September 8, 2025 | Chopping Time, Again

Happy Monday Morning!

Just a couple weeks ago we learned Canada’s second quarter GDP shrank at a 1.6% annualized pace, the biggest decline since the pandemic and the first contraction in nearly two years. While roughly in line with the Bank of Canada’s forecasts, the decline was worse than expected in a Bloomberg survey of economists, which had forecast a 0.7% decline.

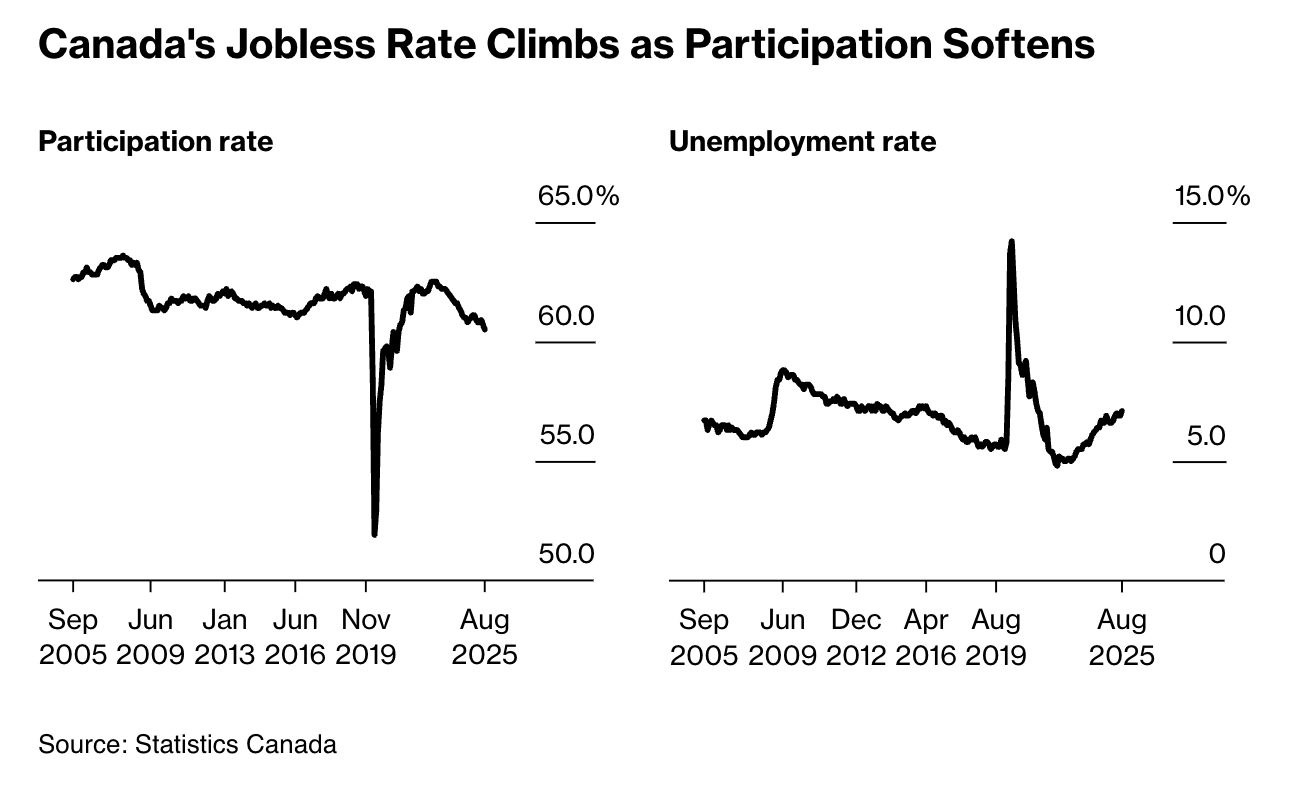

This week we learned the labour market is following suit. The Canadian economy shed 65,000 jobs in August, with the unemployment rate rising to 7.1%, the highest in nine years outside of the pandemic. The share of the labour force without work for more than six months is now at levels last seen in 2011.

“The trend is not your friend here. Looking through the details, they’re probably not quite as weak as the headline number suggests, but that’s only because the headline number was putrid,” warns Andrew Kelvin, head of Canada and global rates strategy at TD Securities.

