September 27, 2025 | Trading Desk Notes for September 27, 2025

Buy The Dip has worked like a charm for years. Is it still a good idea?

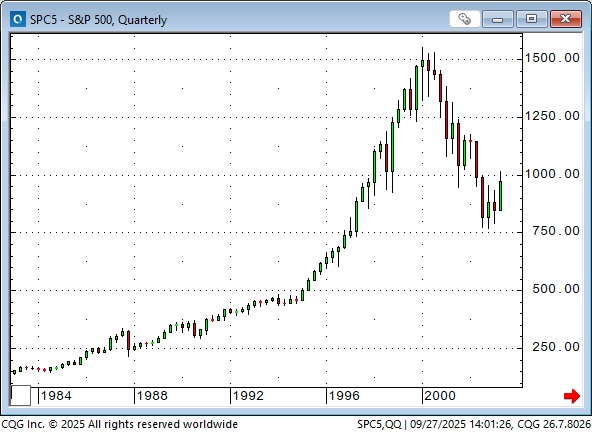

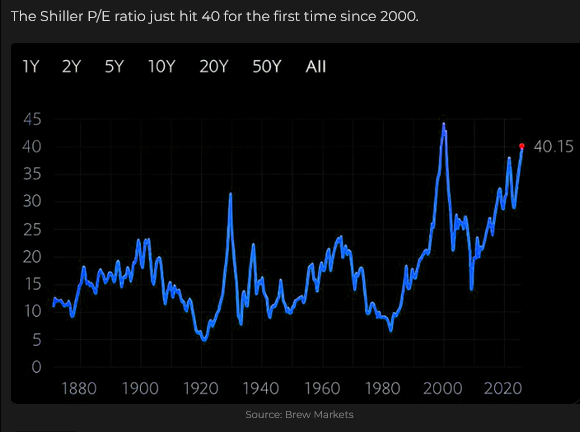

The S&P has rallied ~40% from its low in April and reached another all-time high this week. It’s up ~92% from the October 2022 lows, and more than 200% from the 2020 lows. It’s up 10X from the 2009 lows. Can anything stop this train? My honest answer is that I don’t know, but this feels a lot like 1999 to me.

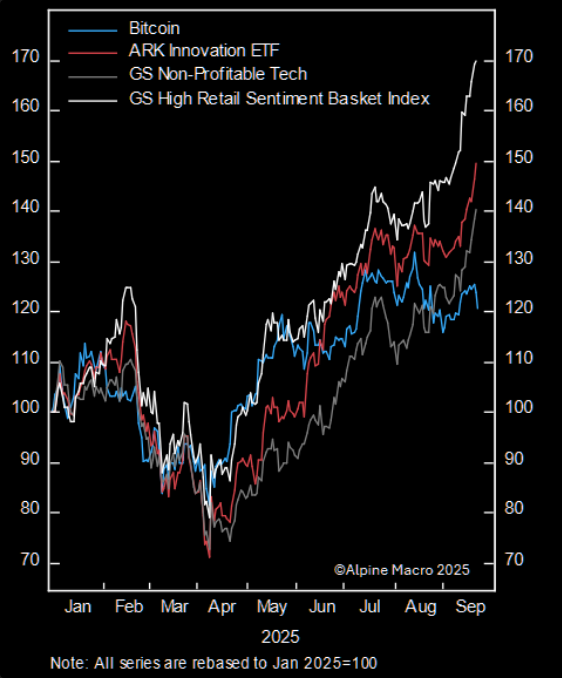

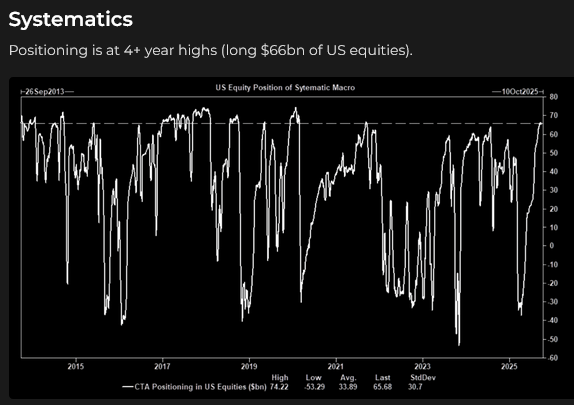

I don’t make my trading decisions based on assumptions about how I think the world will look 18 months from now; I’ve no idea about that (and I’m dismissive about anybody who thinks he knows), but I pay very close attention to mass psychology (thank you, James Dines, for the autographed copy) and that “feels” giddy to me lately. Could the market continue to surge higher? Of course, but I think the market action over the past month shows (a possible late-stage) surge of leveraged capital into the higher-risk/higher-reward end of the market, and that may signal a looming top. Check out the white line on this chart from Goldman Sachs: High Retail Sentiment. That last leg higher started around mid-August.

