September 26, 2025 | Gold at Technical Resistance

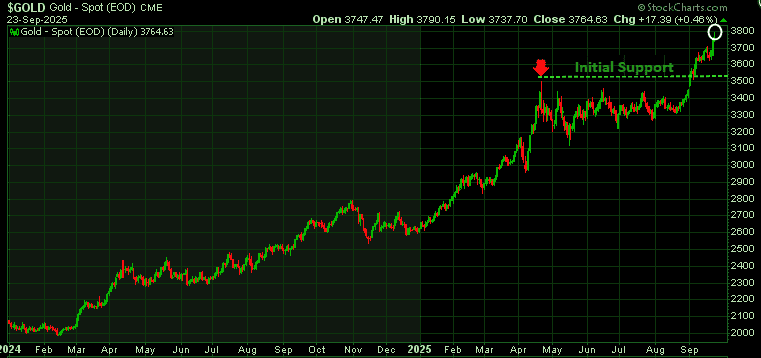

Gold is once again approaching major parallel trend line resistance – a key juncture for both short-term traders and long-term investors. After months of sharp gains, the charts now suggest a likely pullback. Parallel trend channels have historically provided strong support and resistance, and we see this in action: the upper band held after the post-April Liberation Day rally (red arrow), and it is being tested again today.

Technical Picture: Momentum Meets Resistance

- Gold’s 2024 rally began under $2,000, doubling to nearly $3,800.

- After weeks of bullish consolidation (a classic bull flag), the breakout carried prices roughly 13% higher from the base.

- Historically, bull flag breakouts often retrace back toward the prior high before resuming their uptrend.

- This suggests a pullback toward the $3,500 support zone –about 8% lower than current levels.

Investor Implications

- Traders: A pullback could present tactical opportunities to profit from short-term swings.

- Long-term investors: Any correction looks routine within the broader bull cycle. Gold’s trajectory still points toward a possible $5,000 -$6,000 target before this bull market peaks.

- Accumulation strategy: The $3,500 level may offer an attractive entry for those looking to build positions.

Final Take: Pause, Don’t Panic

Gold’s chart signals a likely correction, not a collapse – a pause within a powerful uptrend. Volatility may dominate the near term, but the long-term case for gold remains intact.

Cheers!

Martin

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Martin Straith September 26th, 2025

Posted In: The Trend Letter