September 21, 2025 | Trading Desk Notes for September 20, 2025

Keep dancing until the music stops

The S&P 500 Index closed the week at 6664, a new record high, up 10X from the March 2009 lows of 666, and up ~38% from the April lows.

The rally in global stock indices is impressive as capital flows into equity markets everywhere. China is experiencing deflation, as property prices continue to fall, yet the leading stock indices have increased by ~50% over the last 12 months and by ~30% since the April lows. The stock market is not the economy.

The Canadian economy is weakening with unemployment over 7%, yet the TSE index closed this week at a record high, up ~35% since the April lows, closing green for 20 of the past 24 weeks.

I wonder if Canadian pension funds, with total assets of approximately CAD$3 trillion, have withdrawn some capital from USA markets due to “Trump” and redeployed those funds in Canadian markets. The leading Canadian pension fund is the CPP, which, as of June 2025, had ~47% of its total assets of CAD$714 billion invested in the USA, compared to ~13% invested in Canada. Do you think there might be some pressure from PM Carney to invest more in Canada?

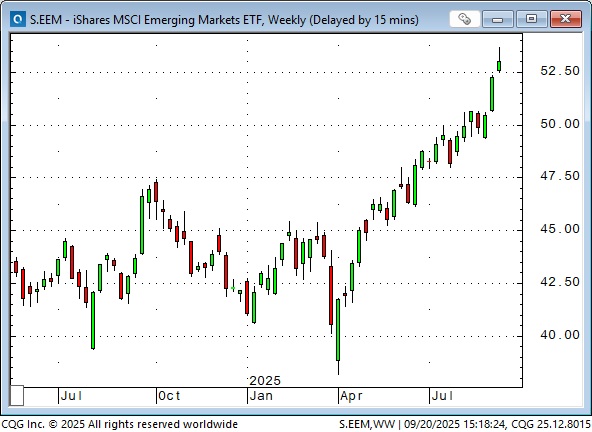

The emerging markets ETF is up ~40% from the April lows.

The Dow Jones World Index is at an all-time high, up ~36% from its April lows.

Most global stock indices were at or near record highs before the Fed cut short-term rates by 25 basis points on Wednesday, and they rallied further on Thursday and Friday, boosted by assumptions that the Fed will continue to cut rates over the next several months.

A “friendly” telephone conversation between Trump and Xi on Friday, and a confirmation that they will meet at the October APEC conference in South Korea (meeting for the first time since 2019), together with a strong “quad witching” bid boosting prices above Thursday’s highs, may have helped lift the S&P (and NAZ and DJIA and Russell 2000, and TSE) to a new all-time high close.

“Everybody knows” (as Leonard Cohen would say) that AI/technology has been leading the global stock market rallies and that “concentration” is at or near record highs, and that is (apparently) dangerous because parabolic rallies don’t correct by going sideways.

In last week’s Notes, I wrote that some analysts claim that “Old School” valuation metrics no longer apply (I said that sounded suspiciously like This Time Is Different), but, in reality, the FOMO/TINA flow of capital into equity markets, including, and perhaps especially passive flows are creating a “perpetual motion machine” whereby massive inflows drive prices higher begetting even more massive inflows.

The Federal Reserve reports that American household wealth (the increased asset values of real estate, equities, bonds, and other assets) is up by approximately $65 trillion since the March 2020 equity market lows. That’s an average of ~$1 trillion per month.

Ben Graham told us that in the short run, the market is a voting machine (a popularity contest), but in the long run, it is a weighing machine (valuations determine prices). Well, that may be true, but it seems that nowadays, a “short run” may be measured in years, not days.

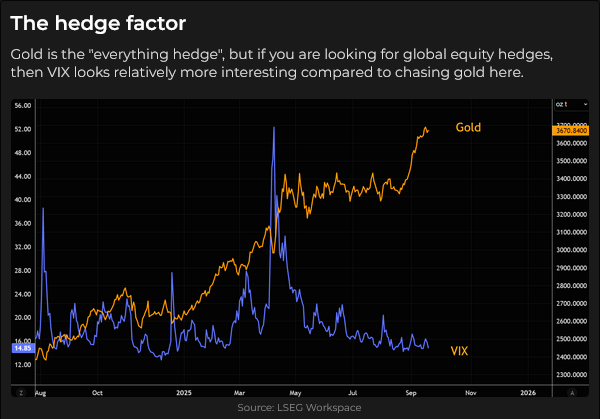

Volatility is trending lower, but would likely spike higher if stocks were to tumble.