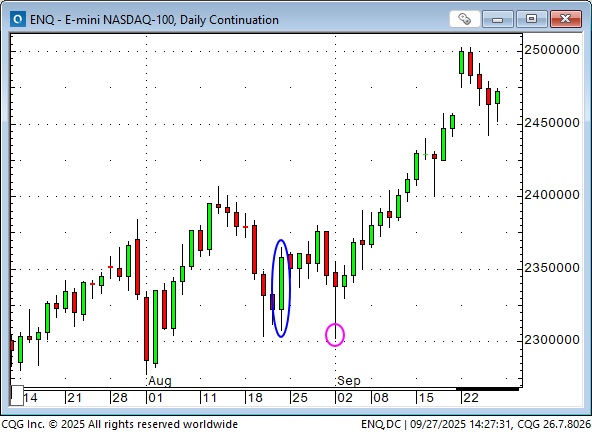

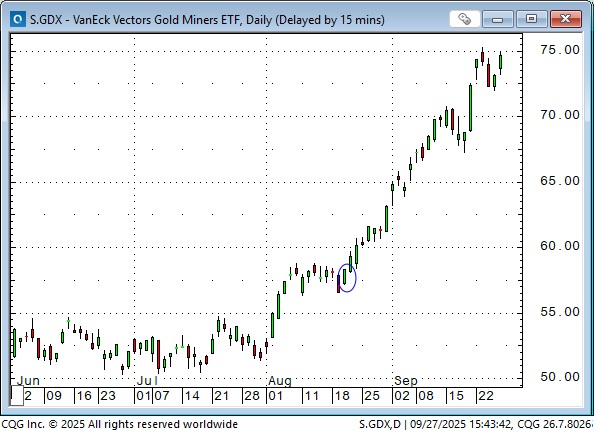

The stage was set for this FOMO surge of capital into higher-risk assets when the Nasdaq futures reached an all-time high on August 13, but closed red on the day. It closed red for seven consecutive days (blue ellipse) and some people may have thought that was THE high. (I looked back over five years of charts and couldn’t find another example of the NAZ closing red for seven consecutive days.)

However, the lows of August 20 held, followed by an inside day on the 21st, and then the NAZ had a strong green day on August 22 in response to Powell’s Jackson Hole speech (blue ellipse). The lows were tested on September 2 (pink ellipse), following the Labour Day weekend, and then the surge to this week’s record highs began with a vengeance. (Over the years, I’ve noticed markets tend to be “un-eventful” during August and then open September with a bang – that happened in spades this year!)

The Key Turn Date

When several different markets change direction on or around the same date, it signals that a significant event has occurred. A gangbuster KTD would be when equities, currencies, interest rates and commodities all reversed on or around the same date. The August 20/21 KTD was not a gangbuster; currencies (mostly) continued to drift sideways, but there were notable reversals in some higher-risk equity markets, interest rates, and commodities (especially metals).

Reasons for the loss of momentum: 1) too high, too fast, especially “speculative issues,” 2) expectations for more Fed cuts have been scaled back as US economic, employment, and consumer spending data came in stronger than expected. Since the September 17 FOMC (blue ellipse) meeting, SOFR futures have reduced cut expectations by 25 basis points. The Atlanta Fed’s GDPNow for Q3 is now over 3%.

I’m not saying “sell everything, the market’s going to crash” (nothing on this website constitutes investment advice for anyone about anything), I’m simply illustrating a trading idea/view. (If you have similar views about the “giddy” nature of market psychology, I recommend this article about taking defensive action published yesterday by my friend Lance Roberts.)

I’ve circled the KTD on a variety of charts (some folks may accuse me of “cherry-picking” and maybe I am). Still, I’m trying to make the point that mass psychology shifted on the August 20/21 KTD, and for the next month, especially after Labour Day, capital surged into higher-risk assets. This month-long surge appeared to lose momentum this week, which may signal a top.

Equities

On Monday of this week (pink ellipse) NVDA announced a $100 billion investment in OpenAI. The stock closed at an all-time high, as did the NAZ and the S&P. Prices fell away from those record highs on Tuesday through Friday.

Interest rates

Commodities

Currencies

In this chart of the Chinese RMB, lower prices mean it takes fewer RMB to buy one USD.

The DXY US Dollar index hit a 4-year low on September 17, Fed day (pink ellipse) and has rallied ~2.5% since as markets have priced in the diminishing chance of aggressive Fed cuts over the next few months. The sharp rally on Wednesday/Thursday may reflect some unwinding of the big short USD speculative short positioning.

