October 25, 2025 | Trading Desk Notes for October 25, 2025

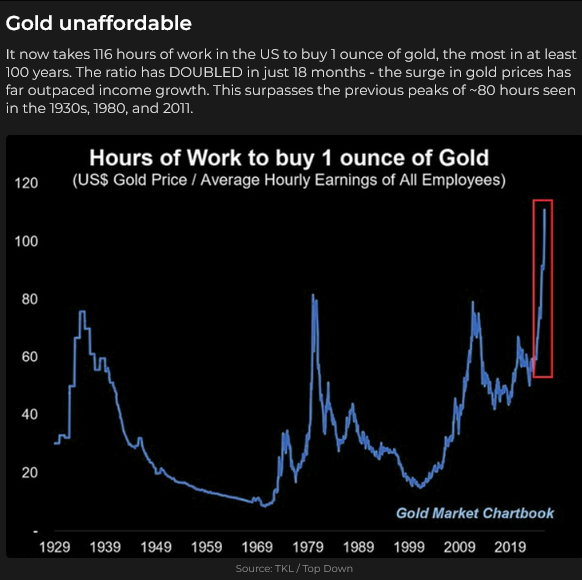

Gold prices corrected this week after closing higher for nine consecutive weeks, with prices up over $1,000 (~31%) from the August lows.

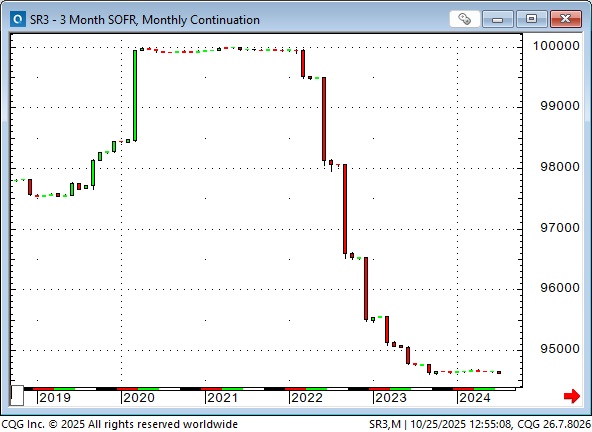

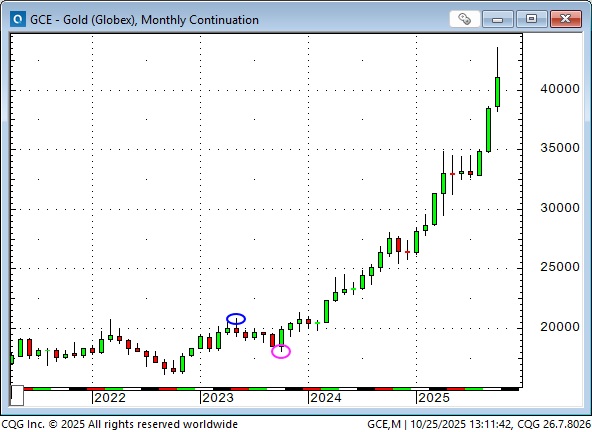

Gold rallied above $2,000 for the first time in August 2020 (blue ellipse) as governments and central banks reacted to covid, and as the US 10-year bond yield fell to a historic low of ~0.50%.

Gold rallied to a slightly higher level in early 2022 following the Russian invasion of Ukraine (pink ellipse), but then fell for seven consecutive months (blue rectangle) down ~$450 (22%) from the March 2022 highs as the Fed began raising interest rates and the USDX surged ~20% to 20-year highs. (A rising US Dollar, together with rising US interest rates, was “toxic” to the gold market.)