US corporate share buybacks have averaged ~$5 billion per day YTD. Buybacks are expected to be substantially reduced over the next few weeks due to “blackouts” ahead of quarterly reports.

Quote of the week

“This has been a market where you’ve been paid to be irresponsibly bullish, period.” Tony Pasquariello, Goldman Sachs

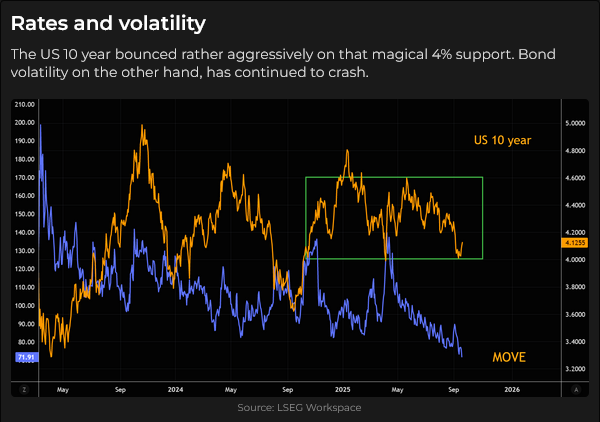

Stocks love interest rate cuts, but bonds don’t

The long bond printed a 5-month high (blue ellipse) immediately after the Fed cut was announced, then dropped to close the week below last week’s low.

I’ve previously written about a “teeter-totter” bond market. If overall market sentiment expects a weaker economy and rising unemployment, bond prices are likely to increase. Conversely, thoughts of a (Trump-controlled) Fed tolerating higher inflation (3% is the new 2%) due to a combination of fiscal and monetary stimulus will weigh on bond prices. Bond VOL at a multi-year low = cheap puts and calls.

When inflation is high/rising, consider owning stocks, real estate, gold, and/or commodities, rather than bonds.

Currencies

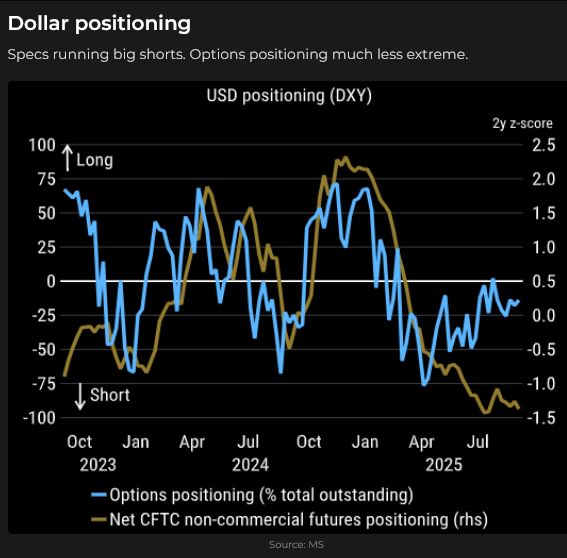

The DXY US Dollar index fell to a 43-month low (blue ellipse) immediately after the Fed cut was announced, then rallied ~1.5% by Friday’s close. Market sentiment and positioning had been very bearish on the USD before the Fed meeting – short-covering may have spurred the rally (or perhaps traders see falling short-term interest rates and a soaring stock market as the opening act in a new Gilded Age for America and the US Dollar!)