In other news

Stocks

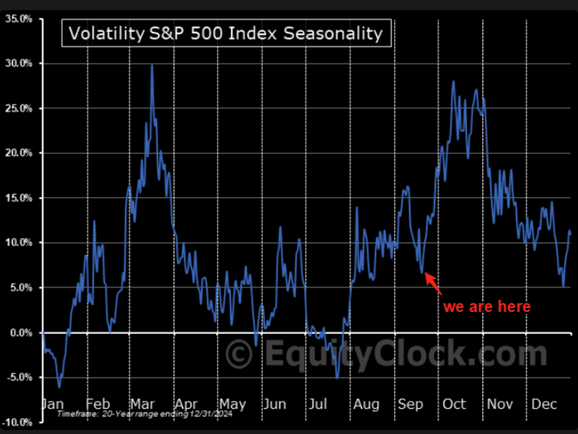

Equity markets have had a powerful rally from the April lows and I think they may now be at risk of (at least) a correction, as short-term interest rates are rising. Additionally, month-end and quarter-end rebalancing this week may pressure prices. Buyback volumes will be lower as corporations enter a blackout period ahead of quarterly reports, and systematics may turn sellers if volatility rises.

Metals

Copper rallied ~5% on Wednesday on news that mining activity at the Grasberg copper mine in Indonesia has been suspended. Freeport-McMoRan shares fell ~22%.

Silver prices, which had been aggressively bid over the last few weeks, jumped ~$3 to new 14-year highs ~$47 on Thursday/Friday as markets realized that newly mined silver supplies would be reduced by copper mines shutting down. (About 70 – 75% of newly mined silver comes as a byproduct from base metal mines.) The sharp rally in silver prices over the past month has caused OTM silver calls to soar. People who own silver might consider writing calls.

Gold

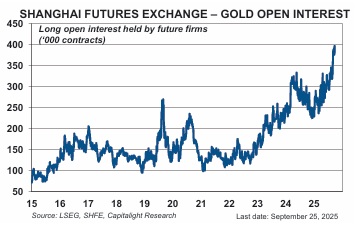

Open interest on the Shanghai gold futures market keeps climbing to new record highs. I maintain that Chinese buying (Central bank and speculators) is setting the global gold price. (These charts are from the Gold Monitor)

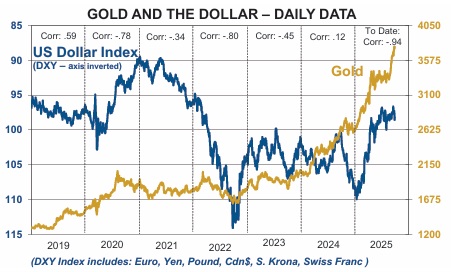

Gold and the USD have had a strong negative corelation YTD: USD down, gold up.

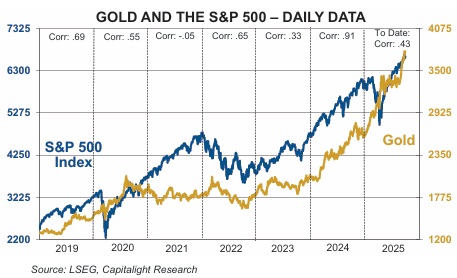

Since the lows in 2022, gold and the S&P have been rising together.

Quote of the week

“There is no risk free path.” Jay Powell, Federal Reserve Chairman

My short-term trading

I was stopped out of my long Yen position early this week for another slight loss after it had been “looking good” on Fed day (blue ellipse). My analysis time frame is expecting a stronger Yen, but my trading time frame (that’s where my risk management shows up) says “not yet.” The NFP report on Oct 3 may impact FX markets, and Yen traders will be watching the outcome of the October 4 vote for a new leader of the LDP party.

I shorted the S&P on Tuesday as prices fell away from Monday’s all-time highs. I’ve held that trade into the weekend.

The Josef Schachter Annual Energy Conference – Calgary, October 18, 2025

I look forward to attending Josef’s annual energy conference again this year. I’ve attended every one over the past several years, and I’m not only continually amazed at the quality and diversity of the presenters, but I also learn more every year about the energy business and the incredible technological advances the industry is undergoing. For more information about the conference and to buy a ticket, click here. Check out Josef’s weekly “Eye On Energy” letter on Substack.

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show Mike and I discussed my ideas about a possible turn in the stock market. We also discussed the metals market, especially silver. You can listen to the entire show here. My spot with Mike starts around the 46-minute mark. Be sure to listen to Josef Schachter and Mike talking about the oil and natural gas markets, starting around the 6-minute mark.

The Barney report

Here’s Barney catching a little sun while he guards the gate between our house and the golf course. What a beauty!

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair September 27th, 2025

Posted In: Victor Adair Blog

Next: Disruptive Thoughts »

Thank you Victor, like always your wisdom is either enlightening or a confirmation of some of my lucky brilliance in trade decisions.