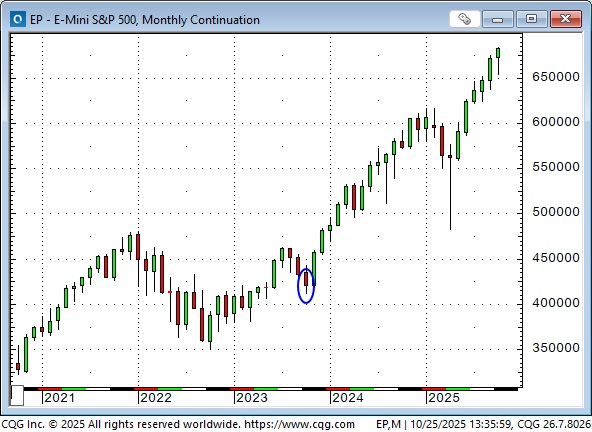

The S&P fell ~27% from January to October 2022 (blue rectangle), giving back ~50% of the rally from the March 2020 covid lows to the January 2022 all-time highs, as the Fed raised interest rates from ~0.25% to ~3.25%, and the market expected the Fed to keep raising rates.

(The Fed continued to raise interest rates in late 2022 and into 2023, reaching a high of 5.25-5.50%, but gold and the S&P rallied during that time.)

Gold briefly reached a new record high in May 2023 (blue ellipse at ~$2,085), but couldn’t sustain those levels and dropped ~$275 to the October 2023 lows (pink ellipse) as US 10-year Treasury yields rose from ~3.45% to a 16-year high of 4.95%.

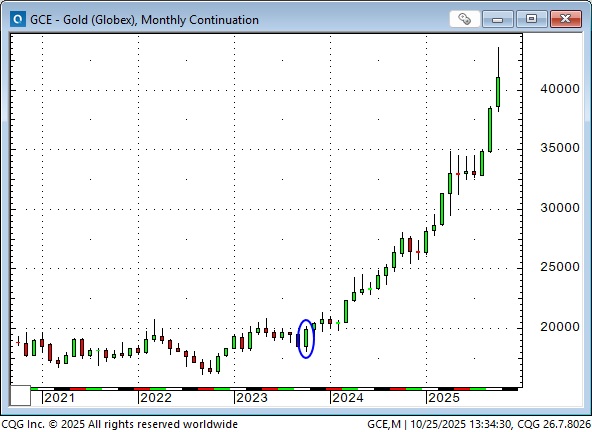

Hamas attacked Israel in early October 2023 (blue ellipse on the chart below), sparking a $300 (~17%) rally to new record highs over the next two months. Two years later, in October 2025, gold was ~$2,550 above its October 2023 lows.

In late October 2023, US bond prices began to rally from 16-year lows, and the S&P also turned decisively higher. From the October 2023 lows to the October 2025 highs, gold rallied ~140%, and the S&P rose ~66%.

Gold shares outperformed gold in 2025 for the first time since 2011

The GDX (Gold Miners ETF) modestly outperformed gold during the late stages of the 2008 to 2011 commodity bull market, but then woefully underperformed gold from 2012 to 2025. The GDX nearly tripled from October 2024 to this month’s highs, as did gold, but the GDX rallied ~112% from April’s lows to this month’s highs while gold gained ~48%.

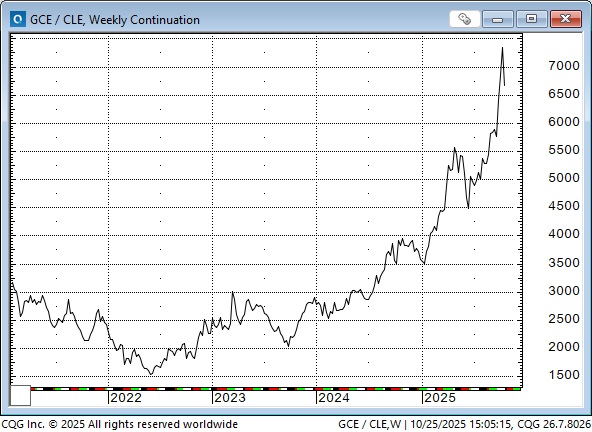

The gold / crude oil ratio

The value of 70 barrels of WTI is now about equal to the value of one ounce of gold. Outside of a very brief spike in April 2020, when front-month WTI futures traded negative for a day, that’s the most expensive gold has been relative to WTI over the past forty years (and probably much longer than that!) The value of gold relative to WTI has soared by a factor of 5 over the last 3 years.

I started trading gold in 1974 when it rose from ~$100 to ~$200 in anticipation of “huge demand” once Americans were allowed to own gold in 1975, for the first time in 42 years. (There was also an element of gold being recommended as “real money” compared to “paper money,” while “gurus” advised clients to own gold, silver coins, dehydrated food and guns.) The DJIA had reached record highs in 1973 and fell nearly 50% by late 1974. That massive decline may have added to investors’ anxiety and boosted demand for gold.