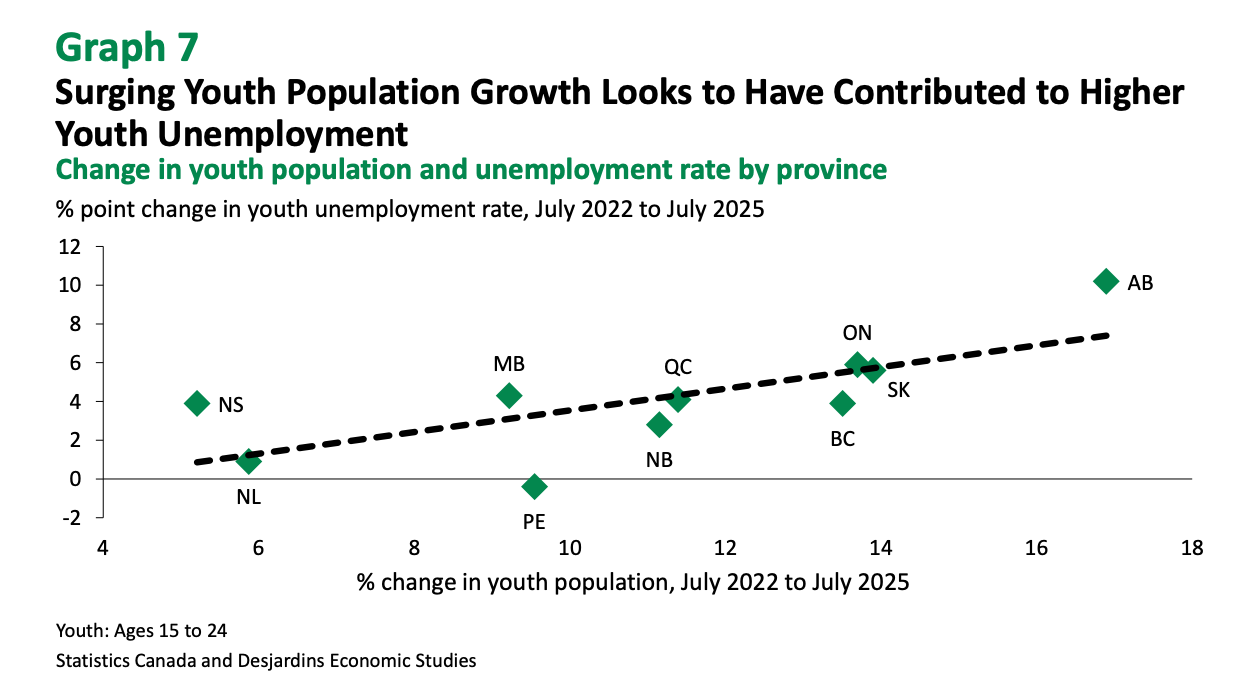

In Toronto, the unemployment rate has now sitting north of 9%. The highest level in 15 years. Things are particularly dire for our Canadian youth, with unemployment sitting at 14%, the highest levels since 2010. According to Desjardins, “the youth unemployment rate has risen much faster than the unemployment rate for older age cohorts and is now at a level more commonly seen during a recession.”

The ongoing weakness in the labour market is now sparking considerable backlash against Canada’s immigration system which recklessly flooded the country with more than a million immigrants a year for the past few years. Perhaps the single biggest policy blunder in many decades. In particular, a sharp increase in foreign students and temporary foreign workers.

Per Desjardins,

To satisfy surging demand for labour in the early postpandemic period, work restrictions for non-permanent residents, notably international students, were relaxed. This led to a sharp increase in the population growth of young workers, particularly those ages 20 to 24. Many of these newcomers to Canada went directly into the labour force, helping to meet the acute demand for workers in sectors like retail trade; accommodation and food services; and arts and recreation. However, as the pandemic moved into the rearview mirror and economic activity normalized, this deluge of available labour well outpaced demand, putting upward pressure on the youth unemployment rate.

This is not a left vs right debate. Politicians from all political spectrums are now calling for an end to the temporary foreign worker program that has ultimately flooded the labour market with excess supply, driving unemployment higher and wages lower.

So what does this all mean? Through hell or high water, Canada’s immigration numbers should continue to drift lower in the year ahead. The writing is on the wall.

