September 3, 2025 | Which Housing Domino Will Fall First?

At least three big groups of homeowners have the potential to crash the US housing market. And with home prices at unaffordable levels and mortgage rates above 6%, it’s now a question of when, not if, this market tanks. But it’s still fun to speculate about which domino will be first to fall?

Here are three likely suspects:

Aging Boomers

I live in a neighborhood that’s mostly retirees in pricy houses. And a couple of things are happening:

- Many of our neighbors are sick, some seriously, which makes statistical sense. If a married couple is in their 70s, the odds that one of them is dealing with health issues are pretty high. In just the past year, several of them have died, and in every case, the surviving spouse — in no shape to manage a big house on a high-maintenance lot — has immediately put it on the market.

- Other neighbors are moving to be closer to their grandchildren. One couple, who have become good friends and will be sorely missed, just made an offer on a Florida house for that reason. If the offer is accepted, they’ll immediately list their current house for sale.

Basic math says that as Boomers age, the above trends will intensify. Who will buy the Boomers’ 30 or so million houses? Well, at today’s prices, no one, obviously. The average Millennial or Gen Z buyer can’t come close to affording the required mortgage.

Meanwhile, the kids and grandkids who inherit Boomer McMansions frequently can’t keep them. Another personal aside: A friend just died, leaving her house in Washington state to her daughter, who lives in Alaska. The daughter and her husband have just remodeled their existing home, leaving them with no money for upkeep on an inherited house in another state. Faced with this new cash drain, they’re considering listing the house immediately.

Conclusion: Boomers are becoming a source of massive new housing inventory, and will continue thus for at least another decade.

Failed Airbnb entrepreneurs

Once upon a time, Airbnb was about making housing part of the “sharing economy” by allowing regular people to monetize spare rooms or RVs or even backyard tents by renting them to strangers. (Yes, that sounds even creepier than ride sharing.)

It worked, at first. Tenants got cheap, quirky, and convenient rentals while owners got small but welcome bits of extra cash.

One more personal aside: My first Airbnb experience was maybe a decade ago, when I rented an RV in Arizona for a couple of nights. The owners lived in a neighboring RV and invited me over for dinner. We had a good time, and I left a 5-star review. Smooth and easy.

But now, the typical Airbnb rental is an upscale, expensive, and highly complicated proposition, with requirements that the tenant clean up before leaving and multiple fees that frequently raise the cost to as much or more than nearby hotels.

Adding to the creepy vibe, it has recently been discovered that some Airbnb hosts have wired cameras into their units to spy on tenants. Here’s a video explaining how to detect those cameras:

Last but not least, a typical Airbnb entrepreneur now owns multiple properties and only interacts with tenants when there’s a problem. The algorithm handles everything else.

The result: A growing number of travelers are asking Why bother with the complexities and uncertainties of an Airbnb when a hotel costs the same and doesn’t require you to clean up after yourself?

So…an inferior — or at least unpredictable — product peddled by amateurs who are leveraged to the hilt and have never weathered a serious downturn. A bust sounds pretty much guaranteed. But is it imminent? Let’s see what’s happening now:

Soaring inventory. Short-term rentals became a get-rich-quick scheme for inexperienced people who had access to cheap financing in the early 2020s. And now these folks have over 2 million units, many of which are not generating positive cash flow:

One of the biggest challenges currently facing the short-term rental market is market saturation. As the Airbnb platform gained popularity, an influx of new property owners and investors rushed to list their homes and apartments. Cities like Dallas saw more than 6,000 new Airbnb listings added since 2020, far outpacing local demand. This oversupply has created intense competition among property managers, driving down nightly rates and occupancy in many areas. What once looked like easy profit has become a struggle for visibility and pricing power in an increasingly crowded STR market.

The following video predicts massive forced selling by Airbnb landlords:

Private Equity “Landlords”

After the 2008 housing bust, the only people with access to cheap credit were hedge funds and private equity firms. They used some of this capital to buy up houses — sometimes entire neighborhoods — and converted them to rentals, raising rents and scrimping on upkeep in the face of strong demand from people who had no choice but to rent.

What more needs to be said? Obviously, Wall Street sharks are terrible landlords, and — given their propensity to pile into and then back out of bubble assets — they’re setting the housing market up for a crash.

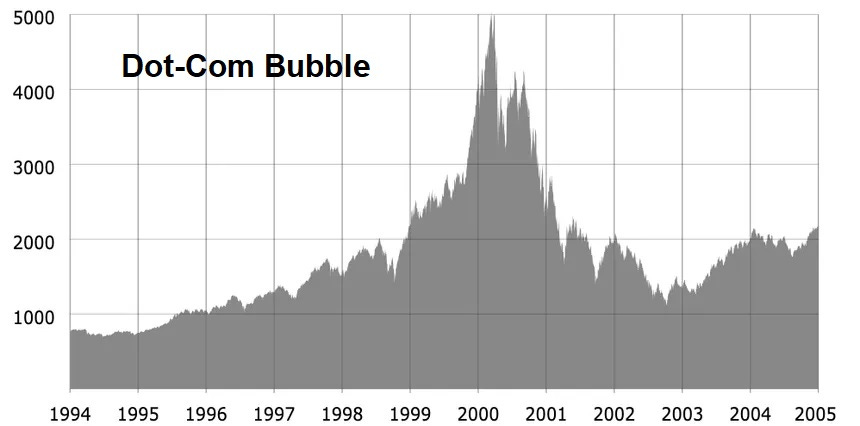

But, you might ask, aren’t these guys the world’s most intelligent people? Well…high IQs, yes, but judgement, no. Look at the chart for the 1990s tech stock bubble for a view of housing’s future. Remember that in 1999, Wall Street’s geniuses were all-in on the dot-com stocks:

Which Goes First?

This is a tough one, because all three of these potential dominoes are teetering as this is written. Boomers are aging, Airbnb landlords are hemorrhaging cash, and private equity “landlords” are in waaayyy over their heads. So relying on personal experience, I’m going to rank them in this order: Airbnb landlords first, Boomers second, and private equity as the crescendo that blows up the banks along with housing. Have fun, and keep stacking

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino September 3rd, 2025

Posted In: John Rubino Substack