Gold prices slumped from ~$200 to ~$100 by mid-1976 as Americans showed little interest in gold, and the DJIA recovered most of its losses, but then a magnificent rally developed, which took gold to ~$850 by January 1980. The big “inspiration” at that time was “runaway inflation” with the American CPI rising from ~10% in 1975 to ~15% in 1979. The “cherry on top” may have been the Russian invasion of Afghanistan in late December 1979.

The daily chart shows that gold rose from ~$600 to ~$850 and back to ~$600 in 12 trading days in January 1980.

What’s next for gold?

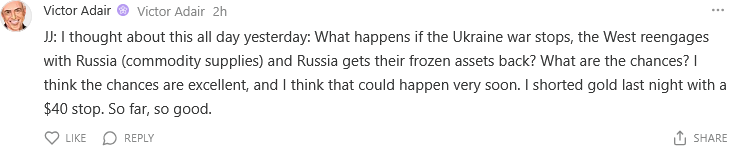

I traded gold from the short side this week as the market fell ~9% from top to bottom. I’ve thought it was overdue for a correction for the past couple of weeks, but I waited patiently for a good entry point. I noted that open interest has been declining from mid-September (not a good sign when prices are rising), and I saw record COMEX trading volumes on October 17. That, together with weakness in the “super-charged” GDX, seemed to create an opportunity to get short. I looked at several ways to participate, including time spreads and option strategies, but decided to simply short futures with a $40 stop. As always, my position size relative to my account equity was modest.

I’m flat over the weekend (I can’t manage risk when the markets are closed), but I’ll look for opportunities to get short again next week.