Currency hedging

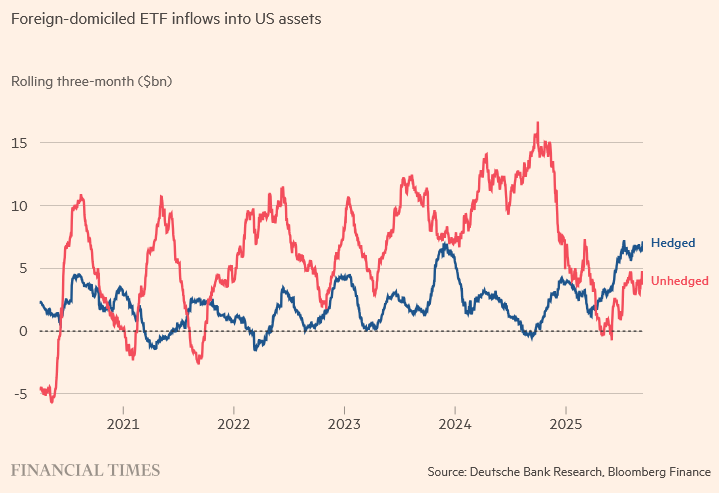

After years of under-hedging the currency risks associated with investing in American assets, foreigners have substantially increased their hedge ratios this year.

When the USD and USD-based investments (such as American stocks) were both rising, unhedged/under-hedged foreign investors had a double-win. (Think of Canadian pension funds or European institutions investing in U.S.-listed stocks while the USD was rising.)

This year to date, the S&P is up ~14% for an American investor. It is about “net-unchanged” for a European investor who did not hedge the FX risk of the Euro rising ~14% against the USD YTD.

FX traders have always considered interest rate differentials in their trading, not just in absolute terms (buy the Brazilian Real because Brazilian short rates are 10% higher than US rates) but also in terms of the direction and rate of change of differentials. (Don’t buy the Turkish Lira because the high and rising interest rates there, relative to US rates, signal a weak currency.)

The trend of the differential between US and European rates is narrowing (the US premium over Eurozone rates is getting smaller), so the cost for Europeans to hedge US FX risk exposure is falling. The same goes for Japanese accounts.

Like Brent Donnelly (watch this great 30-minute interview between Tony Greer and Brent), I believe Real Money flows are the most important in the FX world. I think Real Money has stepped up its selling of USD YTD, not as a speculative trade, but to hedge the FX risk of its asset investments. I also think this selling may have “emboldened” speculators to short the USD. This chart from Deutsche Bank shows a significant ramp-up in net FX hedging by foreign investors beginning in the fall of 2024 (when Trump won the election).

Trading currencies

One of the biggest struggles I face as a trader is aligning the time frame of my trading with that of my analysis. For instance, based on past, present, and likely future energy policies, I want to be short the Euro and the British Pound against the USD. (As Doomberg says, energy is life.) Throw in the Ukraine war and socialist/woke European policies (compared to American policies), and the likelihood that the common currency is only as strong as its weakest link, and I sincerely want to be short.

But I am not the only person trading these markets, and other people have different views; both the Euro and the Pound are higher against the USD YTD. This either sets up a better opportunity for me to take a short position, or I need to re-examine the time frame of my analysis.

Peter Brandt, a Market Wizard and hugely successful technical trader (who, like John Johnston of Market Vibes and me, worked at ContiCommodity in the 1970s), wrote in his weekly letter that the Japanese Yen is the most undervalued currency in the world. I agree! Read Stephen Innes’ Substack column on the Yen here.

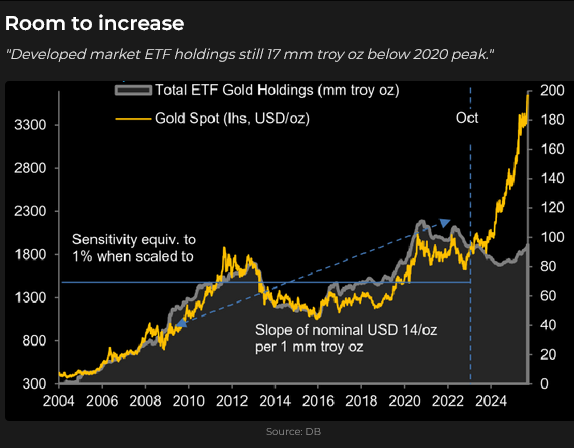

Gold

Gold touched an all-time high immediately after the announcement of the Fed cut (blue ellipse) and then fell ~$85 to Thursday’s low, only to come roaring back on Friday to create five consecutive higher weekly closes. Silver rallied to a new 14-year high of ~$43.40 on Friday.

I continue to think that China is the epicentre of gold buying, and that European and North American markets just “follow-along” with the price discovery in China. On balance, Americans would rather buy the S&P than gold.

