronger Expectations

Nvidia once again reminded investors why it sits at the center of today’s market narrative. Late Wednesday, the chipmaker reported fiscal third‑quarter results that exceeded Wall Street’s expectations and offered a revenue outlook for the January quarter that was even more impressive.

Source: FactSet

For the October quarter, Nvidia posted adjusted earnings per share of $1.30, topping consensus estimates of $1.26. Revenue came in at $57 billion, well ahead of the $54.9 billion analysts had forecast. Looking ahead, management guided to a midpoint of $65 billion in revenue for the current quarter, comfortably above the $62.2 billion consensus.

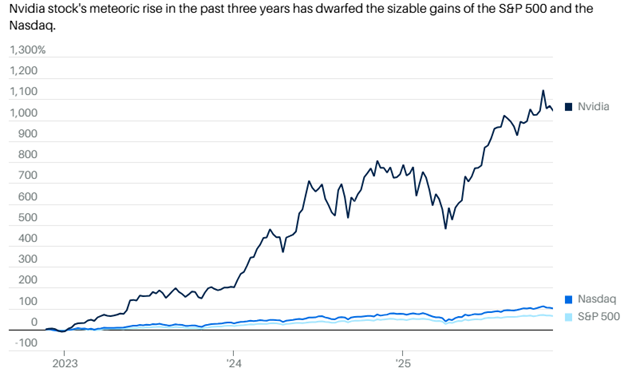

Markets responded swiftly. Nvidia shares jumped 4.4% in after‑hours trading, helping to stall a broader selloff that had weighed on equities in recent sessions. The S&P 500 broke a four‑day losing streak on Wednesday, underscoring how pivotal Nvidia’s results are to overall sentiment.

Context Matters

While the numbers are undeniably strong, it’s important to place them in context. The so‑called “Magnificent Seven” stocks — the group of mega‑cap technology leaders including Nvidia — have collectively fallen nearly 8% from their late‑October highs. With the exception of Alphabet, they’ve led the decline since the market peaked on October 28. This pullback has nudged them below their 50‑day moving averages, interrupting what had been a remarkably consistent upward trend since May.

Nvidia itself has seen its market capitalization shrink by more than $600 billion in recent weeks, a staggering figure that nonetheless only resets the company to levels seen before its last earnings report. Investors appear to be waiting for confirmation that growth remains intact before recommitting capital. Wednesday’s results may provide that reassurance, but it would be premature to declare the volatility over.

Broader Market Signals

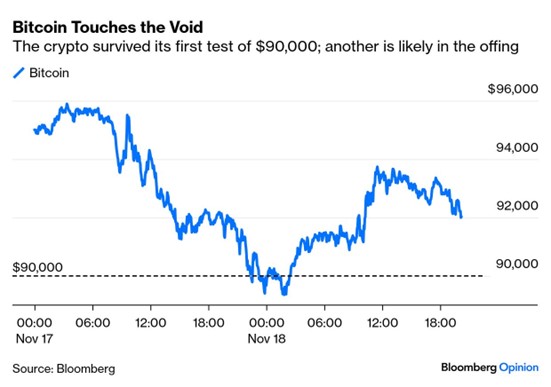

Beyond equities, other asset classes are flashing caution. Bond market volatility, subdued for much of the year, has begun to stir again. Bitcoin — often viewed as a proxy for speculative appetite — recently dipped below the $90,000 threshold before bouncing back, suggesting traders are nervous but not panicked. These signals reinforce the idea that markets are being driven as much by psychology as fundamentals.

What It Means for Investors

Nvidia’s quarter was undeniably strong, and its guidance suggests momentum will carry into early 2026. Yet investors should resist the temptation to extrapolate too much from one company’s results. U.S. equities remain expensive by most valuation measures, and history reminds us that no one can reliably time the market.

The lesson here is not to chase exuberance but to remain disciplined. A diversified portfolio across sectors and geographies continues to be the best defense against volatility. Nvidia’s performance highlights the opportunities in technology, but it also underscores the risks of concentration.

In short, Nvidia delivered — and the market cheered. But prudence remains the wiser course.

Fraser Betkowski

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth November 21st, 2025

Posted In: Hilliard's Weekend Notebook