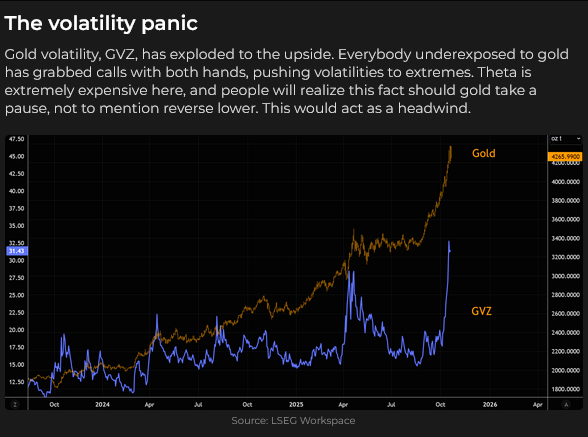

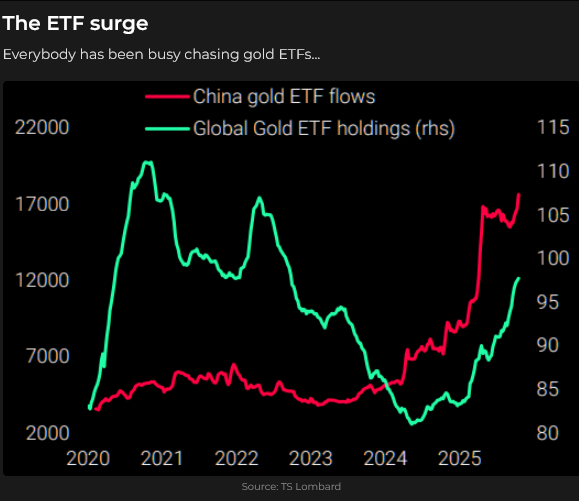

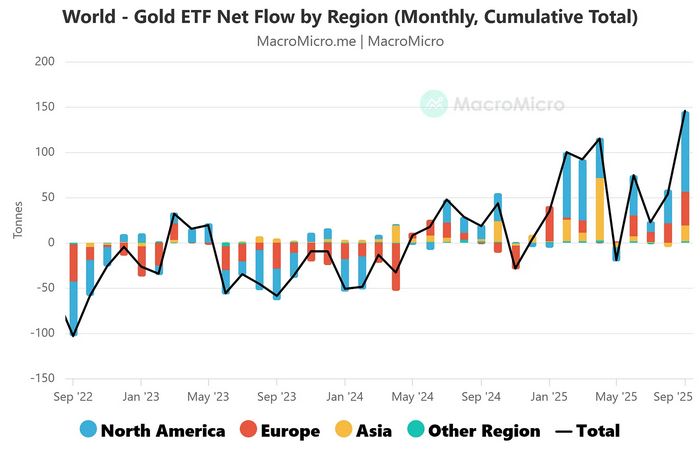

I’m well aware of central bank buying, and I certainly understand the “debasement/lack of trust in government” ideas that have boosted prices, but I think that “speculative fever” has exaggerated the rally, and there will be more of a correction.

To be fair, I’ve also thought that stock indices were gripped by “speculative fever,” and I’ve lost a little money shorting them.

My willingness to probe the short side of gold is not based simply on technical analysis. Given the news flow these days, it is easy for people to have dark thoughts about the future (and they may be right!), but I was wondering this week what would happen if the Ukraine war ended. If I were asked to imagine what would happen if the war stopped, how would I answer?

My other trade this week was to short WTI futures at ~$62 after they rallied from around $56 following Trump’s announcement of sanctions against Rosneft and Lukoil. I understand these sanctions may have more “bite” than the European sanctions, which have done nothing to slow the flow of Russian crude, but I think speculators were heavily short and their covering caused the rally—it was not new buying that took the price up. My fundamental (short-term) view is that the market is oversupplied. As always, I have an active stop and a modest position size.

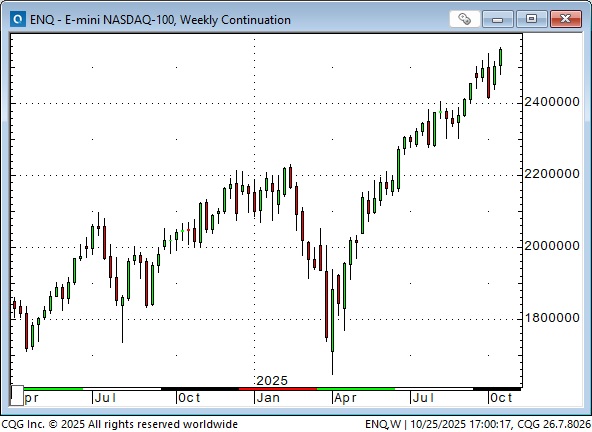

Stock indices

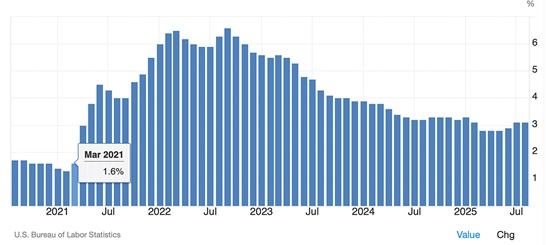

Global stock indices continue to rally, with leading US indices at all-time highs, following Friday’s CPI report, which was a shade weaker than expected. (But still, 3% is the new 2%.)

The seasonal “Santa Claus” rally is historically one of the strongest rallies each year. BUY THE DIP has been a great strategy! AAPL is at a new record high—the top 10 US stocks = 40% of the US market cap. This coming week is the “Big One” for companies reporting, and (of course) they will beat estimates, they always do. Corporate buybacks will resume in force in November.

The Nasdaq 100 futures are up ~55% from the April lows.

ICYMI: here is the long-term NAZ chart. It is up 25X from the 2009 lows.