Energy

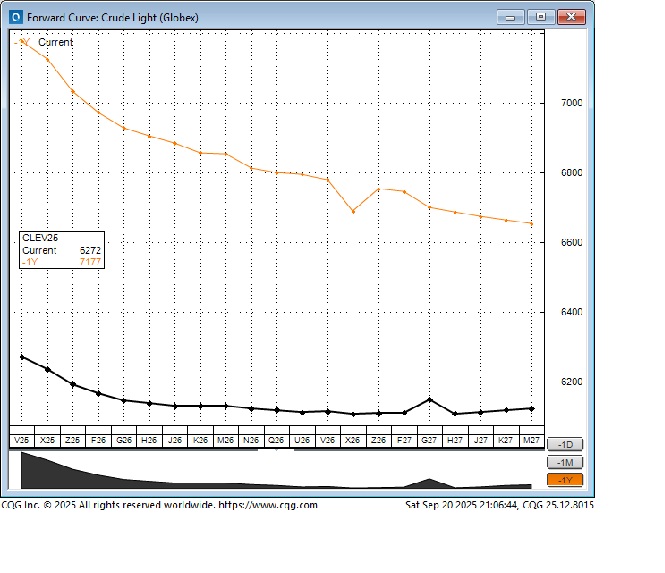

WTI has been trending lower since it reached ~$120 following the Russian invasion of Ukraine in 2022, with the front-month contract trading either side of $60 over the past six months, marking a four-year low.

The following chart shows the current forward price curve (black line) and the one-year-ago forward price curve (gold line) for NYMEX WTI futures. Current prices are approximately $6 to $10 cheaper than they were a year ago; however, note that the steepness of the backwardation curve has flattened since last year. Given the anticipated growth in future demand and the reduction of capex expenditures to develop future supply, I can imagine the forward curve shifting into contango, where forward prices (say 2027) become more expensive than nearby prices (say 2026). This is an intriguing idea, but getting the timing right might be tricky.

The Josef Schachter Annual Energy Conference – Calgary, October 18, 2025

I look forward to attending Josef’s annual energy conference again this year. I’ve attended every one over the past several years, and I’m not only continually amazed at the quality and diversity of the presenters, but I also learn more every year about the energy business and the incredible technological advances the industry is undergoing. For more information about the conference and to buy a ticket, click here. Check out Josef’s weekly “Eye On Energy” letter on Substack.

I lost a good friend this week

My good friend, Peter Appleby, died this week. He was 87, and he was like a big brother to me since I joined ContiCommodity in 1979. Peter had been Conti’s first hire in Canada (they lured him away from Merrill Lynch), and I joined the firm a few months later. We worked together on and off over the years, but we always stayed in touch and remained good friends. The last time Peter was at our house, he really enjoyed playing with Barney and renamed him “Barnsarino.” That nickname has endured.

Another friend told me a few days ago that I should say a prayer for Peter. I wasn’t sure how to do that, so I decided to talk to Peter while I was out on the golf course alone, practicing my game. For instance, I’d say, “You know, Peter, I think a seven iron is the right club here. What do you think?” I imagined him agreeing with me and hit the seven iron.

One more quote of the week

“Trade the market getting in, trade your P&L getting out.” John Johnston, author of Market Vibes on Substack

My short-term trading

I shorted the S&P twice this week and lost a little money both times. It was a “non-confidence vote” both times, rather than a well-thought-out trade, but at least I had the sense to use tight stops.

I bought the Yen on Monday and was nicely ahead on the trade when it broke out to six-week highs following the Fed cut (blue ellipse), but it couldn’t sustain the gains, and I was stopped for another slight loss when it fell back.

I was flat going into the weekend.

The Barney report

Summer is slipping away. The sun comes up later and goes down earlier now, and I had Barney in his raincoat when we went out for a short walk before dinner. He’s four years old now, still a bit of a puppy, but he listens to me more than he used to, and doesn’t go crazy when he sees a rabbit, but he still loves to chew on a good stick!

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the Fed’s rate cut and its impact on various markets, including stocks, bonds, currencies and gold. You can listen to the entire show here. My spot with Mike starts around the 1-hour and 8-minute mark. Be sure to listen to Mike’s interview with Martin Armstrong beginning at the 6-minute mark.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair September 21st, 2025

Posted In: Victor Adair Blog