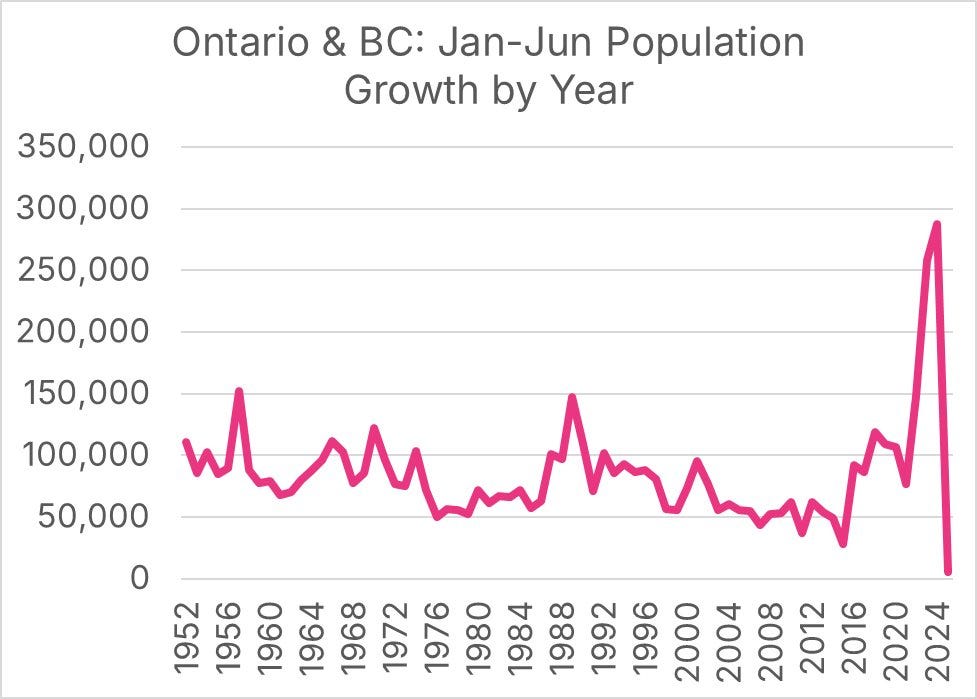

Population growth is already running at record lows through the first half of this year in BC & Ontario. Nature is healing.