Trump

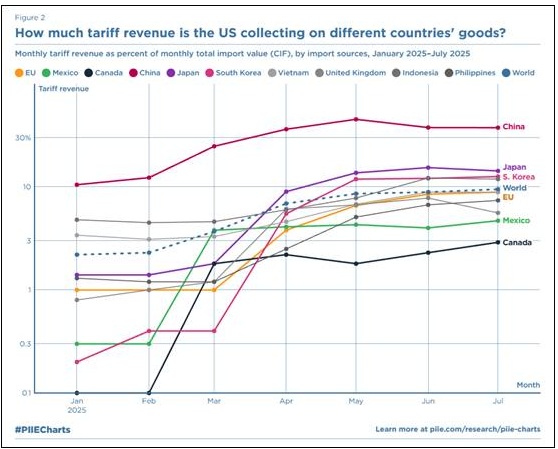

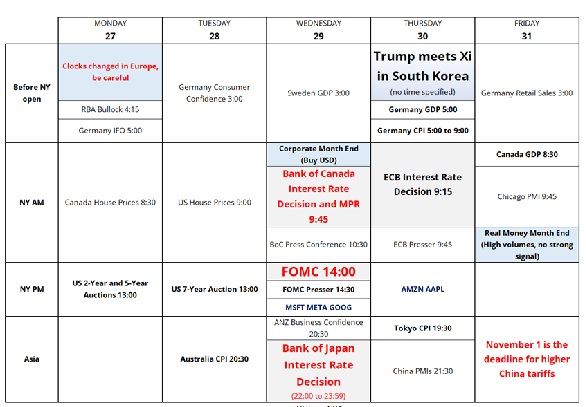

Trump’s “brinkmanship” is a massive driver of price volatility across markets. (See my comments on oil above.) He will be in Asia this week (Malaysia, Japan, and South Korea) and is scheduled to meet Xi on Thursday at the APEC conference in South Korea, 48 hours before his new tariffs against China go into effect. Markets are expecting a “cooling” of trade tensions, but who knows?

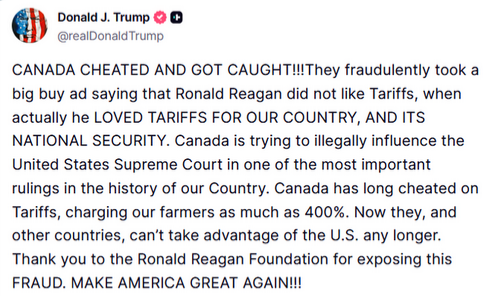

Trump “took issue” with Doug Ford’s American advertising campaign, which showed Ronald Reagan speaking out against tariffs, and called a halt to trade talks between the USA and Canada.

The US Supreme Court is scheduled to start hearing arguments on the “legality” of Trump’s tariffs on November 5. Two lower courts have already ruled against Trump.

Trump has ordered the American Super Carrier Gerald Ford Strike Group to leave the Mediterranean and take up position in the Caribbean.

It will be a busy week!

Markets expect the FOMC and the BoC to cut rates by 25 bps next week, and the FOMC to cut another 25 bps in December. The Fed is more worried about unemployment than inflation.

Japan has its first female Prime Minister. She sees herself as a Japanese Margaret Thatcher. Trump will meet her in Tokyo this week.

Argentina holds mid-term elections on Sunday, which will be a vote for/against Milei’s reforms.

Here’s a calendar from Brent Donnelly

Listen to Mike Campbell and me discuss markets

On the Moneytalks podcast this morning, Mike and I discussed the sharp break in gold, the surging stock market, and the rally in WTI on the back of Trump’s sanctions. I also told Mike why I had been greatly impressed by the Catch The Energy Conference in Calgary. You can listen to the entire show here. My spot with Mike starts around the 46-minute mark. Be sure to listen to my friend Tony Greer (around the 5-minute mark), who will be speaking again this year at the World Outlook Conference in Vancouver in February 2026.

The Barney report

Barney and I have been playing a lot of “fetch the ball” lately because I’ve noticed he’s gained a little weight. It’s my fault, because I give him more food than I should when he gives me the big “sad eye.” We go to this big open field and he chases the ball until he gets tired, and then we go for our regular walk in the forest.

I lost another longtime friend two weeks ago

I got a call from a friend who told me Jimmy was in the hospital and not looking good. I took the first ferry to Vancouver the next morning and was in his hospital room by 9 am. We had a super visit for two hours, talking about different things that had happened over the 50 years we’ve known each other. He was like an older brother to me. He had been a very successful new-issue trader, initially in the bond market, but for the past 25 years, he had primarily traded new stock issues. He only traded his own money; he never had any interest in managing other people’s money. He was a good man who always kept his word. He passed away a few days after our visit. I talk to Jimmy and Peter (who died in September) when I’m walking Barney.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair October 25th, 2025

Posted In: Victor Adair Blog