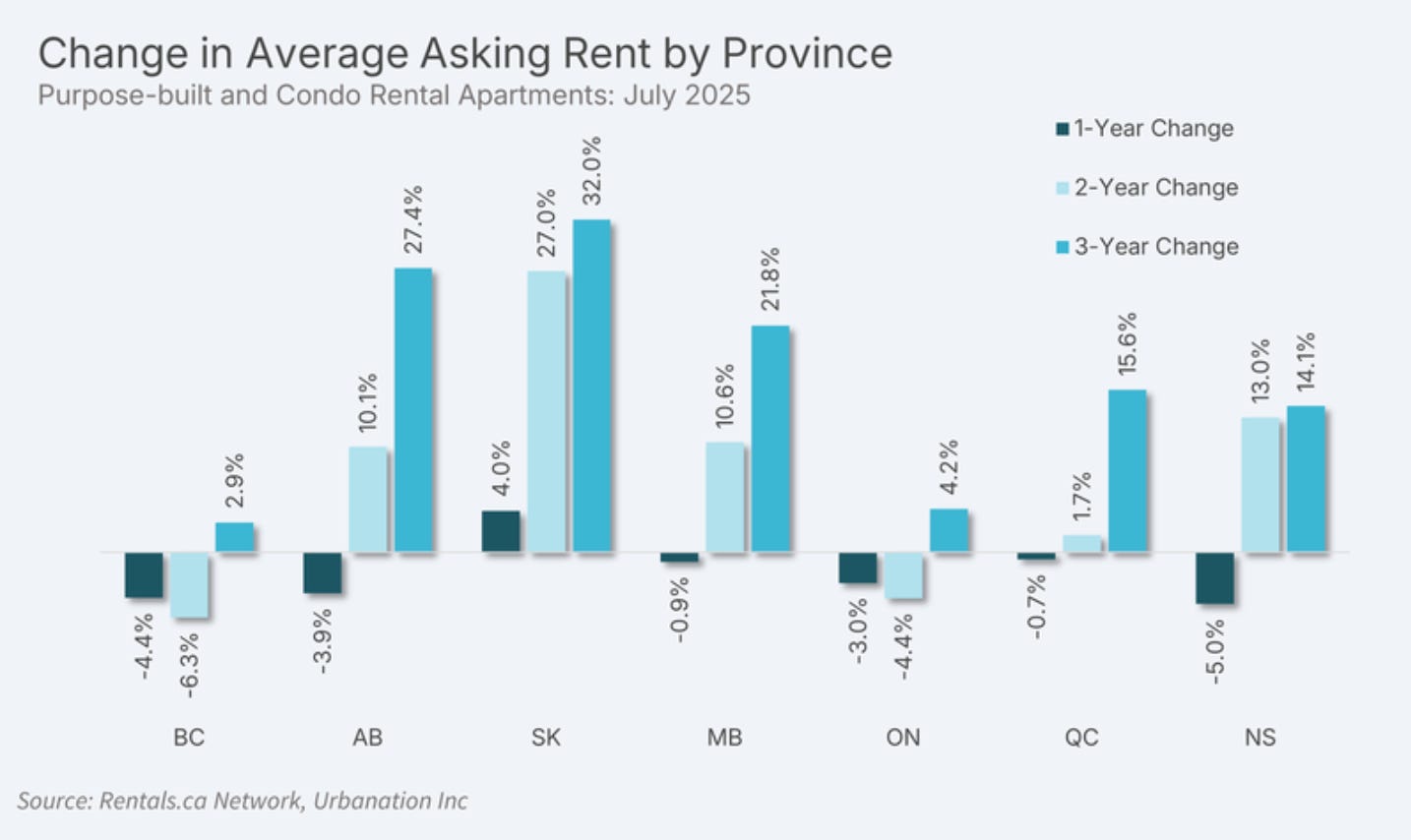

As we have flagged numerous times in this newsletter, the sharp reversal in immigration combined with a record wave of new condo completions are pushing rents lower in Canada’s once frothy provincial housing markets.

Good for renters, bad for developer proformas.

The takeaway here is this, the Canadian economy is slowing considerably and is probably already in a recession. The labour market is soft and getting softer. There’s not enough jobs being created for Canadians, let alone temporary foreign workers. Population growth is running near zero, which will bring nominal GDP lower. The outlook is not great.

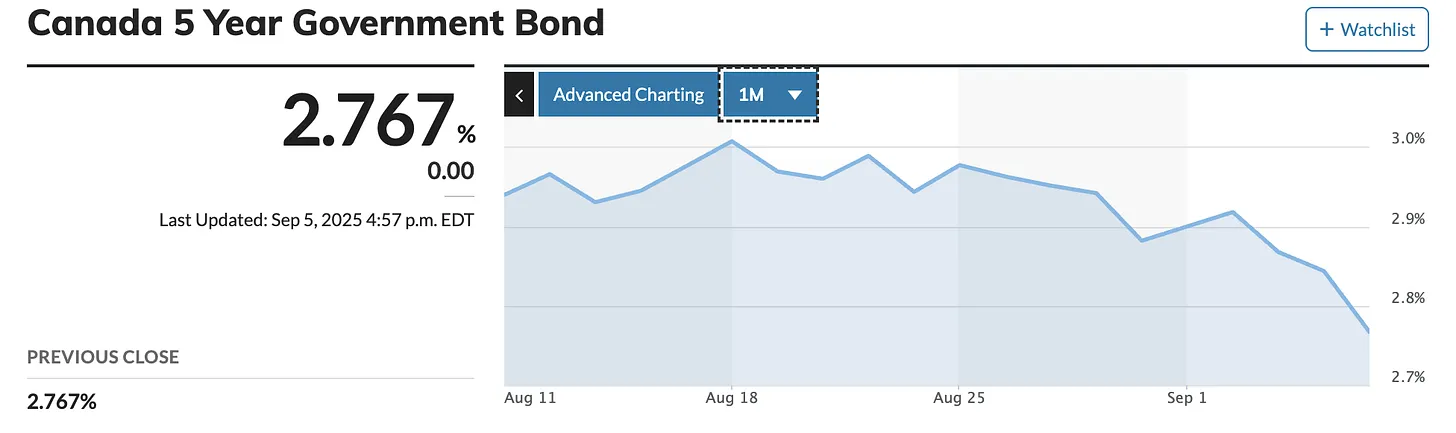

It’s no wonder the odds for another Bank of Canada rate cut on September 17th have gone from 40% to 90% in the matter of a few weeks. It’s chopping time and the BoC’s rate cut will be supported by the Fed who is also expected to cut rates in the US this month.

The only silver lining for the housing market and the 60% of mortgages renewing over the next eighteen months is the benefit of modest rate relief on the horizon.

Here’s a look of the 5 year bond yield. Down nearly 25bps over the past month.

Things are happening. Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky September 8th, 2025

Posted In: Steve Saretsky Blog